Polyethylene Terephthalate (PET) Industry Capacity and Capital Expenditure Forecasts with Details of All Active and Planned Plants to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Polyethylene Terephthalate Capacity and Capex Market Report Overview

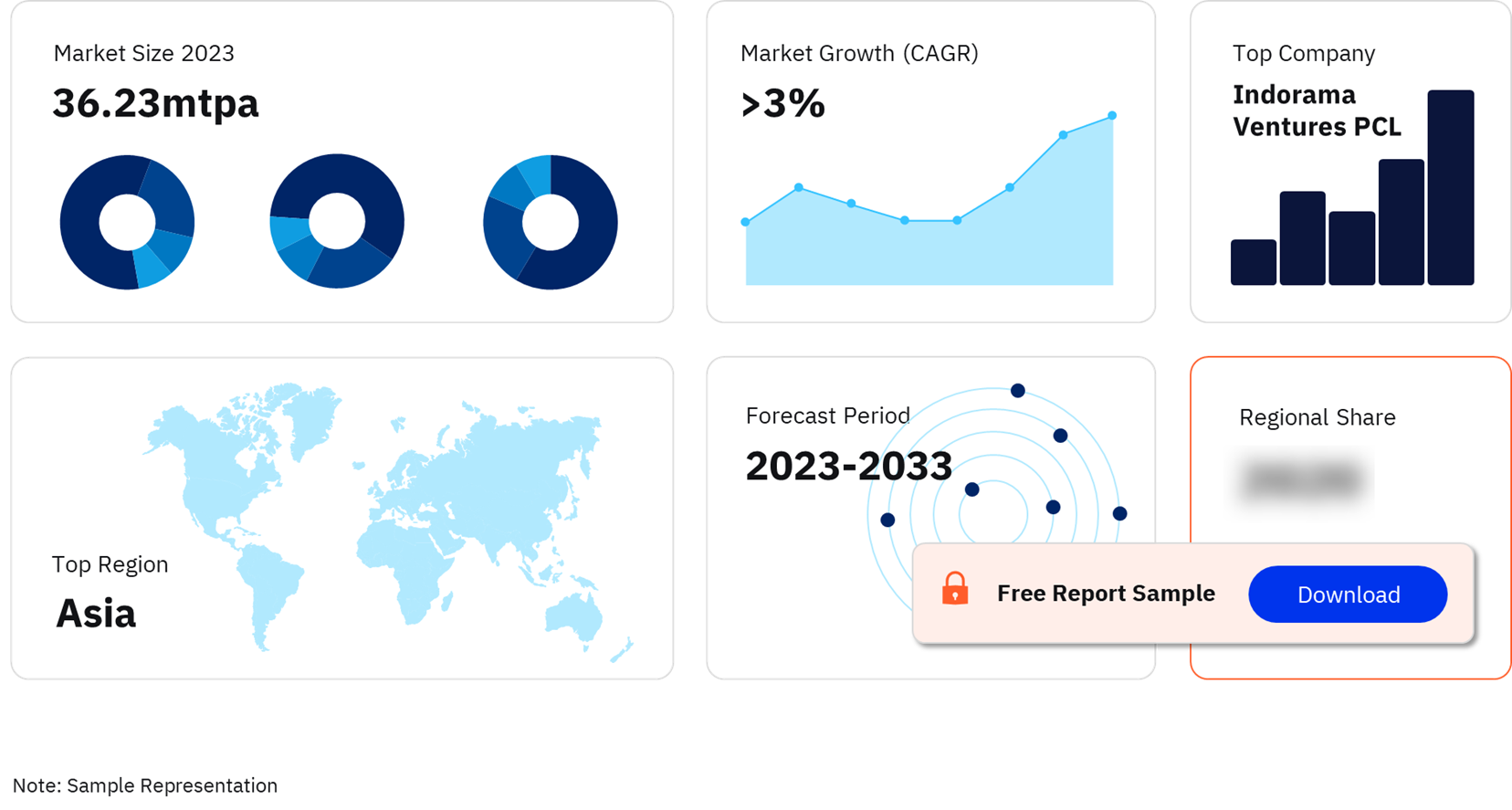

The polyethylene terephthalate (PET) industry capacity was 36.23 million tonnes per annum (mtpa) in 2023 and is expected to increase at an AAGR of more than 3% during 2023-2028. Around 17 planned and announced plants are slated to come online by 2028, primarily in Asia, Middle East and the Former Soviet Union (FSU). Additionally, the growing consumption of PET in packaging, food and beverage, as well as in textile industry will drive the demand for polyethylene terephthalate (PET) during the forecast period.

Polyethylene Terephthalate (PET) Industry Capacity and CapEx Outlook, 2023-2028 (mtpa)

Buy the Full Report for More Insights on Polyethylene Terephthalate (PET) Capacity and Capex Market Forecast

Download a Free Report Sample

The PET Industry Capacity and Capital Expenditure Outlook is a comprehensive report on all active and upcoming (planned and announced) PET projects by region and country for the period 2018–2028. It provides global and regional capital expenditure outlook forecasts up to 2028. Furthermore, the report gives a comparative analysis of key countries based on their contribution to global as well as regional Polyethylene Terephthalate (PET) capacities.

| Market Capacity 2023 | 36.23 Mtpa |

| AAGR (2023-2028) | >3% |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2028 |

| Key Regions | · Africa

· Europe · FSU · Middle East · North America · Oceania |

| Key Countries | · China

· The US · India · Turkey · Taiwan |

| Major Upcoming Projects | · Zhejiang Petrochemical Daishan Polyethylene Terephthalate Plant 2

· Reliance Industries Dahej Polyethylene Terephthalate Plant 2 · Hainan Yisheng Petrochemical Yangpu Polyethylene Terephthalate Plant · Pan-Asia PET Resin Jazan Polyethylene Terephthalate Plant 1 · Almex Petrochemical Atyru Polyethylene Terephthalate (PET) Plant |

| Leading Companies | · Indorama Ventures PCL

· Alfa SAB de CV · Far Eastern New Century Corp · Zhejiang Wankai New Materials Co Ltd · Reliance Industries Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

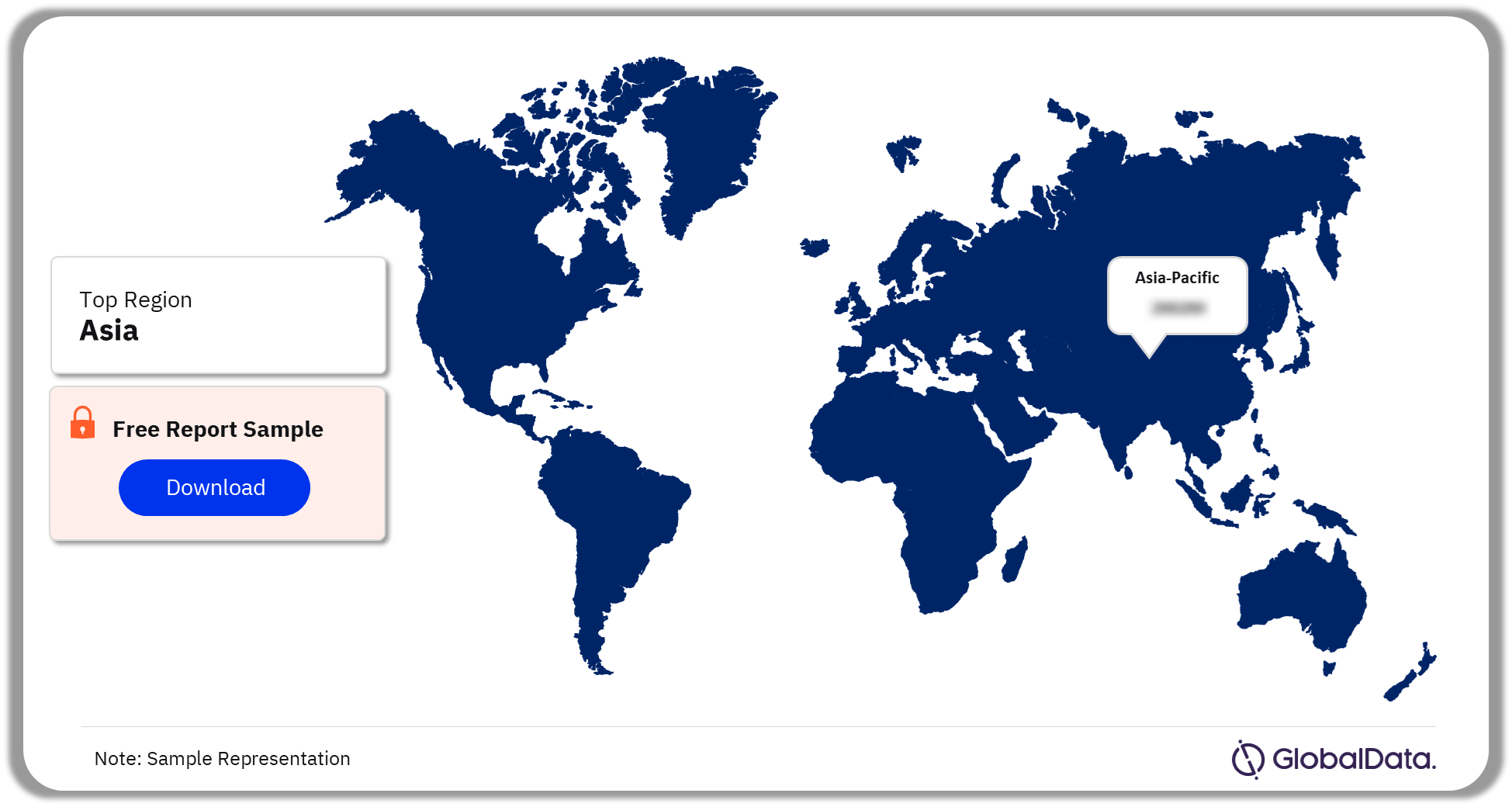

Polyethylene Terephthalate (PET) Industry Capacity Contribution by Region

The key Polyethylene Terephthalate (PET) capacity contributing regions include China, the US, India, Turkey, and Taiwan. Asia accounted for the highest share of the global PET capacity in 2023, followed by North America and Europe.

Polyethylene Terephthalate (PET) Industry Market Analysis by Regions, 2023 (%)

Buy the Full Report for More Regional Insights into the Polyethylene Terephthalate (PET) Industry Capacity Contribution

Download a Free Report Sample

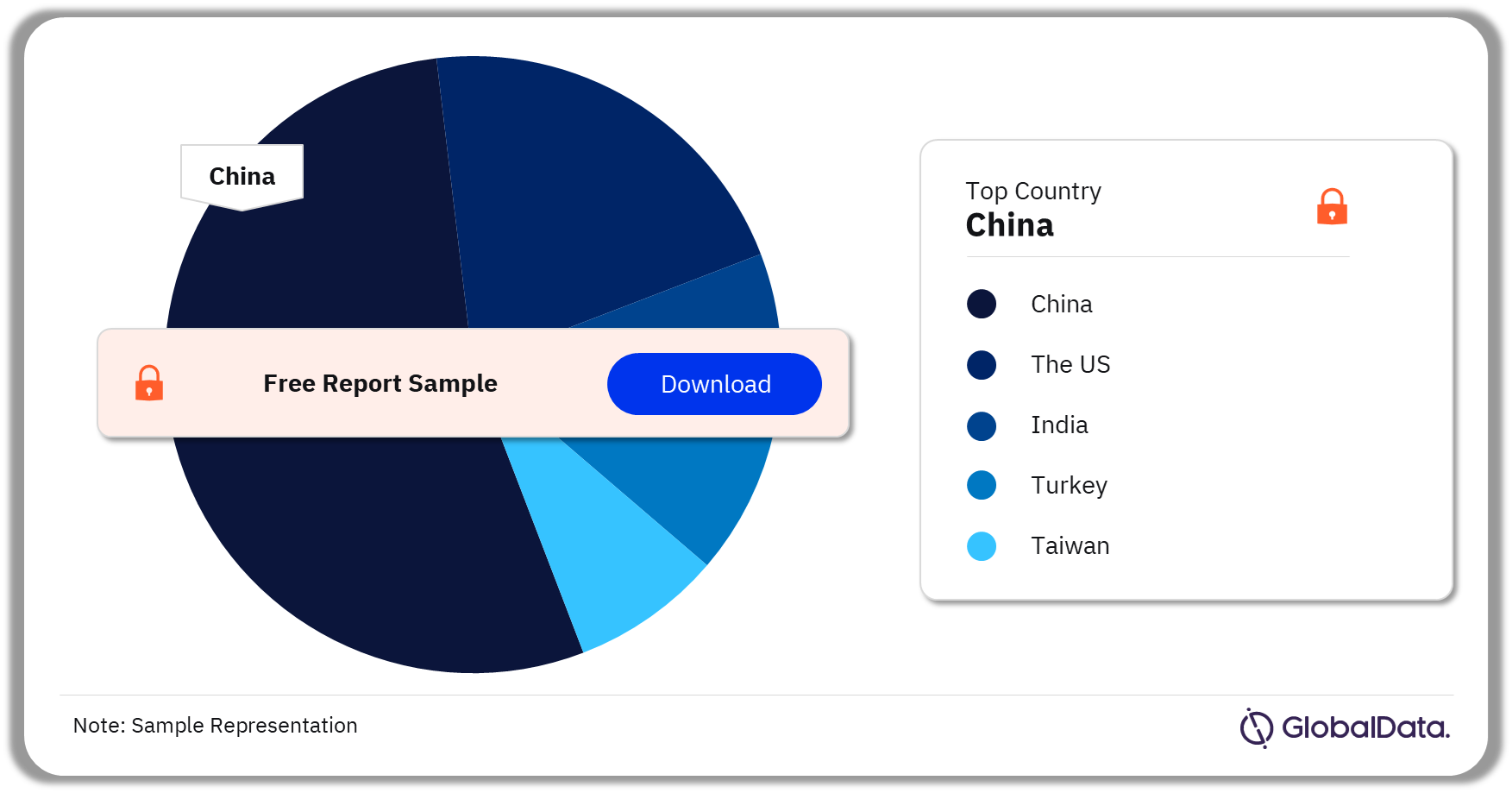

Polyethylene Terephthalate Industry Capacity Contribution by Countries

In 2023, China, Russia, India, the US, and Indonesia were the key countries in the world accounting for over 60% of the total Polyethylene Terephthalate (PET) capacity. China led with the largest capacity contribution globally in 2023, followed by the US and India due to the rapid urbanization, expanding beverage industry and high demand of sustainable and versatile packaging solutions.

Polyethylene Terephthalate (PET) Industry Market Analysis by Countries, 2023 (%)

Buy the Full Report for More Insights into the Country-wise Capacity Contributors to the Polyethylene Terephthalate Industry

Download a Free Report Sample

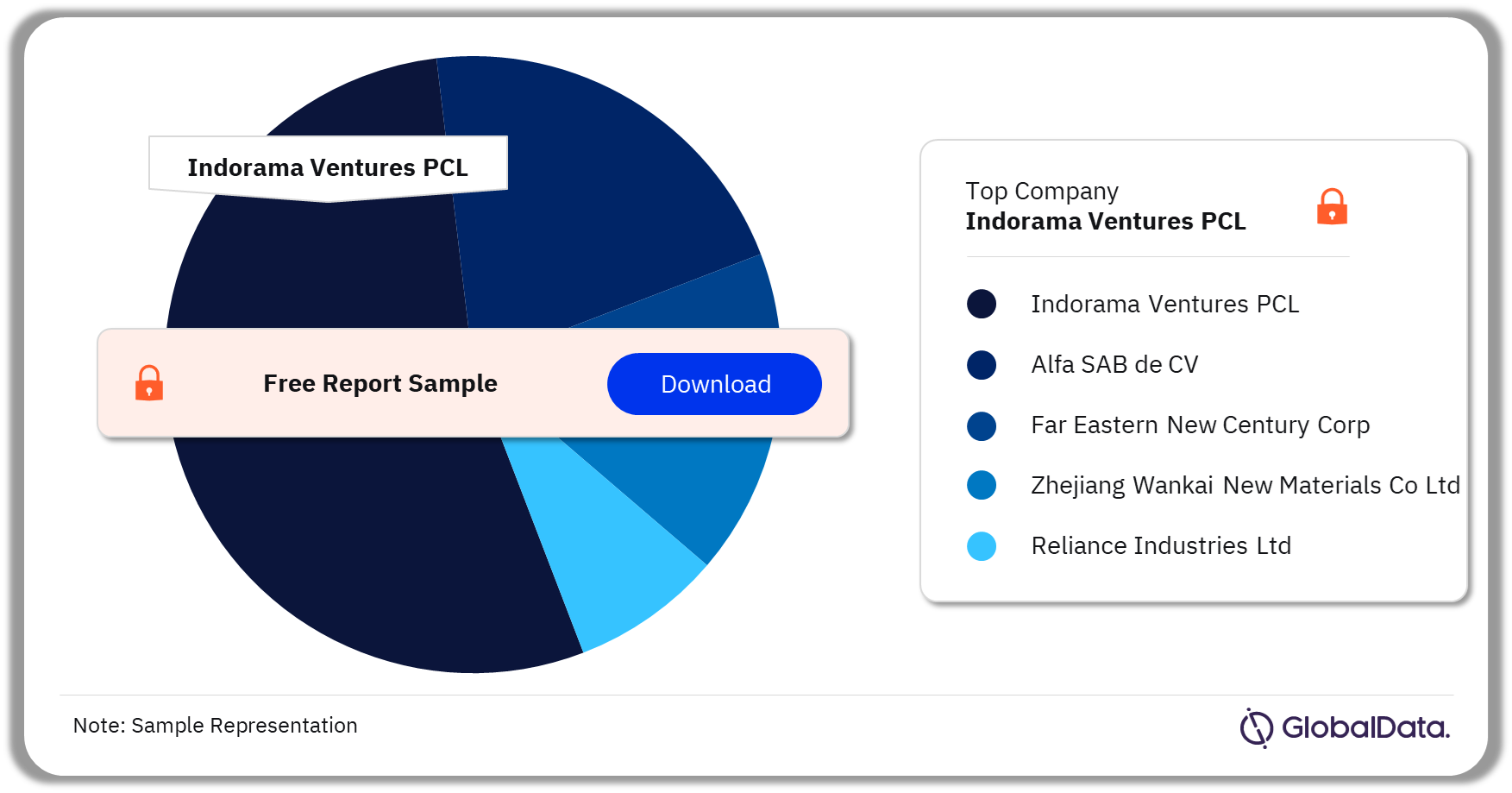

Polyethylene Terephthalate Industry Market - Competitive Landscape

A few of the key companies in the global Polyethylene Terephthalate (PET) industry are Indorama Ventures PCL, Alfa SAB de CV, Far Eastern New Century Corp, Zhejiang Wankai New Materials Co Ltd, Reliance Industries Ltd among others. Indorama Ventures PCL accounted for the highest capacity contribution globally. The company’s Ipojuca Polyethylene Terephthalate Plant was the major capacity contributor.

Polyethylene Terephthalate (PET) Industry Market Analysis by Companies, 2023 (%)

Buy the Full Report for More Insights on the Leading Companies in the Polyethylene Terephthalate (PET) Industry

Download a Free Report Sample

Polyethylene Terephthalate (PET) Industry Capacity Contribution Regional Outlook (Capacity, mtpa, 2018-2028)

- Africa

- Europe

- FSU

- Middle East

- North America

- Oceania

Polyethylene Terephthalate (PET) Industry Capacity Contribution Country Outlook (Capacity, mtpa, 2018-2028)

- China

- The US

- India

- Turkey

- Taiwan

Scope

The report provides:

- Update information on the global Polyethylene Terephthalate industry capacity outlook by region

- Key details about the Polyethylene Terephthalate industry planned and announced project

- Information on the capacity share of the major Polyethylene Terephthalate producers globally

- Annual break-up of new-build and expansion capital expenditure outlook by region and by key countries for the period 2024–2028.

Reasons to Buy

- Obtain the most up-to-date information available on all active, planned, and announced Polyethylene Terephthalate (PET) plants globally.

- Identify opportunities in the global Polyethylene Terephthalate (PET) industry by analyzing upcoming projects and their capital expenditure outlook.

- Facilitate decision-making based on strong historical and forecast Polyethylene Terephthalate (PET) capacity data.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the total PET industry capacity in 2023?

The PET industry capacity was 36.23 mtpa in 2023.

-

What is the PET industry capacity estimated growth during the forecast period?

PET industry capacity is expected to increase at an AAGR of more than 3% during 2023-2028.

-

Which region had the highest Polyethylene Terephthalate (PET) industry capacity contribution in 2023?

Asia had the highest Polyethylene Terephthalate (PET) capacity contribution globally in 2023.

-

Which country had the highest share in the Polyethylene Terephthalate (PET) industry capacity and capital expenditure market in 2023?

Among the key countries, China led with the largest capacity contribution in 2023.

-

Which are the leading companies in the Polyethylene Terephthalate (PET) industry?

A few of the key companies in the global Polyethylene Terephthalate (PET) industry are Indorama Ventures PCL, Alfa SAB de CV, Far Eastern New Century Corp, Zhejiang Wankai New Materials Co Ltd, Reliance Industries Ltd among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.