Robotics in Oil and Gas – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Robotics has been a part of the oil and gas industry for several decades. However, growing digitalization and integration with AI, cloud computing, the Internet of Things (IoT), and edge computing have helped diversify robot use cases. A myriad of robots are now involved in oil and gas operations, including terrestrial crawlers, quadrupeds, aerial drones, autonomous underwater vehicles (AUVs), and remotely operated vehicles (ROVs).

The robotics in oil and gas thematic intelligence report takes an in-depth look at look at how important robotics are in the oil and gas sector. This report also discusses how robotics is impacting the oil and gas industry, the growth of this market in the future, as well as the industry’s leaders and laggards.

Robotics in Oil and Gas – Industry Analysis

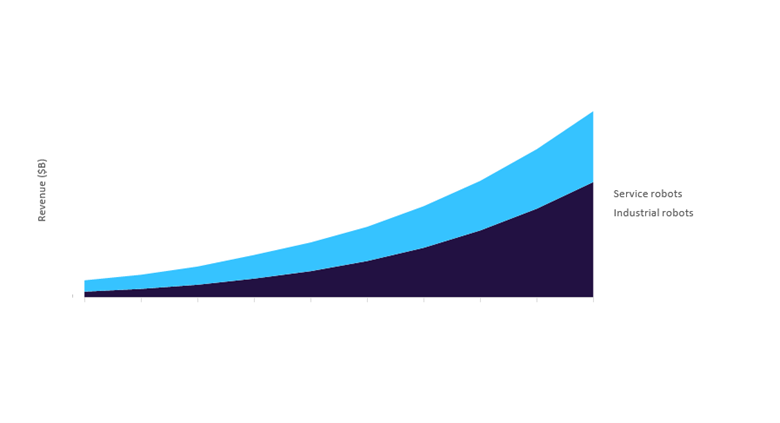

The robotics industry was worth $52.9 billion in 2021 and is expected to achieve a CAGR of more than 29% during 2021-2030. The industry is divided into two segments: industrial robots and service robots. The industrial robots segment drove growth in robotics in the 2020s, and the innovation coming from applications in manufacturing is expected to spill over to areas such as logistics and energy.

The robotics in oil and gas industry analysis also covers:

- Mergers and acquisitions

- Patent trends

- Company filings trends

- Hiring trends

- Robotics timeline

Service and Industrial Robots Revenue, 2021-2030

To gain more information about the robotics market forecast, download a free report sample

To gain more information about the robotics market forecast, download a free report sample

Robotics in Oil and Gas - Value Chain Analysis

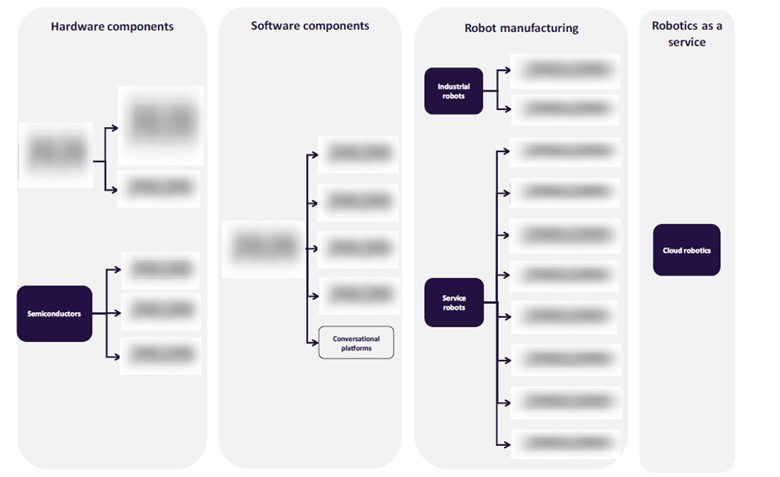

GlobalData’s robotics value chain consists of four segments: hardware components, software components, robot manufacturing, and robotics as a service.

Software components: In recent years, software has become an increasingly important part of the robot design process. Due to the nature of the industry historically, most of the software powering industrial robots is proprietary and closed. However, this is changing with the emergence of software specialists that have developed robot operating systems (ROSs).

Robotics Value Chain Analysis

For more insights on the robotics value chains, download a free report sample

Leading Robotics Adopters in the Oil and Gas Industry

Some of the leading oil and gas companies that are currently deploying robotics are BP, Chevron, China Petrochemical Corp (Sinopec), and Equinor, among others.

To know more about the leading robotics adopters in the oil and gas industry, download a free report sample

Leading Robotics Vendors in the Oil and Gas Industry

Some of the leading vendors associated with the robotics theme are Cognex, Cyberdyne, Estun Automation, and FANUC, among others.

To know more about the leading robotics vendors in the oil and gas industry, download a free report sample

Specialist Robotics Vendors in the Oil and Gas Industry

Some of the specialist robotics vendors in the oil and gas sector are ANYbotics, Applied Impact Robotics, Baker Hughes, and Built Robotics, among others.

To know more about the specialist robotics vendors in the oil and gas industry, download a free report sample

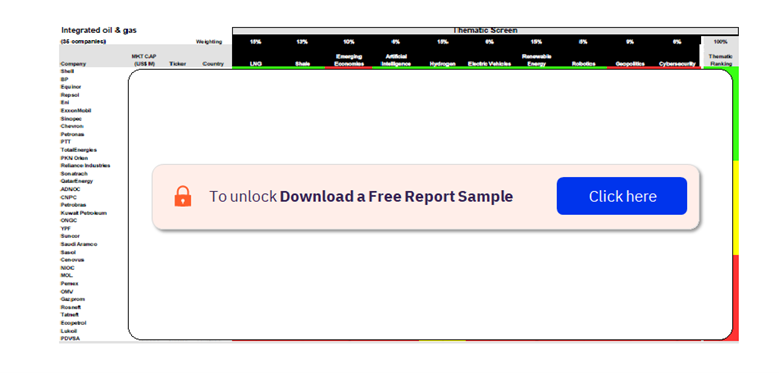

Integrated Oil and Gas Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen. The integrated oil and gas sector scorecard has three screens:

- The thematic screen tells us who are the overall leaders in the 10 themes that matter most, based on our thematic engine.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- Our risk screen ranks companies within a sector based on overall investment risk.

Integrated Oil and Gas Sector Scorecard – Thematic Screen

To know more about the oil and gas sector scorecards, download a free report sample

To know more about the oil and gas sector scorecards, download a free report sample

Robotics in Oil and Gas Market Report Overview

| Report Pages | 60 |

| Regions Covered | Global |

| Market Size (2021) | $52.9 billion |

| CAGR (2021-2030) | >29% |

| Value Chains | Hardware Components, Software Components, Robot Manufacturing, and Robotics as a Service |

| Leading Robotics Adopters | BP, Chevron, China Petrochemical Corp (Sinopec), and Equinor |

| Leading Robotics Vendors | Cognex, Cyberdyne, Estun Automation, and FANUC |

| Specialist Robotics Vendors | ANYbotics, Applied Impact Robotics, Baker Hughes, and Built Robotics |

Scope

- The detailed value chain is comprised of hardware and software components, robot manufacturing, and robotics as a service. The value chain is further broken down into caged industrial robots, industrial co-bots, logistics robots, consumer robots, drones, inspection, cleaning, and maintenance robots, field robots, defense and security robots, semiconductors, robotic intelligence, and cloud robotics. Leading and challenging vendors are identified across all the value chain segments.

- Challenges the oil and gas sector is currently facing are outlined, and how these interact with the theme of robotics is explored. Details of case studies of how oil and gas companies are boosting their robotics ecosystem are also given.

- Forecasts of robotics revenues to 2030 are split by service and industrial robots, and key elements of the value chain for the oil and gas industry are explored. An overview of key robotics mergers and acquisitions between February 2020 to September 2022 is provided. A comprehensive industry analysis is also provided, looking at company filings, hiring, and patent trends related to robotics within the oil and gas sector.

- A timeline highlighting key milestones in the relationship between robotics and the oil and gas sector is given. A list of leading robotics technology vendors, a separate list of robotics vendors specific to oil and gas, and leading industry adopters are provided. Finally, thematic scorecards rank integrated oil and gas companies on 10 themes including robotics.

Reasons to Buy

- To understand the impact robotics is having on the oil and gas industry.

- To identify the emerging trends in this theme and how these developments might advance in the future.

- Learn about the different use cases of robotics in oil and gas and how robotics relates to the sector’s challenges. View market forecast data for robotics technology up to 2030.

- Source the leading robotics vendors for the oil and gas sector from our winners lists and shortlist potential partners based on their areas of expertise. GlobalData’s thematic research ecosystem is a single, integrated global research platform that provides an easy-to-use framework for tracking all themes across all companies in all sectors. It has a proven track record of identifying important themes early, enabling companies to make the right investments ahead of the competition, and securing that all-important competitive advantage.

ABB

Abundant Robots

Aerialtronics

Agrobot

Alibaba

Amazon

Ambarella

American Robotics

ANYbotics

AppHarvest

Applied Impact Robotics

Atlas Copco

Autel Robotics

Baker Hughes

Bear Robotics

Boeing

Boston Dynamics

BP

Broadcom

Brooks Automation

Built Robotics

C2RO

Cambridge Medical Robotics

Chevron

Cisco

Clearpath

Cognex

Cyberdyne

Cyberhawk

CyPhy

Delair

DHL

DJI

Doosan Mobility Innovation

Dyson

Ecorobotics

EcoRobotix

Eelume

Ekso Bionics

Electrolux

Elephant Robotics

Energy Robotics

Eni

Equinor

Estun

ExRobotics

EXRobotics

ExxonMobil

FANUC

Festo

Flyability

Flytrex

Focal Meditech

Ford

Franka Emika

FreeFly

Fugro

Hahn Group

Haier

Harmonic Drive

Helix Energy Solutions

HollySys

Honda

Honda Robotics

Honeywell

Huawei

Huntington Ingalls Industries

Hyundai Motor

Infineon

Inset

Intel

iRobot

John Deere

Johnson & Johnson

Kawasaki

Keyence

KOKS

Kongsberg

LG Electronics

Lockheed Martin

Lockheed Martin

Maxon

Medrobotics

Medtronic

Mic AG

Midea

Mitsubishi Motors

Modus Subsea Services

Nabors Industries

Nabtesco

Nachi-Fujikoshi

Nauticus Robotics

Nippon Ceramic

Northrop Grumman

NOV

Novatek

NXP

Ocado

Oceaneering

Oil India

Omron

Parker Hannifin

Parrot

Petrobras

Petronas

Preferred Networks

Qualcomm

Rabbit Tractors

Reach Robotics

Repsol

ReWalk Robotics

Rigarm

Robert Bosch

Robotiq

Rockwell Automation

Samsung Electronics

Saudi Aramco

Seegrid

Shell

Siasun

Sinopec

SoCalGas

Softbank

Sony

Stellantis

Stryker

Taurob

TE Connectivity

TechnipFMC

Teradyne

Textron

Thales Group

TotalEnergies

Toyota

Ubtech

United Robotics Group

uWare

Vecna

Wingcopter

Yaskawa

Yuneec

Zimmer Biomet

Zipline

Zora Robotics

Table of Contents

Frequently asked questions

-

What was the robotics market size in 2021?

The robotics market size was valued at $52.9 billion in 2021.

-

What is the robotics market growth rate?

The robotics market is expected to achieve a CAGR of more than 29% during 2021-2030.

-

What are the components of the robotics value chain?

GlobalData’s robotics value chain consists of four segments: hardware components, software components, robot manufacturing, and robotics as a service.

-

Which leading oil and gas companies are currently deploying robotics?

Some of the leading oil and gas companies that are currently deploying robotics are BP, Chevron, China Petrochemical Corp (Sinopec), and Equinor.

-

Which leading vendors are associated with the robotics theme?

Some of the leading vendors associated with the robotics theme are Cognex, Cyberdyne, Estun Automation, and FANUC, among others.

-

Which are the specialist robotics vendors in the oil and gas sector?

Some of the specialist robotics vendors in the oil and gas sector are ANYbotics, Applied Impact Robotics, Baker Hughes, and Built Robotics, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.