Sharing Economy in Insurance – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Sharing Economy in Insurance Thematic Intelligence Report

The sharing economy is an economic system in which private individuals share assets and services, often using a community-based online platform. The sharing economy has witnessed a rapid rise, particularly over the last decade. It has penetrated most industries, facilitated by improvements in the performance of digital platforms and consumers’ increasing willingness to use mobile apps that support peer-to-peer (P2P) business models.

In response to the growth, the insurance industry has had to innovate as the lines are blurred between personal and commercial use. Flexible and on-demand insurance products, facilitated by the evolution of technologies such as big data, artificial intelligence (AI), and the Internet of Things (IoT), have become highly desirable in the sharing economy. These products offer commercial risk management without the unaffordability that would come for many individuals with purchasing a full commercial policy.

The sharing economy in insurance report helps to identify leaders in insurance provision for the sharing economy. The report will also assist to understand how competitors are looking to break into the market and identify opportunities in a growing market where insurance provision can be made simpler for the customer.

Sharing economy in Insurance Trends

The main trends shaping the sharing economy in insurance theme over the next 12 to 24 months are technology trends, macroeconomic trends, and regulatory trends.

Technology Trends: The key technology trends shaping the sharing economy in insurance are the increasing use of AI, cybersecurity, and big data among others.

Macroeconomic Trends: The key macroeconomic trends shaping the sharing economy in insurance are rising inflation and the cost-of-living crisis, the impact of COVID-19, and rapid urbanization among others.

Regulatory Trends: The key regulatory trends shaping the sharing economy in insurance are concerns regarding carbon emissions, labor rights, and data privacy.

For more insights on the trends shaping the sharing economy in insurance, download a free report sample

Sharing Economy in Insurance Industry Analysis

The sharing economy is one of the fastest-growing business trends of the last 10 years, with more than $23 billion invested since 2010 in venture capital funding on sharing economy start-ups, according to GlobalData’s Deals Database. During this time, insurance has been challenged with meeting the unusual requirements of sharing economy agents.

Some insurtech startups have emerged with the primary aim of meeting some of the demand within the sector, while others have taken the principles of the sharing economy, modern technology, and mutual insurance companies to create scalable P2P insurance businesses.

The sharing economy in the insurance industry analysis also covers:

- Market size and growth forecasts

- Use cases

- Timeline

For more insights on the analysis of sharing economy in insurance, download a free report sample

Sharing Economy in Insurance Industry Value Chain

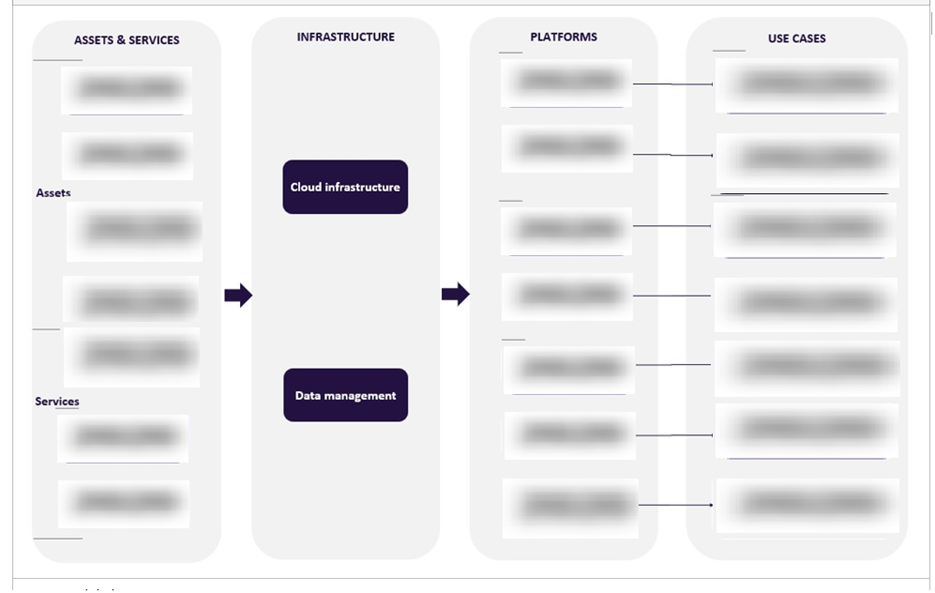

The sharing economy allows individuals and companies to make money by sharing, exchanging, and renting resources. GlobalData splits the sharing economy value chain into four segments: shared assets and services, infrastructure, sharing economy platforms, and use cases.

Infrastructure: The infrastructure segment of our sharing economy value chain has two components: cloud infrastructure and data management.

Sharing Economy in Insurance Industry Value Chain

For more insights on the value chain of sharing economy in insurance, download a free report sample

Sharing economy in Insurance – Competitive landscape

The key public players in the sharing economy in insurance are Airbnb, Allianz, Aon, AXA, and Expedia Group among others.

The key private players in the sharing economy in insurance are Cuvva, Friendsurance, Laka, Pikl, Versicherix, and Zego.

For more insights on key players in the sharing economy in insurance, download a free report sample

Sharing Economy in Insurance Consumer Trends Report Overview

| Key Trend | Technology Trends, Macroeconomic Trends, and Regulatory Trends |

| Key Value Chain Components | Shared Assets and Services, Infrastructure, Sharing Economy Platforms, and Use Cases |

| Key Public Players | Airbnb, Allianz, Aon, AXA, and Expedia Group |

| Key Private Players | Cuvva, Friendsurance, Laka, Pikl, Versicherix, and Zego |

Scope

- Insights from GlobalData’s 2022 UK Insurance Consumer Survey indicate that younger consumers (Generation Z and millennials) are more likely to use the sharing economy.

- The sharing economy is also more widely utilized in London than the UK average, with more than 28% of London dwellers indicating that they either use, will use, or have used the sharing economy.

- Most leading P2P platforms offer insurance through an embedded model in collaboration with an insurer. For insurers, this creates access to new markets and target groups.

Key Highlights

- The global insurance industry reached $6 trillion in premiums in 2018. The sharing economy in insurance is disrupting primarily non-life insurers (specifically motor, property, and liability).

- The sharing economy in insurance blurs the lines between personal and commercial use of assets, posing challenges when establishing liability.

- So far, innovation in insurance for the sharing economy in insurance has focused on personal rather than commercial lines. For instance, some companies have developed add-ons for personal lines to provide cover for commercial activities.

- The potential of the sharing economy in insurance is still untapped, and new shared mobility models will bring further lucrative opportunities to insurers.

Reasons to Buy

- Identify leaders in insurance provision for the sharing economy.

- Understand how competitors are looking to break into the market.

- Identify opportunities in a growing market where insurance provision can be made simpler for the customer.

- Determine how insurance is provided in different segments of the sharing economy.

Mulsanne

Allianz

Zego

AXA

Liberty Mutual

Progressive

Inshur

Zurich

Generali

Sompo

Pikl

State Farm

Tokio Marine

Chubb

Zurich

Nationwide

USAA

Guardhog

Travelers

Shuidihuzhu

Friendsurance

Ledger Investing

Lemonade

Nexus Mutual

Laka

Versicherix

Otherwise

Tapoly

Dinghy

Superscript

Slice

Coverdash

Airbnb

Uber

HiyaCar

Karshare

Just Park

Camplify

Lime

JUMP

Vrbo

Onefinestay

Table of Contents

Frequently asked questions

-

What are the key trends shaping the sharing economy in insurance?

The main trends shaping the sharing economy in insurance theme over the next 12 to 24 months are technology trends, macroeconomic trends, and regulatory trends.

-

What are the key components of the value chain in the sharing economy in insurance?

The sharing economy value chain has four segments: shared assets and services, infrastructure, sharing economy platforms, and use cases.

-

Who are the key public players in the sharing economy in insurance?

The key public players in the sharing economy in insurance are Airbnb, Allianz, Aon, AXA, and Expedia Group among others.

-

Who are the key private players in the sharing economy in insurance?

The key private players in the sharing economy in insurance are Cuvva, Friendsurance, Laka, Pikl, Versicherix, and Zego.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports