Sompo Holdings Insurance Strategy, Company Overview, Key Financials and Competitive Comparison

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Sompo Holdings Insurance Strategy Report Overview

Sompo Holdings Inc. (Sompo Holdings) reported a total revenue of $33.8 billion in 2021. The company is implementing its innovation and transformation strategy by tapping into the power of technologies, such as insurtech, artificial intelligence (AI), robotics, data analytics, machine learning, wearable tech, automation, and big data to achieve operational efficiencies, as well as to improve its underwriting and claims management procedures. Moreover, the company is committed to creating a resilient and sustainable society with the implementation of ESG-integrated investment, insurance underwriting, and lending activities.

The Sompo Holdings insurance strategy report provides in-depth market analysis, information, and insights into the strategy and growth of the company. The report provides values for key performance indicators such as written premiums and claims during the review period (2017-21) and forecast period (2021-26). It also gives a comprehensive overview of the global and regional life insurance industry, key lines of business, key trends, drivers, challenges, and insight into key technological developments impacting Sompo Holding’s insurance strategy. Moreover, it provides a detailed analysis of the competitive landscape, overview, and comparative analysis of leading companies and top insurance markets’ premium and profitability trends for every region.

| Market Revenue (2021) | $33.8 billion |

| Forecast Period | 2021-2026 |

| Historical Period | 2017-2020 |

| Key Lines of Business | Motor, Property, Life Insurance & Pension, Liability, PA&H, Marine, Aviation, & Transit, and Financial Lines |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Sompo Holdings Insurance – Company Overview

Sompo Holdings Inc. is a provider of multi-line insurance products. It provides a wide range of life and non-life insurance products to individuals, families, and corporate clients. Sompo Holding’s portfolio of insurance products includes fire & allied insurance, marine insurance, personal accident insurance, automobile insurance, individual & group life insurance, pension plans, and annuities. The company also provides investment advisory, fund trust management, asset management, risk consulting, health consultation, nursing care, disease prevention, and assistance services. The company intends to create the latest work style strategy to boost the job satisfaction of employees and reach comparatively high productivity for the group’s long-term success.

In September 2022, Universal Sompo General Insurance announced its Bancassurance partnership with West Bengal State Cooperative Bank to distribute insurance products and provide security to the customers of the bank.

Sompo Holdings Insurance – Strategy and Themes

Implementation of ESG in operations is a major theme for Sompo’s sustainability approach. ESG integration in insurance is carried out by the company’s operating entities and global lines, using group-wide ESG guidelines.

The company’s goal is to help customers live in safety, health, and happiness. To achieve its goal, the Group will continue to provide new customer value by leveraging digital, AI, and data analysis technologies. Moreover, it will promote behavioral change through risk visualization, improve quality of life through various means of support, and provide health support that enables women to be active in the workplace.

The Group is also working upon creating a new value beyond the existing businesses by attracting human resources and diverse businesses as cooperation partners, promoting digital transformation, and establishing a new Real Data Platform (RDP) business model.

Sompo Holdings Insurance – Regional Exposure

Sompo’s general insurance segment accounted for majority of the total gross written premium (GWP) in 2021. Geographically, the company’s business is skewed towards the Asia-Pacific region. In 2021, the company’s Asia-Pacific general insurance business was concentrated in Japan followed by India. In the South and Central American region, the company’s business was concentrated in Brazil, while in the European region, the business was concentrated in Turkey.

Life and Pension Business, 2021 (%)

For more regional insights on Sompo Holdings Insurance, download a free report sample

Sompo Holdings Insurance - Lines of Business

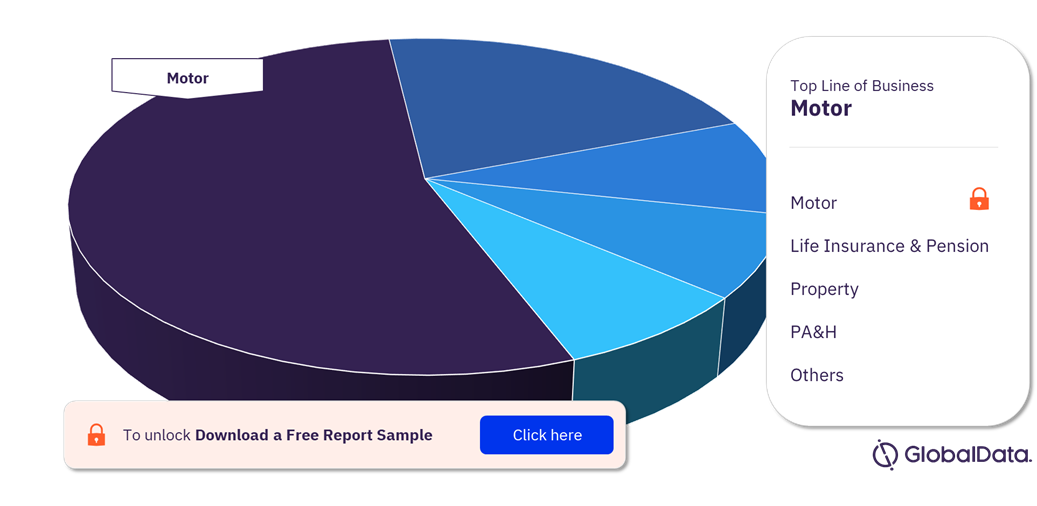

The key lines of business analyzed for Sompo Holdings Insurance are motor, property, life insurance & pension, liability, PA&H, marine, aviation, & transit, and financial lines, among others. In 2021, the motor line of business accounted for the highest value in the market.

Sompo Holdings Insurance Analysis by Lines of Business, 2021 (%)

For more insights on the Sompo Holdings Insurance lines of business, download a free report sample

Segments Covered in the Report

Sompo Holdings Insurance Lines of Business Outlook (Value, US$ Billion, 2017-2026)

- Motor

- Property

- Life Insurance & Pension

- Liability

- PA&H

- Marine, Aviation, & Transit

- Financial Lines

Scope

This report provides:

- Key development areas of Sompo Holding’s insurance strategy.

- In-depth analysis of Sompo Holding’s insurance strategy.

- Rankings, premiums, and market share of top global and regional insurers and analyzes the competitive landscape.

Reasons to Buy

- In-depth market analysis, information, and insights into Sompo Holding’s insurance strategy

- In-depth analysis of the competitive landscape in global and regional markets.

- Understand the key dynamics, trends, and growth opportunities of Sompo Holdings.

- Identify growth opportunities in key global and regional markets.

Table of Contents

Frequently asked questions

-

What was the total revenue of Sompo Holdings in 2021?

The total revenue of Sompo Holdings was $33.8 billion in 2021.

-

What are the key lines of business of Sompo Holdings insurance?

The key lines of business analyzed for Sompo Holdings insurance are motor, property, life insurance & pension, liability, PA&H, marine, aviation, & transit, and financial lines, among others.

-

What was the leading line of business for Sompo Holdings in 2021?

Motor insurance was the leading line of business for Sompo Holdings in 2021.

-

How does Sompo Holdings aim to create a resilient and sustainable society?

Sompo Holdings aims to create a resilient and sustainable society with the implementation of ESG-integrated investment, insurance underwriting, and lending activities.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports