South Africa Cards and Payments – Opportunities and Risks to 2025

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

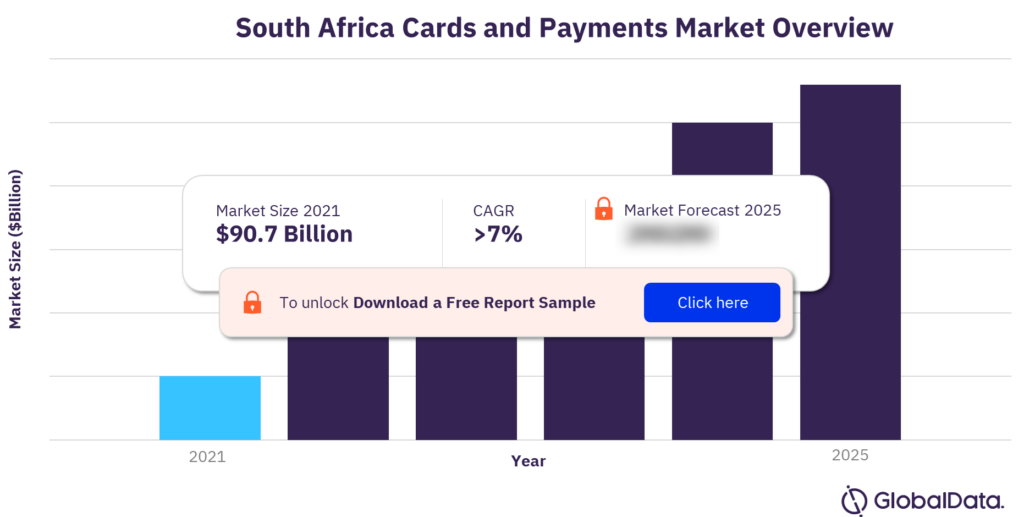

South Africa Cards And Payments Market Overview

South Africa cards and payments market size was valued at $90.7 billion in 2021. The market is expected to grow at a CAGR of more than 7% during the period 2021-2035.

The South Africa cards and payments market research report provides detailed analysis of market trends in the South Africa cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including cash, credit transfers, cards, and cheques during the review-period. The report also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values and volumes during the review-period and over the forecast-period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes.

South Africa cards and payments market outlook

For more insights on the report, download a free sample

What are the market dynamics in the South Africa cards and payments market?

While South Africa remains a cash-driven society – with consumers preferring to use cash for day-to-day transactions, the country’s payments market is steadily shifting towards electronic payments. There has been significant progress in the adoption of card-based payments, which recorded a compound annual growth rate over 2017–21e in terms of transaction volume. This can be attributed to the combined efforts of the government and financial institutions to boost financial awareness through the launch of financial literacy programs, the provision of basic bank accounts, and the expansion of payment card acceptance among retailers.

Which are the key segments in the South Africa cards and payments market?

The key segments in the South Africa cards and payments market are card-based payment, merchant acquiring, e-commerce payments, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, alternative payments.

Card-based payment in the South Africa cards and payments market

Debit cards remain the most widely used payment card type among South Africans, accounting for the largest share in terms of both number of cards in circulation and transaction value during 2017–21e. This was supported by the country’s high banked population. Debit cards will continue to lead the South African payment card market over 2021e–25f, supported by the growing migration of low-value cash payments to payment cards, the emergence of digital-only banks, and the increasing preference for contactless payments.

Merchant acquiring in the South Africa cards and payments market

The acquiring and processing environment in South Africa is dominated by banks, with Absa leading the way. Absa offers a wide range of card acceptance solutions, including physical POS and ecommerce acquiring solutions. To encourage merchant acceptance, Absa also offers a low-cost POS device called SmartPay specifically for SMEs. The device can accept magnetic stripe, chip and PIN, and contactless cards.

E-commerce payments in the South Africa cards and payments market

South African ecommerce spending is led by food and drink, followed by accommodation and clothing and footwear. Electrical goods, travel, and health and beauty also account for notable shares in terms of transaction value.

In-store payments in the South Africa cards and payments market

Essential items such as food and drink, motor fuel, and clothing and footwear lead in-store purchases in South Africa, collectively accounting for nearly half of total in-store transaction value. In-store payments were badly affected by the COVID-19 pandemic, which discouraged consumers from visiting stores out of fear of contracting the virus. Meanwhile, lockdown restrictions resulted in the closure of non-essential stores. But as the government eased restrictions owing to a drop in the number of cases, in-store purchases have been on the path to recovery.

Buy now pay later payments in the South Africa cards and payments market

Buy now pay later payments are gaining prominence among consumers in South Africa, with a growing number of merchants, banks, and payment providers now offering this service. In September 2021, online payment gateway PayFast announced the addition of MoreTyme (a buy now, pay later feature launched by digital-only bank TymeBank) as a payment option on its platform. At checkout, consumers select MoreTyme and scan the displayed QR code using their TymeBank app.

Mobile payments in the South Africa cards and payments market

Consumers mostly use their mobile wallets for accommodation, followed by food and drink and clothing and footwear. In addition to local mobile wallets such as SnapScan and Zapper, international payment solutions such as Samsung Pay are popular.

P2P payments in the South Africa cards and payments market

PayPal, mobile banking apps, and online bank transfers are the favored tools for both domestic and international P2P transfers. Some of the country’s banks offer fund transfer services in association with money transfer services providers. Absa Bank allows its customers to access the Western Union transfer service via its mobile banking app to send and receive money.

Bill payments in the South Africa cards and payments market

Bank transfer is the preferred option for bill payments in South Africa. With the growing preference for mobile banking, Standard Bank incorporated the utility bill payment feature MyBills into its mobile banking app. Meanwhile, Absa Bank offers the walletdoc app, which notifies users of bill payments on the due date. Users can add Visa, Mastercard, and Diners Club cards to the wallet to make bill payments.

Alternative payments in the South Africa cards and payments market

Apple Pay, Samsung Pay, VodaPay, SnapScan are some of the alternative payments in the South Africa cards and payments market.

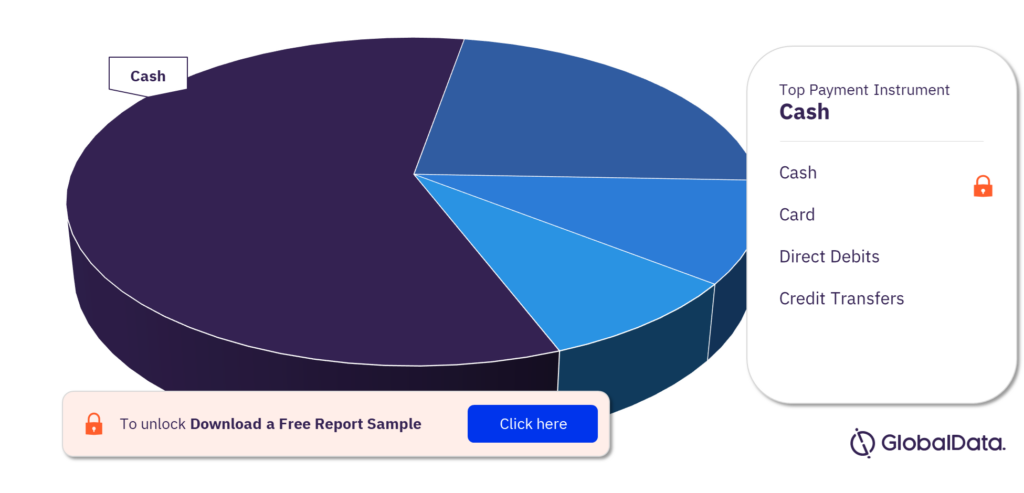

Which are the key payment instruments in the South Africa cards and payments market?

The key payment instruments in the cards and payments market in South Africa are cash, cards, credit transfers and direct debits. Cash is the largest payment instrument in the cards and payments market in South Africa in terms of volume.

South Africa cards and payments market, by payment instrument

For more payment instrument insights on the report, download a free sample

Which are the key players in the cards and payments market in South Africa?

The key players in the cards and payments market in South Africa are Absa Bank, FNB, Standard Bank, Nedbank, Capitec Bank, Mercantile Bank, TymeBank, American Express, Diners Club, Visa, and Mastercard.

Market report overview

| Market size | $90.7 billion |

| CAGR % (2021-2035) | >7% |

| Key segments | Card-Based Payment, E-Commerce Payments, Merchant Acquiring, In-Store Payments, Buy Now Pay Later, Mobile Payments, P2P Payments, Bill Payments, Alternative Payments |

| Key payment instruments | Cash, Cards, Credit Transfers, and Direct Debits |

| Key companies | Absa Bank, FNB, Standard Bank, Nedbank, Capitec Bank, Mercantile Bank, TymeBank, American Express, Diners Club, Visa, and Mastercard |

Scope

The report provides top-level market analysis, information and insights into the South African cards and payments industry, including –

- Current and forecast values for each market in the South African cards and payments industry, including debit, credit and charge cards.

- Detailed insights into payment instruments including cash, cards, credit transfers, and direct debits. It also, includes an overview of the country’s key alternative payment instruments.

- Ecommerce market analysis.

- Analysis of various market drivers and regulations governing the South African cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the South African cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the South African cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the South African cards and payments industry.

- Assess the competitive dynamics in the South African cards and payments industry.

- Gain insights into marketing strategies used for various card types in South Africa.

- Gain insights into key regulations governing the South African cards and payments industry.

FNB

Standard Bank

Nedbank

Capitec Bank

Mercantile Bank

TymeBank

American Express

Diners Club

Visa

Mastercard

Zapper

SnapScan

Click to Pay

PayPal

Cell Pay Point

Apple Pay

Samsung Pay

VodaPay

FlickPay

Huawei Pay

Table of Contents

Frequently asked questions

-

What was the South Africa cards and payments market size in the year 2021?

The cards and payments market size in South Africa was $90.7 billion in the year 2021.

-

What was the South Africa cards and payments market growth rate?

The cards and payments market in South Africa is projected to grow at a CAGR of more than 7% during the period 2021-2035.

-

What are the key segments in the South Africa cards and payments market?

Card-based payments, e-commerce payments, merchant acquiring, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, alternative payments are the key segments in the South African cards and payments market.

-

Which are the key payment instruments in the South Africa cards and payments market?

Cash, cards, credit transfers and direct debits are the key payment instruments in the South African cards and payments market.

-

What are the key companies in the South Africa cards and payments market?

Absa Bank, FNB, Standard Bank, Nedbank, Capitec Bank, Mercantile Bank, TymeBank, American Express, Diners Club, Visa, and Mastercard are the key companies in the South African cards and payments market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports