South Asia Infrastructure Construction Market Size and Trends Analysis by Countries, Sector and Segment Forecast 2022-2026

Powered by ![]()

Access in-depth insight and stay ahead of the market

Explore actionable market insights from the following data in our ‘South Asia Infrastructure Market’ report:

- Analysis of historical figures and forecasts of revenue opportunities from the sector (roads, railways, electricity and power, water and sewage, and others) and regional segments.

- Outlook for the South Asia infrastructure construction industry to 2026.

- Analysis of the infrastructure investment in major countries: Bangladesh, India, Pakistan, and Sri Lanka.

- Insight into the project pipelines for sectors such as roads and railways.

How is the ‘South Asia Infrastructure Market’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get the ‘South Asia Infrastructure Market’ report today, which will help you to:

- Evaluate regional trends in infrastructure development from insight into output values and project pipelines. Identify the fastest growers to enable assessment and targeting of commercial opportunities in the markets best suited to strategic focus.

- Identify the drivers in the South Asia infrastructure construction market and consider growth in developed economies. Formulate plans on where and how to engage with the market while minimizing any negative impact on revenues.

- Examine the assumptions and drivers behind ongoing and upcoming trends in the South Asia infrastructure construction market.

We recommend this valuable source of information to anyone involved in:

- Contractors Including Civil Works, Electrical, HVAC, and Others

- Consultants/Designers

- Building Material Merchants/Players

- Management Consultants and Investment Banks

- Portfolio Managers/Buy-Side Firms

- Strategy and Business Development

- Investment Banking

To Get a Snapshot of the South Asia Infrastructure Market Report, Download a Free Report Sample

South Asia Infrastructure Construction Market Report Overview

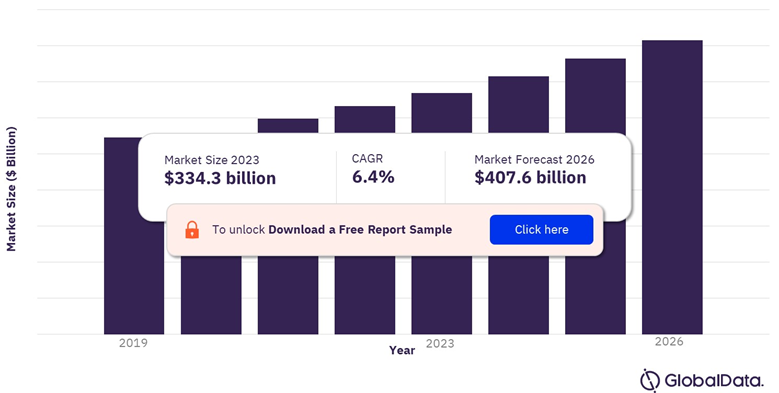

The South Asia infrastructure construction market size will be valued at $334.3 billion in 2023 and is estimated to grow at a compound annual growth rate (CAGR) of 6.4% over the forecast period. The industry’s growth is primarily driven by the strong project pipeline from India and Bangladesh.

Both countries including India and Bangladesh are anticipated to exhibit an annual average growth rate of nearly 6.5% and 6.2% respectively over the forecast period. The Indian government’s intention to increase the number of greenfield highways and works as part of the Pradhan Mantri Gati Shakti Master Plan, which includes the construction of 200,000km of national highways by 2025 is likely to aid the market growth over the near future.

South Asia Infrastructure Construction Market Outlook, 2019-26 ($ Billion)

View Sample Report for Additional Insights on the South Asia Infrastructure Construction Market Forecast, Download a Free Sample

According to estimates from GlobalData, the South Asia infrastructure construction market observed a dip of nearly 6.8% in 2020 owing to the disruption caused by the emergence of a pandemic. The momentum picked up in 2021 depicting a growth rate of more than 17.0% in terms of total construction output value (Real). The strong growth achieved in 2021 was largely due to the held-up projects amid the widespread of coronavirus and enforced social restrictions in the respective countries of the region.

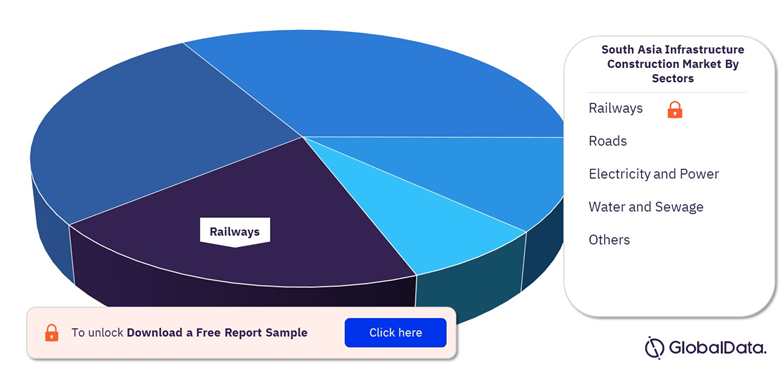

South Asia Infrastructure Construction Market Segmentation by Sectors

The South Asia infrastructure construction industry covers railways, roads, water and sewage, electricity and power, and others. The electricity and power segment is projected to dominate the overall market share in 2022.

Electricity and Power: The South Asia electricity and power infrastructure construction sector is strongly dominated by traditional sources of electricity generation. For instance, the South Asia electricity and power infrastructure construction sector pipeline demonstrates that coal-fired power plants account for nearly 20.4% of the total regional project pipeline. Similarly, nuclear and hydroelectric power plants together accounted for approximately 53.0% of the total regional pipeline.

Among countries, India leads with a strong project pipeline and steady construction output value in 2021. The country is immensely focused on creating renewable projects with the deployment of solar power plants. For instance, the government of India plans to develop a 600 MW floating solar power plant in the state of Madhya Pradesh.

South Asia Infrastructure Construction Market Share by Sectors, 2023 (%)

Fetch Sample PDF for South Asia Infrastructure Construction Segment-Specific Revenues and Shares, Download a Free Sample

Roads: The roads segment in the South Asia region is predicted to observe steady growth owing to the strong project pipeline from India. The country accounts for nearly 83.0% of the regional pipeline followed by Pakistan and Bangladesh with a combined share of 13.6%. The government of India’s National Infrastructure Pipeline (NIP) plan aims at the spending of INR108 trillion ($1.4 trillion) from April 2019 to March 2025 to support the nation’s construction industry growth over the forecast period.

In Bangladesh, the road infrastructure construction sector is projected to prosper with an increased focus on reducing traffic accidents or crashes. According to the estimates of the World Bank, the costs related to traffic crashes could be as high as 5.1% of GDP. The World Bank approved financing of BDT30.8 billion ($358 million) in March 2022 to help Bangladesh improve road safety, and reduce injuries and fatalities caused by road accidents on selected high-risk highways and district roads.

Railways: This sector is projected to account for the third-largest revenue share within the regional space of South Asia infrastructure construction industry over the forecast period. In addition, the segment is poised to observe the highest compounded annual growth rate of nearly 7.3% from 2022 to 2026. The growth in this sector is primarily driven by the strong project pipeline from India. Among the largest railway projects in the nation’s pipeline is the INR3.3 trillion ($48.0 billion) Delhi to Kolkata High-Speed Rail development. This project involves the construction of railway stations, access roads, the installation of signaling and electrical systems, and the laying of railway tracks.

Water and Sewage: The water and sewage segment is estimated to showcase a stable growth rate over the forecast period mostly fueled by urban piped water supply projects in the region. For instance, Pakistan government in September 2022 signed an agreement with the Asian Infrastructure Investment Bank (AIIB) worth PKR268.1 million ($1.6 million) to improve water infrastructure in Lahore. Through the implementation of the Project Readiness Advance Loan Agreement, the government will ensure a sustainable supply of water by properly treating sewage disposal and delivering improved services to the population.

Others: The others category comprises airports, ports, marine, and inland waterways. The air transport industry in India, the largest market in South Asia, is one of the world’s fastest-growing air transport sectors, with forecasts estimating it to be the world’s third largest in terms of passenger volume by 2024. Similarly, major markets in South Asia are investing substantially in port facilities to maximize trade opportunities with their trading partners and support high growth in trade volumes.

South Asia Infrastructure Construction Market Segmentation by Countries

India is projected to remain a growth engine for the South Asia infrastructure construction sector accounting for the largest share in terms of value and project pipeline over the forecast period. The strong measures undertaken by the domestic government to promote and incentivize investments in the nation’s infrastructure sector are anticipated to remain a key driver for growth over the near future. For instance, the country has a total construction project pipeline of approximately $1.1 trillion which includes all projects from pre-planning to execution.

Bangladesh is estimated to emerge as the second-largest country within the South Asia infrastructure construction regional space in 2022. The key trend observed in the nation’s infrastructure construction sector was the extended measures taken by the domestic government to attract greater investment in the country’s transport infrastructure through public-private partnerships. In 2022, the country’s infrastructure construction sector observed growth of nearly 4.9% in real terms and is projected to register an annual average growth rate of 6.2% for the remainder of the forecast period.

The ongoing economic turbulence in Pakistan owing to the high inflation rates, mounting debt, reduced currency levels, and political instability is anticipated to impact the market growth of the infrastructure construction sector in the country over the near future.

Moreover, according to the National Disaster Management Authority (NDMA), flooding in Pakistan has resulted in the deaths of 1,391 people, as of September 9, 2022, and caused economic damage of approximately PKR3 trillion ($18 billion) and the displacement of over 33 million people. These losses are expected to lower Pakistan’s GDP growth to 3% in the 2022 fiscal year.

South Asia Infrastructure Construction Market Share by Country, 2023 (%)

View Sample Report for Additional South Asia Infrastructure Construction Market Insights, Download a Free Sample

Sri Lanka’s infrastructure construction sector shrinks by 7.1% in 2022. Falling government revenues and mounting foreign debt is expected to affect spending on public sector projects in 2022 and into 2023. Additionally, projects that are being funded through foreign financial assistance are also likely to be delayed, due to temporary suspension in loan operations. These factors are expected to restrict new project launches and thus, directly impact the dynamics of the domestic infrastructure construction sector.

South Asia Infrastructure Construction Market Research Scope

| Market Size (2023) | $334.3 billion |

| Market Size (2026) | $407.6 billion |

| CAGR | 6.4% from 2022 to 2026 |

| Historic Years | 2016-2021 |

| Forecast Period | 2022-2026 |

| Report Scope & Coverage | Sector Overview, Construction Output Value ($ Million), Project Pipeline by Country and Sector, Regional Outlook by Key Sectors, Top 20 Project Details by Sector |

| Key Segments | Roads, Railways, Electricity and Power, Water and Sewage, Others |

| Key Countries | Bangladesh, India, Pakistan, and Sri Lanka |

Key Players

Table of Contents

Table

Figures

Frequently asked questions

-

What was the South Asia infrastructure construction market size in 2023?

The infrastructure construction market size in South Asia will be valued at $334.3 billion in 2023.

-

What is the South Asia infrastructure construction market growth rate?

The infrastructure construction market in South Asia is expected to grow at a CAGR of 6.4% during the forecast period (2022-2026).

-

What are the key sectors in the South Asia infrastructure construction market?

The key sectors in the South Asia infrastructure construction market are roads, railways, electricity and power, water and sewage, and others.

-

Which are the key countries in the South Asia infrastructure construction market?

The key countries in the South Asia infrastructure construction market are Bangladesh, India, Pakistan, and Sri Lanka.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.