South Korea Power Market Size and Trends by Installed Capacity, Generation, Transmission, Distribution, and Technology, Regulations, Key Players and Forecast, 2022-2035

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

South Korea Power Market Overview

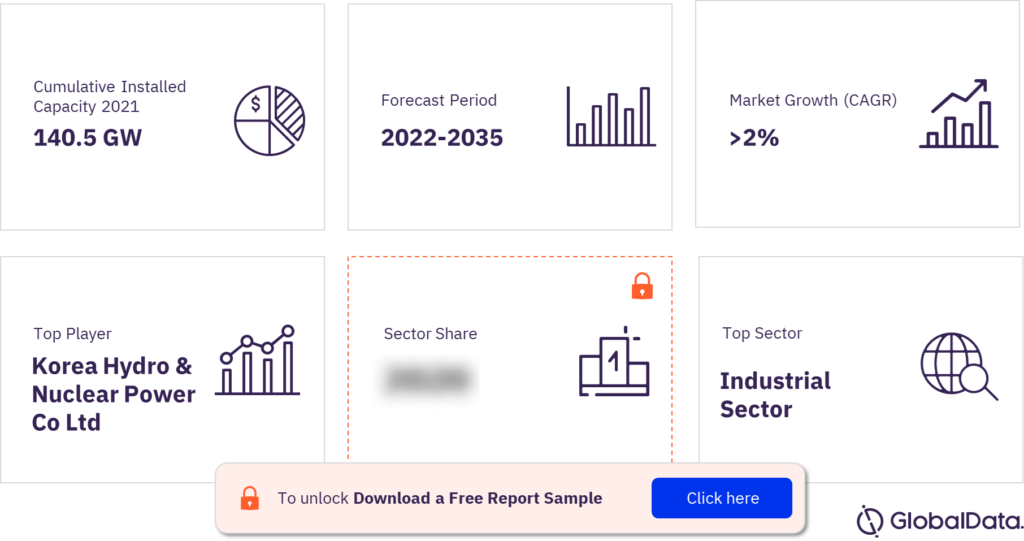

The South Korea power market cumulative installed capacity was 140.5 GW in 2021. The market is expected to grow at a CAGR of more than 2% from 2021 to 2035. South Korean government’s initiatives and incentives led to considerable growth in renewable capacity during the 2010–2021 period. The major factor behind the growth of renewable capacity is the adoption of the Renewable Portfolio Standard (RPS) policy and the government’s increasing support for biomass-fueled energy.

The South Korea power market research report discusses the power market structure of South Korea and provides historical and forecast numbers for capacity, generation, and consumption up to 2035. Detailed analysis of the country’s power market regulatory structure, competitive landscape, and a list of major power plants are provided. The report also gives a snapshot of the power sector in the country on broad parameters of macroeconomics, supply security, generation infrastructure, transmission and distribution infrastructure, electricity import and export scenario, degree of competition, regulatory scenario, and future potential.

South Korea Power Market Outlook

To gain more information on the South Korea power market forecast, download a free report sample

What are the market dynamics in the South Korea power market?

South Korea has a democratic form of government, with a presidential system. It is a member of the United Nations, Group 20 (G20), the Association of Southeast Asian Nations, the South Asian Association for Regional Corporation, and the Organization for Economic Co-operation and Development. Concerning the power sector, the rapid economic growth has resulted in increases in electricity demand and energy requirements. This has led to an increasing dependence on imported fossil fuels, such as oil, natural gas, and bituminous and anthracite coal, to meet energy demand.

Solar PV and biopower are currently the top renewable energy sources in terms of capacity. The country is trying to reduce its dependence on fossil fuel electricity production, instead of encouraging the development of renewable resources. These factors are expected to drive the renewable power market in South Korea during 2021-2035.

The South Korean power sector is overseen by the Ministry of Trade, Industry, and Energy (MOTIE). A government agency functioning under the ministry, the Electricity Regulatory Commission (KOREC), is responsible for regulatory matters. The Korea Electric Power Corporation (KEPCO), a government-owned company, dominates all aspects of the power sector, such as generation, transmission, and distribution (T&D).

What are the key sectors in the South Korea power market?

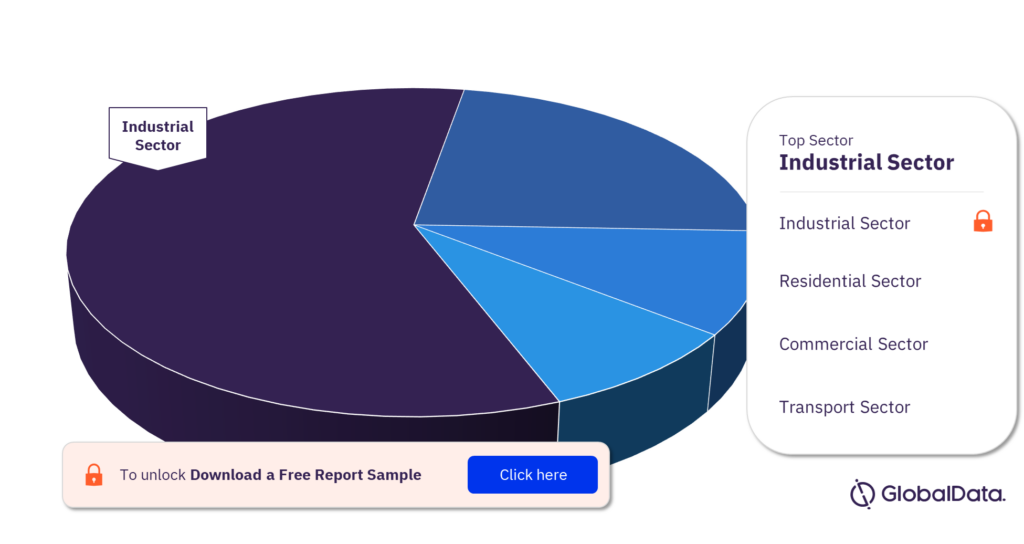

The key sectors in the South Korea power market are the residential sector, commercial sector, industrial sector, and transport sector. In 2021, the industrial sector had the dominant share in the power consumption market followed by the commercial sector and residential sector.

South Korea Power Market Analysis by Sectors

For more sector insights, download a free report sample

Who are the key market players in the South Korea power market?

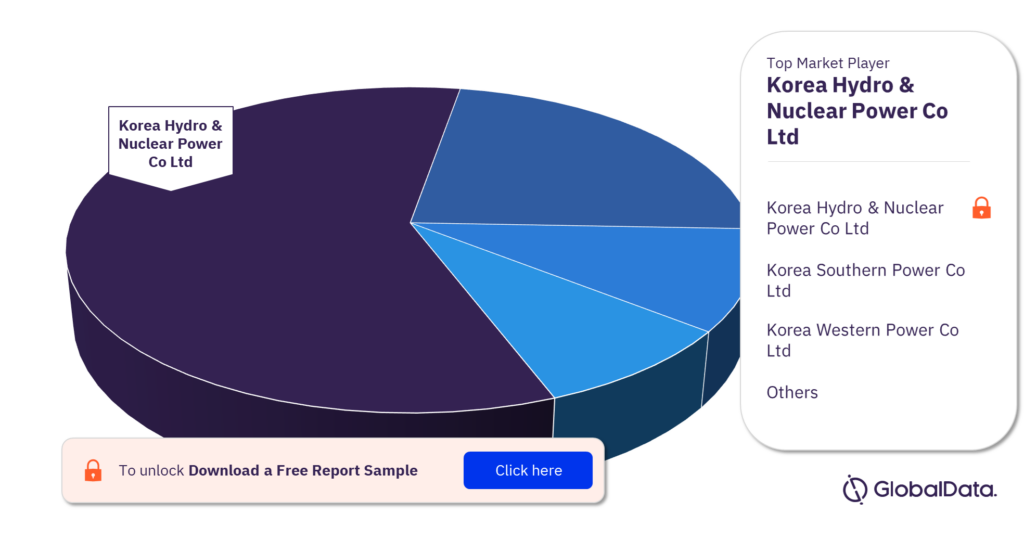

Some of the key market players in the South Korea power market are Korea Hydro & Nuclear Power Co Ltd, Korea Southern Power Co Ltd, Korea Western Power Co Ltd, Korea East-West Power Co Ltd, Korea South-East Power Co Ltd, Korea Midland Power Co Ltd, POSCO Energy Co Ltd, and Korea District Heating Corp. In 2021, South Korea’s power generation market was dominated by Korea Hydro & Nuclear Power Co Ltd.

South Korea Power Market Analysis by Market Players

To know more about key market players, download a free report sample

Market Report Overview

| Market size (Year – 2021) | 140.5 GW |

| Growth rate (CAGR) (2021-2035) | >2% |

| Forecast period | 2022-2035 |

| Key sectors | Residential Sector, Commercial Sector, Industrial Sector, and Transport Sector |

| Key market players | Korea Hydro & Nuclear Power Co Ltd, Korea Southern Power Co Ltd, Korea Western Power Co Ltd, Korea East-West Power Co Ltd, Korea South-East Power Co Ltd, Korea Midland Power Co Ltd, POSCO Energy Co Ltd, and Korea District Heating Corp |

Scope

- Snapshot of the country’s power sector across parameters – macroeconomics, supply security, generation infrastructure, transmission infrastructure, electricity imports and export scenario, degree of competition, regulatory scenario, and future potential of the power sector.

- Statistics for installed capacity, generation, and consumption from 2010 to 2021, and forecast for the next 14 years to 2035

- Capacity, generation, and major power plants by technology

- Data on leading active and upcoming power plants

- Information on transmission and distribution infrastructure, and electricity imports and exports

- Policy and regulatory framework governing the market

- Detailed analysis of top market participants, including market share analysis and SWOT analysis

Reasons to Buy

- Identify opportunities and plan strategies by having a strong understanding of the investment opportunities in the country’s power sector

- Identify key factors driving investment opportunities in the country’s power sector

- Facilitate decision-making based on strong historic and forecast data

- Develop strategies based on the latest regulatory events

- Position yourself to gain the maximum advantage of the industry’s growth potential

- Identify key partners and business development avenues

- Identify key strengths and weaknesses of important market participants

- Respond to your competitors’ business structure, strategy, and prospects

POSCO Energy Co Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

What was the South Korea power market size in 2021?

The power market size in South Korea was 140.5 GW in 2021.

-

What is the South Korea power market growth rate?

The power market in South Korea is expected to grow at a CAGR of more than 2% from 2021 to 2035.

-

Who are the key market players in the South Korea power market?

Some of the key market players in the South Korea power market are Korea Hydro & Nuclear Power Co Ltd, Korea Southern Power Co Ltd, Korea Western Power Co Ltd, Korea East-West Power Co Ltd, Korea South-East Power Co Ltd, Korea Midland Power Co Ltd, POSCO Energy Co Ltd, and Korea District Heating Corp.

-

Who regulated South Korea’s energy policy?

South Korea’s electricity sector is guided on policy matters by the Ministry of Trade, Industry, and Energy (MOTIE).

-

What is the annual power consumption in South Korea?

Power consumption increased from 239.5 TWh in 2000 to 513.9 TWh in 2020, growing at a CAGR of more than 3%.

-

What sector is the leading driver of South Korea’s power consumption?

In 2020, industrial power consumption had the dominant share in power consumption accounting for more than 50%.

-

Who owns and operates South Korea’s transmission network?

KEPCO is responsible for electricity transmission via a multi-loop transmission grid.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.