Spain General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Spain General Insurance Market Report Overview

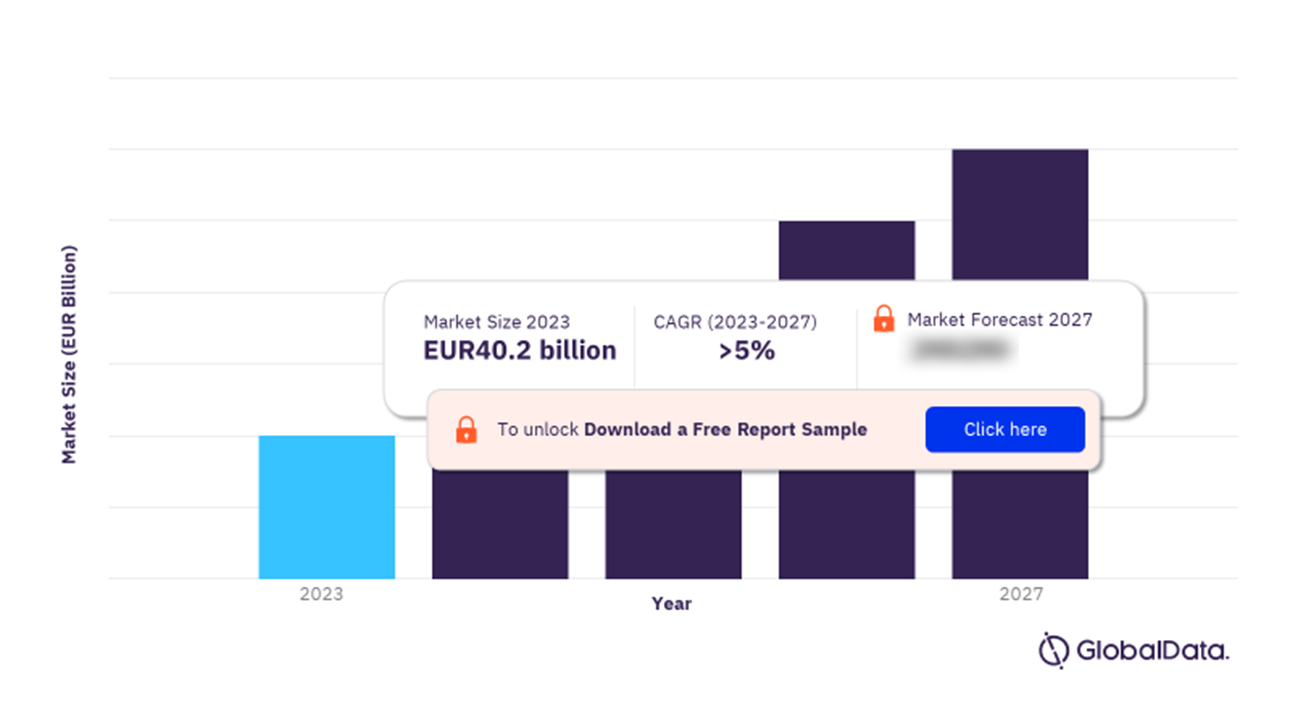

The gross written premium of the Spain general insurance market was EUR40.2 billion in 2022 and is expected to achieve a CAGR of more than 5% during 2023-2027. The Spain general insurance market research report provides in-depth market analysis, information, and insights into the Spain’s general insurance segment. It also provides values for key performance indicators such as gross written premium, loss ratio, retail, and commercial split, premium by line of business, and reinsurance premiums during the review period and forecast period.

Spain General Insurance Market Outlook, 2022-2026 (EUR Billion)

To gain more information about the Spain general insurance market forecast, download a free report sample

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of The Spain economy and demographics, and provides detailed information on the competitive landscape in the country. The report also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2022) | EUR40.2 billion |

| CAGR | >5% |

| Forecast Period | 2023-2027 |

| Historical Period | 2017-2022 |

| Key Lines of Business | · Non-Life PA&H

· Motor · Property · Miscellaneous · Financial lines · Liability · MAT |

| Key Distribution Channel | · Direct Marketing

· E-commerce · Insurance Brokers · Bancassurance · Agencies · Other Distribution Channels |

| Leading Companies | · Mapfre Espana

· Segurcaixa Adeslas · Allianz · Axa Seguros Generales · Generali Espana · Others |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Spain General Insurance Market Trends

Pet insurance, cyber insurance, electric vehicles (EVs), ESG and gig economy are some of the trends impacting the Spain GI market.

The growth in pet insurance in Spain is supported by the rise in the adoption of companion animals. Also, according to the Spanish Association of Food Manufactures, the number of cats and dogs living in Spain grew by 54% and 38% which has caused the development of new products in the field of pet insurance.

Furthermore, in 2022, Spain was ranked at third position in the world for the most cyberattacks on companies, with 94% of companies suffering with at least one cybersecurity incident, thereby creating a need for cyber insurance products. The most affected sectors were insurance, telecommunications, media, technology, manufacturing, public administration, and banking.

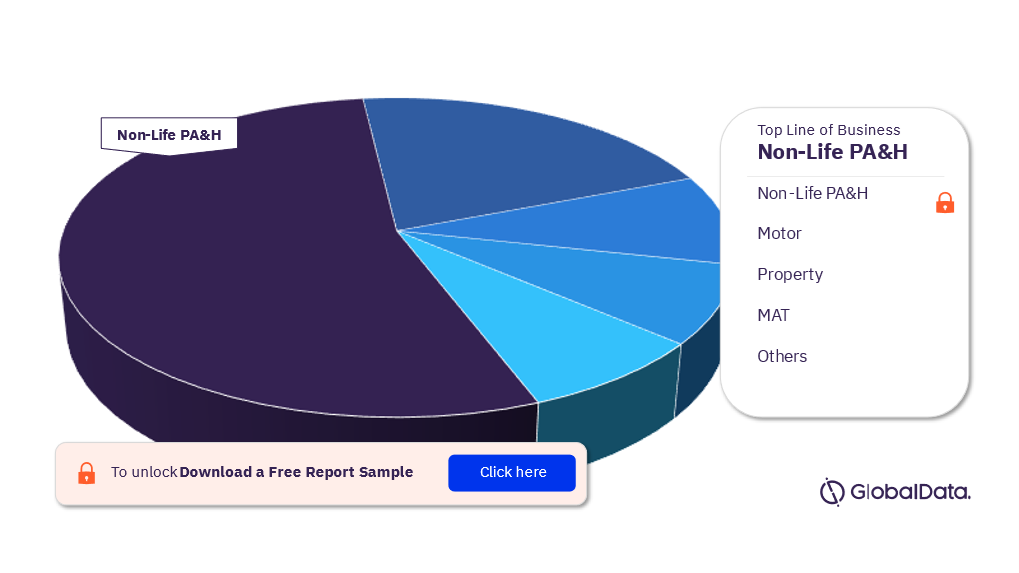

Spain General Insurance Market Segmentation by Lines of Business

The key lines of business in The Spain general insurance market are motor, property, MAT, liability, non-life PA&H, financial lines, and miscellaneous. In 2022, the non-life PA&H segment held the highest share.

Spain General Insurance Market Analysis by Lines of Business, 2022 (%)

For more lines of business insights into the Spain general insurance market, download a free report sample

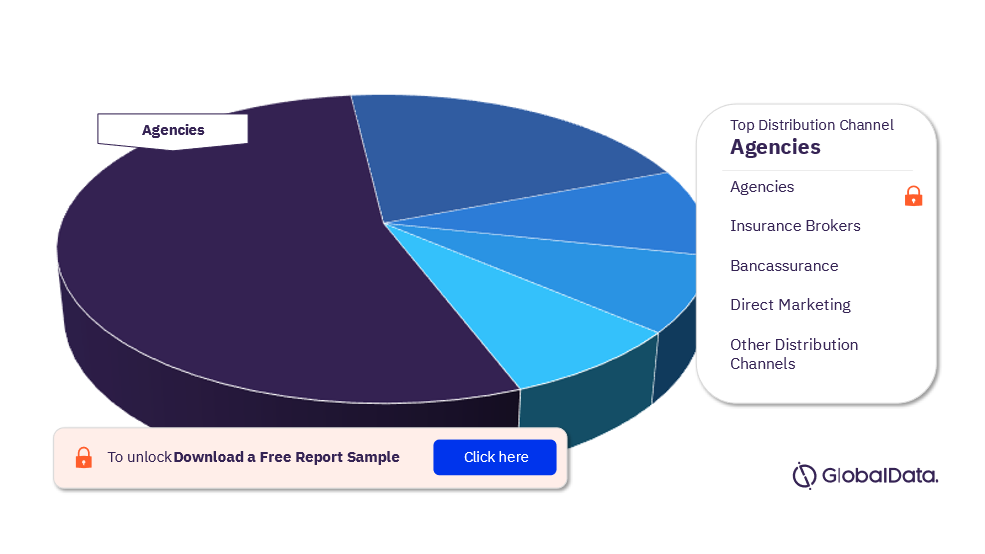

Spain General Insurance Market Segmentation by Distribution Channel

The key distribution channels in the Spain life insurance industry are direct marketing, e-commerce insurance brokers, bancassurance, agencies, and other distribution channels. In 2022, agencies accounted for the highest Spain general insurance market share, followed by insurance brokers.

Spain General Insurance Market Analysis by Distribution Channel, 2021 (%)

For more distribution channel insights into the Spain general insurance market, download a free report sample

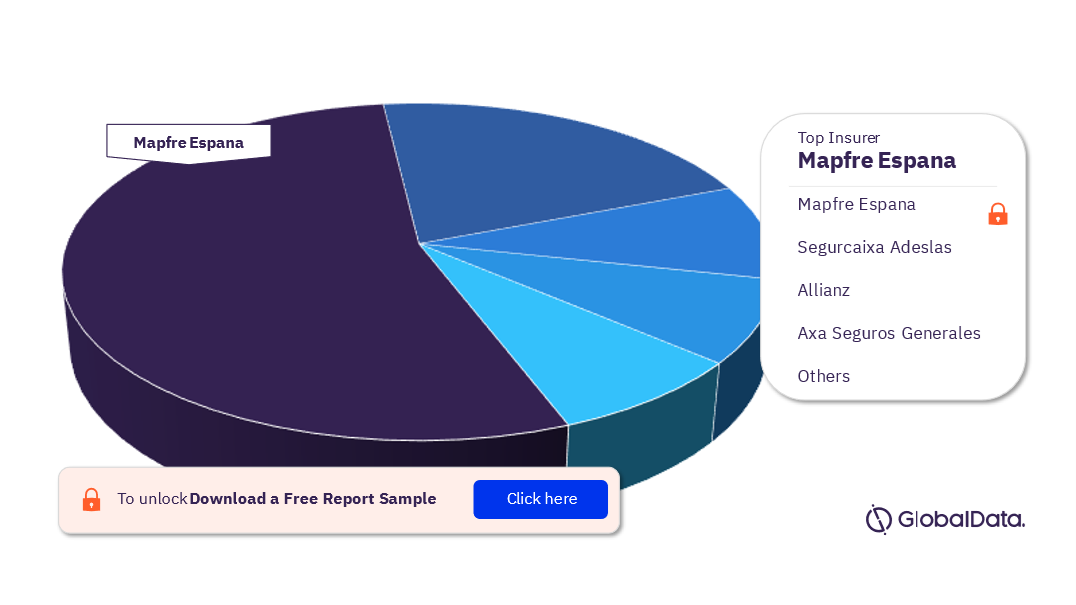

Spain General Insurance Market - Competitive Landscape

The leading general insurance companies in the Spain general insurance market are Santa Lucia, ASISA, Mutua Madrilena Automovilista, Sanitas, Generali Espana, Atradius Credito Spain, Axa Seguros Generales, Allianz, Segurcaixa Adeslas, and Mapfre Espana among others. In 2021, Mapfre Espana was the leading insurer.

Spain General Insurance Market Analysis by Companies, 2021 (%)

To know more about the leading companies in the Spain general insurance market, download a free report sample

Segments Covered in the Report

Spain General Insurance Market Lines of Business Outlook (Value, EUR Billion, 2017-2026)

- Property Insurance

- Motor Insurance

- Liability Insurance

- Financial Lines Insurance

- MAT Insurance

- Non-Life PA&H Insurance

Spain General Insurance Market Distribution Channel Outlook (Value, EUR Billion, 2017-2026)

- Direct Marketing

- Insurance Brokers

- Bancassurance

- Agencies

- Other Distribution Channels

Scope

This report provides a comprehensive analysis of the general insurance segment in Spain –

- It provides historical values for the Spain general insurance segment for the report’s review period and projected figures for the forecast period.

- It offers a detailed analysis of the key categories in Spain’s general insurance segment and market forecasts until 2026.

- It profiles the top general insurance companies in Spain and outlines the key regulations affecting them.

Key Highlights

• Key insights and dynamics of the Spanish general insurance segment.

• A comprehensive overview of the Spanish economy, government initiatives, and investment opportunities.

• The Spanish insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

• The Spanish general insurance industry’s market structure giving details of lines of business.

• The Spanish general insurance reinsurance business’s market structure giving details of premium ceded along with cession rates.

• Distribution channels deployed by the Spanish general insurers.

• Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to The Spain general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in The Spain general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

- Gain insights into key regulations governing Spain’s general insurance industry, and their impact on companies and the industry’s future.

Segurcaixa Adeslas, Sociedad Anonima De Seguros y Reaseguros

Allianz, Compania De Seguros y Reaseguros, SA

Axa Seguros Generales, SA De Seguros Y Reaseguros

Generali Espana, Sociedad Anonima De Seguros y Reaseguros

Sanitas, Sociedad Anonima De Seguros

Mutua Madrilena Automovilista, Sociedad De Seguros a Prima Fija

Atradius Credito y Caucion SA De Seguros y Reaseguros

Table of Contents

Frequently asked questions

-

What was the Spain general insurance market grow written premium in 2022?

The gross written premium of the Spain general insurance market was EUR40.2 billion in 2022.

-

What is Spain’s general insurance market growth rate?

The general insurance market in the Spain is expected to achieve a CAGR of more than 5% during 2023-2027.

-

Which LoB held the highest share of the Spain general insurance market?

In 2022, the non-life PA&H line of business segment held the highest share in the Spain general insurance market.

-

Which was the most preferred distribution channel in the Spain general insurance market?

Agencies were the most preferred distribution channel in the Spain general insurance market.

-

Which are the leading companies in the Spain general insurance industry?

The leading insurance companies in Spain’s general insurance industry are Santa Lucia, ASISA, Mutua Madrilena Automovilista, Sanitas, Generali Espana, Atradius Credito Spain, Axa Seguros Generales, Allianz, Segurcaixa Adeslas, and Mapfre Espana among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports