Spain Wealth Management – High Net Worth (HNW) Investors

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Spain Wealth Management Report Overview

Female HNW investors remain underrepresented, but have a huge potential to grow in the Spanish wealth management market. Males account for more than 85% of the total HNW population in the country, which is slightly above average for Europe. Several programs have been established to educate and support women in establishing businesses to foster female participation in the field of entrepreneurship. For instance, in September 2022, the government launched The Break: a 10-week program for EU resident women that aids female entrepreneurs by offering mentorship, networking opportunities, and access to funding.

The Spain wealth management market report sizes the opportunity within Spain’s wealth market and analyzes the investment preferences, service requirements, and portfolio allocations of the country’s HNW investors.

Spain Wealth Management Market Dynamics

Spanish HNW individuals have made their fortunes predominantly through earned income. The entrepreneurial HNW market is notably smaller but growing rapidly. Despite the global economic downturn and volatile market conditions, the Spanish entrepreneurial segment has remained resilient.

To encourage business creation and expansion, in February 2021, the government launched the Spain: Entrepreneurial Nation Strategy, which includes 50 measures to support entrepreneurs. The strategy aims to boost investments, help retain and attract talent, increase the scalability of companies, and provide administrative and regulatory support for entrepreneurs. These measures include the introduction of the Startup Law and the creation of RENACE – a national network of entrepreneurship centers, incubators, and accelerators. Family-owned business is a small but growing source of wealth for the Spanish HNW population. Family businesses play a key role in the country’s economy.

For more additional Spain wealth management market dynamics, download a free sample report

Spain Wealth Management Market Investment Preferences

The key investment preferences in the Spain wealth management market are advisory asset management, automated investment services, discretionary asset management, and execution-only asset management. There is currently strong demand for most styles of asset management services. However, demand for advisory mandates is expected to remain stagnant. Furthermore, there will be a rise in demand for discretionary mandates which can be partly attributed to growing levels of trust, as wealth managers have navigated their clients through volatile market conditions following the outbreak of COVID-19.

Automated investment services will make further inroads into the HNW market. Factors such as changing client demographics and preferences as well as the rapid advancement of technology are driving the growth of digital investment platforms. In addition, rising confidence in managing their own investments is driving Spanish HNW individuals to opt for self-directed investments. A surge in the adoption of digital investment tools such as robo-advisors and online broking platforms have sparked the interest of digital-savvy HNW investors. Also, another reason for investors to engage in self-directed investing is because a significant portion of their wealth is locked in the form of property, collectibles, or other physical assets. Wealth managers need to educate investors about the range of financial products they can provide to offer better diversification.

To know more about the Spain wealth management market investment preferences, download a free sample report

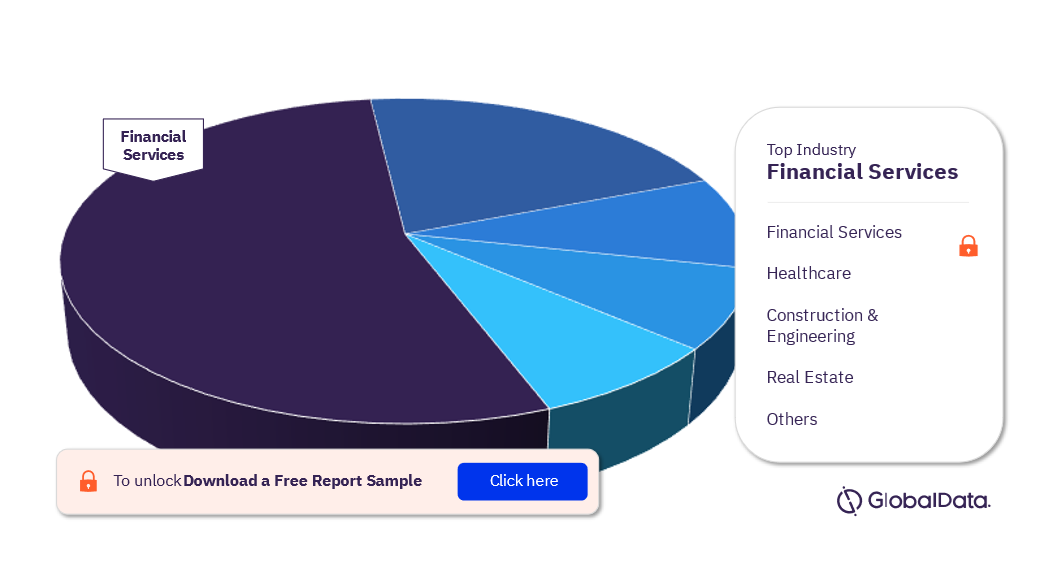

Spain Wealth Management Market Segmentation by Industry

Some of the key industries in the Spain wealth management market are financial services, healthcare, construction & engineering, real estate, manufacturing, tech & telecommunications, transport & logistics, retail, fashion & luxury goods, FMCG, hotels, restaurants & leisure, media, diversified, government, basic materials, energy & utilities, and others. In 2022, the financial services sector emerged as the largest contributor to HNW wealth in Spain

Spain Wealth Management Market Analysis by Industry, 2022 (%)

For more insights on industries in the Spain wealth management market, download a free sample report

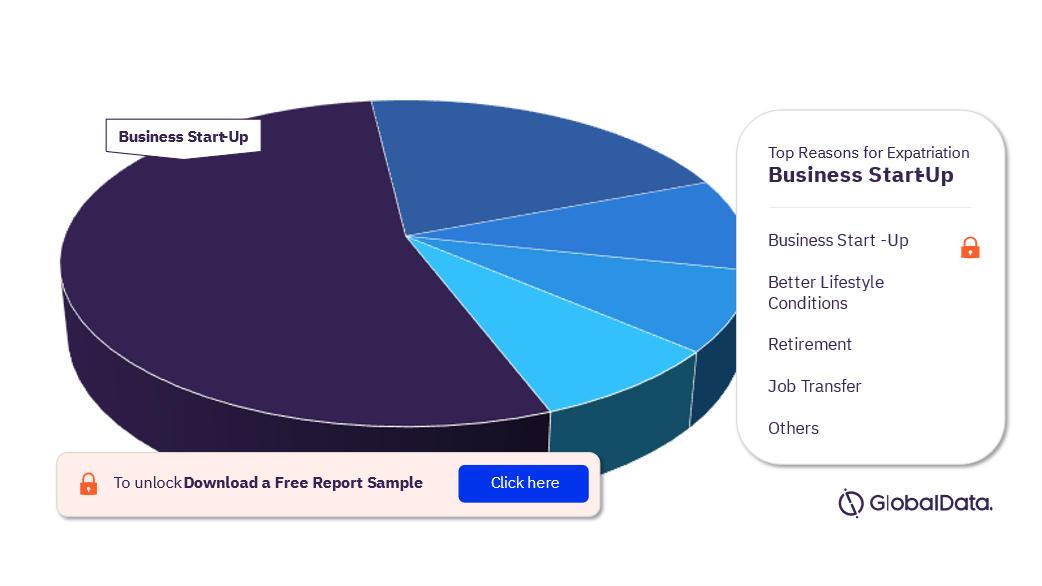

Spain Wealth Management Market - Reasons for Expatriation for HNW Investors

The drivers of expatriation to Spain are job transfer, better lifestyle conditions, better opportunities for expats’ children, business start-ups, tax efficiencies, and retirement among others. Business start-up is the most prominent driver for expatriation to Spain as the government is taking steps to develop the entrepreneurial ecosystem.

Spain Wealth Management Market By Reasons For Expatriation, 2022 (%)

For more expatriation reason insights in the Spain wealth management market, download a free report sample

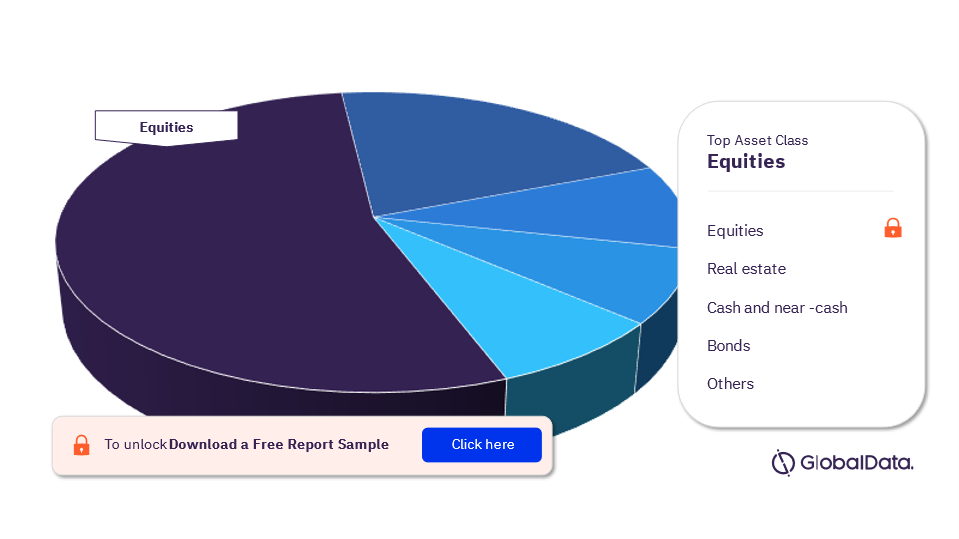

Spain Wealth Management Market – Asset Allocation Preferences

Onshore Asset Allocation: The major asset classes of onshore investment for HNW investors in the Spain wealth management market include equities, bonds, cash and near-cash, real estate, commodities, and alternatives. HNW investors in Spain allocate the largest proportion of their onshore wealth to equities, in line with regional trends. Inflation protection is the most important reason for equity investments among HNW investors in Spain, followed by capital appreciation and dividend income.

Offshore Asset Allocation: Alternatives constitute nearly a quarter of offshore holdings in Spain. This is a natural response to market volatility, as many alternatives are prized for their hedging or uncorrelated returns. Equities are the second most popular offshore asset class. Factors such as better returns, diversification opportunities, and tax efficiencies are some of the key drivers for offshore equity investments by HNW clients in Spain.

Spain Wealth Management Market By Asset Classes Of Onshore Investment, 2022 (%)

For more asset classes of onshore investment insights in Spain wealth management market, download a free report sample

Spain Wealth Management Market – Product and Services

Some of the key products and services in the Spain wealth management market are ESG investments, financial planning, inheritance planning, life insurance, lifestyle privileges, pensions and retirement planning, philanthropy, and tax planning among others. Pensions and retirement planning is set to see the biggest increase in demand in the upcoming years mainly due to the aging composition of the country’s HNW population.

For more product and services information in the Spain wealth management market, download a free report sample

Spain Wealth Management Market Report Overview

| Key Investment Preferences | Advisory Asset Management, Automated Investment Services, Discretionary Asset Management, and Execution-Only Asset Management. |

| Key Reasons For Expatriation | Job Transfer, Better Lifestyle Conditions, Better Opportunities for Expats’ Children, Business Start-Ups, and Retirement |

| Major Asset Classes Of Investment | Equity, Cash and Near Cash, Bonds, Property, Alternatives, and Commodities |

| Key Products and Services | ESG Investments, Financial Planning, Inheritance Planning, Life Insurance, Lifestyle Privileges, Pensions and Retirement Planning, Philanthropy, and Tax Planning |

Spain Wealth Management Market Asset Classes Outlook (2022)

- Equity

- Cash and Near Cash

- Bonds

- Property

- Alternatives

- Commodities

Key Highlights

Key Highlights

- Expats constitute 24.7% of the local HNW population. They represent an attractive target market thanks to their more complex service requirements.

- Robo-advice currently accounts for 13.3% of the Spanish HNW portfolio.

- Equities, property, and cash and near-cash investments dominate the Spanish HNW asset portfolio.

Reasons to Buy

- Develop and enhance your client targeting strategies using our data on HNW profiles and sources of wealth.

- Enhance your marketing strategies and capture new clients using insights from our data on HNW investors’ asset management style preferences.

- Tailor your investment product portfolio to match current and future demand for different asset classes among HNW individuals.

Barclays

inbestMe

Table of Contents

Frequently asked questions

-

What are the various investment services in the Spain wealth management market?

Advisory asset management, automated investment services, discretionary asset management, and execution-only asset management are the various investment services in the Spain wealth management market.

-

What are the key reasons for expatriation for HNW investors in the Spain wealth management market?

Job transfer, better lifestyle conditions, better opportunities for expats’ children, business start-ups, and retirement are the key reasons for expatriation for HNW investors in the Spain wealth management market.

-

What is the key driver for expatriation for HNW investors in the Spain wealth management market?

The key driver of expatriation to the Spain management market is emerging business start-ups.

-

What are the major asset classes of investments for HNW investors in the Spain wealth management market?

Equity, cash and near-cash products, bonds, property, alternatives, and commodities are the major asset classes of investments for HNW investors in the Spain wealth management market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports