Steam and Gas Turbines Market Size, Share and Trends Analysis by Regions, Countries, Technology, Installed Capacity, Generation, Key Players and Forecast, 2021-2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Accessing in-depth insights from the ‘Steam and Gas Turbines Market’ report can help you:

- Enhance your decision-making capability in a more rapid and time-sensitive manner.

- Facilitate decision-making by analyzing historical and forecast data on steam and gas turbine markets.

- Develop strategies based on developments in the steam and gas turbine markets.

- Identify key partners and business-development avenues, based on an understanding of the activities of the major competitors in the steam and gas turbine markets.

- Respond to your competitors’ business structure, strategies, and prospects.

How is the ‘Steam and Gas Turbines Market’ report different from other reports in the market?

- In-depth insight, comprehensive information, and understanding of the steam and gas turbine markets.

- Regional and Country Highlights: Analysis of the steam and gas turbine markets at the global, regional (Asia-Pacific, Americas, Europe, and Middle East and Africa) and key country (the US, China, India, Republic of Korea, Indonesia, Egypt, the UK, and Saudi Arabia) levels.

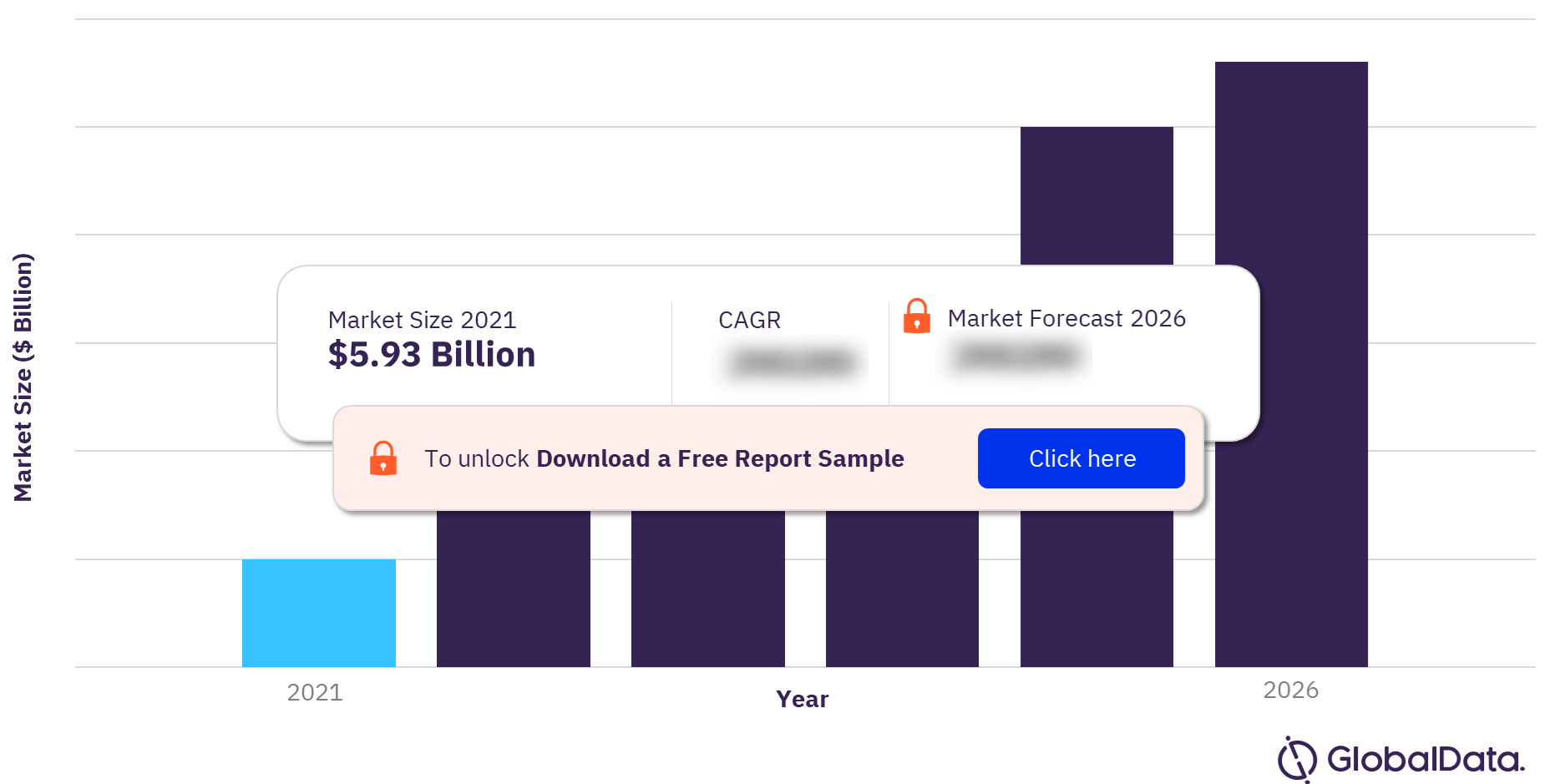

- Market Size and Drivers: Gain access to the historical (2017-2021) and forecast (2022-2026) period growth for the steam turbine market and gas turbine markets.

- Recent Developments and Challenges: Leverage on the drivers and restraints influencing the market and get access to market size analysis with respect to annual capacity (MW) and value ($m).

- Competitive Landscape and Strategic Insights: Get profile snapshots of all the major players along with a list of key upcoming projects.

- The report is built using data and information sourced from proprietary databases, primary and secondary research, and in-house analysis by GlobalData’s team of industry experts.

We recommend this valuable source of information to anyone involved in:

- Strategy and Product Development

- Equipment Manufacturers and Contractors

- Management Consultants, Marketing and Market Intelligence

- Project Owners and Developers

- Government Agencies, M&A, and Investment Banks

- Private Equity Players

- Government agencies

Any stakeholder currently working with companies manufacturing and supplying steam and gas turbines, consultants, and venture capitalists.

To get a snapshot of the steam and gas turbines market report, download a free report sample

Steam and Gas Turbines Market Overview

The gas turbine market was valued at $5.93 billion in 2021. The growing demand for electricity, climate change concerns, rapid development, increasing fuel prices, and the maturity of technology are some of the major factors influencing the steam and gas turbine market. However, evolving manufacturing practices are contributing to the fabrication of new thermal power generation systems with reduced environmental pollution that enhances market acceptance. Additionally, various new technologies such as Integrated Gasification and Combined-Cycle (IGCC), carbon capture and storage (CCS), supercritical and ultra-critical power generation, and carbon sequestration, developed over the past decade, are a lot cleaner and make thermal power generation more acceptable within the confines of established policies and regulations.

The steam and gas turbines market research report offers comprehensive information and understanding of the steam and gas turbine markets. The report offers an in-depth analysis of the steam and gas turbine markets at the global, regional, and key country levels. It also analyses the steam and gas turbine markets for the historical and forecast period. The report includes drivers and restraints influencing the market and market size analysis with respect to annual capacity (MW) and value ($m). It provides a snapshot of the competitive landscape as well along with a list of key upcoming projects.

Gas Turbines Market Outlook

For more insights into this steam and gas turbines market forecast, download a free report sample

Steam and Gas Turbines Market Drivers

Stringent emission norms are expected to accelerate the demand for gas turbines which is likely to have a direct impact on the global gas industry. Furthermore, increased demand for power is expected to aid growth in the steam and gas turbines market. However, the lack of robust gas infrastructure will ensure the continuity of coal consumption in emerging economies.

Steam and Gas Turbines Market Segmentation by Regions

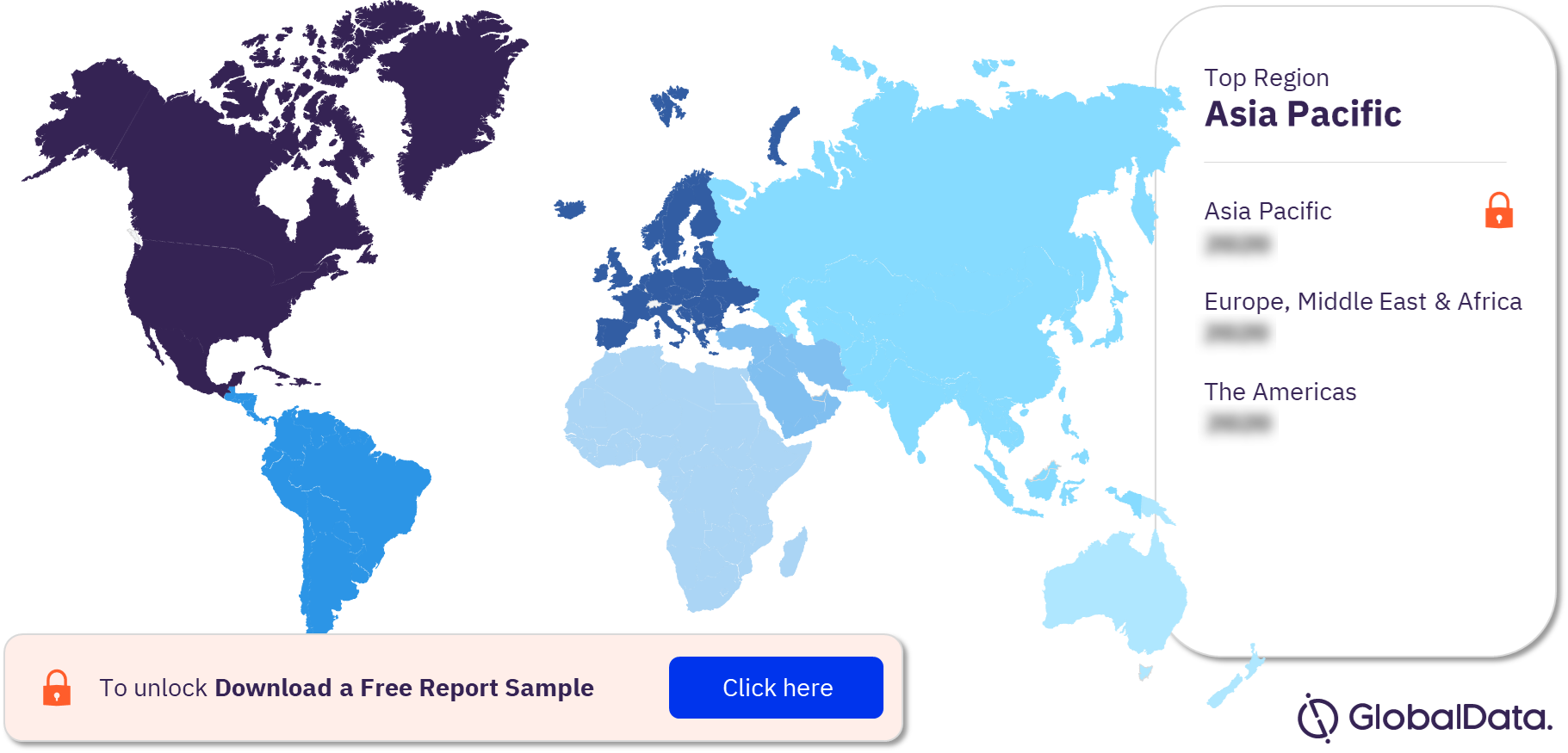

The key regions in the steam and gas turbines market are the Americas, Asia-Pacific, and Europe, Middle East, & Africa (EMEA).

The Asia-Pacific (APAC) region consists of many fast-growing countries such as China, India, Vietnam, and Indonesia, along with developed economies such as Australia, Japan, and South Korea, all of which depend significantly on coal for their energy requirements. As the region registers rapid economic growth, the demand for coal and gas will increase, aiding the market for steam and gas turbines. Moreover, the growth in nuclear power in the region will also enhance the steam turbine market. Malaysia, Thailand, Indonesia, the Philippines, and Vietnam began building nuclear power capacity, apart from the prominent nuclear markets of China, India, Japan, and South Korea, which also have several plants under construction.

The Europe, Middle East, and Africa (EMEA) region is expected to lead the gas turbine market in the forecast period with countries such as the US and China, and the UK and Saudi Arabia, to a lesser extent, aiding growth in the market. The increase in demand for electricity, stringent emission norms, urbanization, unfavorable coal economics, and reliable supply chain and infrastructure are some of the critical factors complementing the gas turbine market.

Steam Turbines Market Analysis, by Regions

For more regional insights into the steam and gas turbines market, download a free report sample

Steam and Gas Turbines Market - Competitive Landscape

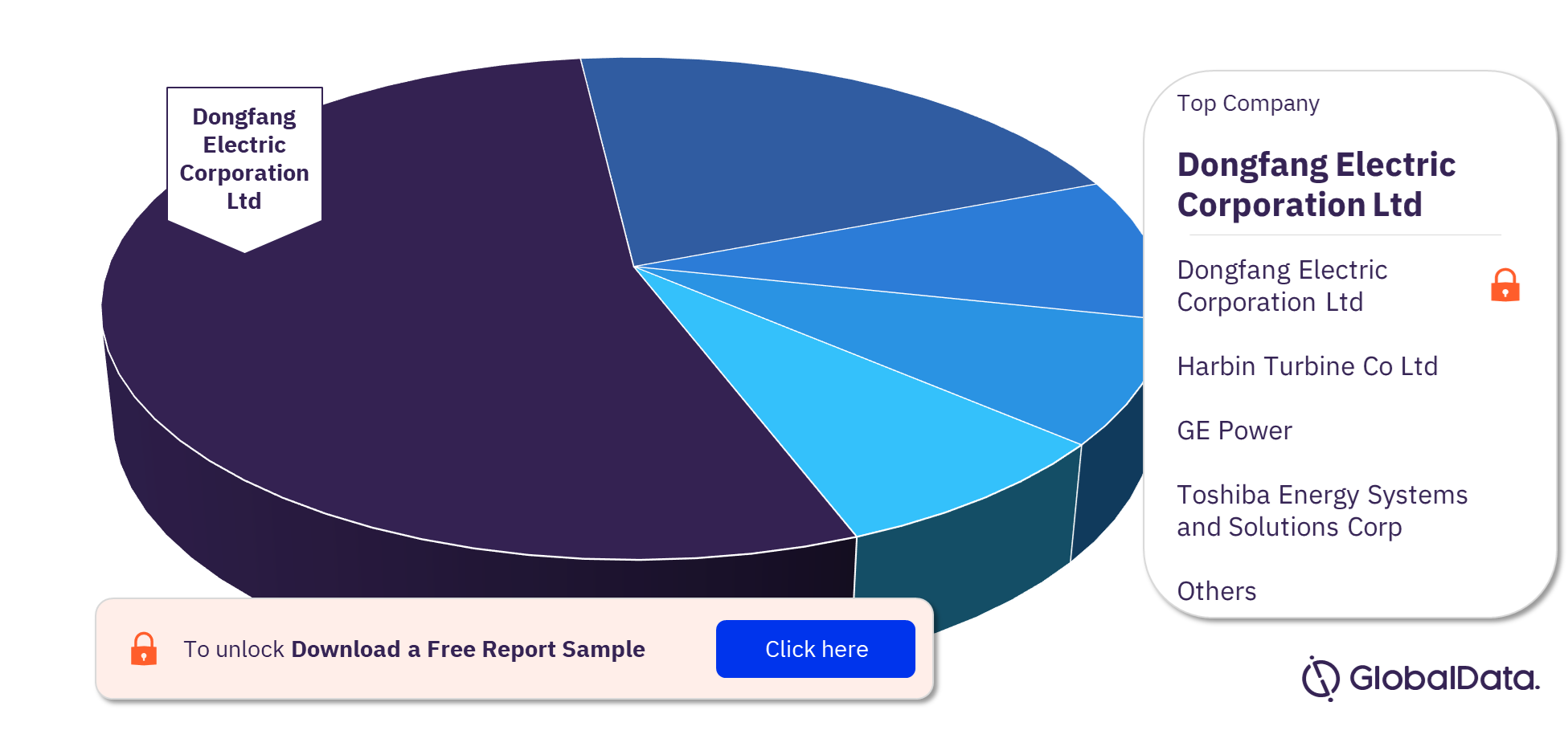

Some of the leading companies in the steam turbines market are Dongfang Electric Corporation Ltd, Harbin Turbine Co Ltd, GE Power, Toshiba Energy Systems and Solutions Corp, Shanghai Electric Group Co Ltd, Doosan Enerbility Co Ltd, Siemens AG, and Mitsubishi Hitachi Power Systems Ltd. Dongfang Electric Corporation Ltd led the steam turbines market by market share in 2021.

Some of the leading companies in the gas turbines market are GE Power, Siemens AG, Mitsubishi Power Ltd, Nanjing Turbine & Electric Machinery (Group) Co Ltd, Ansaldo Energia SpA, AVIADVIGATEL, and REP Holding. GE Power led the gas turbines market by market share in 2021.

GE Power (GEP): It is a business division of the General Electric Company and a provider of power generation and water processing products and related services. Its product portfolio includes aeroderivative and heavy-duty gas turbine systems, generators, boilers, steam turbines, air quality control systems, gas engines, reactors and water treatment, and wastewater treatment and process system solutions. It offers products and technologies for generating electricity from various sources such as oil, gas, nuclear, coal, diesel, and water.

Dongfang Electric Corporation Ltd (DEC): It is a power equipment and services company that develops, designs, manufactures, and sells equipment for hydro, thermal, nuclear, wind, steam, and solar thermal-based plants. Its major products include hydropower units, thermal power generating units, and heavy-duty gas turbine equipment, among others. DEC also provides construction contracting and related services to electricity operators, and portion project, equipment package contracting, and equipment supply.

Steam Turbines Market Analysis, by Companies

To know more about the companies in the steam and gas turbines market, download a free report sample

Steam and Gas Turbines Market Report Overview

| Market Size (Gas Turbine – 2021) | $5.93 billion |

| Key Regions | The Americas, Asia-Pacific, and Europe, Middle East, & Africa (EMEA) |

| Key Companies (Steam Turbines) | Dongfang Electric Corporation Ltd, Harbin Turbine Co Ltd, GE Power, Toshiba Energy Systems and Solutions Corp, Shanghai Electric Group Co Ltd, Doosan Enerbility Co Ltd, Siemens AG, and Mitsubishi Hitachi Power Systems Ltd |

| Key Companies (Gas Turbines) | GE Power, Siemens AG, Mitsubishi Power Ltd, Nanjing Turbine & Electric Machinery (Group) Co Ltd, Ansaldo Energia SpA, AVIADVIGATEL, and REP Holding |

Segments Covered in the Report

Steam and Gas Turbines Geographical Outlook (Value, US$ Million, 2017-2026)

- Global

- The Americas

- The US

- APAC

- China

- India

- Republic of Korea

- Indonesia

- EMEA

- Egypt

- The UK

- Saudi Arabia

Steam and Gas Turbines Capacity Outlook (Value, US$ Million, 2017-2026)

- Steam turbine

- Gas turbine

AVIADVIGATEL

Dongfang Electric Corporation Ltd

Doosan Enerbility Co Ltd

GE Power

Harbin Turbine Co Ltd

Mitsubishi Hitachi Power Systems Ltd

Mitsubishi Power Ltd

Nanjing Turbine & Electric Machinery (Group) Co Ltd

REP Holding

Shanghai Electric Group Co Ltd

Siemens AG

Toshiba Energy Systems and Solutions Corp

Table of Contents

Table

Figures

Frequently asked questions

-

What was the gas turbine market size in 2021?

The gas turbine market was valued at $5.93 billion in 2021.

-

What are the key regions in the steam and gas turbines market?

The key regions in the steam and gas turbines market are the Americas, Asia-Pacific, and Europe, Middle East, & Africa (EMEA).

-

What are the leading companies in the steam turbines market?

Some of the leading companies in the steam turbines market are Dongfang Electric Corporation Ltd, Harbin Turbine Co Ltd, GE Power, Toshiba Energy Systems and Solutions Corp, Shanghai Electric Group Co Ltd, Doosan Enerbility Co Ltd, Siemens AG, and Mitsubishi Hitachi Power Systems Ltd.

-

What are the leading companies in the gas turbines market?

Some of the leading companies in the gas turbines market are GE Power, Siemens AG, Mitsubishi Power Ltd, Nanjing Turbine & Electric Machinery (Group) Co Ltd, Ansaldo Energia SpA, AVIADVIGATEL, and REP Holding.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.