Switzerland Defense Market Size, Trends, Budget Allocation, Regulations, Acquisitions, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Switzerland Defense Market Report Overview

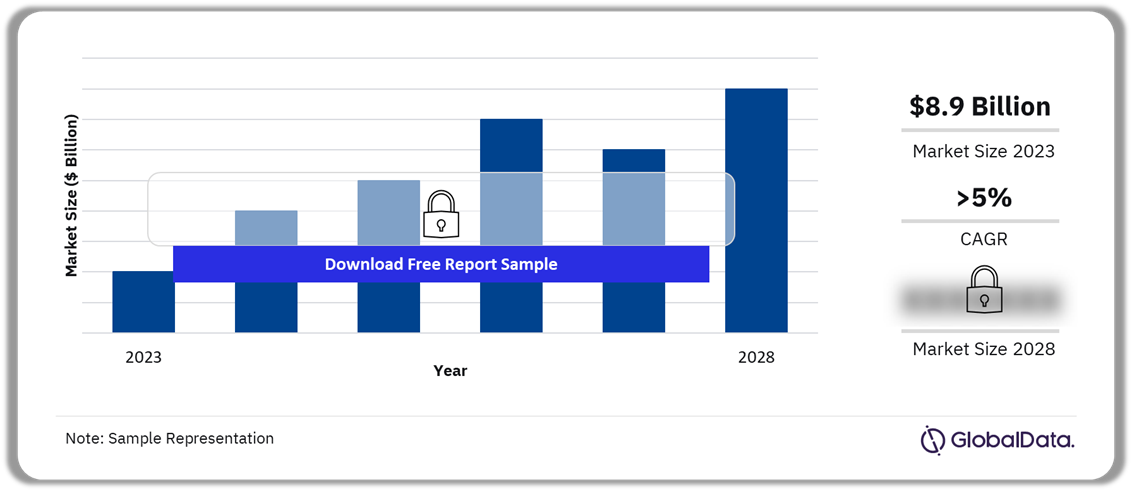

Switzerland’s defense budget is estimated at $8.9 billion in 2023 and is expected to grow at a CAGR of more than 5% from 2024 to 2028. This is due to several recent modernization efforts within the Swiss military, such as the Air2030 program and the expansion of its cyber defense units. Indeed, the purchase and integration of new capabilities will drive up expenditure on acquisitions, operations and maintenance, and other ancillary costs over the forecast period as the Swiss military modifies infrastructure and trains additional personnel to facilitate the deployment of those capabilities.

Switzerland Defense Market Outlook, 2023-2028 ($ Billion)

Buy the Full Report to Gain More Information about the Switzerland Defense Market Forecast

The Switzerland defense market research report provides the market size forecast and the projected growth rate for the next five years. It also covers industry analysis including the key market drivers, emerging technology trends, segments, and major challenges faced by market participants. It offers insights regarding military strategies as well as key factors and government programs that are expected to influence the demand for military platforms over the forecast period.

| Market Size (2023) | $8.9 billion |

| CAGR (2024-2028) | >5% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Sectors | · Military Fixed-Wing Aircraft

· Missiles and Missile Defense Systems · Tactical Communications Systems · Artillery Systems · EO/IR Systems · Military Land Vehicles |

| Leading Companies | · ABB Ltd

· TE Connectivity Ltd · STMicroelectronics NV · Garmin Ltd · Lockheed Martin Corp · Maxon Motor AG |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Switzerland Defense Market Drivers

The rising popularity of domestic modernization programs is one of the key factors driving the defense market in Switzerland. The Air2030 program has become the largest defense acquisitions program in Swiss history, whilst other programs have sought to acquire new armored vehicles, modernize artillery systems, and reduce the armed forces’ environmental impact through greater reliance on renewable energy sources.

Furthermore, the Russian invasion of Ukraine and the subsequent deterioration of wider European security has driven Swiss military and government officials to seek increased defense expenditure and military rapprochement with international allies, as the decision to impose economic sanctions on Russian assets has resulted in a heightened sense of unease throughout the country.

Switzerland Military Doctrines and Defense Strategies

In accordance with the 2017 Military Doctrine, Switzerland considers remote direct military threats, including additional potential threats, such as espionage, cyber-attacks, external influence operations, and sabotage, as well as the actions of non-state groups. A substantial part of Swiss military doctrine is the active participation of Swiss troops in humanitarian and international peacekeeping missions. Swiss nationals are currently involved in peacekeeping missions globally.

Though Switzerland is not a full-fledged member of the NATO alliance, it has been a signatory to the international PfP agreement since 1996, alongside NATO members and other partner states, as the primary objective of that agreement was the enhancement of trust and transparency on security and defense policy matters, as well as promoting dialogue amongst Euro-Atlantic states to ensure peace in the region. Since its accession to the United Nations in 2002, Switzerland’s policy of military neutrality and the promotion of international peace has allowed it to play the key role of mediator in many international disputes. Furthermore, Switzerland hosts the United Nations Office of Geneva (UNOG), one of the four major UN offices worldwide, which hosts various UN agencies, such as the World Health Organization, World Trade Organization, and the Human Rights Council.

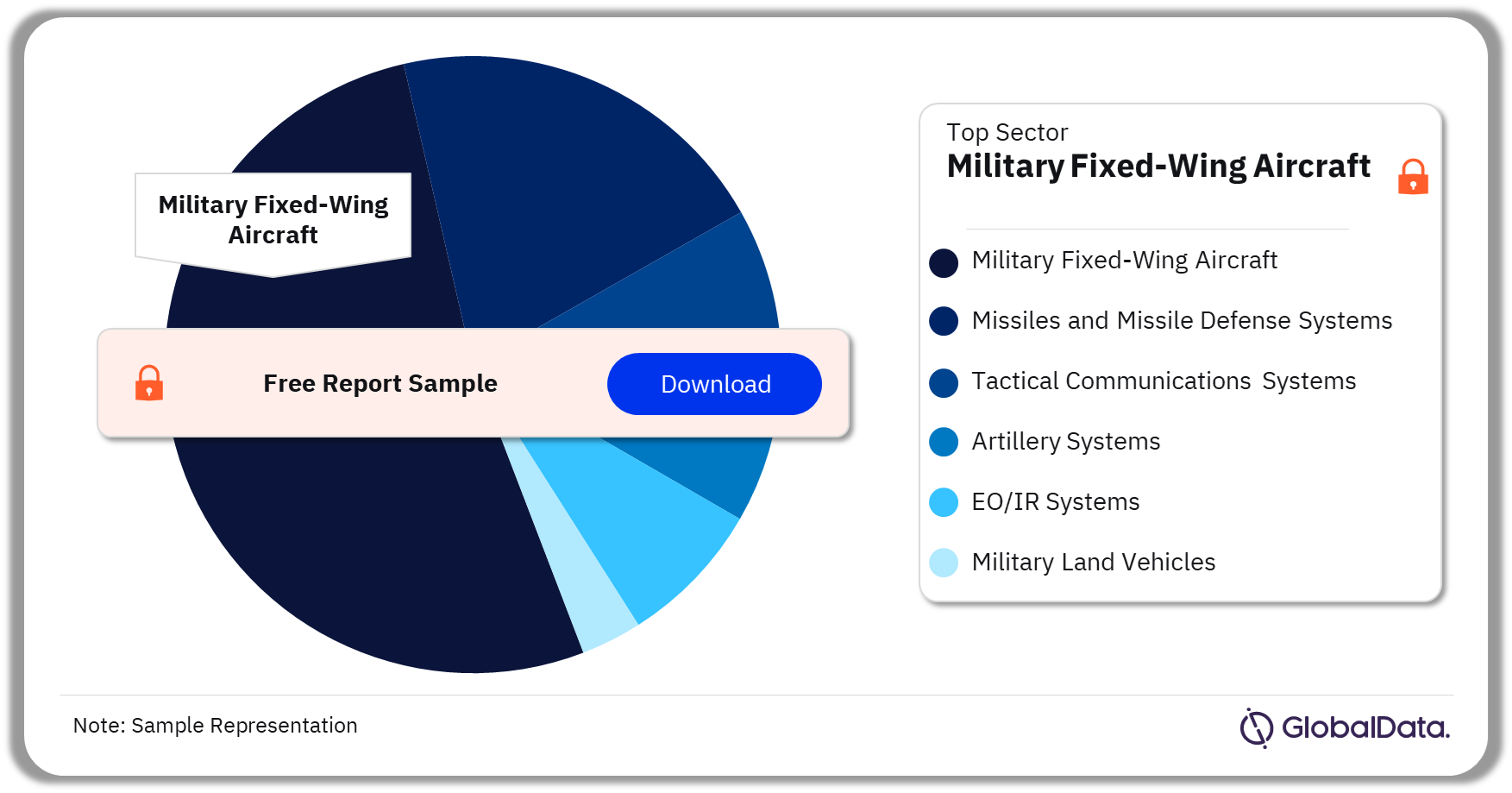

Switzerland Defense Market Segmentation by Sectors

The key sectors in the Switzerland defense market are military fixed-wing, tactical communications systems, missiles and missile defense systems, artillery systems, EO/IR Systems, and military land vehicles among others. Military fixed-wing aircraft is the largest sector within the Switzerland defense market in 2023. This sector is comprised entirely of the combat aircraft segment, as the Swiss Armed Forces are only procuring Lockheed Martin’s F-35A fighter variant under the Air2030 program, which was designed to ensure air supremacy and will replace their aging F/A-18 combat aircraft. The sector is likely to grow slightly and reach a peak by 2033.

Switzerland Defense Market Analysis by Sectors, 2023 (%)

Buy the Full Report for more Sector Insights into the Switzerland Defense Market

Switzerland Defense Market - Competitive Landscape

Some of the leading defense companies operating in Switzerland are ABB Ltd, TE Connectivity Ltd, STMicroelectronics NV, Garmin Ltd, Astrocast SA, Lockheed Martin Corp, and Maxon Motor AG among others. Lockheed Martin Corp provides advanced technology systems and products for defense, civil and commercial applications. Lockheed Martin provides support and upgrade services for military aircraft, cybersecurity, ground vehicles, missile defense systems, satellites, and space transportation systems.

Switzerland Defense Market Analysis by Companies

Buy the Full Report for more Company Insights into the Switzerland Defense Market

Segments Covered in the Report

Switzerland Defense Market Sectors Outlook (Value, $ Billion, 2019-2028)

- Tactical Communications Systems

- Military Fixed-Wing Aircraft

- Missiles and Missile Defense Systems

- Artillery Systems

- EO/IR Systems

- Military Land Vehicles

Scope

The report provides:

- Detailed analysis of Switzerland’s defense market with market size forecasts covering the next five years. The report will also analyze factors that influence demand for the industry, key market trends, and challenges faced by industry participants.

- Switzerland defense budget: detailed analysis of the Switzerland 2023 defense budget broken down into market size and market share. This is coupled with an examination of key current and future acquisitions.

- Regulation: the procurement policy and process is explained. This is coupled with an analysis of Switzerland’s military doctrine and strategy to provide a comprehensive overview of the military procurement regulation in Switzerland.

- Security Environment: political alliances and perceived security threats to Switzerland are examined to explain trends in spending and modernization.

- Competitive landscape and strategic insights: analysis of the competitive landscape of Switzerland’s defense industry.

Key Highlights

• Drivers of Defense expenditure include Domestic modernization programs, Russian invasion of Ukraine

• Major ongoing procurement program include procurement of Air2030, Mörser-16 artillery

Reasons to Buy

- Determine prospective investment areas based on a detailed trend analysis of the French defense market over the next five years.

- Gain an in-depth understanding of the underlying factors driving demand for different defense and internal security segments in the French market and identify the opportunities offered.

- Strengthen your understanding of the market in terms of demand drivers, market trends, and the latest technological developments, among others.

- Identify the major threats that are driving the Switzerland defense market providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channel resources by focusing on the ongoing programs that are being undertaken by the Switzerland government.

- Make correct business decisions based on an in-depth analysis of the competitive landscape consisting of detailed profiles of the top defense equipment providers in the country. The company profiles also include information about the key products, alliances, recent contracts awarded, and financial analysis, wherever available.

Table of Contents

Frequently asked questions

-

What is the Switzerland defense market size in 2023?

The defense market size in Switzerland is $8.9 billion in 2023.

-

What is the Switzerland defense market growth rate?

The defense market in Switzerland is expected to achieve a CAGR of more than 5% during 2024-2028.

-

Which is the leading sector in the Switzerland defense market in 2023?

Military fixed-wing aircraft is forecast to be the largest sector in Switzerland’s defense market.

-

Who are the key companies operating in the Switzerland defense market?

Some of the leading defense companies operating in Switzerland are ABB Ltd, TE Connectivity Ltd, STMicroelectronics NV, Garmin Ltd, Astrocast SA, Lockheed Martin Corp, and Maxon Motor AG among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Homeland Security reports