Taiwan Healthcare (Pharma and Medical Devices) Market Analysis, Regulatory, Reimbursement and Competitive Landscape

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Taiwan Healthcare Market Overview

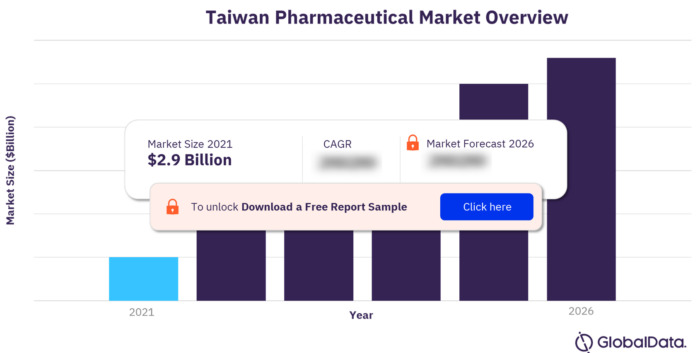

Taiwan pharmaceutical market size was $2.9 billion in 2021. The market grew at a CAGR of more than 3% during 2015-2018. Increasing social awareness of health and well-being, a growing aging population, government efforts like biotechnology parks to promote foreign investment, and fast improvements in healthcare technology and digital health are driving the Taiwan pharmaceutical business. Pharmaceutical expansion is hindered by the National Health Insurance Administration’s (NHIA’s) use of medication price controls to curb healthcare costs.

For more pharmaceutical insights, download a free report sample

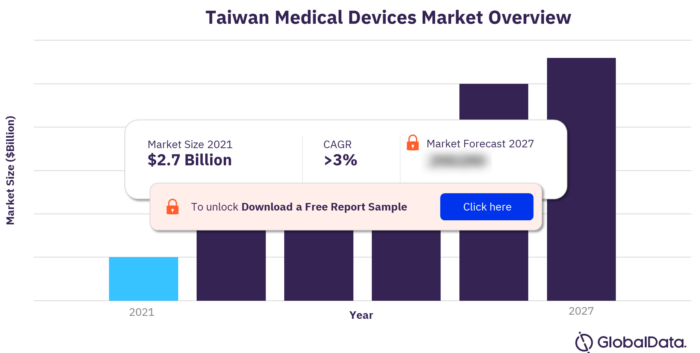

Taiwan medical devices market size was $2.7 billion in 2021. The market is expected to grow at a CAGR of more than 3% during the period 2022-2027. In March 2022, Taiwan’s Wistron Medical Technology digitized an AI-based dialysis management system, the “Best Shape Chronic Kidney Disease Care,” which can transmit warnings by detecting a drop in blood pressure in terminal-stage renal patients. It provides great support to frontline health workers and makes optimal care possible.

For more medical devices insights, download a free report sample

Market Dynamics in the Taiwan Pharmaceutical Market

- The Taiwan pharmaceutical market is heavily reliant on imported drugs. Most pharma manufacturing facilities in Taiwan are either in Tainan, a city on Taiwan’s southwest coast, or around Taiwan’s capital city, Taipei, in the far north of the country. They are particularly concentrated in Taoyuan and new Taipei.

- There is a lack of international pharma companies and contract manufacturing organizations (CMOs) in Taiwan, particularly in the eastern-most counties like Pingtung, Taitung, and Hualien, where there are no locations registered with the FDA or European Medicines Agency (EMA). Yilan, which borders new Taipei, only has one industrial facility, operated by Sinphar Pharmaceutical (Dongshan, Taiwan).

Key Segments in the Taiwan Pharmaceutical Market

The key segments in the Taiwan pharmaceutical market are generics, biologics, biosimilars, and over-the-counter (OTC). The Taiwan Generic Pharmaceutical Association (TGPA) is a non-profit organization established in April 2007. It represents manufacturers and distributors of finished generic pharmaceutical products and active pharmaceutical chemicals, and suppliers of other goods and services to the generic pharmaceutical industry. Since 2015, the TGPA has been a member of the International Generic and Biosimilar Medicines Association (IGBA).

Key Players in the Taiwan Pharmaceutical Market

The key players in the Taiwan pharmaceutical market are F. Hoffmann-La Roche Ltd. (Roche), Sanofi, Merck KGaA (Merck), GlaxoSmithKline (GSK), CCPC, and Sinphar Pharmaceutical.

- Hoffmann-La Roche Ltd. (Roche)

- Hoffmann-La Roche Ltd. (Roche) is a biotechnology company that develops drugs and diagnostics to treat major diseases including auto-immune diseases, central nervous system disorders, ophthalmological disorders, infectious diseases, and respiratory diseases.

Sanofi

Sanofi is a healthcare company that researches, develops, manufactures, and markets a wide range of medicines and vaccines. It has operations across Europe, the Americas, Asia-Pacific, Africa, and the Middle East. Sanofi’s headquarters are located in Paris, France. In Taiwan, it operates from Taipei.

Merck KGaA (Merck)

Merck KGaA (Merck) is a science and technology company that discovers, develops and manufactures prescription drugs to treat cancer, multiple sclerosis and infertility.

Key Segments in the Taiwan Medical Devices Market

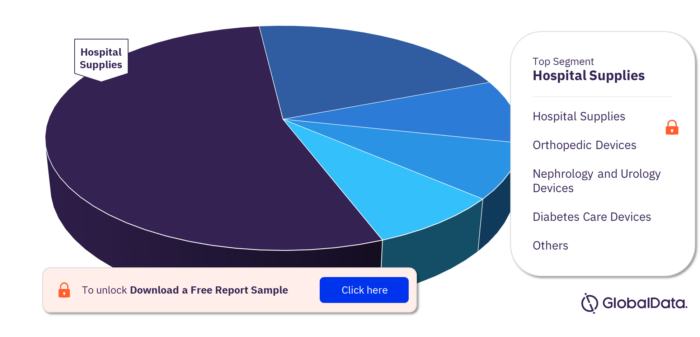

The key segments in the Taiwan medical devices market are cardiovascular devices, hospital supplies, nephrology and urology devices, orthopedic devices, diabetes care devices, and others.

Taiwan Medical Devices Market, by Segments

For more insight on the medical devices segments, download a free report sample

Key Players in the Taiwan Medical Devices Market

The key players in the Taiwan medical devices market are Fresenius, Medtronic, Stryker, DePuy Synthes, TaiDoc Technology.

Fresenius

Fresenius is a global healthcare group that offers products and services for dialysis, hospitals, and outpatient treatment. It has major manufacturing plants in the US, Germany, China, Sweden, and Japan. The company’s headquarters are located in Bad Homburg, Hessen, Germany. In Taiwan, its office is in Taipei city, Taiwan.

Stryker

Stryker is a medical technology company that manufactures an array of orthopedic, medical and surgical, and neurotechnology and spine products and allied services. The company offers products to doctors, hospitals, and other healthcare facilities. Stryker’s headquarters are located in Kalamazoo, Michigan, US. In Taiwan, Stryker operates from Taipei.

DePuy Synthes

DePuy Synthes is a subsidiary of Johnson & Johnson. It is a medical devices company that provides products for orthopedic procedures. The company offers its products to physicians, hospitals, surgeons, and caregivers, among others. DePuy Synthes’s headquarters are located in Raynham, MA, US. In Taiwan, its offices are located in Taipei.

Market report overview of pharmaceutical market in Taiwan

| Market size 2021 | $2.9 billion |

| CAGR % (2013-2018) | >3% |

| Key segments | Generics, Biologics, Biosimilars, and Over-The-Counter (OTC) |

| Major players | F. Hoffmann-La Roche Ltd. (Roche), Sanofi, Merck KGaA (Merck), GlaxoSmithKline (GSK), CCPC, and Sinphar Pharmaceutical |

Market report overview of medical devices market in Taiwan

| Market size 2021 | $2.7 billion |

| CAGR% (2022-2027) | >3% |

| Key segments | Cardiovascular Devices, Hospital Supplies, Orthopedic Devices, Nephrology and Urology Devices, Diabetes Care Devices, and Others |

| Major players | Fresenius, Medtronic, Stryker, DePuy Synthes, and TaiDoc Technology |

Scope

The report provides information on the healthcare, regulatory, and reimbursement landscape in Taiwan, and includes:

- An overview of the pharmaceutical and medical device markets, comprising market size, segmentation, and key drivers and barriers.

- Profiles and SWOT analyses of the major players in the pharmaceutical market: Roche, Sanofi, Merck, GSK, and CCPC.

- Profiles and SWOT analyses of the major players in the medical device market: Fresenius, Medtronic, Stryker, Depuy Synthes, and TaiDoc.

- An insightful review of the COVID-19 epidemiology, COVID-19 impact and developments in healthcare market, HealthTech landscape, reimbursement and regulatory landscape, with analysis covering details of the country’s healthcare reimbursement process, regulatory agencies and the approval processes for new drugs and medical devices.

- Detailed analysis of the country’s healthcare policy highlights, demographics, healthcare infrastructure and healthcare expenditure.

- An overview of the opportunities for and challenges to growth in the Taiwan healthcare market.

Reasons to Buy

- This report will enhance your decision-making capability by allowing you to:

- Develop business strategies by understanding the trends shaping and driving Taiwan healthcare market

- Drive revenues by understanding the key trends, reimbursement and regulatory policies, pharmaceutical market segments and companies likely to impact Taiwan healthcare market in the future

- Formulate effective sales and marketing strategies by understanding the competitive landscape and analyzing competitors’ performance

- Organize your sales and marketing efforts by identifying the market categories and segments that present the most opportunities for consolidation, investment and strategic partnership

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Taiwan pharmaceutical market size in the year 2021?

The Taiwan pharmaceutical market was valued at $2.9 billion in 2021.

-

What was the Taiwan pharmaceutical market growth rate?

The Taiwan pharmaceutical market grew at a CAGR of more than 3% during 2015-2018.

-

What was the Taiwan medical devices market size in the year 2021?

The Taiwan market was valued at $2.7 billion in the year 2021.

-

What is the Taiwan medical devices market growth rate?

The Taiwan medical devices market is expected to grow at a CAGR of more than 3% during 2022-2027.

-

What are the key segments in the Taiwan pharmaceutical market?

The key segments in the pharmaceutical market are generics, biologics, biosimilars, and over-the-counter (OTC).

-

Who are the key players in the Taiwan pharmaceutical market?

The key players in the Taiwan pharmaceutical market are F. Hoffmann-La Roche Ltd. (Roche), Sanofi, Merck KGaA (Merck), GlaxoSmithKline (GSK), CCPC, and Sinphar Pharmaceutical.

-

What are the key segments in the Taiwan medical devices market?

The key segments in the Taiwan medical devices market are cardiovascular devices, hospital supplies, nephrology and urology devices, orthopedic devices, diabetes care devices, and others.

-

Who are the key players in the Taiwan medical devices market?

The key players in the Taiwan medical devices market are Fresenius, Medtronic, Stryker, DePuy Synthes, and TaiDoc Technology.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Pharmaceuticals reports