Thailand Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Thailand Cards and Payments Market Overview

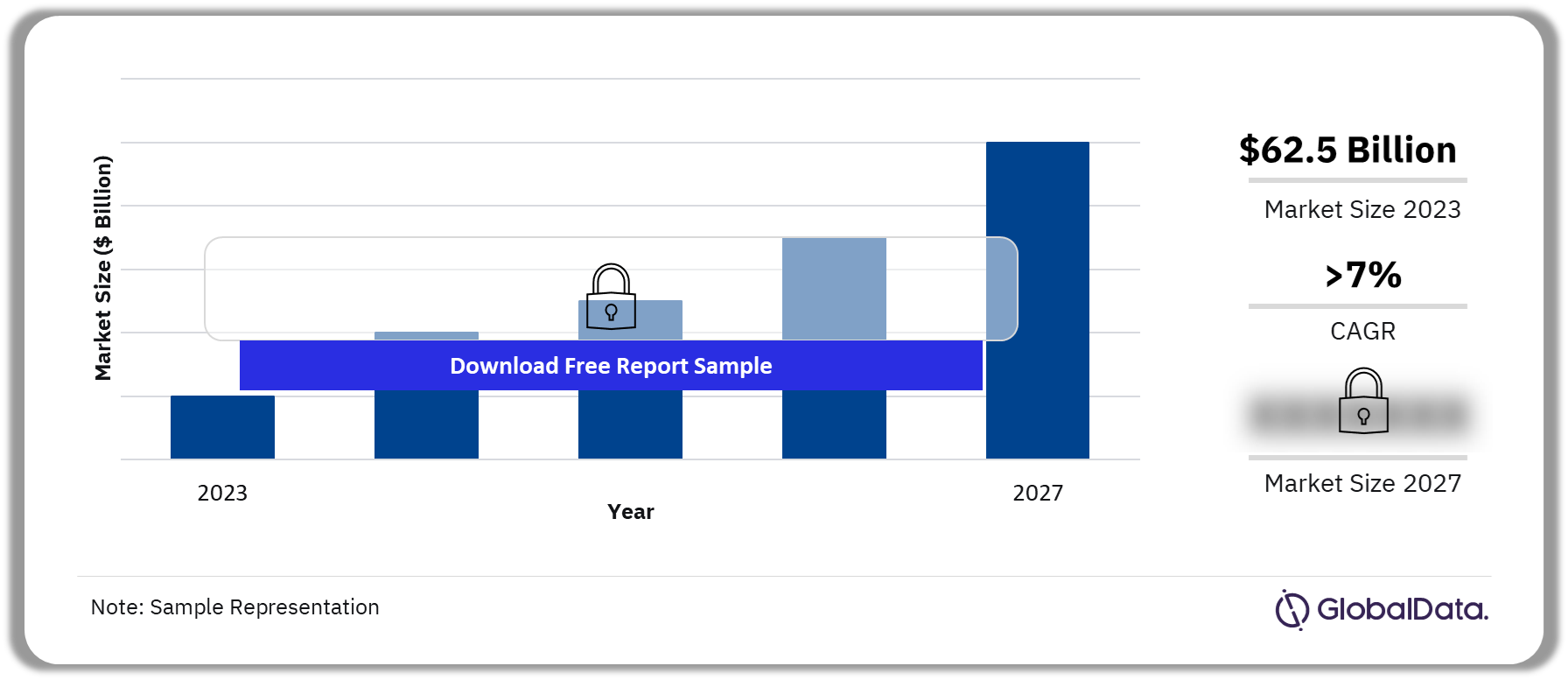

The annual value of card transactions in the Thailand cards and payments market is estimated to be $62.5 billion in 2023 and is expected to grow at a CAGR of more than 7% during 2023-2027. To encourage the adoption of cashless payments, the government and payment providers are increasingly pushing QR code-based mobile payments as an alternative to cash.

Thailand Card Transactions Outlook, 2023-2027 ($ Billion)

Buy the Full Report for More Information on the Thailand Cards and Payments Market Forecast, Download a Free Sample Report

The Thailand cards and payments market research report provides a detailed analysis of market trends in the Thailand cards and payments industry. It provides values and volumes for several key performance indicators in the industry, including cards, credit transfers, direct debits, and cheques during the review period. The report also analyzes various payment card markets operating in the industry. It provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report also covers regulatory policy details and recent regulatory structure changes. It includes information on the payment instruments that are in use in the Thailand market, the key segments within the market, as well as the companies associated with the Thailand cards and payments market.

| Annual Value of Card Transactions (2023) | $62.5 Billion |

| CAGR (2023-2027) | >7% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cash

· Credit transfers · Cards · Mobile Wallets · Direct debits · Cheques |

| Key Segments | · Card-Based Payments

· E-commerce Payments · In-Store Payments · Buy Now Pay Later · Mobile Payments · P2P Payments · Bill Payments · Alternative Payments |

| Leading Players | · Visa

· American Express · Mastercard · Kbank · Google Pay |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Thailand Cards and Payments Market Dynamics

To encourage the adoption of cashless payments, the government and payment providers are increasingly pushing QR code-based mobile payments as an alternative to cash. To further expand payment infrastructure in the country, payment companies and fintech firms are rolling out new POS solutions to merchants. For instance, in August 2023, Qashier launched the QashierX2 smart POS terminal for SMEs.

Furthermore, the growing adoption of contactless card payments for transport services will support growth in the card payment space. For example, in March 2023, UOB introduced Tap & Go contactless payment service to its debit card holders at all Mass Rapid Transit (MRT) stations in Bangkok and Nonthaburi province, allowing the bank’s cardholders to make payments by simply tapping on the contactless payment card reader at the ticket gates.

Buy now pay later (BNPL) is also gaining traction in Thailand, particularly among Gen Z consumers. It serves as an alternative payment tool for individuals who lack a credit card.

Buy the Full Report to Get Additional Thailand Cards and Payments Market Dynamics

Thailand Cards and Payments Market Segmentation by Payment Instruments

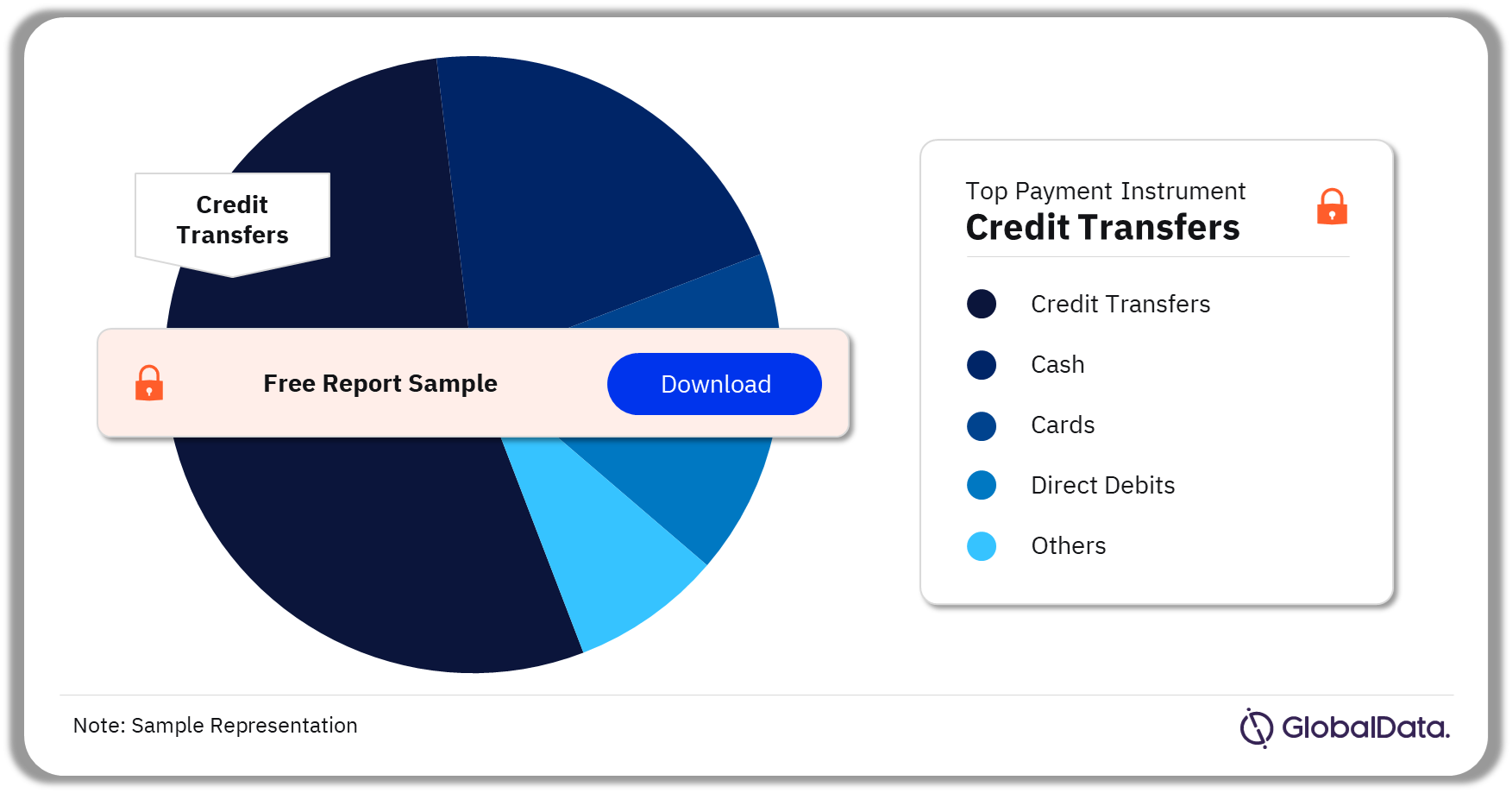

Credit transfers account for the highest share of transaction volume in 2023.

The key payment instruments in the Thailand cards and payments market are cash, credit transfers, cards, mobile wallets, direct debits, and cheques. Credit transfers are used for high- and low-value corporate and retail transactions. BAHTNET is the real-time gross settlement system that settles high-value fund transfers. The introduction of the PromptPay instant payment service in 2016 fostered the growth of credit transfers for retail transactions.

Thailand Cards and Payments Market Analysis by Payment Instruments, 2023 (%)

Buy the Full Report for More Payment Instrument Insights into the Thailand Cards and Payments Market

Thailand Cards and Payments Market Segments

The key segments in the Thailand cards and payments market are card-based payments, e-commerce payments, in-store payments, buy now pay later, mobile payments, P2P payments, bill payments, and alternative payments.

Card-Based Payments: Thai consumers are comfortable using their payment cards for a variety of purposes, with credit and charge cards used for daily essentials such as food and drink and clothing and footwear. This is fueled by benefits such as discounts and cashback offered by card issuers to increase their market shares among different customer segments. The country’s highly banked population coupled with its strong payment infrastructure has supported growth. The rising adoption of contactless cards has been a key driver of card-based payments for low-value, day-to-day transactions. Moreover, the strong expansion of e-commerce will boost electronic payments going forward.

Buy the Full Report for More Market Segment Insights into the Thailand Cards and Payments Market

Thailand Cards and Payments Market - Competitive Landscape

Some of the leading players in the Thailand cards and payments market are:

- Visa

- American Express

- Mastercard

- Kbank

- Google Pay

Google Pay: Google Pay is a mobile payment solution offered by Google. It was launched in Thailand in November 2022. The app enables consumers to conduct online and in-store transactions anywhere that UPI is accepted. Users can also send and receive money instantly, split funds, and pay for phone recharges and rent. Google Pay also offers NFC-based contactless payments, allowing users to add supported payment cards to their wallet and make contactless payments using their Android smartphone.

Leading Thailand Cards and Payments Players, 2023

Buy the Full Report to Know More about the Leading Thailand Cards and Payments Companies

Segments Covered in the Report

Thailand Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2027)

- Cash

- Credit transfers

- Cards

- Mobile Wallets

- Direct debits

- Cheques

Thailand Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- In-Store Payments

- Buy Now Pay Later

- Mobile Payments

- P2P Payments

- Bill Payments

- Alternative Payments

Scope

This report provides top-level market analysis, information, and insights into the Thailand cards and payments industry, including –

- Current and forecast values for each market in the Thailand cards and payments industry including debit, credit, and charge cards.

- Detailed insights into payment instruments including cash, credit transfer, cards, mobile wallets, cheques, and direct debits. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Thailand cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

- Comprehensive analysis of consumer attitudes and buying preferences for cards.

- The competitive landscape of the Thailand cards and payments industry.

Reasons to Buy

- Make strategic business decisions, using top-level historical and forecast market data, related to the Thailand cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Thailand cards and payments industry.

- Assess the competitive dynamics in the Thailand cards and payments industry.

- Gain insights into marketing strategies used for various card types in Thailand.

- Gain insights into key regulations governing the Thailand cards and payments industry.

Kbank

Aeon Credit Service

SCB

Krungthai Bank

Bangkok Bank

Citibank

UOB

TMB Bank

American Express

JCB

TPN

Visa

Mastercard

Table of Contents

Frequently asked questions

-

What is the annual value of card transactions in the Thailand cards and payments market in 2023?

The annual value of card transactions in the Thailand cards and payments market is estimated to be $62.5 billion in 2023.

-

What is the growth rate of the annual card transactions in the Thailand cards and payments market?

The annual value of card transactions in the Thailand cards and payments market is expected to grow at a CAGR of more than 7% during 2023-2027.

-

Which is the leading payment instrument in the Thailand cards and payments market in 2023?

Credit transfers account for the highest share of transaction volume in 2023.

-

Which are the leading players in the Thailand cards and payments market?

Some of the leading players in the Thailand cards and payments market are Visa, American Express, Mastercard, Kbank, and Google Pay among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports