United Kingdom (UK) Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Construction Market Report Overview

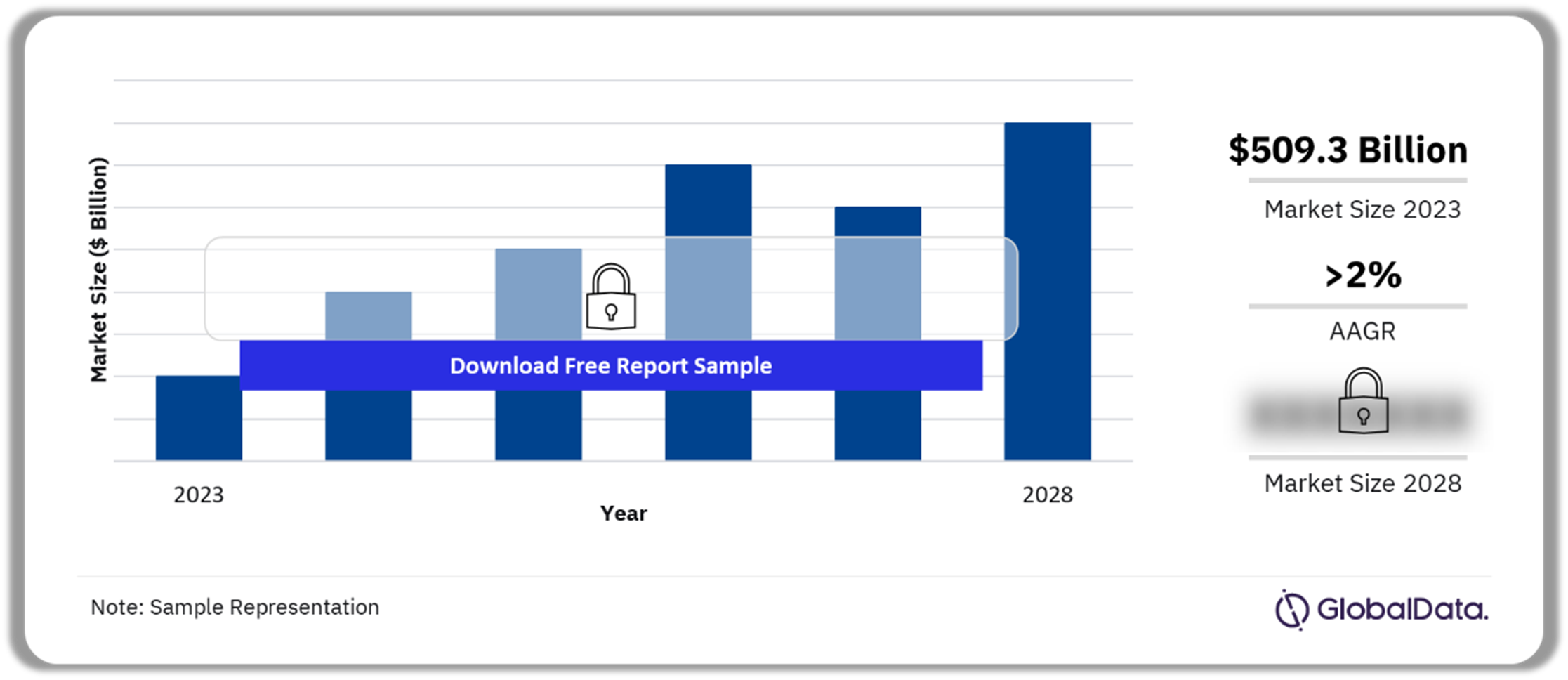

The UK construction market size was $509.3 billion in 2023. The market will achieve an AAGR of more than 2% during 2025-2028 supported by investments in renewable energy, industrial, and infrastructure projects.

UK Construction Market Outlook, 2023-2028 ($ Billion)

Buy the Full Report to Know More about the UK Construction Market Forecast

The UK construction market research report gives a comprehensive understanding of project types and construction activities in the country. It analyzes the mega-project pipeline, focusing on development stages, participants, and listings of major projects in the pipeline. The market report further discusses the key sectors in the construction market and their growth drivers. Along with reviewing the details of the construction projects, our analysts have elaborated on emerging trends and assessed key risks and opportunities that will influence the UK construction market growth in the coming years.

| Market Size (2023) | $509.3 billion |

| AAGR (2025-2028) | >2% |

| Forecast Period | 2023-2028 |

| Historical Period | 2019-2022 |

| Key Sectors | · Commercial Construction

· Industrial Construction · Infrastructure Construction · Energy and Utilities Construction · Institutional Construction · Residential Construction |

| Key Contractors | · Balfour Beatty Plc

· Bouygues SA · Laing O’Rourke Plc · Royal BAM Group NV · Vinci SA |

| Key Consultants | · Tetra Tech Inc

· WSP Global Inc · SNC-Lavalin Group Inc · AECOM · Arup Group Ltd |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

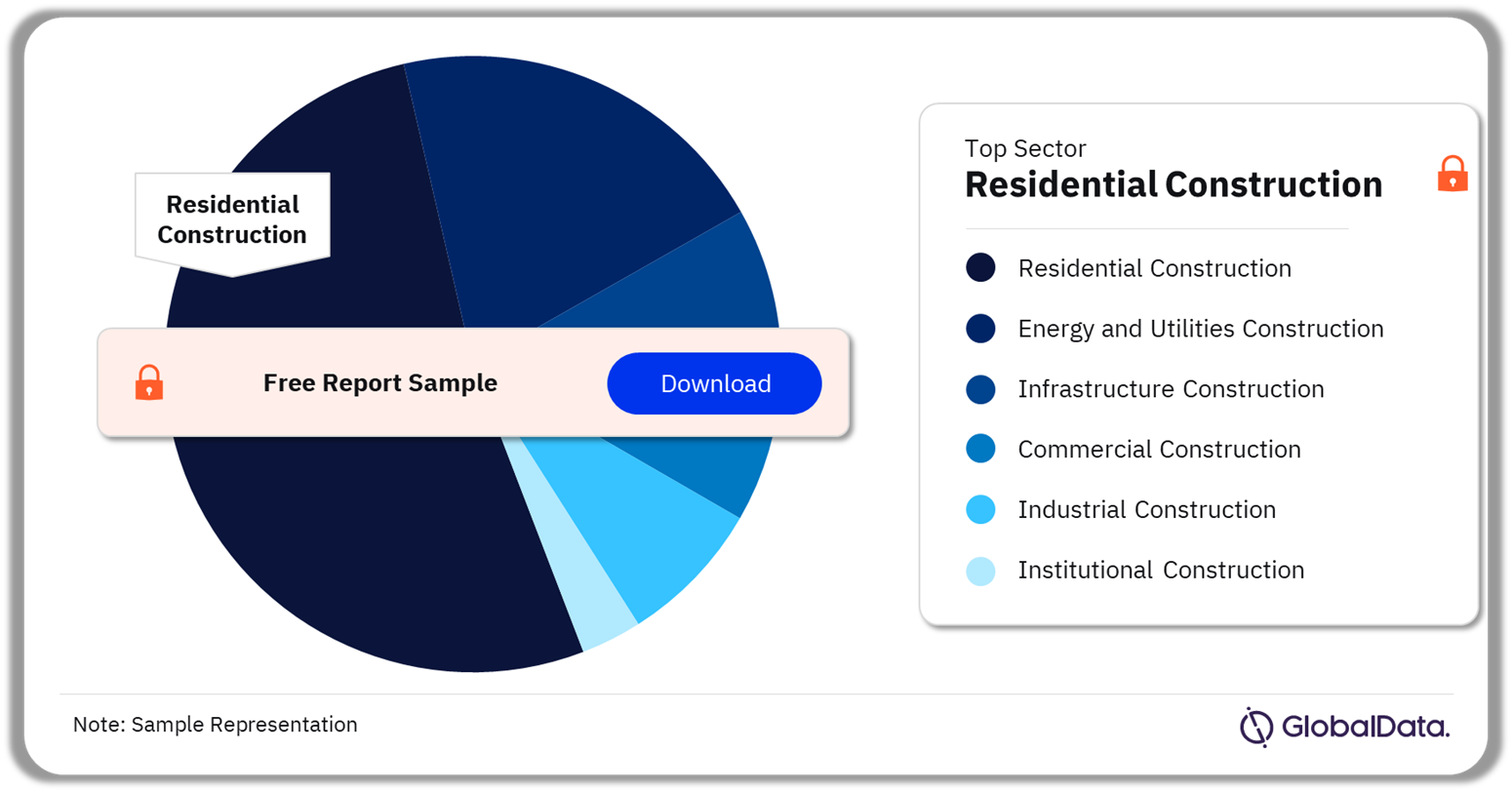

UK Construction Market Segmentation by Sectors

The residential construction sector accounted for the highest UK construction market share in 2023

The key sectors in the UK construction market are commercial construction, industrial construction, infrastructure construction, energy and utilities construction, institutional construction, and residential construction.

Residential construction: The project types in this sector include single-family housing and multi-family housing. The government’s focus on the construction of 180,000 affordable homes in the country by 2026, with an investment of GBP11.5 billion ($14.2 billion) will support the residential sector output over the forecast period.

Infrastructure construction: The project types in this sector include rail infrastructure, road infrastructure, and other infrastructure projects. The construction of road and rail networks to improve connectivity across the country will mainly support the infrastructure sector’s output during the forecast period.

Energy and utilities construction: The project types in this sector include electricity and power, oil and gas, telecommunications, sewage infrastructure, and water infrastructure. Investments in renewable energy projects in line with the government’s aim to generate 95% of the country’s electricity from low-carbon sources by 2030 will drive the sector growth during 2025-2028.

Commercial construction: The project types in this sector include leisure and hospitality buildings, office buildings, outdoor leisure facilities, retail buildings, and other commercial construction. An improvement in the investments in leisure and hospitality, retail, office, data center, and warehouse buildings will be mainly responsible for the sector’s growth during the forecast period.

Industrial construction: The project types in this sector include chemical and pharmaceutical plants, manufacturing plants, metal and material production and processing plants, and waste processing plants. Investments as part of the Advanced Manufacturing Plan unveiled in November 2023 and include an allocation of funds for the automotive industry and aerospace industry will drive the sector’s growth during the forecast period.

Institutional construction: The project types in this sector include educational buildings, healthcare buildings, institutional buildings, research facilities, and religious buildings. The growth in the construction orders for schools and universities coupled with investments in the reconstruction and repair of hospital buildings will fuel the growth of the institutional construction sector during the forecast period.

UK Construction Market Analysis by Sectors, 2023 (%)

Buy the Full Report for more Sector Insights into the UK Construction Market

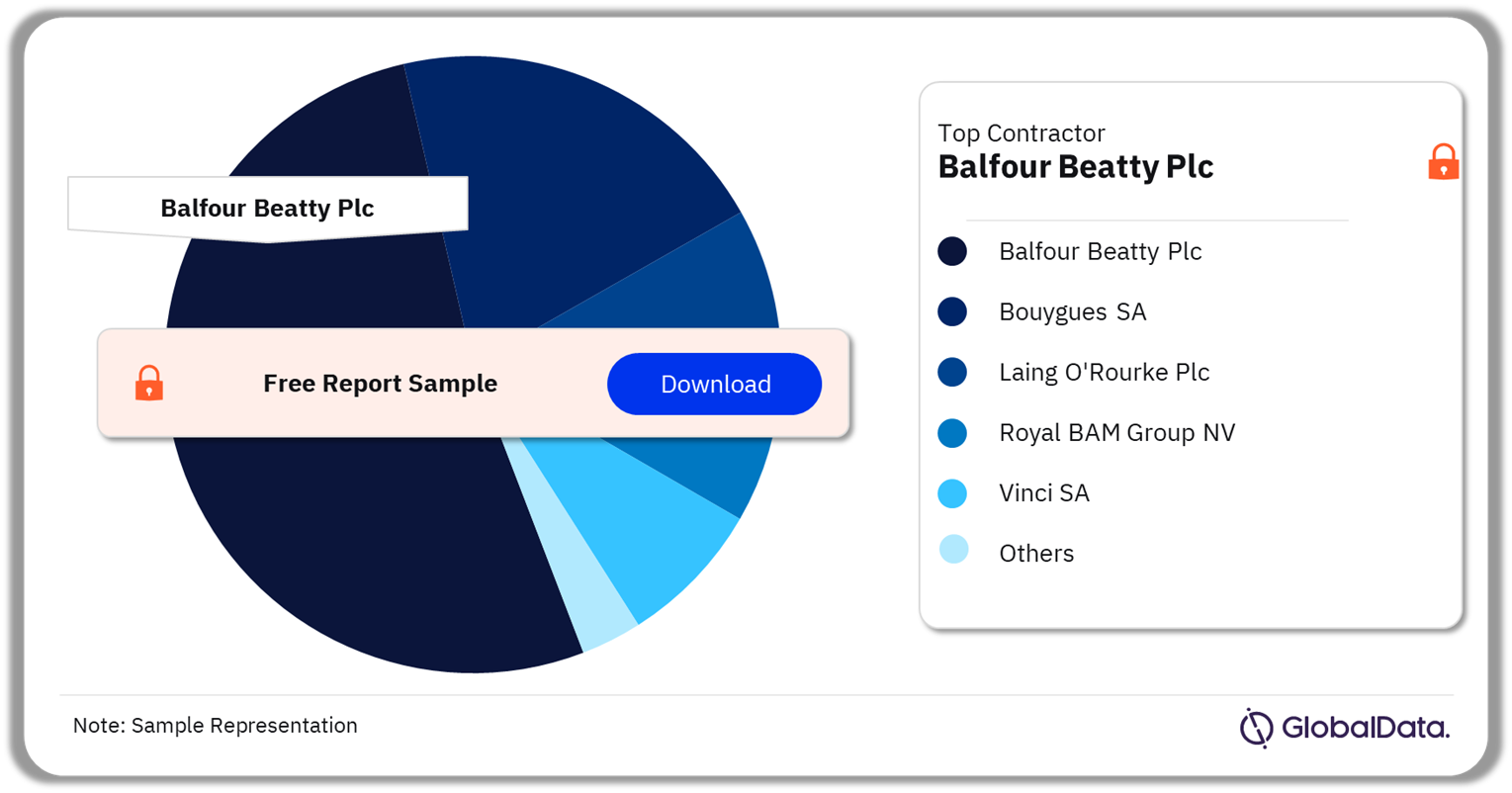

UK Construction Market - Competitive Landscape

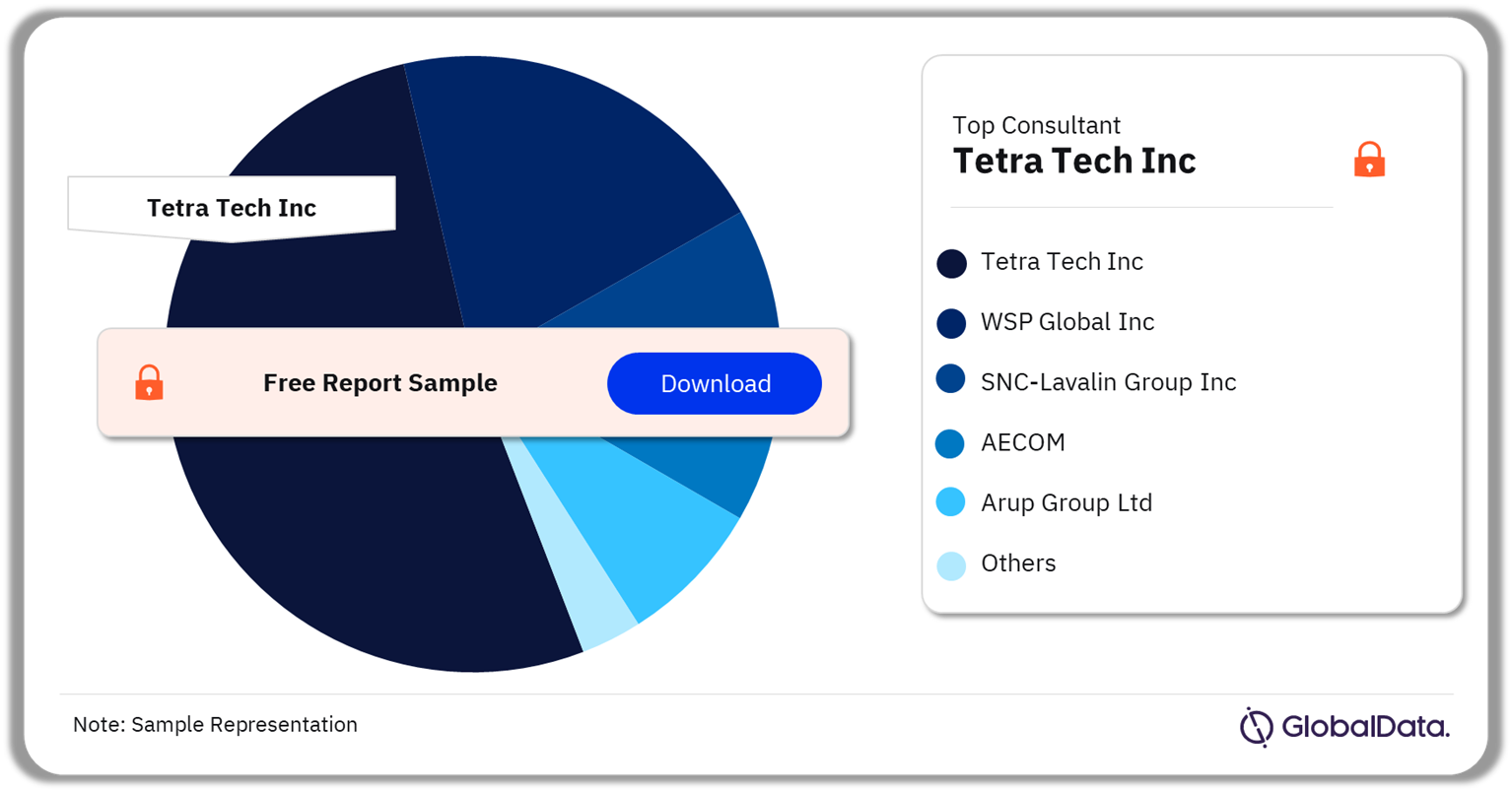

Balfour Beatty Plc emerged as the leading contractor and Tetra Tech Inc as the leading consultant in the UK construction market in 2023

A few of the leading contractors in the UK construction market are:

- Balfour Beatty Plc

- Bouygues SA

- Laing O’Rourke Plc

- Royal BAM Group NV

- Vinci SA

Domestic contractors account for the majority share of the project pipeline in the UK construction market.

UK Construction Market Analysis by Contractors, 2023 (%)

Buy the Full Report to Know More about the Contractors in the UK Construction Market

A few of the leading consultants in the UK construction market are:

- Tetra Tech Inc

- WSP Global Inc

- SNC-Lavalin Group Inc

- AECOM

- Arup Group Ltd

Consultants with headquarters within the UK are involved in most of the project pipeline by value.

UK Construction Market Analysis by Consultants, 2023 (%)

Buy the Full Report to Know More about Consultants in the UK Construction Market

UK Construction Market - Latest Developments

- In November 2023, Iberdrola, a Spain-based electric utility company announced its plans to invest in the UK, for the development of electricity transmission projects in renewable sectors from 2024 to 2028.

- In December 2023, the government announced its plan to construct a rail project, which will improve connectivity in northern England connecting Manchester, Huddersfield, Leeds, and York by 2029.

Segments Covered in the Report

UK Construction Sectors Outlook (Value, $ Billion, 2019-2028)

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

- Energy and Utilities Construction

- Institutional Construction

- Residential Construction

Scope

This report provides:

- A comprehensive analysis of the construction industry in the

- Historical and forecast valuations of the construction industry in the UK, featuring details of key growth drivers.

- Segmentation by sector and by sub-sector.

- Analysis of the mega-project pipeline, including breakdowns by development stage across all sectors and projected spending on projects in the existing pipeline.

- Listings of major projects, in addition to details of leading contractors and consultants.

Reasons to Buy

- Identify and evaluate market opportunities using GlobalData’s standardized valuation and forecasting methodologies.

- Assess market growth potential at a micro-level with over 500 time-series data forecasts.

- Understand the latest industry and market trends.

- Formulate and validate strategy using GlobalData’s critical and actionable insight.

- Assess business risks, including cost, regulatory, and competitive pressures.

- Evaluate competitive risk and success factors.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the construction market size in the UK in 2023?

The construction market size in the UK was $509.3 billion in 2023.

-

What will the UK construction market growth rate be during the forecast period?

The construction market in the UK is projected to achieve an AAGR of more than 2% during 2025-2028.

-

Which sector accounted for the highest share of the UK construction market in 2023?

The residential construction sector accounted for the highest share of the UK construction market in 2023.

-

Which are the leading contractors in the UK construction market?

A few of the leading contractors in the UK construction market are Balfour Beatty Plc, Bouygues SA, Laing O’Rourke Plc, Royal BAM Group NV, and Vinci SA, among others.

-

Which are the leading consultants in the UK construction market?

A few of the leading consultants in the UK construction market are Tetra Tech Inc., WSP Global Inc., SNC-Lavalin Group Inc., AECOM, and Arup Group Ltd, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.