United Kingdom (UK) Household Insurance Market Dynamics, Trends and Opportunities, 2023

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Household Insurance Market Report Overview

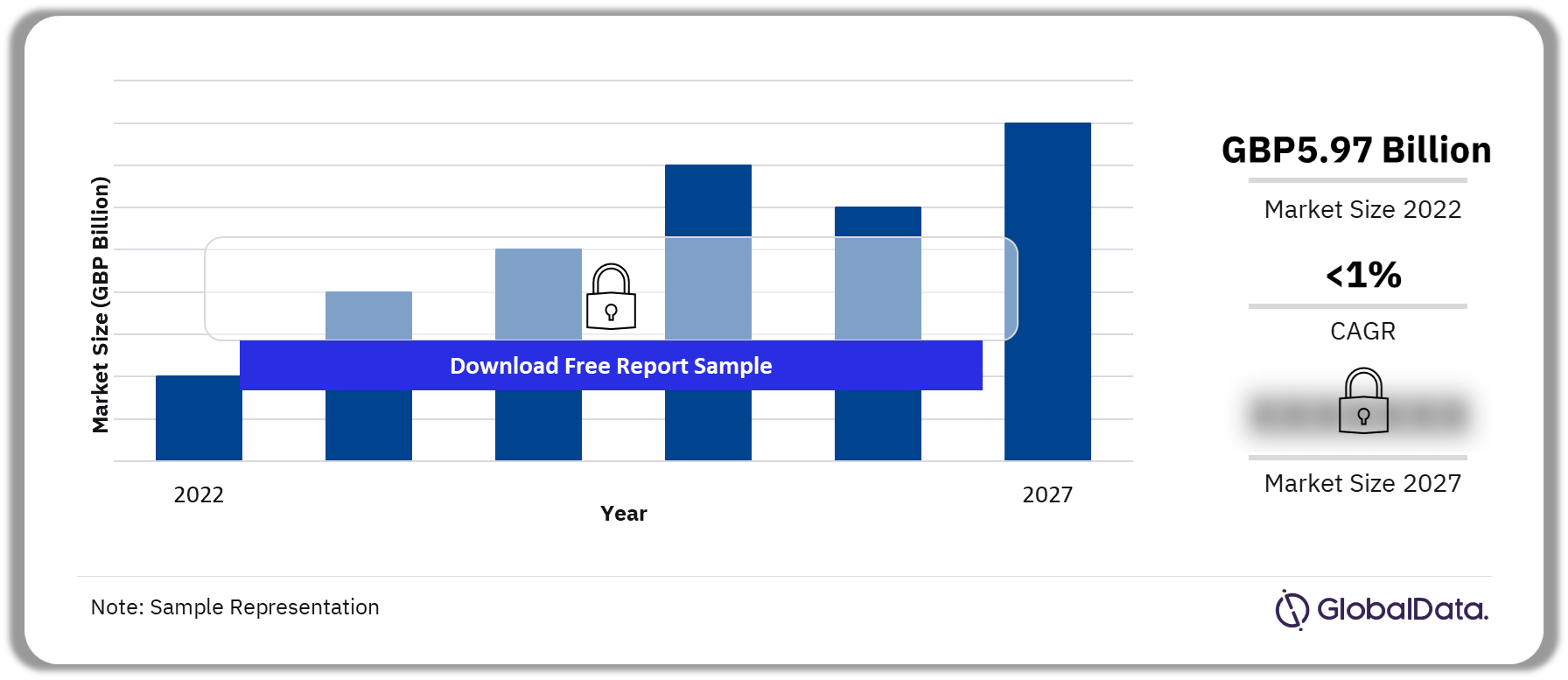

The gross written premium of the United Kingdom (UK) household insurance market was GBP5.97 billion in 2022 and is expected to achieve a CAGR of less than 1% during 2023-2027. Since the younger generations find it difficult to afford homeownership and living expenses are high, insurers must focus on Generation Rent in order to preserve or grow market share and GWP of household insurance. By providing solutions suited to the requirements of younger populations, insurtech startups are challenging established insurers in this market.

UK Household Insurance Market Outlook 2022-2027 (GBP Billion)

Buy the Full Report to Gain More Information about the UK Household Insurance Market Forecast

The UK household insurance market research report analyzes the UK household insurance market and looks at drivers of uptake across different demographics and dwelling types. It discusses the claims landscape in 2022, the housing market, and upcoming regulatory changes within insurance. Incumbent competitors, newcomers, and insurtechs within the space are analyzed and compared. Future impactors in the market are also covered.

| Gross Written Premium (2022) | GBP5.97 billion |

| CAGR (2023-2027) | <1% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2027 |

| Key Claim Types | · Escape of Water

· Weather · Fire · Theft · Accidental Damage · Subsidence · Other Domestic Claims |

| Key Insurers | · Aviva

· RSA · Direct Line · Chubb · Allianz |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Household Insurance Market Dynamics

Younger consumers, especially those under the age of 30, are exhibiting an interesting trend where they are far more eager to share their smart home data with insurance carriers. Tech giants such as Sky are beginning to see the potential as the adoption of smart home devices rises. Insurance companies have the opportunity to capitalize on the growing potential of this group regardless of whether they choose to live in rental housing or eventually become homeowners.

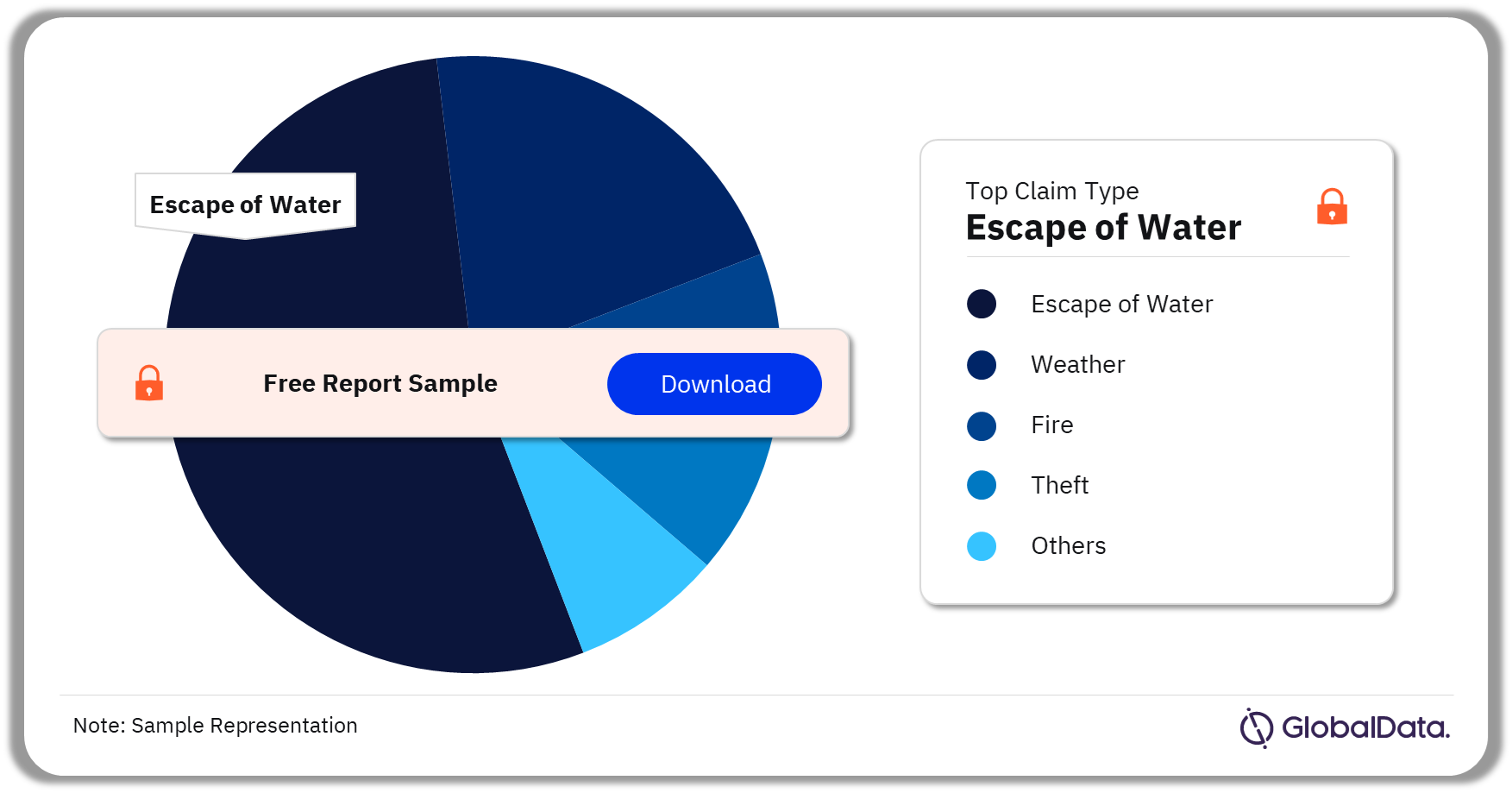

UK Household Insurance Market Segmentation by Gross Claims Types

Increases in weather and subsidence-related claims drove up the overall cost and number of claims incurred in 2022.

The key gross claims type in the UK household insurance market includes escape of water, weather, fire, business interruption, theft, accidental damage, subsidence, and other domestic claims. Escape of water incurred the highest claims in 2022. There was a decline in the value of household insurance claims in the second quarter of 2022. This was due to a drop in weather-related claims mostly owing to the second quarter’s lack of major storms and a much-below-average monthly rainfall, which minimized potential damage.

Meanwhile, there was a rise in theft claims during the holiday season as well as throughout the year. As a result of the cost-of-living crisis, fraudulent theft claims increased, especially those involving jewelry and electrical goods, and many of them went undetected. This might be one of the reasons for the growth of the number of theft claims in the UK household insurance market.

UK Household Insurance Market Analysis by Gross Claim Types, 2022 (%)

Buy the Full Report for More Claim Type Insights into the UK Household Insurance Market

UK Household Insurance Market - Competitive Landscape

Aviva led the household insurance industry in 2022, followed by RSA and Direct Line.

Some of the leading household insurers in the UK household insurance market are:

- Aviva

- RSA

- Direct Line

- Chubb

- Allianz

Aviva has made major inroads in the High Net Worth (HNW) market and has extended its home and travel insurance arrangement with TSB Bank for a further five years till 2028, strengthening its position within the market.

UK Household Insurance Market Analysis by Household Insurers, 2022 (%)

Buy the Full Report to Know More about the Insurers in the UK Household Insurance Market

UK Household Insurance Market – Latest Developments

- In the UK, Amazon has launched the Amazon Insurance Store to give customers a new method of buying home insurance. This insurance store seeks to improve the home insurance shopping experience by offering reliable like-for-like quote comparisons and a simplified process for obtaining a quote, in order to make the process seamless.

- Sky Protect Smart House Insurance is a new service that combines home insurance with smart home technologies. This package comes with smart home devices including a video doorbell, indoor camera, leak detectors, motion sensor, and contact sensors. The aim is to offer consumers peace of mind by providing them with comprehensive cover, home emergency support, access to reputable tradesmen, and legal and cyber protection.

Segments Covered in the Report

UK Household Insurance Claim Types Outlook (Value, GBP Billion, 2018-2027)

- Escape of Water

- Weather

- Fire

- Theft

- Accidental Damage

- Subsidence

- Other Domestic Claims

Scope

• The UK household insurance market is expected to grow by 2.9% in 2023, following a 3.3% decline in 2022.

• The average premium prices for combined, buildings-, and contents-only insurance decreased by 5.6%, 8.1%, and 8.4% respectively in 2022. Furthermore, the number of policies for all products fell, contributing towards the overall decline in GWP.

• Home insurance claims in the UK rose in 2022, with the cost of claims growing by 6.2% and the total number of claims reported increasing by 2.6%. A significant increase in weather-related and subsidence claims was the main factor behind the uptick in overall claims.

• Generation Rent remain an untapped demographic as roughly half have contents-only insurance in place.

Key Highlights

- In 2021, the UK’s home insurance market shrank.

- For combined policies, the average premium price rose in 2021. However, they declined by for buildings-only and contents-only insurance.

- All types of claims notified fell except for escape of water. Gross claims for escape of water increased in 2021 because of lockdown relaxations, meaning fewer individuals were at home.

- Less than half of all UK renters have a contents-only insurance policy, making Generation Rent a large, untapped demographic for insurers.

Reasons to Buy

- Identify underlying drivers of demand and premium prices for home insurance products.

- Examine the nature of the claims landscape in 2022.

- Compare the performances of market leaders throughout the year.

- Determine how insurtechs are attempting to gain traction in the market.

- Understand the impact of inflation on the home insurance market going forward.

Allianz

RSA

Direct Line

Chubb

Lloyds Banking Group

Ageas

AXA

NFU Mutual

LV=

L&G

Flood Re

Zurich

Barclays

TSB Bank

Lemonade

JPMorgan

Co-op

Amazon

GoCompare

Sky

Hiscox

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK household insurance gross written premium in 2022?

The gross written premium of the UK household insurance market was GBP5.97 billion in 2022.

-

What is the UK household insurance market growth rate?

The UK household insurance market is expected to achieve a CAGR of less than 1% during 2023-2027.

-

Which was the leading claims type in the UK household insurance market in 2022?

Escape of water incurred the highest claims in the UK household insurance market in 2022.

-

Who are the leading household insurers in the UK household insurance market?

Some of the leading household insurers in the UK household insurance market are Aviva, RSA, Direct Line, Chubb, and Allianz.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports