United Kingdom (UK) Online Retail Market Size, Segment Analysis, Drivers and Constraints, Trends and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore actionable market insights from the following data in our ‘United Kingdom (UK) Online Retail Market’ report:

- A comprehensive insight and analysis of the online channel in the UK.

- Analyzing the main trends and hot issues shaping the market in the UK.

- Market forecast for 2027 across key retail sectors (Clothing & Footwear, Food & Grocery, Electricals, Furniture & Floorcoverings, Health & Beauty, Homewares, Entertainment, DIY & Gardening, Books, and Others).

- Major players (Amazon, Tesco, Waterstones, Marks & Spencer, Screwfix, Argos, IKEA, The Body Shop, Currys, ASDA, and Sainsbury’s) as well as consumer shopping behavior.

How is the ‘UK Online Retail Market’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get the report today for valuable insights that will help you to make strategic decisions.

- Growth of different sectors online and the issues affecting the online market to ensure you capitalize on high-growth areas such as click & collect and third-party pickup in each sector.

- Understand why and how consumers shop online for different products to capitalize on the growth in the online market.

- Explore which retailers have the most popular online propositions in each sector, enabling you to better compete with market leaders and enhance your own online propositions.

We recommend this valuable source of information to anyone involved in:

- Startups/Suppliers/White-label manufacturers

- Retail and Consumer Good Companies

- Luxury Store Suppliers/Retailers

- Strategy/Innovation and Business Development

- Market Intelligence and Portfolio Managers

- Government Agencies/Health Associations

To Get a Snapshot of the United Kingdom (UK) Online Retail Market Report, Download a Free Report Sample

UK Online Retail Market Report Overview

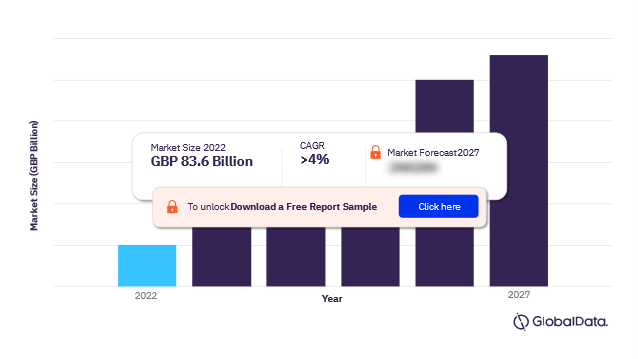

The United Kingdom (UK) online retail market size was GBP 83.6 billion in 2022. The performance of online pureplays is expected to improve over the next five years driven by early investment in online technology. Yet, online pureplays and multichannel retailers alike must invest further in online platforms, including colour-matching tools within the beauty sector, or room planning for retailers within the home sector sphere, to retain appeal. This is expected to drive the UK online retail market to witness a CAGR of over 4% during 2022-2027.

The UK online retailing market research report offers comprehensive insight and analysis of the online channel in the UK, the main trends and hot issues, major players, and consumer shopping behavior. It also provides forecasts for 2027 across key retail sectors.

UK Online Retail Market Overview 2022-2027, (GBP Billion)

For more insights on the UK online retail market forecast, download a free sample report

UK Online Retail Market Drivers and Trends

The key UK online retail market drivers include increased ease of usage, convenience for consumers, and more accessibility of integrated technology. The ease of online shopping has increased since the pandemic. Shoppers who switched to shopping online during the pandemic are more likely to continue shopping online in the future due to the convenience and choice it offers. In addition, value retailers and discounters are improving their online offers, giving consumers the option to trade down on big-ticket items, as well as clothing and footwear.

The key trends likely to proliferate the UK online retail market growth are flexible working and delivery schedules, returns in clothing & footwear, and increased mobile device usage in older shoppers. Hybrid working became the norm for many consumers in 2022. As a result, many consumers will try to arrange delivery slots for online orders based on their hybrid working schedule. This means that offering flexibility on delivery options is key for retailers, as it enables consumers to ensure they are home to receive their deliveries. In addition, consumers are spending increasing amounts of time on social media, resulting in the platforms becoming shopping channels. Consumers can scroll through their social media feeds and click on links promoted through ads or influencers’ commission links, taking them directly to retailer websites.

For more insights on the UK online retail market dynamics, download a free sample report

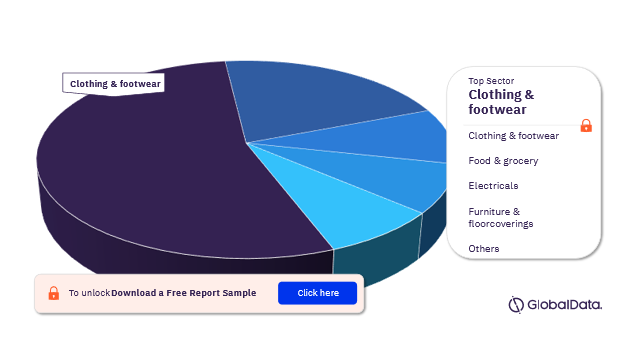

UK Online Retail Market Segmentation by Sectors

The key sectors in the UK online retail market are clothing & footwear, food & grocery, electricals, furniture & floorcoverings, health & beauty, homewares, entertainment, DIY & gardening, books, and others. In 2022, the clothing & footwear segment accounted for the highest revenue. However, food & grocery, DIY & gardening, and health & beauty offer the biggest growth potential in the online channel, with these sectors forecast to grow the most between 2022 and 2027.

UK Online Retail Market Analysis by Sectors, 2022 (%)

For more insights on the sectors of the UK online retail market, download a free sample report

UK Online Retail Market Segmentation by Fulfilment Method

The key fulfilment methods in the UK online retail market are third-party pickup, click & collect, and home delivery & digital. In 2022, the home delivery & digital fulfilment method dominated the UK online retail market growth. The growth was driven mainly due to the growth in hybrid working culture among consumers post the pandemic.

UK Online Retail Market Analysis by Fulfilment Method, 2022 (%)

For more insights on the fulfilment method of the UK online retail market, download a free sample report

UK Online Retail Market – Competitive Landscape

Some of the key retailers in the UK online retail market are Amazon, Tesco, Waterstones, Marks & Spencer, Screwfix, Argos, IKEA, The Body Shop, Currys, ASDA, and Sainsbury’s among others.

UK Online Retail Market – Consumer Attitudes

The key consumers in the UK online retail market are segmented into males and females. In 2022, females dominated the consumer penetration share. In terms of consumer age groups, consumers between the age group 25-34 led the UK online retail market in 2022. The rise of cheap fast-fashion brands and social media have undoubtedly contributed to the rise in fashion purchases made online as apps such as TikTok and Instagram allow consumers to immediately buy clothing seen on their social media feeds.

To know more about leading retailers and consumer attitudes in the UK online retail market, download a free sample report

UK Online Retail Market Overview

| Market Size (2022) | GBP 83.6 billion |

| CAGR (2022-2027) | >4% |

| Historical Period | 2017-2021 |

| Forecast Period | 2022-2027 |

| Key Sectors | Clothing & Footwear, Food & Grocery, Electricals, Furniture & Floorcoverings, Health & Beauty, Homewares, Entertainment, DIY & Gardening, Books, and Others |

| Key Fulfilment Methods | Third-Party Pickup, Click & Collect, and Home Delivery & Digital |

| Key Retailers | Amazon, Tesco, Waterstones, Marks & Spencer, Screwfix, Argos, IKEA, The Body Shop, Currys, ASDA, and Sainsbury’s |

Key Segments Covered in this Report

UK Online Retail Market Sector Outlook (Value, GBP Million, 2017-2027)

- Clothing & Footwear

- Food & Grocery

- Electricals

- Furniture & Floorcoverings

- Health & Beauty

- Homewares

- Entertainment

- DIY & Gardening

- Books

- Others

UK Online Retail Market Fulfilment Method Outlook (Value, GBP Million, 2017-2027)

- Third-Party Pickup

- Click & Collect

- Home Delivery & Digital

Amazon

Amazon Fresh

AO

Apple

Argos

ASDA

ASOS

Audible

B&Q

Beelivery

Book Depository

Boots

Currys

Deliveroo

DFS

Dunelm

Fancy

GAME

Getir

GoPuff

Gorillas

H&M

Holland & Barrett

Home Bargains

Homebase

Hotel Chocolat

Iceland

IKEA

iTunes

Jiffy

John Lewis & Partners

Laithwaites

Lidl

Lookfantastic

Marks & Spencer

Matalan

Microsoft

Milk & More

Moonpig

Morrisons

New Look

Next

Nike

Nintendo

Oak Furniture Land

Ocado

Playstation

Sainsbury's

Screwfix

Sky

Sports Direct

Steam

Superdrug

Tesco

The Body Shop

The Book People

The Range

The Works

TikTok

Toolstation

Uber Eats

Very

Waitrose & Partners

Waterstones

Wayfair

WH Smith

Wickes

Wilko

YouTube

Zara

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK online retail market size in 2022?

The online retail market size in the UK was GBP 83.6 billion in 2022

-

What will be the UK online retail market growth rate during 2022-2027?

The online retail market in the UK will grow at a CAGR of over 4% during 2022-2027

-

Which are the key sectors of the UK online retail market?

The key sectors of the UK online retail market are clothing & footwear, food & grocery, electricals, furniture & floorcoverings, health & beauty, homewares, entertainment, DIY & gardening, books, and others

-

What are the key fulfilment methods of the UK online retail market?

Third-party pickup, click & collect, and home delivery & digital are the key fulfilment methods of the UK online retail market.

-

Which are the key retailers in the UK online retail market?

Amazon, Tesco, Waterstones, Marks & Spencer, Screwfix, Argos, IKEA, The Body Shop, Currys, ASDA, and Sainsbury’s are some of the key retailers in the UK online retail market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.