United Kingdom (UK) Personal Lines Insurance Distribution Dynamics by Consumer Channel Preferences and Future Market, 2022 Update

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Personal Lines Insurance Market Report Overview

The direct channel remains the most frequently used option when it comes to purchasing insurance in the UK. The channel increased its share of distribution in 2021, rising by 0.5 percentage points (pp) when compared to 2020. With many insurers and distributors enhancing their online and digital capabilities in response to shifting consumer habits owing to the COVID-19 pandemic, consumers are increasingly inclined to purchasing insurance online.

The UK personal lines insurance market research report will help to understand how certain distribution channels in the UK general insurance market performed in 2021. The report will also ascertain how underlying factors and drivers in these markets will shape them going forward.

Key UK Personal Lines Insurance Segmentation by Distribution Channels

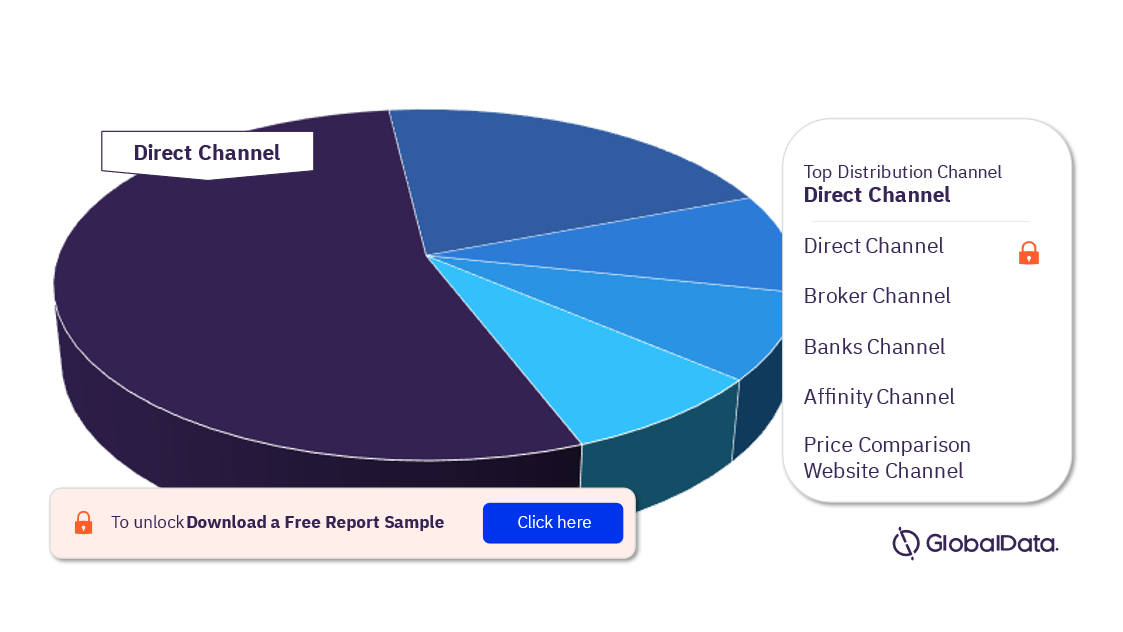

The key distribution channels in the UK personal lines insurance industry are direct channel, broker channel, bank channel, affinity channel, and price comparison website channel. In 2022, direct channel led the market personal general insurance market in the UK.

Direct Channel: Many consumers purchased their insurance online via a PC or laptop in 2022. Consumers choose this channel primarily due to the reputation of the insurer and the lower premium costs. For larger insurers that operate across numerous lines, cross-selling opportunities exist. The top three direct channel players are admiral, Aviva, and Petplan. This channel will continue its dominance in the coming years as insurers improve their digital capabilities and online consumer experiences.

Broker Channel: Consumers who use brokers value cheaper premiums over specialist advice. More than 33% of consumers felt their broker could get them a better deal. The top three broker channel players are Hastings Direct, Saga, Aviva, and AA. The broker channel will continue to play a significant role in providing personal insurance, holding on to more than a third of the market

Bank Channel: Despite the continuous closure of branches, face-to-face purchases through the channel increased by less than 1pp from 2021 to 2022. The top three bank channel players are Halifax, Admiral, and Nationwide. Short-term growth in the bank channel is forecasted as consumers seek reliable and reputable financial institutions following the pandemic and amid current uncertain macroeconomic conditions.

Affinity Channel: The channel remains important for the distribution of other insurance products, including pet insurance. However, the affinity channel’s share of product distribution fell for home and motor insurance. The top three affinity channel players are Tesco Bank, Post Office, and M&S Bank. Retailers are set to concentrate on their primary areas of business, resulting in stagnant growth in the coming years.

Price Comparison Website Channel: The increased trend towards digitalization suggests an opportunity exists to boost sales via apps. The top three price comparison website channel players are Admiral, Hastings Direct, and Animal Friends.

UK Personal Lines Insurance Industry Analysis, by Distribution Channels, 2022 (%)

For more insights on the distribution channels in the UK personal lines insurance market, download a free report sample

UK Personal Lines Insurance Market Report Overview

| Key Distribution Channels | Direct Channel, Broker Channel, Bank Channel, Affinity Channel, and Price Comparison Website Channel |

| Top Direct Channel Players | Admiral, Aviva, and Petplan |

| Top Broker Channel Players | Hastings Direct, Saga, Aviva, and Aa |

| Top Bank Channel Players | Halifax, Admiral, and Nationwide |

| Top Affinity Channel Players | Tesco Bank, Post Office, and M&S Bank |

| Top Price Comparison Website Channel Players | Admiral, Hastings Direct, and Animal Friends |

UK Personal Lines Insurance Market Distribution Channel Outlook (Value, GWP Billion, 2017-2026)

- Direct

- Broker

- Banks

- Affinity

- Price Comparison Website Channel

Reasons to Buy

- Understand how certain distribution channels in the UK general insurance market performed in 2021.

- Ascertain how underlying factors and drivers in these markets will shape them going forward.

- Discover preferred methods of purchasing through each respective distribution channel.

- Understand switching behavior in each respective distribution channel.

- Explore the future market shares in the distribution of personal lines to 2026f.

Aviva

Direct Line

Petplan

Animal Friends

InsureandGo

AXA

Urban Jungle

Getsafe

Gallagher

A-Plan

Ardonagh

Makerstudy

Halifax

Lloyds Bank

Age UK

Nationwide

Asda

Barclays

RBS

HSBC

Revolut

Sainsburys

Tesco Bank

M&S Bank

John Lewis

Pets at Home

Compare the Market

Confused.com

MoneySuperMarket

GoCompare

Amazon

Table of Contents

Frequently asked questions

-

What are the key personal line distribution channels in the UK personal lines insurance industry?

The key distribution channels in the UK personal lines insurance industry are direct channel, broker channel, bank channel, affinity channel, and price comparison website channel.

-

Which are the top three direct channel players in the UK personal lines insurance industry?

The top three direct channel players in the UK personal lines insurance industry are admiral, Aviva, and Petplan.

-

Which are the top three broker channel players in the UK personal lines insurance industry?

The top three broker channel players are Hastings Direct, Saga, Aviva, and AA.

-

Which are the top three bank channel players in the UK personal lines insurance industry?

The top three bank channel players are Halifax, Admiral, and Nationwide.

-

Which are the top three affinity channel players in the UK personal lines insurance industry?

The top three affinity channel players are Tesco Bank, Post Office, and M&S Bank.

-

Which are the top three price comparison website channel players in the UK personal lines insurance industry?

The top three price comparison website channel players are Admiral, Hastings Direct, and Animal Friends.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Personal Insurance reports