United Kingdom (UK) Pet Insurance Market Dynamics, Trends and Opportunities

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Pet Insurance Market Overview

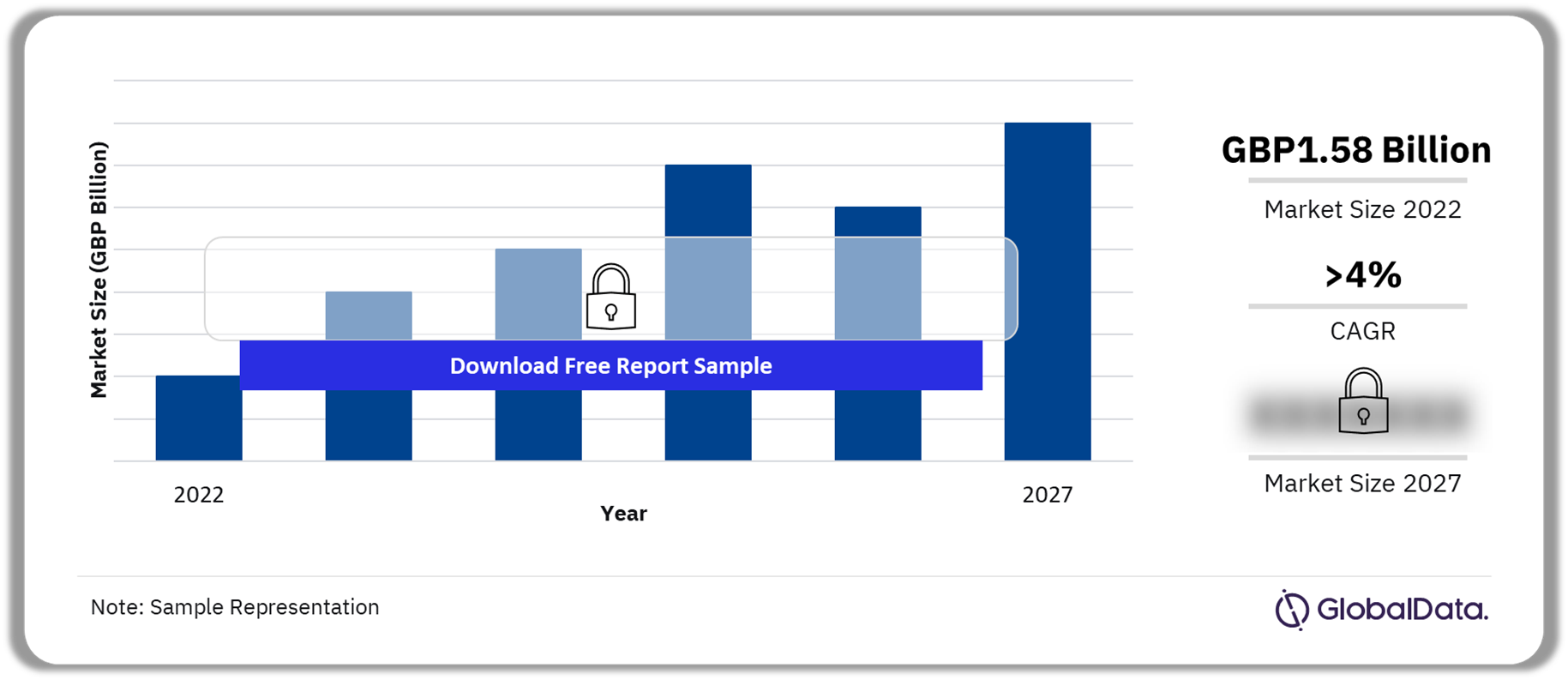

The UK pet insurance market size was GBP1.58 billion in 2022. The market is expected to achieve a CAGR of more than 4% during 2022-2027. The market will be primarily driven by rising premiums, which are unavoidable due to the increasing cost of veterinary care.

UK Pet Insurance Market Outlook, 2022-2027 (GBP Billion)

Buy the Full Report for More Insights into the UK Pet insurance Market Forecast

The United Kingdom (UK) Pet insurance market research report provides a comprehensive analysis of the UK pet insurance market. It explores drivers of uptake and the claims landscape, as well as looks at the broader pet market and upcoming regulatory changes. Incumbent competitors are analyzed and compared, alongside relevant newcomers and insurtechs. In addition, the report examines future impactors in the market, including inflation and emerging technologies such as artificial intelligence.

| Market Size (2022) | GBP1.58 Billion |

| CAGR (2022-2027) | >4% |

| Historical Period | 2018-2022 |

| Forecast Period | 2023-2027 |

| Pet Insurance Products | · Dog

· Cat · Other |

| Leading Providers | · Allianz

· RSA · Red Sands · Pinnacle Insurance · U K Insurance |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Pet Insurance Market Dynamics

Partnering with insurtechs is one of the factors expected to drive the market. Pet insurers should look to collaborate with insurtechs that can help them tackle problems within the market. For example, the confirmed value and volume of fraud reached record highs in 2022 according to Association of British Insurers (ABI) data. Technology such as artificial intelligence (AI) can be a useful tool in helping insurers fight these problems. By partnering with insurtech companies that specialize in this technology, pet insurers can leverage AI- and machine learning (ML)-powered algorithms to significantly enhance their fraud detection capabilities, minimize fraudulent payouts, and ensure a more secure and efficient claims process.

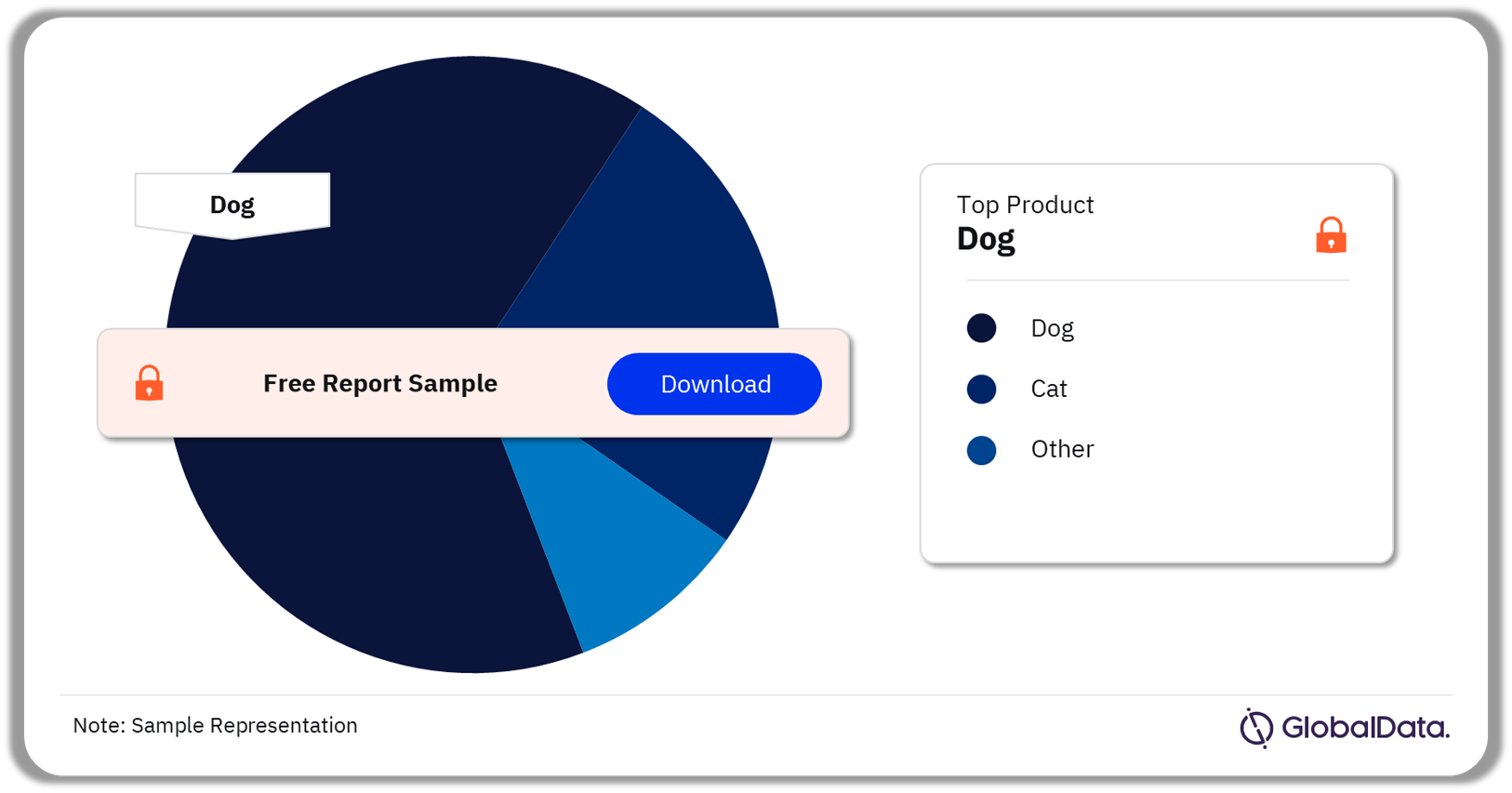

UK Pet Insurance Market Segmentation by Products

In 2022, dog pet insurance held the highest share of the pet insurance market.

The key pet insurance products in the UK pet insurance market include insurance for dogs, cats, and others. The greater uptake of dog insurance compared to cat insurance can be attributed to several factors. One primary reason is the elevated cost of veterinary care associated with dogs. This cost differential becomes more pronounced during periods of economic uncertainty when some individuals face financial constraints. To navigate these potential expenses, dog owners are more inclined to invest in pet insurance to ensure their dog receives necessary medical attention without straining their budgets.

UK Pet Insurance Market Analysis by Products, 2022 (%)

Buy the Full Report for More Products Insights into the UK Pet insurance Market

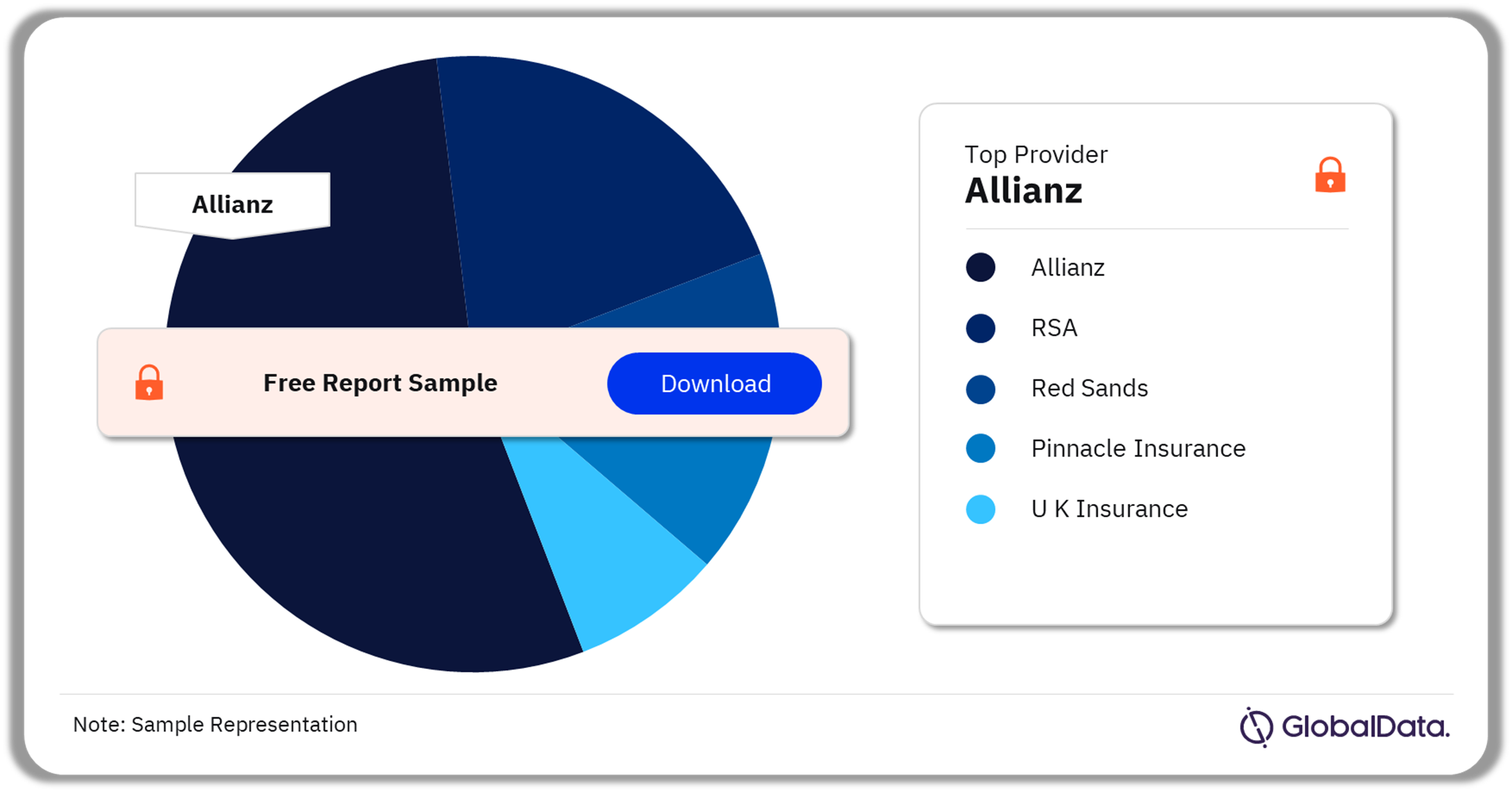

UK Pet Insurance Market - Competitive Landscape

Allianz was the leading company in the UK pet insurance market in 2022.

Some of the leading providers in the UK pet insurance market are:

- Allianz

- RSA

- Red Sands

- Pinnacle Insurance

- U K Insurance

The continued strength of Allianz can be attributed primarily to its subsidiary Petplan, which secures a significant share of GWP. Additionally, contributions from Pets at Home and Allianz itself further reinforced its market presence.

UK Pet Insurance Market Analysis by Providers, 2022 (%)

Buy the Full Report for More Insights into the UK Pet insurance Market Providers

Segments Covered in the Report

UK Pet Insurance Market Products Outlook (Value, GBP Billion, 2018-2027)

- Dog

- Cat

- Other

Scope

- The United Kingdom (UK) Pet insurance market research report provides a comprehensive analysis of the UK pet insurance market.

- It explores drivers of uptake and the claims landscape, as well as looks at the broader pet market and upcoming regulatory changes.

- Incumbent competitors are analyzed and compared, alongside relevant newcomers and insurtechs.

- The report examines future impactors in the market, including inflation and emerging technologies such as artificial intelligence.

Reasons to Buy

- Understand the current and future size of the UK pet insurance market.

- Discover the impact of the cost-of-living crisis and how it has influenced trends in the market.

- Identify the top players, their products, and their strategies.

- Learn how the UK pet insurance market will evolve out to 2027.

RSPCA

Go.Compare

National Equine Welfare Council

PDSA

The Royal College of Veterinary Surgeons

The British Veterinary Association

Allianz

Pet Plan

Pets at Home

RSA

Red Sands

Tesco Bank

More Than

John Lewis

M&S Bank

Animal Friends

Pinnacle Insurance

Admiral

Post Office

Sainsburys

Pet Protect

Churchill

Direct Line

U K Insurance

Post Office

Argos

Costco

PetPartners

Shift Technology

App Radar

Holiday Extras

Aviva

Hastings Direct

Cuvva

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK pet insurance market size in 2022?

The pet insurance market size in the UK was GBP1.58 billion in 2022.

-

What is the UK pet insurance market growth rate?

The UK pet insurance market is expected to achieve a CAGR of more than 4% during 2022-2027.

-

What were the products in the UK pet insurance market?

The key pet insurance products in the UK pet insurance market include insurance for dogs, cats, and others.

-

Who are the key providers in the UK pet insurance market?

Some of the leading providers in the UK pet insurance market are, Allianz, RSA, Red Sands, Pinnacle Insurance, and U K Insurance.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports