United Kingdom (UK) Protection Insurance – Critical Illness Market

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

United Kingdom (UK) Protection Insurance – Critical Illness Market Report Overview

The number of contracts in the UK’s individual protection market declined by 5% in 2022 primarily due to inflation and the cost-of-living crisis that has caused financial constraints for many consumers, making it difficult to afford insurance.

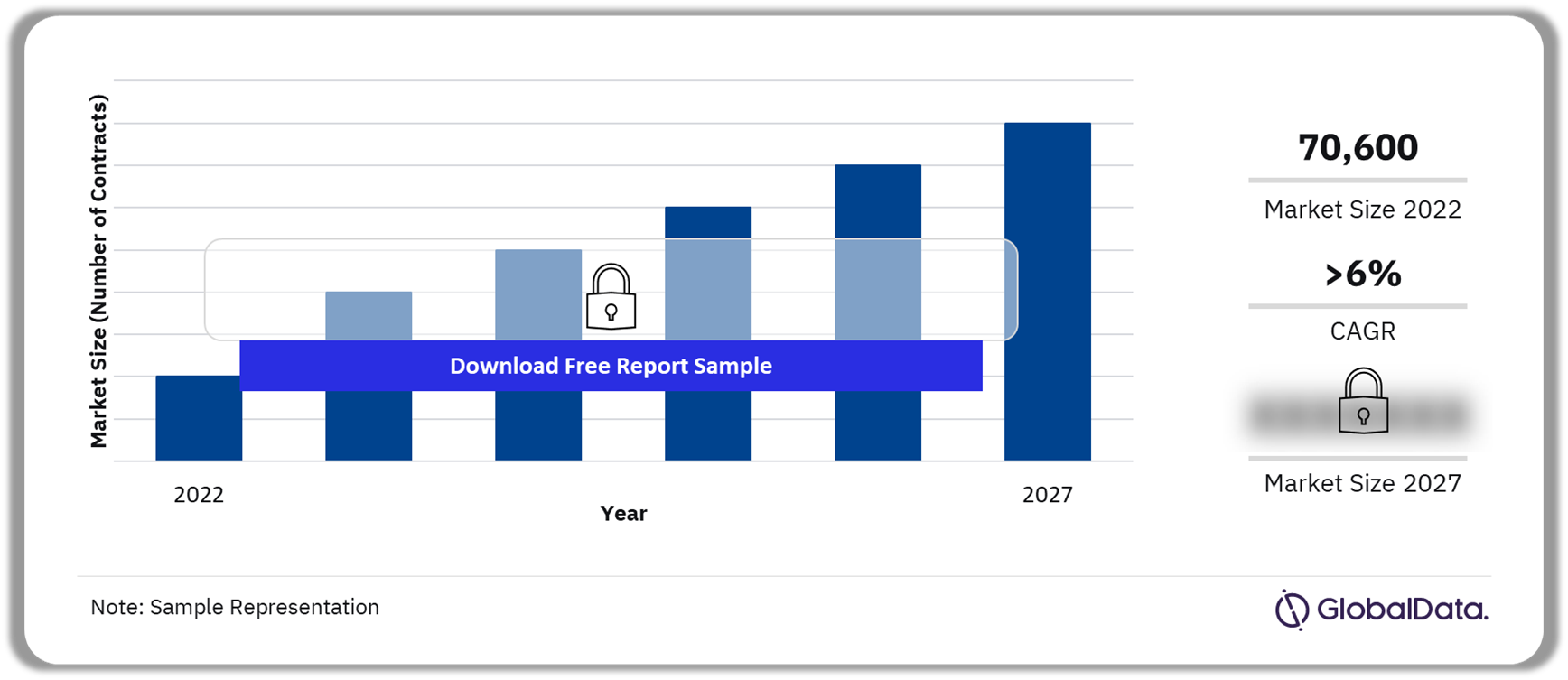

The number of contracts in the standalone critical illness market declined by over 4% to 70,600 in 2022. The contracts for critical illness as a rider are much larger than standalone critical illness. However, the number of contracts for standalone critical illness is further likely to rise gradually due to many individuals wanting to protect themselves from the high-interest rates that are affecting mortgages as buying a house is a key driver of critical illness purchases. As the impact of inflation reduces, interest rates fall, and the economy improves, consumer confidence will return, thus increasing the number of contracts sold. The standalone critical illness market will maintain growth at a CAGR of more than 6% during 2023-2027. The rising number of contracts is expected to boost the growth in premiums directly.

UK Protection Insurance – Critical Illness Market Report Outlook 2022-2027 (Number of Contracts)

This report provides an in-depth assessment of the critical illness insurance market, looking at current and historical market size changes in contracts and premiums. It examines how critical illness products are distributed and highlights notable changes in the competitive landscape, as well as the propositions of key market players. The value of claims is also assessed. The report provides five-year forecasts of contracts and premiums to 2027 and discusses how the market, distribution, and products offered are likely to change in the future (as well as the reasons for these changes).

| Market Size (Number of Contracts) | 70,600 |

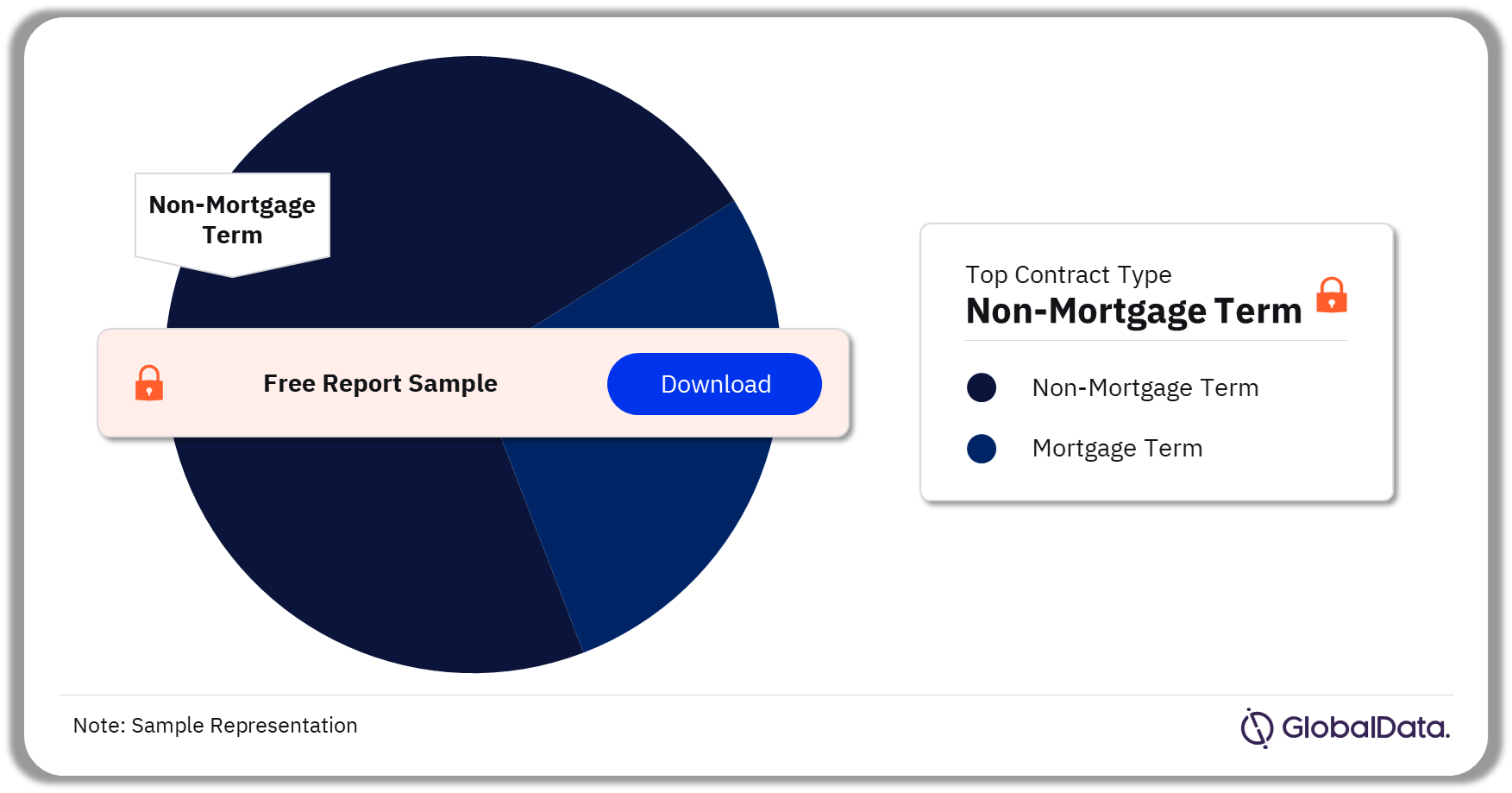

| Key Critical Illness Rider Contracts by Type | Mortgage Term and Non-Mortgage Term |

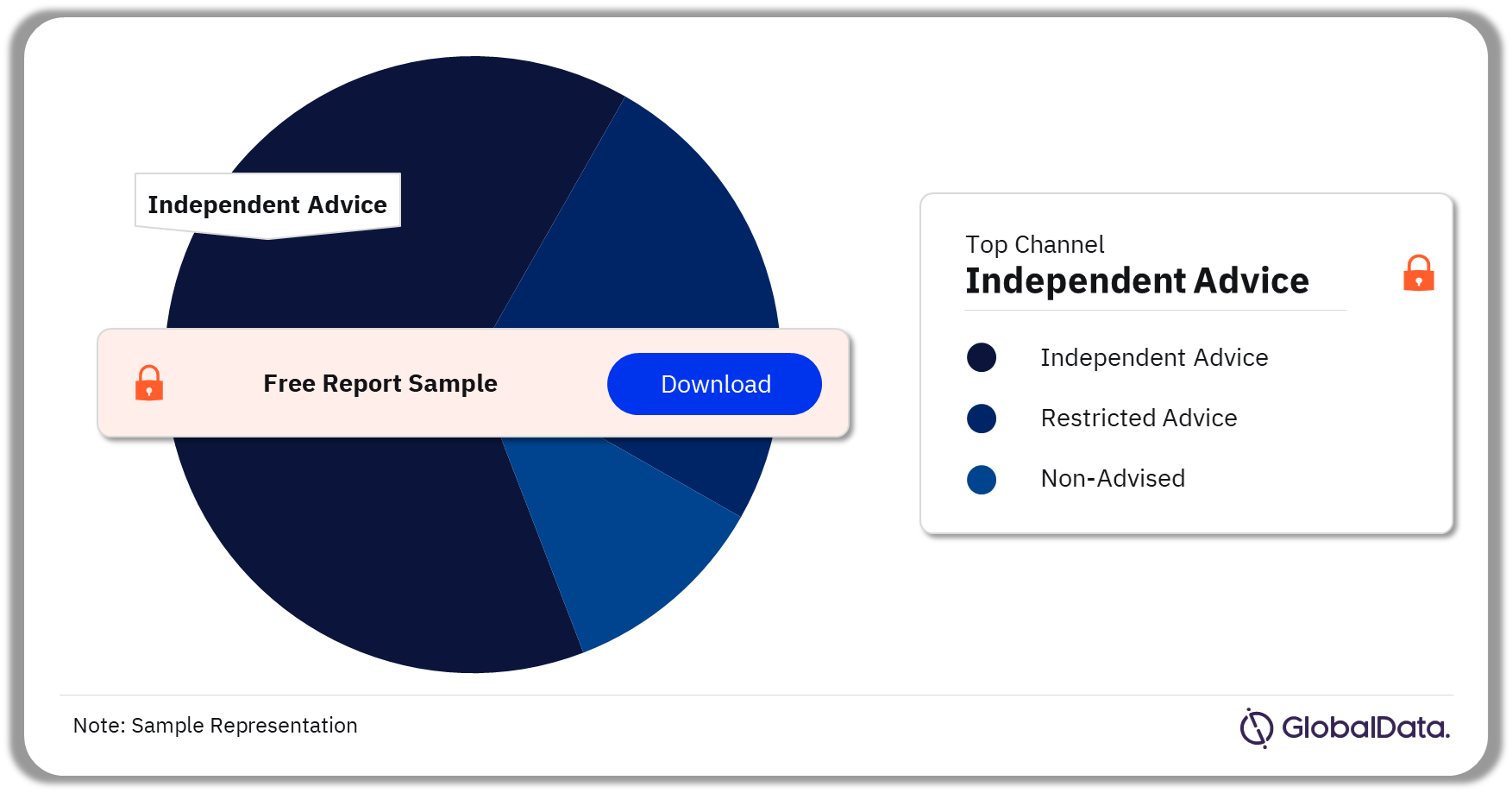

| Key Critical Illness Contracts by Channel | Independent Advice, Restricted Advice, and Non-Advised |

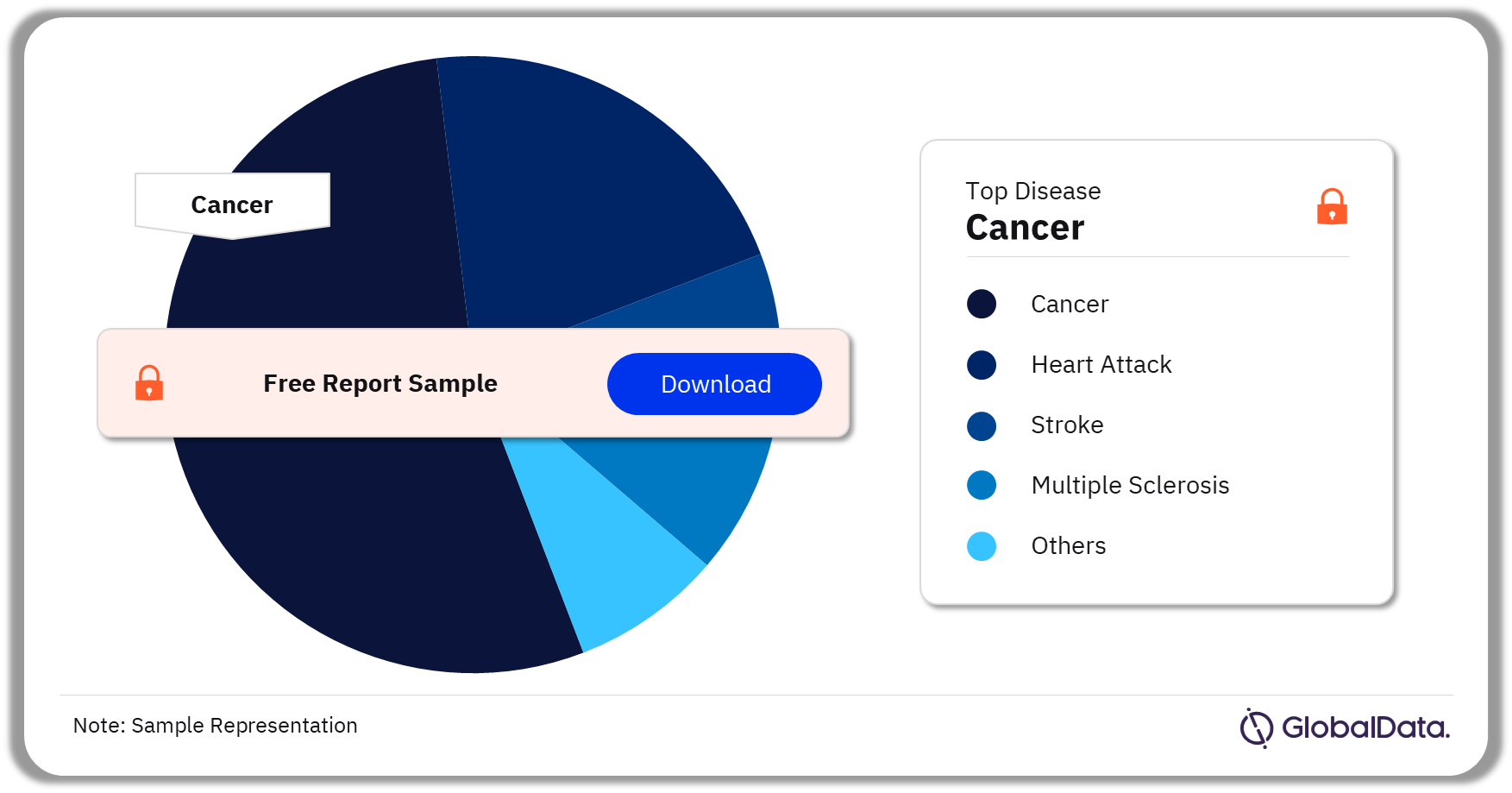

| Key Critical Illness Contracts by Disease | Cancer, Heart Attack, Stroke, Multiple Sclerosis, Benign Brain Tumor, Parkinson’s |

| Key Companies | Legal & General (L&G), Aviva, AIG, Royal London, Vitality, and Zurich |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report or Download a Free Sample Report for More UK Protection Insurance – Critical Illness Market Forecasts

UK Protection Insurance – Critical Illness Rider Market Segmentation by Contract Types

The key contract types in the UK protection insurance–critical illness rider market are mortgage terms and non-mortgage terms. In 2022, the non-mortgage term segment accounted for the maximum critical illness rider share. The mortgage term segment is yet to recover to pre-COVID levels, driven by the economic difficulties faced during the pandemic and beyond.

UK Protection Insurance – Critical Illness Rider Market Analysis by Contract Types, 2022 (%)

Buy the Full Report or Download a Free Sample Report for More Information on the Contract Types in the UK Protection Insurance – Critical Illness Rider Market

UK Protection Insurance – Critical Illness Market Segmentation by Channel

The key channels in the UK protection insurance–critical illness market are independent advice, restricted advice, and non-advised. In 2022, independent advice dominated the market, both in terms of premiums and contracts. The growth of this channel can be attributed to the consumers looking for advice on the product, focusing on affordability and the span of illnesses covered.

UK Protection Insurance – Critical Illness Market Analysis by Channel, 2022 (%)

Buy the Full Report or Download a Free Sample Report for More Channel Insights in the UK Protection Insurance – Critical Illness Market

UK Protection Insurance – Critical Illness Market Segmentation by Disease

The key diseases insurance being claimed for in the UK protection insurance–critical illness market are cancer, heart attack, stroke, Multiple Sclerosis, Benign Brain Tumor, and Parkinson’s among others. In 2022, cancer held the highest UK protection insurance–critical illness market share.

UK Protection Insurance – Critical Illness Market Analysis by Disease, 2022 (%)

Buy the Full Report or Download a Free Sample Report for More Disease Insights in the UK Protection Insurance – Critical Illness Market

UK Protection Insurance – Critical Illness Market – Competitive Landscape

The key companies in the UK protection insurance – critical illness market are Legal & General (L&G), Aviva, AIG, Royal London, Vitality, and Zurich among others. In 2022, Legal & General (L&G) retained first place with the highest number of critical illness contracts (standalone and rider cover combined), followed by Aviva, and AIG.

UK Protection Insurance – Critical Illness Market Analysis by Companies, 2022 (%)

Buy the Full Report or Download a Free Sample Report for More Disease Insights in the UK Protection Insurance – Critical Illness Market

Key Segments Covered in the Report

UK Protection Insurance – Critical Illness Market Outlook by Contract Types (%, 2022)

- Mortgage Term

- Non-Mortgage Term

UK Protection Insurance – Critical Illness Market Outlook by Channel (%, 2018-2022)

- Independent Advice

- Restricted Advice

- Non-Advised

UK Protection Insurance – Critical Illness Market Outlook by Disease (%, 2018-2022)

- Cancer

- Heart Attack

- Stroke

- Multiple Sclerosis

- Benign Brain Tumor

- Parkinson’s

- Others

Scope

• The cost-of-living crisis has impacted consumer behavior, with some individuals canceling policies. As a result, insurers should look to come up with more affordable or flexible policies.

• Insurers should look to improve their underwriting capabilities to include those that have chronic conditions, such as Type 2 diabetes. Given that this market is relatively untapped, it opens up the possibility for growth.

• Consumers have been shifting towards the purchase of insurance online, sped up by the pandemic’s impact on digital adoption. The life insurance sector has generally been behind on digitalization; however, shifting consumer dynamics should act as a catalyst for insurers to improve their digital capabilities.

Key Highlights

- The cost-of-living crisis has impacted consumer behavior, with some individuals cancelling policies. As a result, insurers should look to come up with more affordable or flexible policies.

- Insurers should look to improve their underwriting capabilities to include those that have chronic conditions, such as Type 2 diabetes. Given that this market is relatively untapped, it opens the possibility for growth.

- Consumers have been shifting towards the purchase of insurance online, sped up by the pandemic’s impact on digital adoption. The life insurance sector has generally been behind on digitalization; however, shifting consumer dynamics should act as a catalyst for insurers to improve their digital capabilities.

Reasons to Buy

- Examine the size of the standalone critical illness insurance market.

- Identify the leading providers of critical illness.

- Learn about the implications of the cost-of-living crisis on the market.

- Understand the influence of a variety of factors on market growth.

Zurich

L&G

Aviva

Royal London

AIG

Scottish Widows

HSBC Life

PensionBee

LifeSearch

Teladoc Health

Table of Contents

Frequently asked questions

-

What was the total number of contracts in the UK protection insurance-critical illness market in 2022?

The total number of contracts in the UK protection insurance – standalone critical illness market was 70,600 in 2022.

-

What will be the CAGR of the UK protection insurance-critical illness market?

The UK protection insurance – standalone critical illness market will maintain growth at a CAGR of more than 6% during 2023-2027.

-

Which is the leading channel in the UK protection insurance-critical illness market?

Independent advice is the leading channel in the UK protection insurance-critical illness market.

-

Which are the key companies in the UK protection insurance-critical illness market?

Legal & General (L&G), Aviva, AIG, Royal London, Vitality, and Zurich among others are the leading players in the UK protection insurance-critical illness market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Critical Illnesses reports