United Kingdom (UK) Value, Discount, Variety Stores and General Merchandise Retail Market Trends, Analysis, Key Players and Forecast to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Report Overview

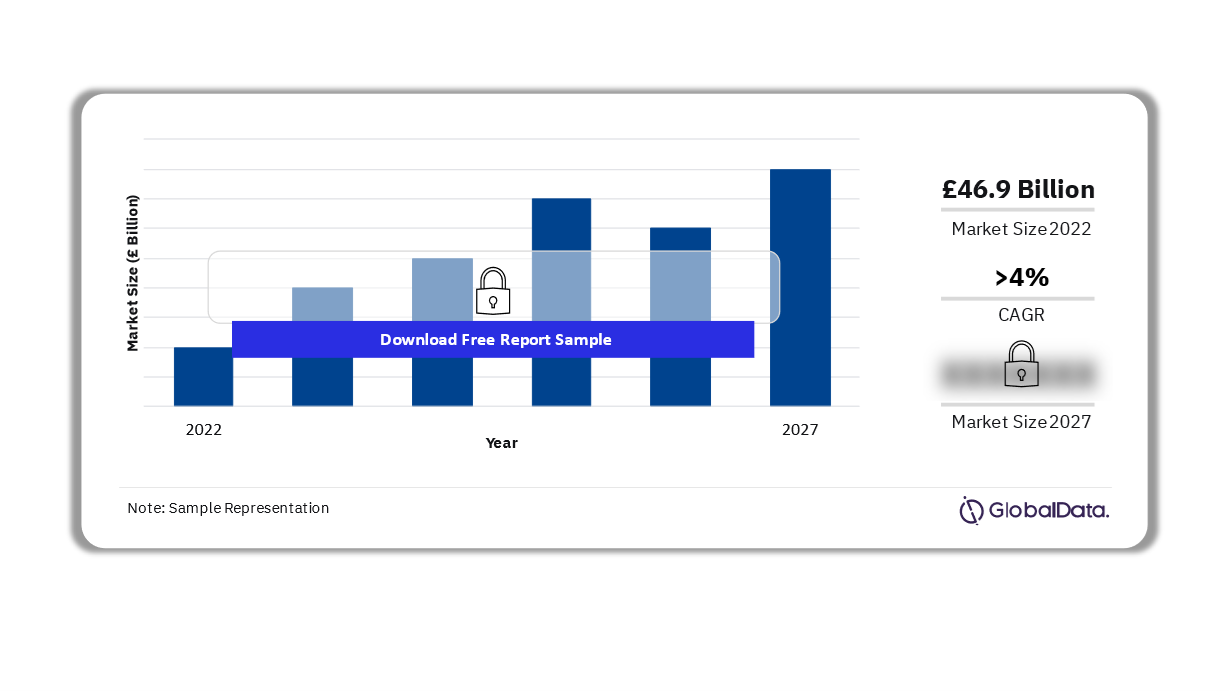

The UK value, discount, variety stores, and general merchandise retail market was valued at £46.9 billion in 2022 and is forecast to grow at a compound annual growth rate (CAGR) of more than 4% between 2022-2027. The retail channel is set to grow as more shoppers turn to value-focused retailers to make their budgets stretch further during the cost-of-living crisis. This demand is met with major investments from operators to make their retail propositions more compelling with improvements to pricing, promotions, ranging, and the in-store customer experience.

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Outlook 2022-2027 (£ Billion)

Buy Full Report for More Insights into The UK Value, Discount, Variety Stores, and General Merchandise Retail Market Forecast, Download A Free Report Sample

The UK value, discount, variety stores, and general merchandise retail report offers a comprehensive insight into the value, discount, variety stores, and general merchandise retail market in the UK, analyzing the sector, the major players, the main trends, and consumer attitudes, as well as providing market forecasts out to 2027.

| Market Size (2022) | £46.9 billion |

| CAGR (2022-2027) | >4% |

| Key Categories | · Food & Grocery

· Home · Other · Electricals · Health & Beauty · Clothing & Footwear |

| Key Distribution Channels | · High Street, Town Centre or In-Town Shopping Centre

· Retail/Shopping Park · Standalone Out of Town Store · Out Of Town Shopping Centre and Supermalls |

| Leading Players | · Aldi

· Lidl · Argos · B&M · Home Bargains |

| Enquire and Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Dynamics

The cost-of-living squeeze boosts has led to the growing preference for value retailers. Severe pressure on the finances of many households is causing many shoppers to turn to discounters, who are developing loyalty schemes to convert the current boost to demand into a permanent gain. The Lidl Plus scheme for instance is helping to drive spending and purchase frequency from its shoppers while The Original Factory Shop has just introduced Member Prices for both digital and physical card holders.

Though it remains a store-based sector, the online shopping trend has become a significant route to market for value retailers. The market players are making multiple strategies to gain a competitive edge. For instance, Aldi and Lidl have taken a cautious approach to their online operations, with Aldi stopping delivery of Specialbuys, wines and spirits in 2023. Lidl has also refrained from establishing an online platform in the UK entirely. B&M has also ended home delivery, just one year after launching the service. Argos by contrast has invested in its local fulfillment centres to drive online growth, offering more rapid delivery and click-and-collect services across the UK.

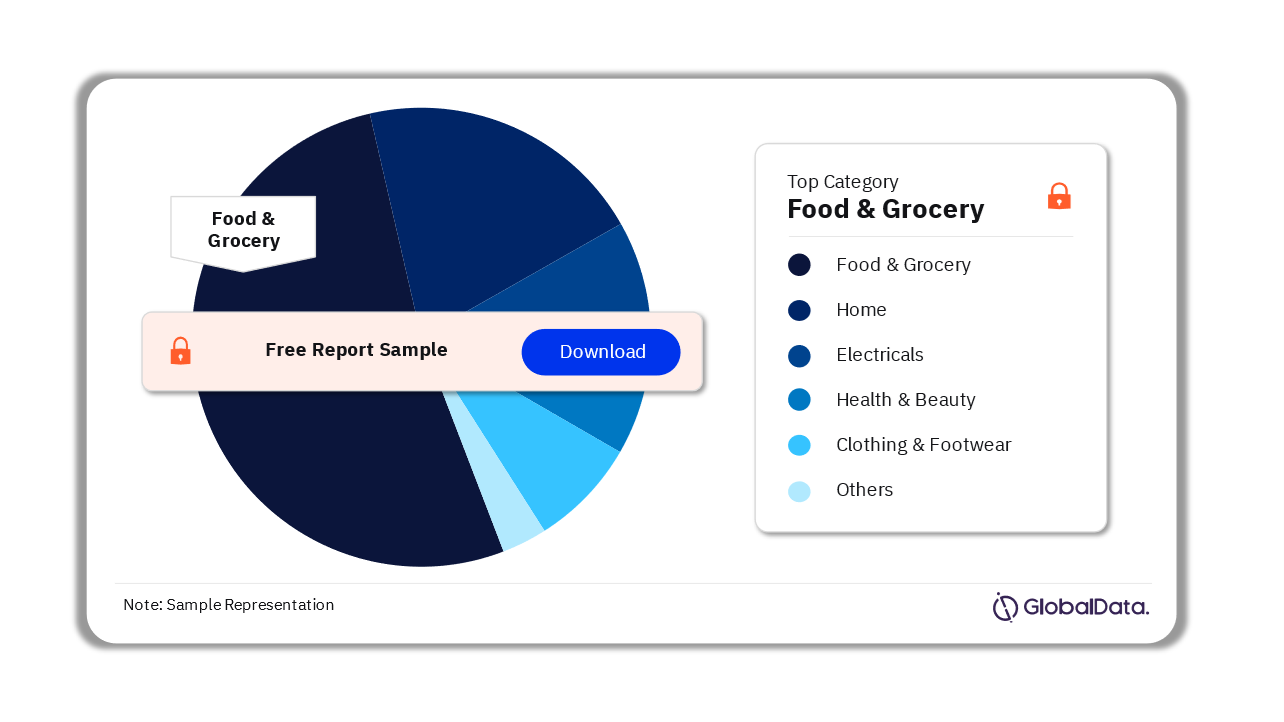

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Segmentation by Category

The UK value, discount, variety stores, and general merchandise retail market is categorized into food & grocery, home, electricals, health & beauty, clothing & footwear, and others. In 2022, the food & grocery category led the market.

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Analysis, by Category 2022(%)

Buy Full Report for More Information on The UK Value, Discount, Variety Stores, and General Merchandise Retail Market Segments, Download A Free Report Sample

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Segmentation by Channel

The key distribution channels in the UK value, discount, variety stores, and general merchandise retail market are high street, town center or in-town shopping center, retail/shopping park, standalone out of town store, and out of town shopping centre and supermalls. In 2022, most consumers in the UK preferred high street, town centre or in-town shopping centre.

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Analysis, by Channel 2022(%)

Buy Full Report for More Channel Insights into the UK Value, Discount, Variety Stores, and General Merchandise Retail Market, Download A Free Report Sample

UK Value, Discount, Variety Stores, and General Merchandise Retail Market - Competitive Landscape

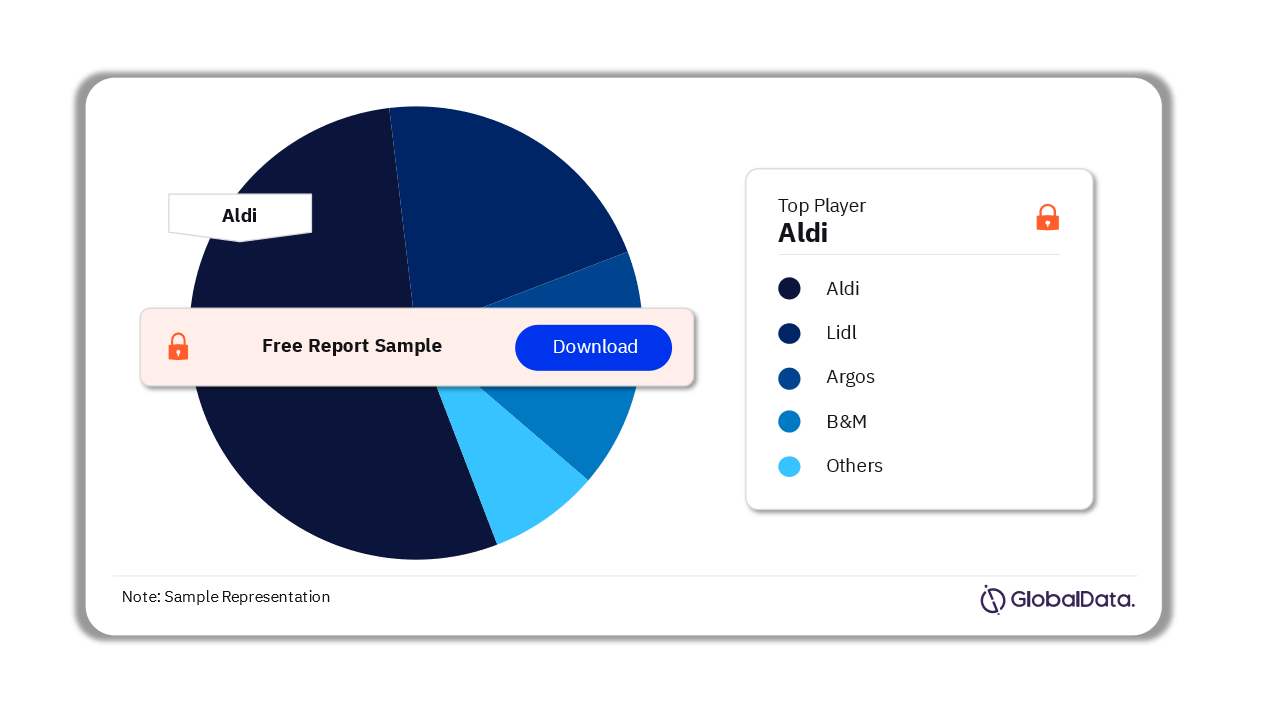

The leading players in the UK value, discount, variety stores, and general merchandise retail market are Aldi, Lidl, Argos, B&M, and Home Bargains among others. Aldi led the market in 2022.

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Analysis, by Retailers 2022(%)

Buy Full Report to Know More About The Leading Player In The UK Value, Discount, Variety Stores, and General Merchandise Retail Market, Download A Free Report Sample

UK Value, Discount, Variety Stores, and General Merchandise Retail Market Segmentation

- UK Value, Discount, Variety Stores, and General Merchandise Retail Market Outlook by Category

- Food & Grocery

- Home

- Other

- Electricals

- Health & Beauty

- Clothing & Footwear

- UK Value, Discount, Variety Stores, and General Merchandise Retail Market Outlook by Distribution Channels

- High Street, Town Centre or In-Town Shopping Centre

- Retail/Shopping Park

- Standalone Out o Town Store

- Out Of Town Shopping Centre and Supermalls

Key Highlights

- Food & grocery to drive channel growth as shoppers look to save money on essential spend

- The home sector to benefit from the need for value but the strongest non-food growth will come from apparel and health & beauty

- Efficiency and customer focus are key for long-term competitiveness

Reasons to Buy

- Use our in-depth consumer and market insight to learn about the growth of the value, discount, variety stores, and general merchandise retail in the UK

- Find out which sectors are growing fastest in the UK value, discount, variety stores, and general merchandise market.

- Discover which retailers have the greatest market share, and the outlook for named retailers.

Amazon

Argos

ASDA

B&M

Bargain Buys

Boots

Dunelm

Flying Tiger Copenhagen

Home Bargains

Iceland

IKEA

John Lewis & Partners

Lidl

Marks & Spencer

Morrisons

Poundland

Poundshop.com

Poundstretcher

Sainsbury's

Savers

Superdrug

Tesco

The Original Factory Shop

The Range

The Works

TK Maxx

Very

Waitrose & Partners

WH Smith

Wickes

Wilko

Table of Contents

Table

Figures

Frequently asked questions

-

What was the UK value, discount, variety of stores, and general merchandise retail market size in 2022?

The UK value, discount, variety stores, and general merchandise retail market size in 2022 was £46.9 billion.

-

The UK value, discount, variety stores, and general merchandise retail market size in 2022 was £46.9 billion.

The UK value, discount, variety stores, and general merchandise retail market will witness a CAGR of more than 4% during 2022-2027.

-

Which category dominated the UK value, discount, variety stores, and general merchandise retail market share in 2022?

The food & grocery category accounted for the highest share of the UK value, discount, variety stores, and general merchandise retail market in 2022.

-

Which distribution channel generated the highest UK value, discount, variety stores, and general merchandise retail market revenue in 2022?

In 2022, most consumers in the UK preferred high street, town centre or in-town shopping centre.

-

Who are the leading players in the UK value, discount, variety stores, and general merchandise retail market?

The leading players in the UK value, discount, variety stores, and general merchandise retail market are Aldi, Lidl, Argos, B&M, and Home Bargains among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.