United Kingdom (UK) Wealth Management – High Net Worth (HNW) Investors

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

UK Wealth Management HNW Investors Market Overview

HNW expats in the UK represent a sizable and lucrative segment to target, as close to a quarter of the HNW population hail from outside the UK – well above the wider region. The UK has long been a major expat hub, partly due to its status as a key global financial center. The UK wealth management market report sizes the opportunity within UK’s wealth market and analyzes the investment preferences, service requirements, and portfolio allocations of the country’s HNW investors.

UK Wealth Management Market Dynamics

The financial services sector is the leading wealth generator in the UK. The wealth-creating potential of the financial world is nothing new, reflecting its outsized role in the UK economy generally, with high salaries being offered for positions across this industry. Political and economic concerns weighed heavily on the performance of the financial services sector in 2022. Surging inflation, economic slowdown, and rising unemployment have elevated the risk of potential loan losses for the banking sector, despite higher interest rates driving revenue growth.

UK Wealth Management Market Investment Preferences

The key investment preferences in the UK wealth management market are advisory asset management, automated investment services, discretionary asset management, and execution-only asset management. UK HNW investors are becoming increasingly hands-on with their investments. Wealth managers need to accommodate this growing desire for control and ensure relationship managers are providing the necessary reassurance to retain faith in their expertise.

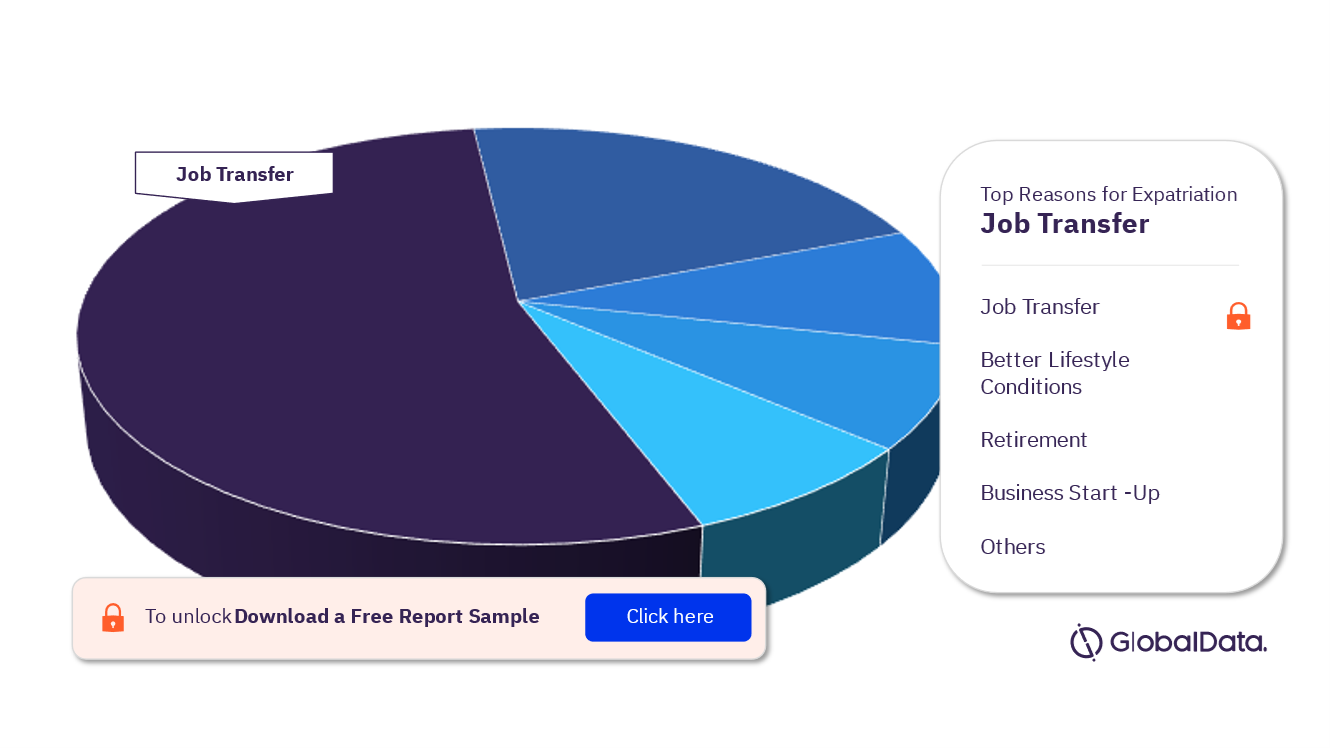

UK Wealth Management Market - Reasons for Expatriation for HNW Investors

The drivers of expatriation to the UK are job transfer, better lifestyle conditions, better opportunities for expats’ children, business start-ups, and retirement among others. The majority of the people shift owing to a job transfer.

UK Wealth Management Market, By Reasons For Expatriation

For more expatriation reason insights in the UK wealth management market, download a free report sample

For more expatriation reason insights in the UK wealth management market, download a free report sample

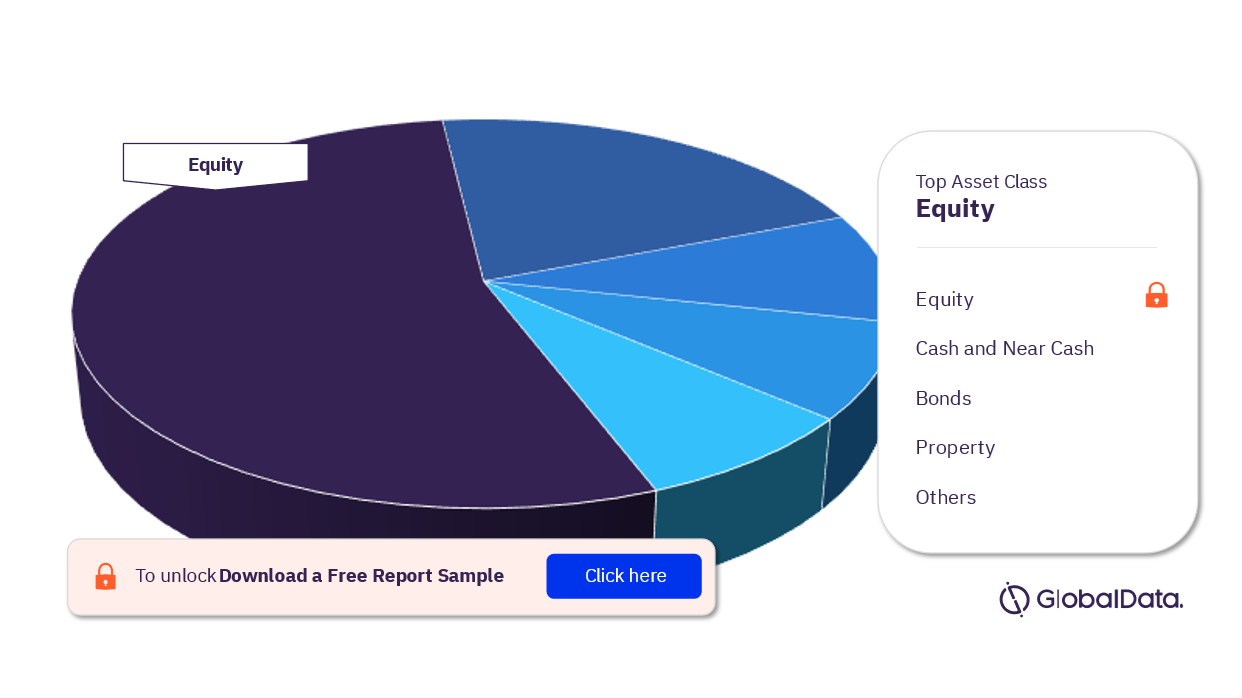

UK Wealth Management Market - Major Asset Classes of Offshore Investment

The major asset classes of offshore investment for HNW investors in the UK wealth management market include equity, cash and near-cash products, bonds, property, alternatives, and commodities. UK HNW investors are offshoring wealth into multiple asset classes, the majority of them are investing in equities.

UK Wealth Management Market, By Asset Classes Of Offshore Investment

For more asset classes of offshore investment insights in the UK wealth management, download a free report sample

UK Wealth Management Market Report Overview

| Key Investment Preferences | Advisory Asset Management, Automated Investment Services, Discretionary Asset Management, and Execution-Only Asset Management. |

| Key Reasons For Expatriation | Job Transfer, Better Lifestyle Conditions, Better Opportunities For Expats’ Children, Business Start-Ups, and Retirement |

| Major Asset Classes Of Offshore Investment | Equity, Cash and Near Cash, Bonds, Property, Alternatives, and Commodities |

Segments Covered in the Report

UK Wealth Management Market Asset Classes Outlook (2022)

- Equity

- Cash and Near Cash

- Bonds

- Property

- Alternatives

- Commodities

Key Highlights

- Expats constitute more than 23% of the local HNW population. They represent an attractive target market thanks to their more complex service requirements.

- Robo-advice accounts for over 11% of the UK HNW portfolio. The demand for robo-advisory services is expected to grow at the strongest rate compared to other investment mandates over the next 12 months.

- Cash and near-cash investments and equities dominate the UK HNW asset portfolio

Reasons to Buy

- Develop and enhance your client targeting strategies using our data on HNW profiles and sources of wealth.

- Enhance your marketing strategies and capture new clients using insights from our data on HNW investors’ asset management style preferences.

- Tailor your investment product portfolio to match current and future demand for different asset classes among HNW individuals.

Citibank

Moneyfarm

M&G Wealth

Frequently asked questions

-

What are the various investment services in the UK wealth management market?

Advisory asset management, automated investment services, discretionary asset management, and execution-only asset management are the various investment services in the UK wealth management market.

-

What are the key reasons for expatriation for HNW investors in the UK wealth management market?

Job transfer, better lifestyle conditions, better opportunities for expats’ children, business start-ups, and retirement are the key reasons for expatriation for HNW investors in the UK wealth management market.

-

What is the key driver of expatriation for HNW investors in the UK wealth management market?

The key driver of expatriation to the UK management market is job transfer.

-

What are the major asset classes of offshore investment for HNW investors in the UK wealth management market?

Equity, cash and near-cash products, bonds, property, alternatives, and commodities are the major asset classes of offshore investment for HNW investors in the UK wealth management market.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports