Urea Capacity and Capital Expenditure Forecast by Region, Countries, Companies and Projects, 2023-2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

The global urea capacity was 234.41mtpa in 2022. FSU, Middle East and Asia are the top regions contributing to capacity additions in the upcoming years. Among the key countries, China led with the largest capacity contribution globally, followed by India and the US.

Urea capacity and capital market research report provides global urea capacity outlook by region. It also provides urea planned and announced plants details.

| Market Size, 2022 (mtpa) | 234.41mtpa |

| Key Countries | China, India, the US, Russia, Iran, Indonesia, Egypt, Pakistan, Nigeria, and Qatar |

| Key Regions | Africa, Asia, Caribbean, Europe, Former Soviet Union, Middle East, North America, Oceania, and South America |

| Key Companies | PT Pupuk Indonesia Holding Co, CF Industries Holdings Inc, Nutrien Ltd, China Petrochemical Corp, Yara International ASA, The National Petrochemical Co, China National Petroleum Corp, Saudi Basic Industries Corp, Indian Farmers Fertiliser Coop Ltd, and Jinneng Holding Equipment Manufacturing Group Co Ltd |

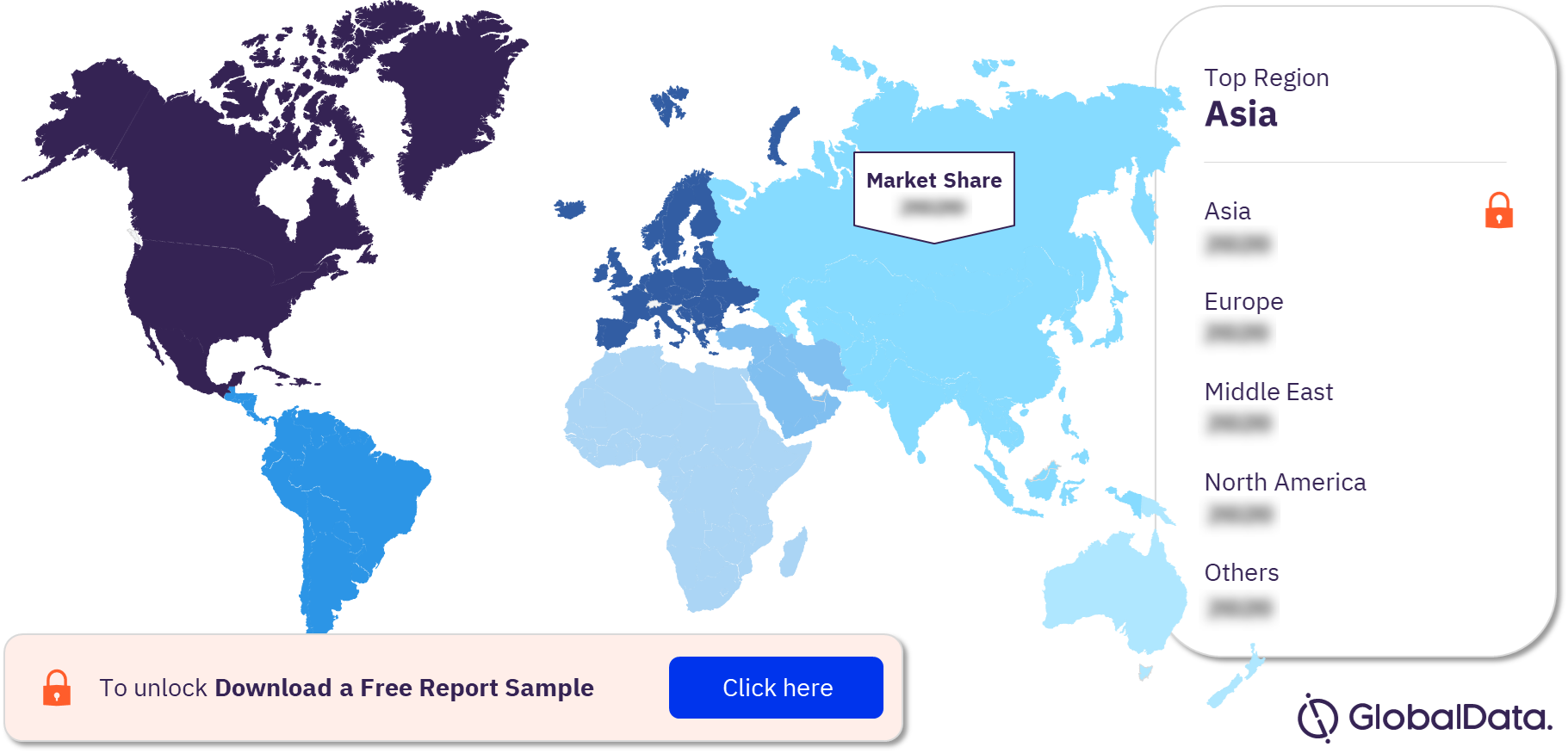

Urea Capacity and Capital Expenditure Segmentation by Regions

The key regions in the global urea capacity and capital expenditure market are Africa, Asia, Caribbean, Europe, Former Soviet Union, Middle East, North America, Oceania, and South America. Among regions, Asia leads global urea capacity and capital market in 2022, followed by Middle East and North America respectively.

Global Urea Capacity and Capital Expenditure Market Analysis, by Regions, 2022 (%)

For more regional insights into the urea capacity and capital expenditure market, download a free report sample

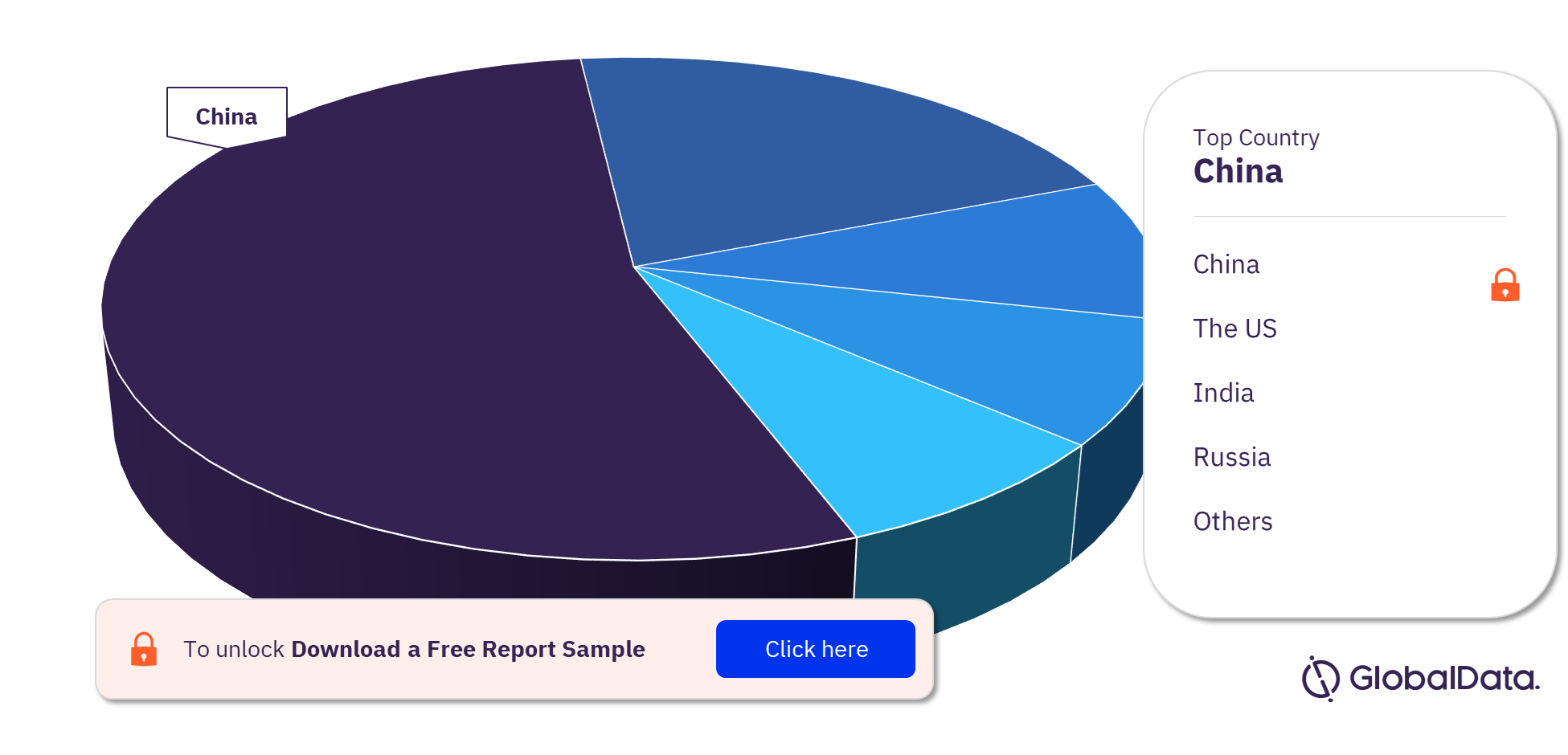

Urea Capacity and Capital Expenditure Market Segmentation, by Countries

The key countries in the urea capacity and capital expenditure market are China, India, the US, Russia, Iran, Indonesia, Egypt, Pakistan, Nigeria, and Qatar. China leads among all the countries with the highest active urea capacity in 2022, followed by India and the US.

Urea Capacity and Capital Expenditure Market Analysis, by Countries, 2022 (%)

For more regional insights into the global urea capacity and capital expenditure market, download a free report sample

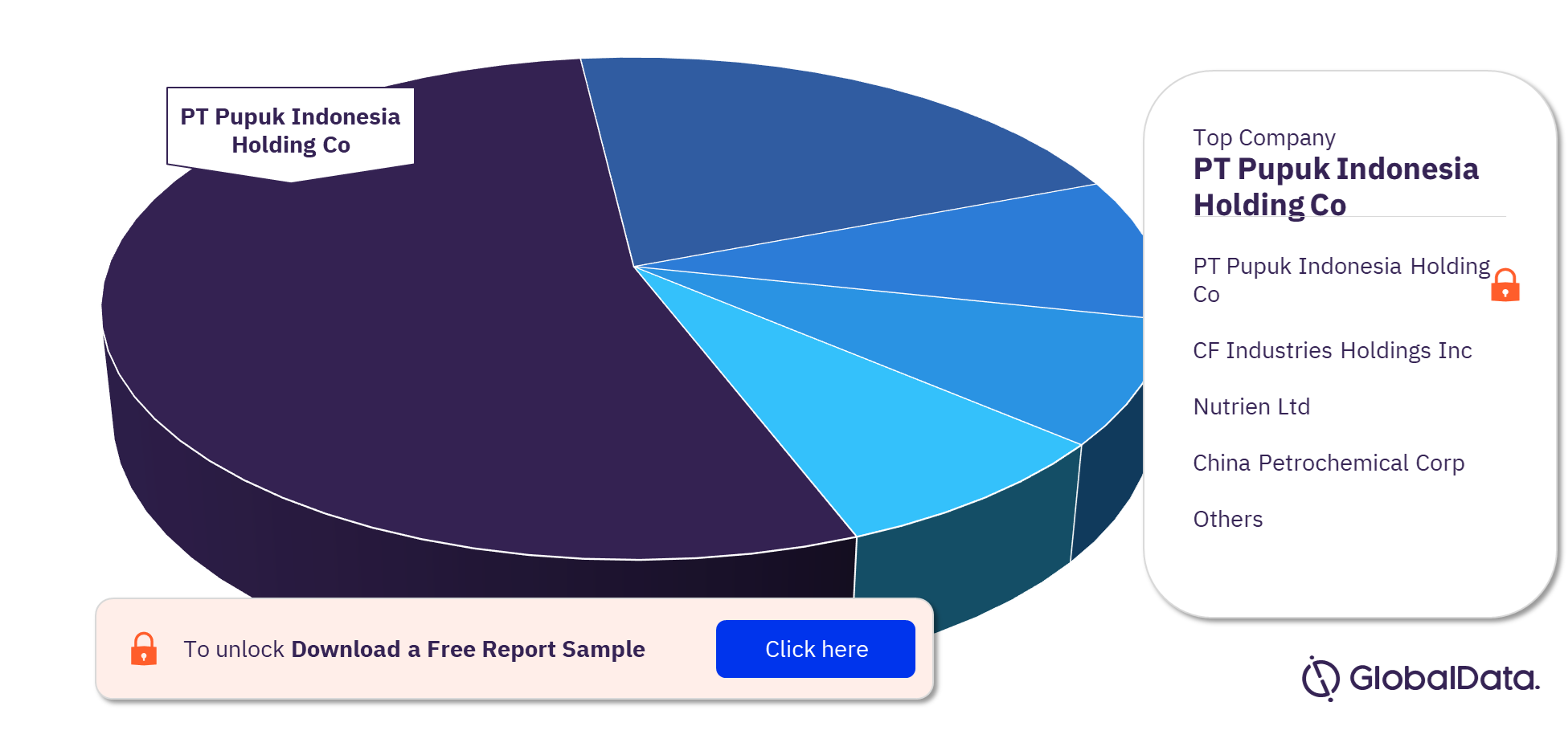

Competitive Landscape - Urea Capacity and Capital Market

The key companies in the global urea capacity and capital expenditure market are PT Pupuk Indonesia Holding Co, CF Industries Holdings Inc, Nutrien Ltd, China Petrochemical Corp, Yara International ASA, The National Petrochemical Co, China National Petroleum Corp, Saudi Basic Industries Corp, Indian Farmers Fertiliser Coop Ltd, and Jinneng Holding Equipment Manufacturing Group Co Ltd. Among companies, PT Pupuk Indonesia Holding Co leads in terms of global new build and expansion capex.

Urea Capacity and Capital Expenditure Market Analysis, by Companies, 2022(%)

To know more about key companies in the urea capacity and capital expenditure market, download a free report sample

Segments Covered in this Report

Urea Capacity and Capital Expenditure Market Regional Outlook (mtpa, 2022-2030)

- Asia

- Europe

- Africa

- Middle East

- North America

- Oceania

- South America

- Former Soviet Union

- Caribbean

Urea Capacity and Capital Expenditure Market Countries Outlook (2022)

- China

- India

- The US

- Russia

- Iran

- Indonesia

- Egypt

- Pakistan

- Nigeria

- Qatar

Scope

The report provides:

- Global urea capacity outlook by region

- Urea planned and announced plants details

- Capacity share of the major urea producers globally

- Global urea capital expenditure outlook by region

Reasons to Buy

- Understand key trends in the global urea industry.

- Identify opportunities in the global urea industry with the help of upcoming plants and capital expenditure outlook.

- Understand the current and future competitive scenario.

Oteko

Perdaman Industries Pty Ltd

Leigh Creek Energy Ltd

Nakhodka Fertilizer Plant

Lukoil Oil Co

The National Petrochemical Co

Parsian Oil & Gas Development Co

Togliattiazot

Matix Fertilisers & Chemicals Ltd

Cronus Chemicals LLC

Strike Energy Ltd

MCC EuroChem

Hamoon Chabahar

Indorama Ventures PCL

Derby Fertilizer and Petrochemical Complex Pty Ltd

Brass Fertilizer Co Ltd

Tanzania Mbolea and Petrochemicals Co Ltd

Brunei Fertilizer Industries Sdn Bhd

Sina Chemical Industries Co

Aria Iran

Kimia Sannat Mabna

Paradeep Phosphates Ltd

Gabon Fertilizers Co SA

Grodno Azot

Madras Fertilizers Ltd

Rashtriya Chemicals and Fertilizers Ltd

PT Pupuk Sriwijaya

Indian Oil Corp Ltd

Gujarat State Fertilizers & Chemicals Ltd

Table of Contents

Table

Figures

Frequently asked questions

-

Which region had the highest share in the urea capacity and capital expenditure market in 2022?

Asia leads the global urea capacity and capital expenditure market in 2022.

-

Which country had the highest share in the urea capacity and capital expenditure market in 2022?

China had the highest share in the urea capacity and capital expenditure market in 2022.

-

Which are the key companies in the urea capacity and capital expenditure market?

The key companies in the urea capacity and capital expenditure market are PT Pupuk Indonesia Holding Co, CF Industries Holdings Inc, Nutrien Ltd, China Petrochemical Corp, Yara International ASA, The National Petrochemical Co, China National Petroleum Corp, Saudi Basic Industries Corp, Indian Farmers Fertiliser Coop Ltd, and Jinneng Holding Equipment Manufacturing Group Co Ltd.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.