USA Apparel Market Size and Trend Analysis by Category, Retail Channel, Supply Chain, Consumer Attitudes, Brands and Forecast to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

US Apparel Market Report Overview

The apparel market size in the US was estimated to be $556.1 billion in 2022. Menswear is expected to outperform womenswear out to 2026, as males are not as volume-driven so have less to cut back on while budgets are squeezed. Childrenswear growth between 2022 and 2026 will be softer than menswear and womenswear, due to the subsector having less of a recovery to make in the earlier years as it was more resilient during the pandemic, but also as a result of slowing birth rates.

US Apparel Market Outlook, 2022-2026 ($ Billion)

For more insights into the US apparel market forecast, download a free report sample

In order to retain demand, brands like Old Navy are striving to avoid raising prices during the inflationary pressures, so that families on lower incomes can continue to afford childrenswear products. The US apparel market research report offers a detailed analysis of the apparel market in US with impact of major events. It also includes analysis of COVID-19 impact on customer shopping behavior, key apparel retailers, sector analysis, trends, and retailer reactions.

| Market Size (2022) | $556.1 billion |

| Historical Period | 2016-2022 |

| Forecast Period | 2023-2026 |

| Key Categories | Clothing, Footwear, and Accessories |

| Key Channels | Clothing, Footwear and Accessories Specialists, Hypermarkets, Supermarkets and Hard Discounters, Department Stores, Online Specialists, Other Offline Channels, and Other Online Retail |

| Key Brands | Nike, Adidas, Shein, Old Navy, Target, and Lululemon |

US Apparel Market Dynamics

The US apparel market grew in 2022, despite consumers grappling with high inflation and the market being up against strong comparatives in 2021, with shoppers still feeling the benefits of the government stimulus payments in the prior year and their lockdown savings. The alleviation of the pandemic also made shoppers feel more comfortable to visit physical stores again, as well as attend events and travel abroad, which drove sales of both holiday-wear and occasion-wear.

Although inflation will be less severe in 2023 compared to 2022, it will still be higher than usual, with the cumulative impact dampening consumer confidence. Therefore, the market’s growth is expected to be slow in 2023, driven by price rises as consumers cut back on volumes.

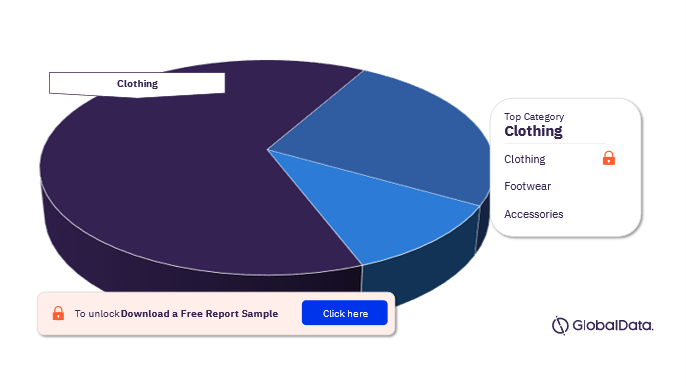

US Apparel Market Segmentation by Category

The key categories of the US apparel market are clothing, footwear, and accessories. Apparel brands would benefit from incorporating resale into their propositions, as nearly a third of US consumers bought secondhand clothing in 2022.

US Apparel Market Analysis, by Category, 2022 (%)

For more category insights into the US apparel market, download a free report sample

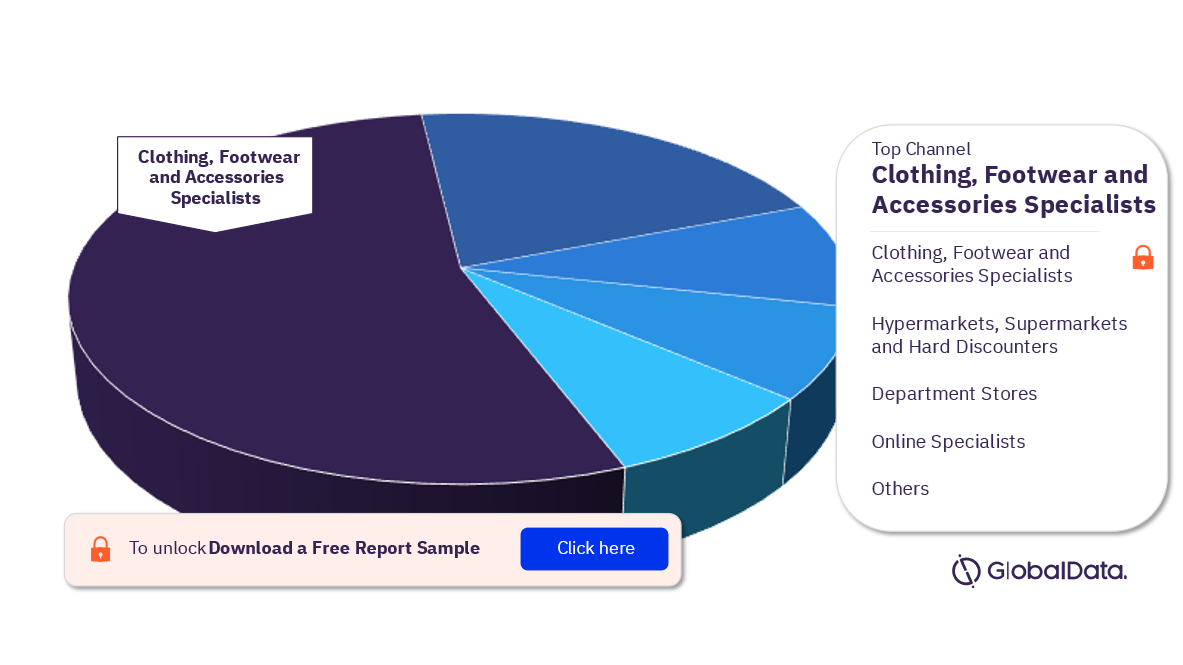

US Apparel Market Segmentation by Channels

The key channels of the US apparel market are clothing, footwear and accessories specialists, hypermarkets, supermarkets and hard discounters, department stores, online specialists, other offline channels, and other online retail. The clothing, footwear, and accessories specialists’ channel dominated the US apparel market in 2022.

US Apparel Market Analysis, by Channels, 2022 (%)

For more channel insights into the US apparel market, download a free report sample

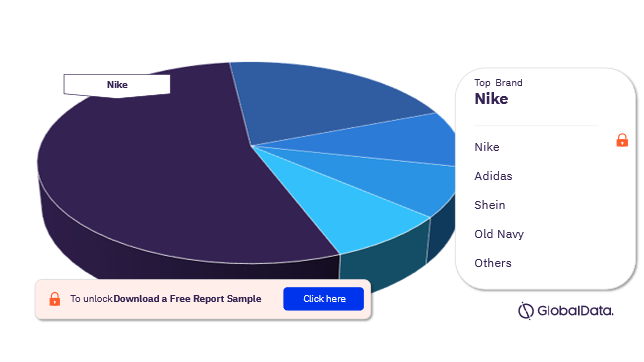

US Apparel Market – Competitive Landscape

Some of the major companies in the US apparel market are Nike, Adidas, Shein, Old Navy, Target, and Lululemon. Nike, Adidas and Lululemon’s sportswear specialisms and strong brand identities enabled them to grow their market shares in 2022. Nike led the US apparel market in 2022.

US Apparel Market Analysis, by Brands, 2022 (%)

For more insights on the leading US apparel market players, download a free report sample

Key Segments Covered in this Report

US Apparel Market Category Outlook (Value, $ Billion, 2016-2026)

- Clothing

- Footwear

- Accessories

US Apparel Market Channels Outlook (Value, $ Billion, 2016-2026)

- Clothing, Footwear and Accessories Specialists

- Hypermarkets, Supermarkets and Hard Discounters

- Department Stores

- Online Specialists

- Other Offline Channels

- Other Online Retail

Reasons to Buy

- Gain a comprehensive view of the US Apparel market and forecasts to 2026

- Explore new opportunities that will allow you to align your product offerings and strategies to meet demand following the impact of COVID-19 on the US apparel market

- Investigate current and forecast trends in apparel to identify the opportunities offering the most potential

- Understand who the main competitors are in the US apparel market and their price positioning

Adidas

Shein,Old Navy

Target

Lululemon

Victoria's Secret

Walmart

Under Armour

Skechers

Table of Contents

Frequently asked questions

-

What was the US apparel market size in 2022?

The apparel market size in the US was valued at $556.1 billion in 2022.

-

What are the key categories in US apparel market?

The key categories in the US apparel market are clothing, footwear, and accessories.

-

What are the key channels in US apparel market?

The key channels in the US apparel market are clothing, footwear and accessories specialists, hypermarkets, supermarkets and hard discounters, department stores, online specialists, other offline channels, and other online retail.

-

Which are the key brands in the US apparel market?

Some of the key brands in the US apparel market are Nike, Adidas, Shein, Old Navy, Target, and Lululemon.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.