Vietnam General Insurance Market Size, Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Vietnam General Insurance Market Report Overview

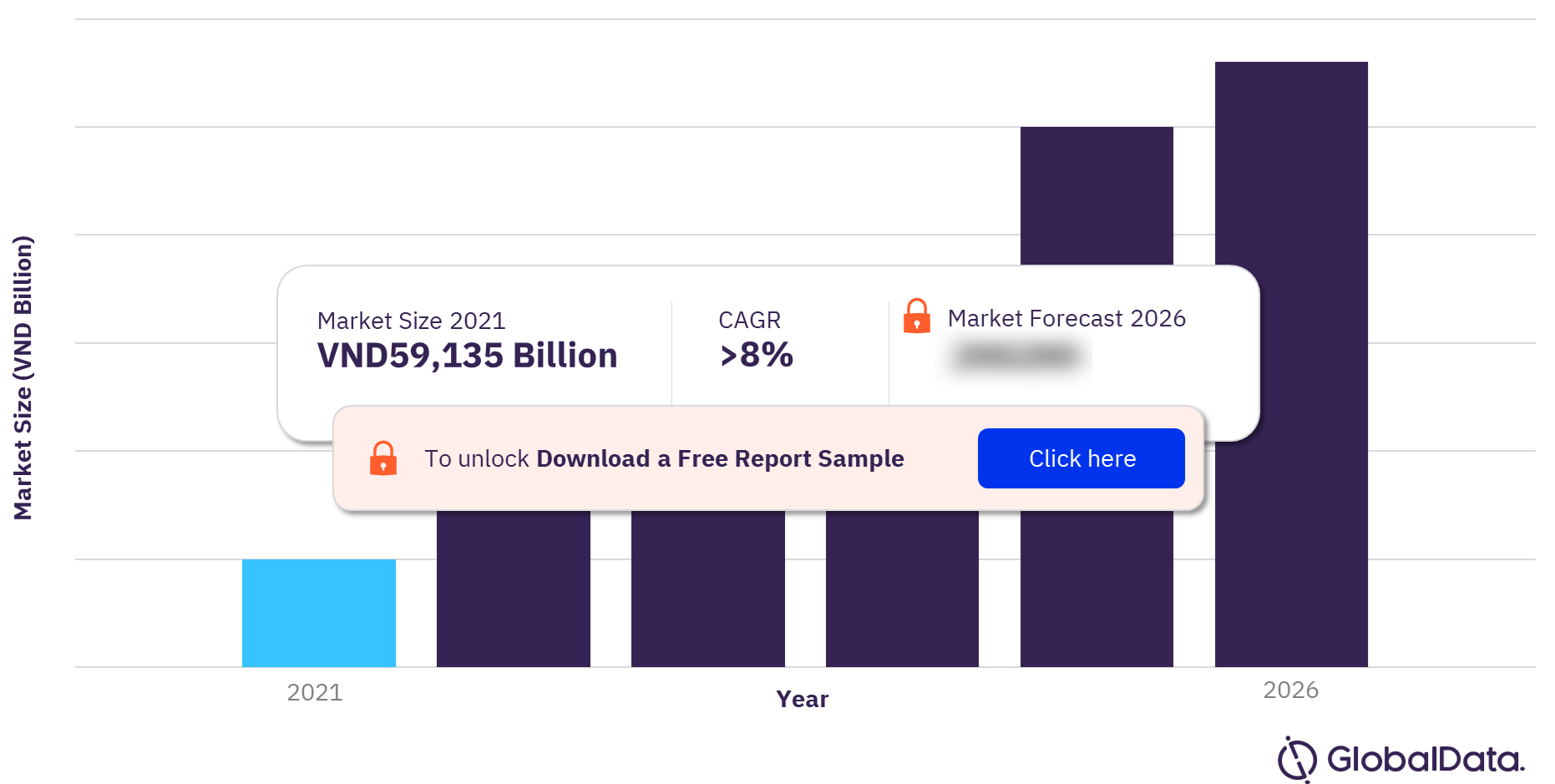

The gross written premium of the Vietnam general insurance market was VND59,135 billion ($2.6 billion) in 2021 and is expected to achieve a CAGR of more than 8% during 2021-2026. The Vietnam general insurance market research report provides in-depth market analysis, information, and insights into Vietnam’s general insurance segment. It also provides values for key performance indicators such as gross written premium, penetration, and premium ceded & cession rates, during the review period and forecast period.

The report analyzes distribution channels operating in the segment, gives a comprehensive overview of the Vietnamese economy and demographics, and provides detailed information on the competitive landscape in the country. The report also gives insurers access to information on segment dynamics and competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

Vietnam General Insurance Market Outlook, 2021-2026 (VND Billion)

To gain more information about Vietnam general insurance market forecast, download a free report sample

Vietnam General Insurance Market Trends

Electric Vehicles (EVs), microinsurance, embedded insurance products, credit risk solution, and ESG are some of the key trends driving the Vietnamese GI market.

Environmental pollution liability insurance has been designated by the government as a compulsory environmental insurance product for several businesses in industries with a high risk of pollution. Most recently, the government issued a notice that mandated the reduction of greenhouse gas emissions in various sectors/industries. Moreover, it announced the launch of public relations campaigns directed at the business community to enhance awareness and support for the government’s implementation of COP26 commitments.

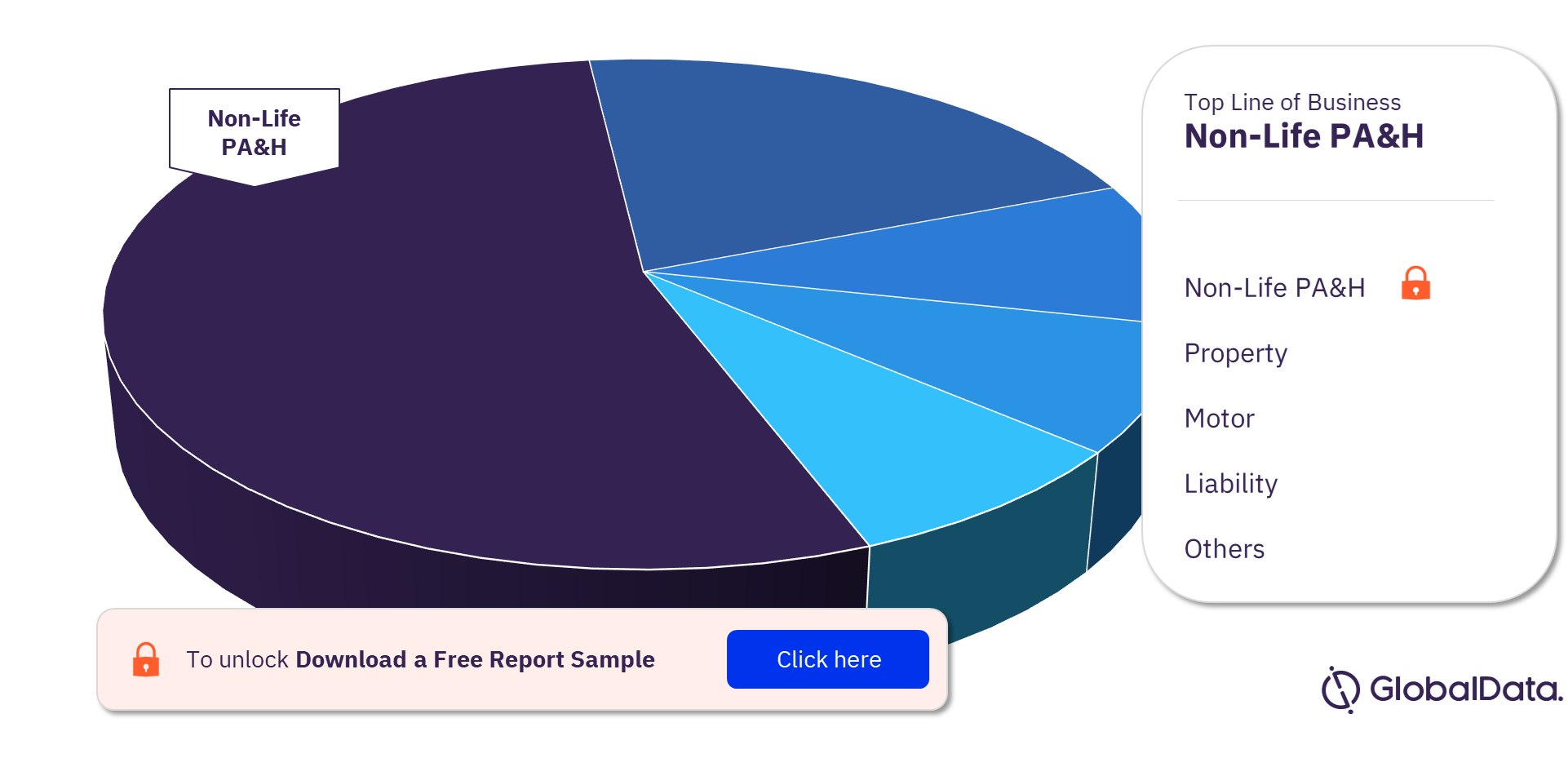

Vietnam General Insurance Market Segmentation by Lines of Business

The key lines of business in the Vietnam general insurance market are property, motor, liability, financial lines, MAT, and non-life PA&H. Non-life PA&H insurance had the highest market share in the Vietnam general insurance market in 2021.

Non-Life PA&H Insurance: Most of the Vietnamese population is covered under mandatory public health insurance. Greater health awareness due to the pandemic, a growing middle class, and inclusive insurance policies such as microinsurance is expected to drive the growth of PA&H insurance in the country.

Property Insurance: Fire and natural hazards insurance accounted for nearly half of property insurance’s GWP in 2021. The mandatory nature of fire and explosion insurance supported the growth of this line.

Vietnam General Insurance Market Analysis by Lines of Business, 2021 (%)

For more lines of business insights into the Vietnam general insurance market, download a free report sample

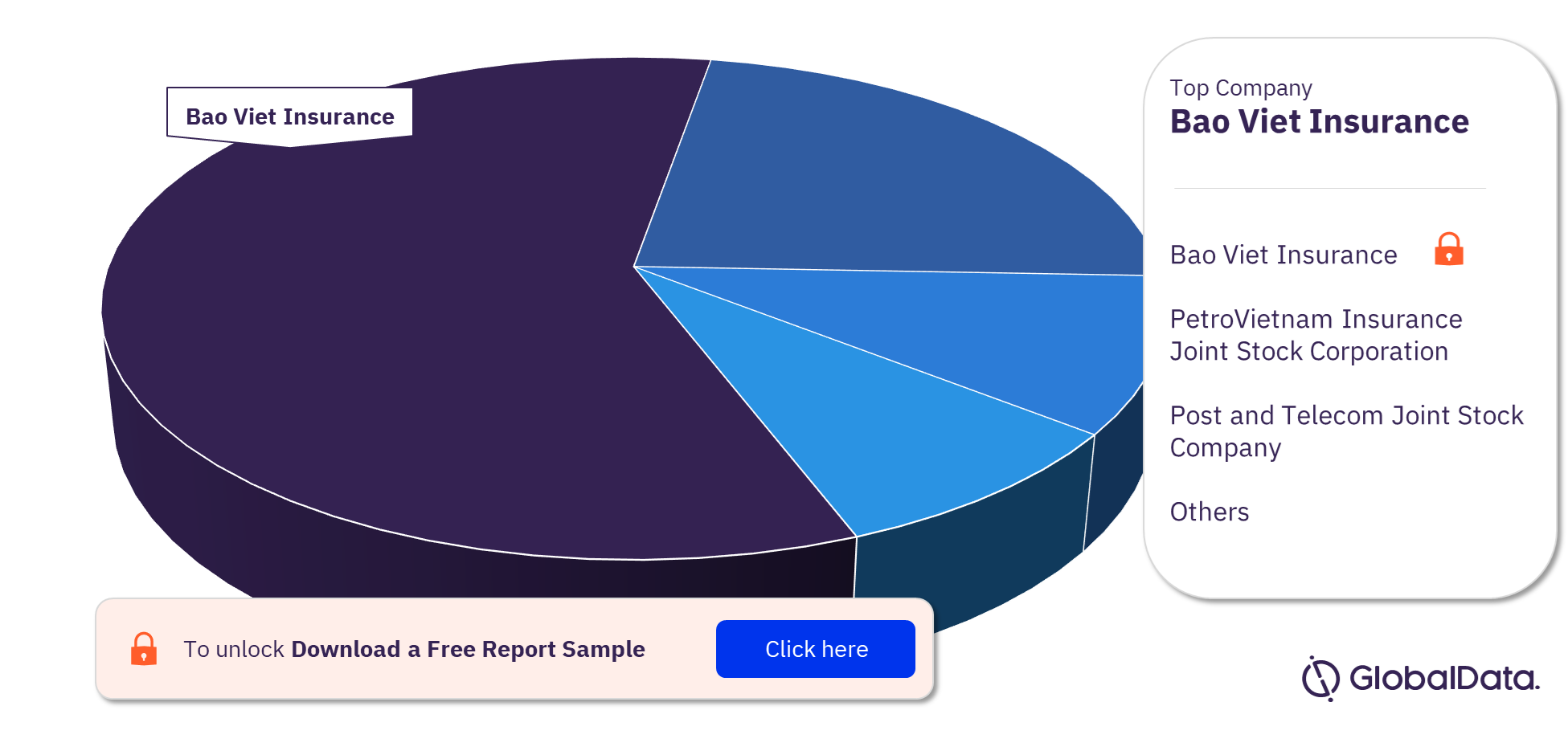

Vietnam General Insurance Market - Competitive Landscape

The leading general insurance companies in Vietnam are Bao Viet Insurance, PetroVietnam Insurance Joint Stock Corporation, Post and Telecom Joint Stock Company, Bao Minh Insurance, Military Joint Stock Insurance Company, Petrolimex Joint Stock Insurance Company, BIDV Insurance, Sai Gon – Hanoi Joint Stock Insurance Company, Vietinbank Insurance, and Vietnam National Aviation Insurance, among others. Bao Viet Insurance was the leading general insurer in 2021.

Bao Viet Insurance: In 2021, Bao Viet Insurance partnered with Tokyo-based conglomerate Hitachi to integrate digital technologies like artificial intelligence and big data analysis into the business. The company aimed to raise health awareness and prevent the development and aggravation of diseases in Vietnam.

Vietnam General Insurance Market Analysis by Companies, 2021 (%)

To know more about the leading companies in the Vietnam general insurance market, download a free report sample

Vietnam General Insurance Market Report Overview

| Market Size (2021) | VND59,135 billion ($2.6 billion) |

| CAGR | >8% |

| Forecast Period | 2021-2026 |

| Historical Period | 2017-2020 |

| Key Lines of Business | Property, Motor, Liability, Financial Lines, MAT, and Non-Life PA&H |

| Leading Companies | Bao Viet Insurance, PetroVietnam Insurance Joint Stock Corporation, Post and Telecom Joint Stock Company, Bao Minh Insurance, Military Joint Stock Insurance Company, Petrolimex Joint Stock Insurance Company, BIDV Insurance, Sai Gon – Hanoi Joint Stock Insurance Company, Vietinbank Insurance, and Vietnam National Aviation Insurance |

Segments Covered in the Report

Vietnam General Insurance Market Lines of Business Outlook (Value, VND Billion, 2017-2026)

- Property Insurance

- Motor Insurance

- Liability Insurance

- Financial Lines Insurance

- MAT Insurance

- Non-Life PA&H Insurance

Scope

This report provides a comprehensive analysis of the general insurance segment in Vietnam –

- It provides historical values for the Vietnam general insurance segment for the report’s review period and projected figures for the forecast period.

- It profiles the top general insurance companies in Vietnam and outlines the key regulations affecting them.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to Vietnam’s general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Vietnam’s general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

PetroVietnam Insurance Joint Stock Corporation

Post and Telecom Joint Stock Company

Bao Minh Insurance Corporation

Military Joint stock Insurance Company

Petrolimex Joint Stock Insurance Company

BIDV Insurance Corporation

Sai Gon - Hanoi Joint Stock Insurance Company

Table of Contents

Frequently asked questions

-

What was the Vietnam general insurance market gross written premium in 2021?

The gross written premium of the Vietnam general insurance market was VND59,135 billion ($2.6 billion) in 2021.

-

What is the Vietnam general insurance market growth rate?

The general insurance market in Vietnam is expected to achieve a CAGR of more than 8% during 2021-2026.

-

What are the key lines of business in the Vietnam general insurance market?

The key lines of business in the Vietnam general insurance market are property, motor, liability, financial lines, MAT, and non-life PA&H.

-

Which are the leading companies in the Vietnam general insurance industry?

The leading insurance companies in Vietnam’s general insurance industry are Bao Viet Insurance, PetroVietnam Insurance Joint Stock Corporation, Post and Telecom Joint Stock Company, Bao Minh Insurance, Military Joint Stock Insurance Company, Petrolimex Joint Stock Insurance Company, BIDV Insurance, Sai Gon – Hanoi Joint Stock Insurance Company, Vietinbank Insurance, and Vietnam National Aviation Insurance, among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports