ESG - A Consistent Disclosure in Corporate Filings

-

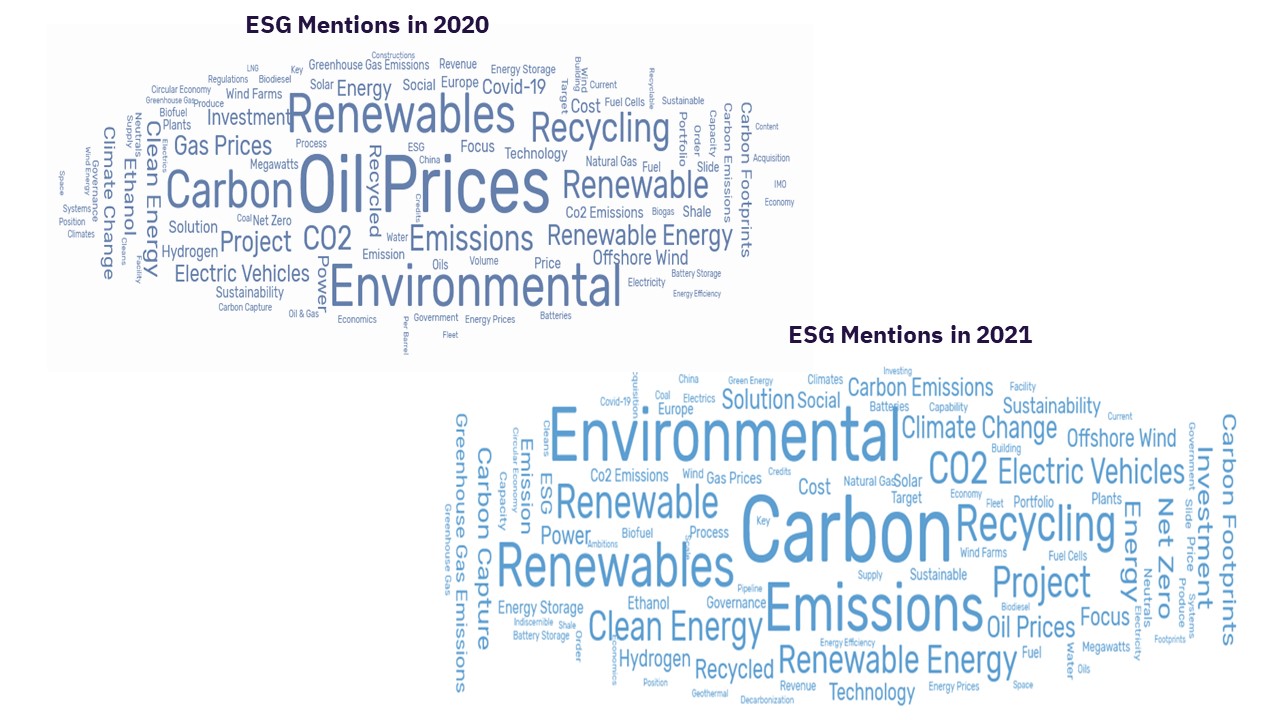

Our business sentiment analysis reveals a continuous rise in ESG-related discussion in company filings

-

The report shows growing awareness about key sustainability areas such as CO2 emissions, carbon capture, and renewable energy

-

Company filings analytics also observed commitments by corporates to their net-zero strategy and investments regarding the same

ESG - A Consistent Disclosure in Corporate Filings

Responsible investment will include safety through disclosure from the investors' perspective. The continued refinement of international frameworks such as the United Nations' Principles for Responsible Investment (UNPRI), Greenhouse Gas Protocol, Sustainable Finance Disclosure Regulation (SFDR), and EU Taxonomy helps organizations understand the complexity of ESG issues in terms of sustainable value creation. It also helps organizations determine, implement, and communicate their sustainability strategy consistently and comparably, which will aid investors in making responsible decisions. Corporate organizations are also using these disclosures to increase investments. Our corporate filings analysis shows an ascending trend in ESG-related discussions in the past.

Business Sentiments Around ESG - 2021 vs 2020

GlobalData's business sentiment analysis of corporate publications in 2021 unveiled a 24% rise in ESG mentions in comparison to that in the previous year. As a result, ESG as a theme appears in the High Mentions-High Growth quadrant of our analysis. The topics discussed by the managements have been diverse, ranging from brown factors such as oil prices and coal to green aspects such as renewable energy and carbon capture. When we focus on the rise in sentiment, it is visible that industry leaders share a positive outlook for ESG's future.

The Environment Pillar of ESG has always seized the attention of businesses globally. In 2020, when the pandemic engulfed the globe, Oil Prices plummeted to a historic low. Negative prices for oil contracts were discussed the most in the company filings of 2020. However, in 2021, the discussions shifted from CO2 Emissions to Carbon Capture. The next most-discussed ESG topic is Renewables. Stringent judicial constraints cooping up conventional fossil fuels, and simultaneous geopolitical conflicts forming in leading economies forced companies to talk about Renewable Energy.

Net Zero – Investments & Targets

Net-zero refers to the balance between GHG emissions from a company's direct and indirect operations and the amount reduced by the business through various initiatives such as carbon sequestration. Ambitious at first glance, achieving net-zero has become the need of the hour. Our Filing Analytics captured a lot of movement in investments towards net-zero targets of individual companies.

Filing Analytics finds combustion engine baron Rolls Royce talking about directing 75% of R&D and Capex investments to technologies such as sustainable fuels. Brookfield Asset Management, the pioneer of long-term impact in filings, describes a $7.5 billion global transition fund that will aim at transitioning to net-zero. Corporate filings of American energy giants such as Duke Energy and CMS Energy Corporation underline their efforts in clean technologies and clean energy transmission to achieve net-zero through R&D expenditure.

The market leaders in every industry have declared net-zero targets, which are promptly captured in our filings database. The timespan for these targets ranges from 2030 to 2050. The above shows several leaders covered in the report, such as Roll-Royce, Crocs, Mitsubishi Heavy Industries, Yum! Brands, and Wheaton Precious Metals. Please access the full report here for a complete list.

Combining our ESG theme with macroeconomic analysis makes these commitments look pollyannaish. Although the isolated picture of ESG looks good, sentiment analysis also shows discussions on inflation, shortages, and supply chain disruptions.

For a complete analysis, please access the full report here.

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer