Global Payment Currency: The Euro Registered a Steep Fall

-

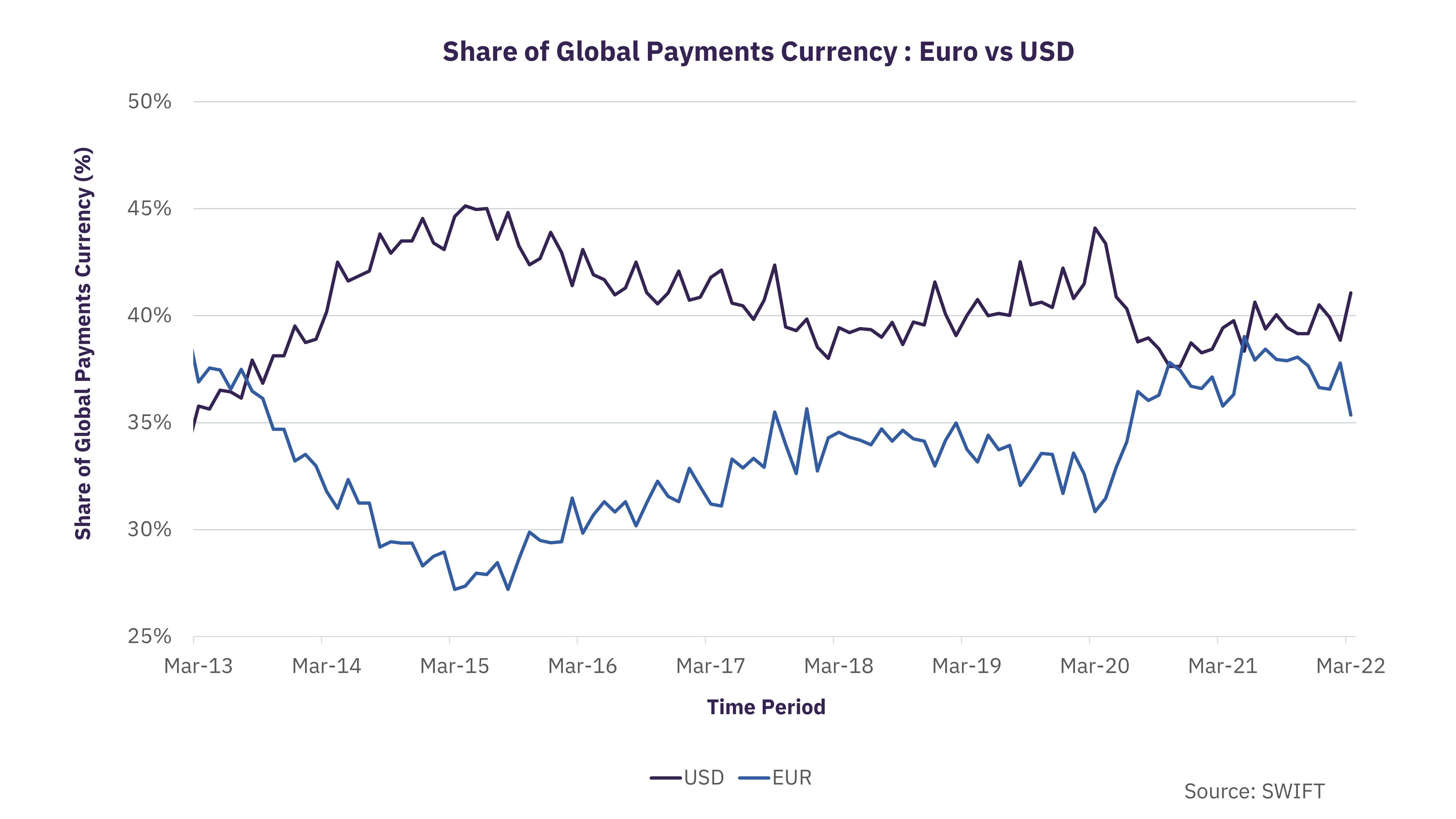

The Euro, as a global payment currency, registered a steep decline of 2.43 percentage points in March 2022, with a share of 35.36%

-

Rising inflation in the Eurozone, sanctions on imports from Russia, and a ban on Russian banks from the SWIFT global payment system have affected the global usage of the Euro

-

The US dollar’s share as a global payments’ currency was the highest at 41.07% in March 2022, which reflected an increase of 2.22 percentage points over that in February 2022

Global Payment Currency: The Euro Registered a Steep Fall

In March 2022, the usage of Euro for international payments fell steeply, with a decline of 2.43 percentage points over that in February 2022. Payments using the Èuro dropped to 35.36% among the global currencies. Rising inflation and the war in Ukraine resulted in such a significant drop.

The US dollar’s share as a global payments’ currency was the highest with 41.07% in March 2022, which reflected an increase of 2.22 percentage points over that in February 2022. British pound (GBP), Japanese yen (JPY), and Chinese yuan (CNY) were the other major currencies being used for global payments, which had a share of 6.47%, 2.8%, and 2.2%, respectively, in March 2022, according to data from SWIFT, the world’s leader in global payments.

Reasons for the Sharp Drop

Rising Inflation

Annual inflation in Eurozone was expected to reach 7.5% in March 2022, up from 1.3% in March 2021, according to Eurostat. Inflation in Belgium is expected to reach 9.3%, whereas the inflation in Germany, Greece, Spain, and France is expected to stand at 7.6%, 8%, 9.8%, and 5.1%, respectively, in March 2022. Energy is the critical factor behind the increasing overall inflation, followed by food, alcohol and tobacco, non-energy industrial goods, and services. The inflation rate of Energy was expected to reach 44.7% in March 2022, up from 32% in February 2022. Sanctions on Russian oil and gas aggravated inflation as the countries in the EU were importing around 25% of their crude oil from Russia. Increasing inflation in the region hampered the global transactions in Euro.

Russia-Ukraine War

Sanctions on imports from Russia, suspension of operations in Russia by several big companies such as Shell, a Dutch-based leading oil & gas company, and a ban on Russian banks from the SWIFT global payment system have hampered the cross-border trade, resulting in a fall in the use of the Euro as a global currency for international payments.

A Strong US dollar and a Growing Chinese yuan

The use of the US dollar as a currency for global payments has increased the highest since 2013 during these troubled times due to the continued confidence in it.

Chinese yuan (CNY) has found a place among the top 5 currencies used for international payments in 2015 and prior to 2013, it was not even in the top 10. The global rise of the yuan could be due to China’s transformation into a consumption and service-based economy, rapid urbanization, and banks with huge assets.

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward