US Inflation Hits 40-Year High

-

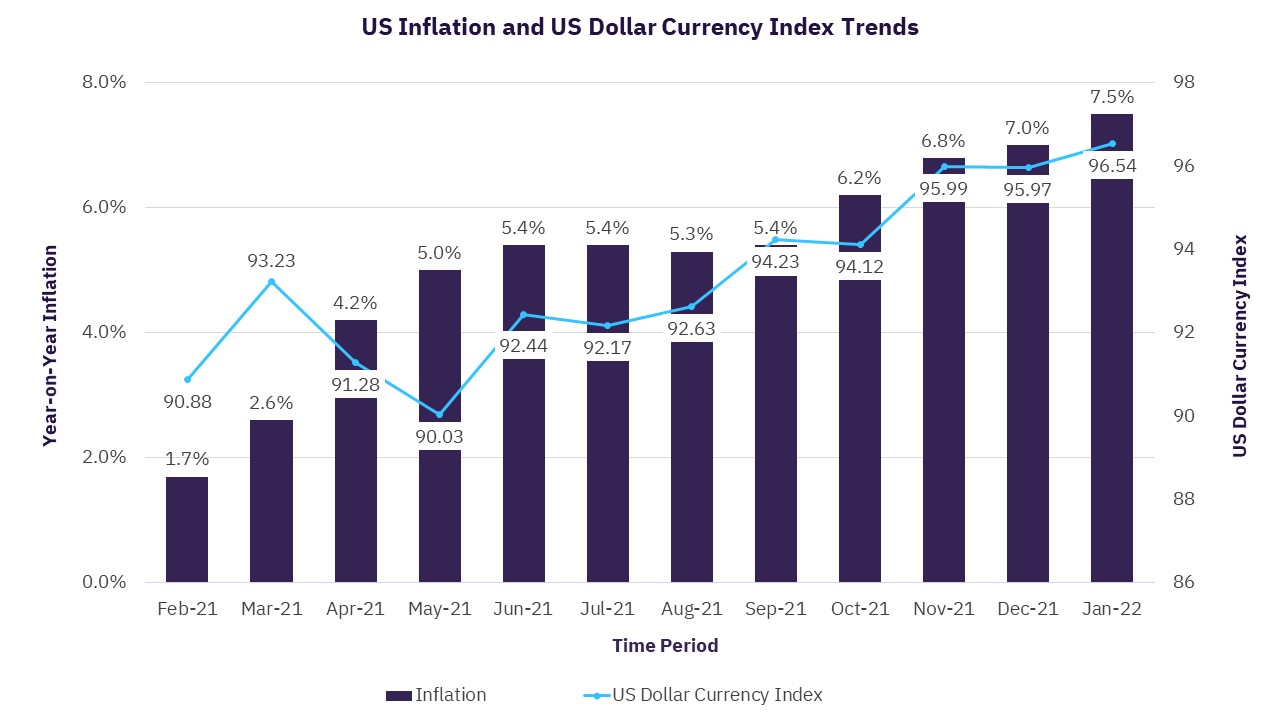

Inflation in the US rose to 7.5% in January 2022, the highest year-on-year rise since February 1982, due to supply chain disruptions and rising prices of energy

-

The US is witnessing tightening of monetary policies, with Wall Street expecting multiple interest rate hikes in 2022

-

Interest rate hikes due to the rise in inflation are strengthening the US Dollar Index, which has already increased 5.02% in the last 12 months

US Inflation Hits 40-Year High

As the world is battling the COVID-19 pandemic, major economies are suffering from the problem of high inflation. Countries such as the US have seen one of the most significant increases in inflation numbers, with the Bureau of Labour Statistics reporting inflation of 7.5% in January 2022 compared to 1.4% in January 2021. On a monthly basis, the Consumer Price Index saw an increase of 0.6% in January, aided by price gains in food, electricity, and shelter. Gasoline prices also registered an increase of over 40% in the last 12 months. According to the latest world economic outlook growth projections of IMF, elevated inflation is expected to continue in 2022 across major economies due to supply chain disruptions, increasing demand for consumer goods, and rising energy prices.

Rising Inflation and Impact on US Dollar

The US Federal Reserve is rolling out changes in its monetary policies to counter inflation – interest rate hikes and liquidity tightening after COVID-related quantitative easing in 2020. The Federal Reserve increased interest rates from 1.09% in January 2021 to 1.8% in January 2022 on a 10-year treasury bond. These interest rate hikes will likely continue in 2022 if inflation rises further. President of Philadelphia Federal Reserve Bank Patrick Harker said: "If inflation stays where it is right now and continues to start to come down, I don't see a 50-basis-point increase, but if we see a spike, then I think we might have to act more aggressively."

Generally, when inflation increases in the country, it decreases the currency's value. This happens due to a decrease in purchasing power of the currency as the price of goods increases. But changes in the monetary policies, such as a consistent hike in interest rates, will attract investment into bonds and fixed income securities, applying upward pressure on the US dollar. The US Dollar Index already increased from a level of 90 in May 2021 to 96 in January 2022.

Wall Street expects multiple interest rate hikes this year. Goldman Sachs recently revised its estimate of seven interest rate hikes of 25 basis points each in 2022 compared to the previous estimate of five hikes. Similarly, Bank of America and Barclays expect seven and five interest rate hikes of 25 basis points each. If the interest rate hikes continue in 2022, the US Dollar Index will continue to rise.

Related Data & Insights

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward