Coal Supply Woes – A Push for Renewables in India?

-

Indonesia, the world’s largest exporter of coal, imposed a month-long ban on exports on January 1, 2022, resulting in an increase in coal prices in the global market

-

The export ban comes in the wake of critically low supplies to the domestic power plants. The ban ensures a steady supply of coal to meet domestic requirements

-

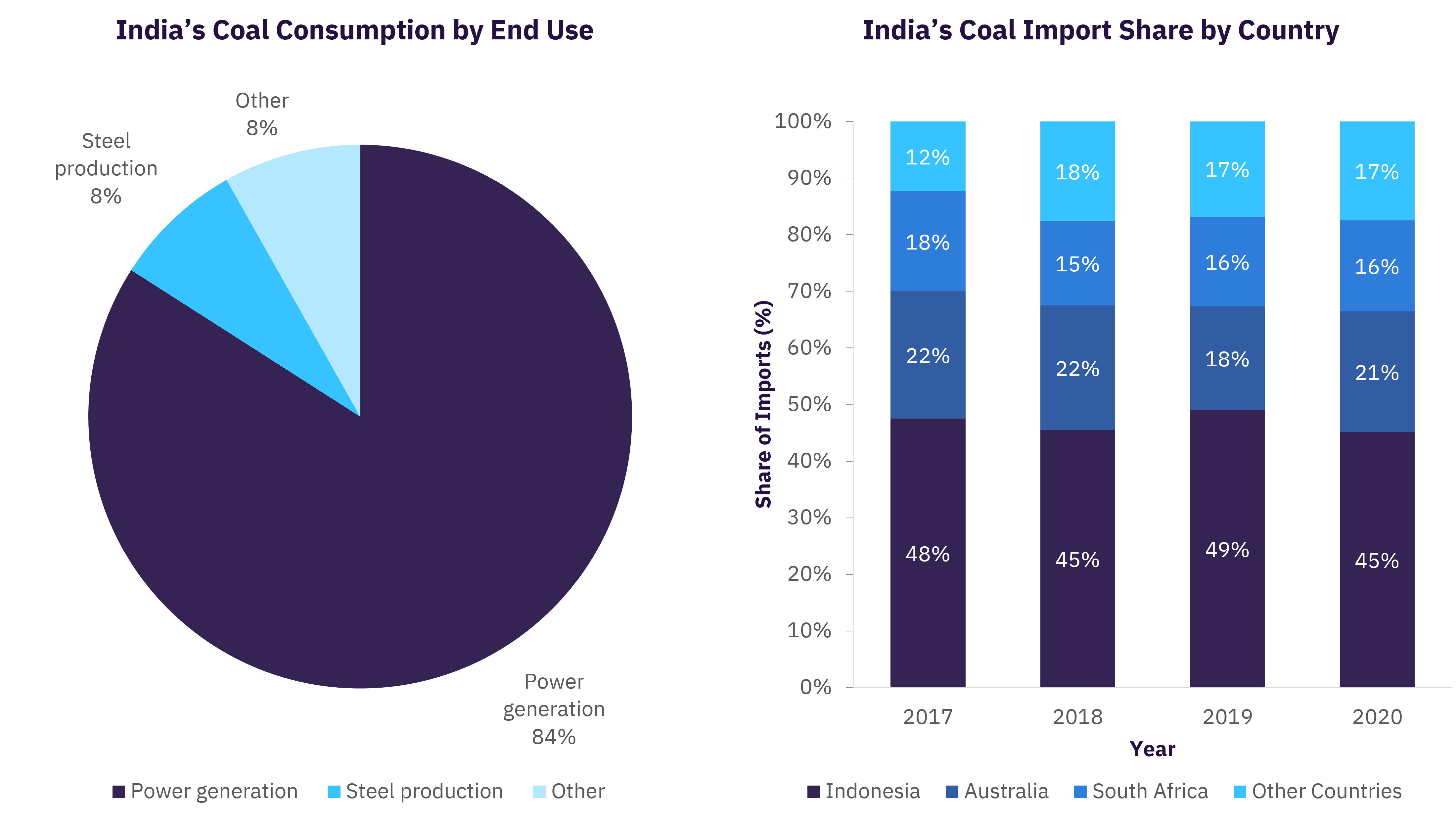

Nearly half of India’s coal imports are from Indonesia, and the ban forces India to pay higher prices and affects its power production

Coal Supply Woes – A Push for Renewables in India?

Indonesia, the largest exporter of coal, announced on January 1, 2022, that a month-long ban had been imposed on coal exports to ensure sufficient supplies for domestic consumption. The Ministry of Energy and Mineral Resources said that the ban was inevitable to avoid power outages across Indonesia. The ban caused a shortage of coal supply, resulting in a price rally in the global market. The Indian e-auction prices of coal were also set to follow the trends in the worldwide market.

Tight Supply of Coal

The shortage crisis in Indonesia arose due to is the country’s policies. It dates back to the Domestic Market Obligation (DMO) policy, introduced for the local coal miners in Indonesia. Under this policy, the coal miners were required to supply 25% of coal production to state utility Perusahaan Listrik Negara (PLN) at a maximum price of $70 per tonne.

However, with the global energy crisis caused due to the COVID-19 pandemic, coal prices globally jumped to a record high of $270 per tonne in October 2021. With global prices being substantially higher than the DMO-capped prices, Indonesian coal miners chose to cater to the worldwide demand and ignore the DMO-stipulated supply. The officials stated that coal supplies to power plants each month were below the DMO-stipulated level, causing critically low inventory levels in PLN. As a short-term measure, the export ban ensured that all import-bound coal was redirected to domestic power plants to replenish the depleted stock and avert a national energy crisis. The ban was relaxed after the state procured enough coal to ensure 15 days of operation.

Australia, another major exporter of coal, also started facing supply issues. Owing to the Indonesian ban, the demand for Australian coal increased. However, the country’s supply was disrupted due to persistent heavy rains that impacted logistics and the rising cases of Omicron and subsequent labor issues.

India’s Supply Woes and Price Volatility

The supply issues meant that countries that relied heavily on coal imports had to pay higher prices and find another source. The coal prices also soared in anticipation of potential supply disruption as the Ukraine tension increased. Countries in Europe stepped up coal imports to safeguard from fuel shortage, as any military engagement in Ukraine will halt gas supply from Russia. It aggravated the shortage of coal, which is still recovering from the supply ban imposed by Indonesia.

India is the second-largest importer of coal, behind China. Around two-thirds of the country’s coal is imported from Indonesia and Australia. The surge in COVID-19 cases in 2021 affected the country’s imports, resulting in severe shortages and increasing prices that compelled India to rely on domestic coal and existing inventories for power generation, the primary use of fossil fuel.

To meet the growing energy demand and reduce imports, the Indian government introduced an auction process to offer coal blocks to private companies for mining. However, the response to these auctions has been tepid, with most coal blocks being rolled over to subsequent rounds. The sharp increase in fossil fuel prices will affect the auction process as the e-auction prices are expected to follow global trends.

The supply woes and rising prices could turn favorable in the long run as such disruptions in the coal market will force India to accelerate its renewable energy projects or transition to alternate fuel sources such as natural gas for power production.

Related Data & Insights

Related Companies

France

Germany

Germany

Italy

France

Japan

South Korea

Spain

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward