Increase Focus on Cybersecurity Amid Ukraine Conflict

-

The Russian invasion of Ukraine has raised concerns about cybersecurity, and the focus on this area is expected to continue for some time

-

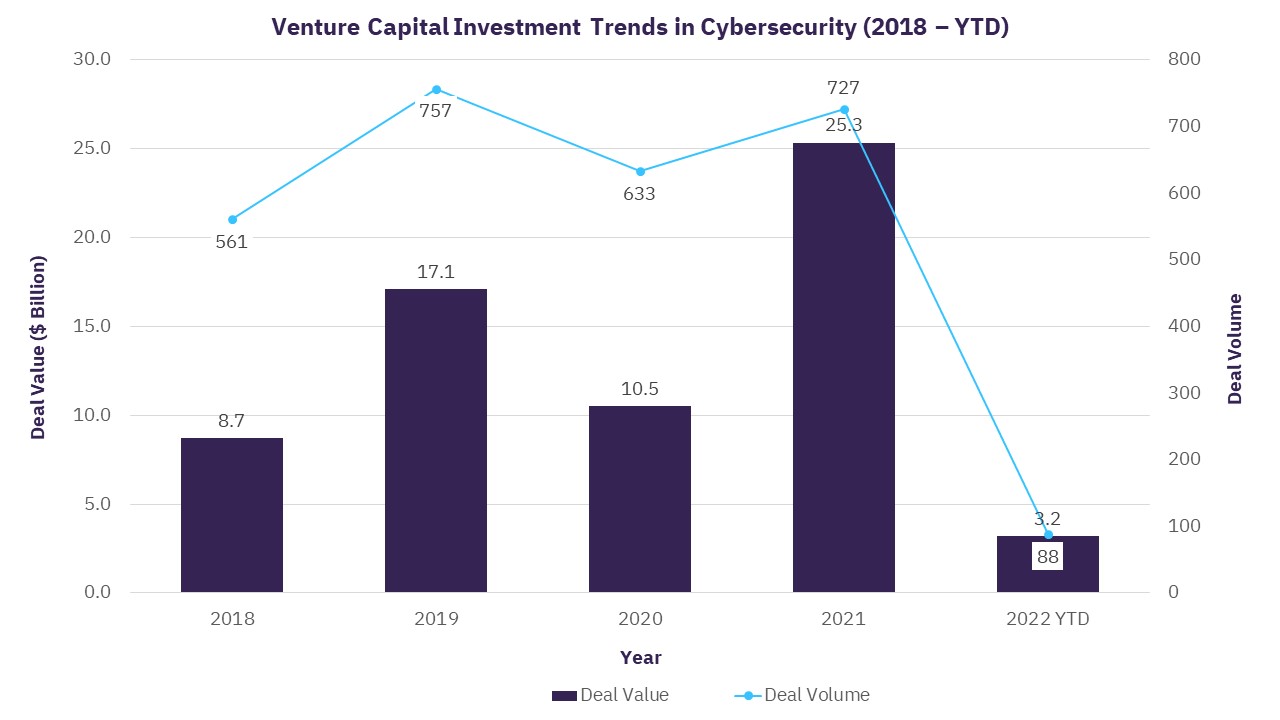

According to GlobalData, 2021 was a record-breaking year with venture capital investments of $25.3 billion in comparison to $10.5 billion in 2020

-

2022 is off to a solid start with an investment of $3.2 billion in January and February in comparison to $2.0 billion during the corresponding period of 2021

Increase Focus on Cybersecurity Amid Ukraine Conflict

Weeks before February 23, 2022, when Russia advanced a full-scale military operation in Ukraine, Moscow began a hybrid war. The Russian attack is not just about guns, bombs, and tanks, it is also a cybersecurity attack. This new method of war rapidly creates misinformation and economic disruption, and defending against such attacks is costly and complex. Hours before the invasion, cybersecurity firms Symantec and ESET reported a new data-wiper malware named Hermetic Wiper that had been detected in several computers in Ukraine. Ukraine officials also said that they faced denial-of-service or DDoS attacks, which affected multiple government websites, and banking services, and caused internet outages. Ukrainians were also bombarded with fake text messages and emails such as ATMs not working, creating panic. Given the massive cyberattacks, both private and public institutions will have to ponder cybersecurity.

Silver Lining for Cybersecurity Companies

With the onset of the Code War era, where any digital device can be "weaponized," cybersecurity companies have increasingly attracted investor interest and considerable investment. Despite the turmoil in the stock market due to the Russia-Ukraine conflict, shares of cybersecurity companies gained last week - Mandiant (+19%), CrowdStrike (+21%), and Palo Alto Networks (+24%).

The private market is not far behind. According to GlobalData, in 2021, cybersecurity start-ups generated massive interest with a significant increase in venture capital investments – 727 deals globally with investments of over $25.3 billion. In 2022, the first two months saw an investment of $3.2 billion in comparison to $2.0 billion in January-February 2021.

Recent Corporate Activity

Redsift Secures $54 million in Series B Funding: On February 24, 2022, Redsift Limited, a UK-based provider of integrated cloud email security and brand protection platform, secured $54 million in a Series B funding round led by Highland Europe. The funding will be used to accelerate its global expansion.

Bluevoyant Mobilizes $250 million in Series D Funding: On February 23, 2022, Bluevoyant, a US-based provider of cyber threat intelligence and security services, secured $250 million in a Series D venture funding round led by Liberty Strategic Capital. It intends to use the funds to accelerate its global expansion.

Cloudflare to Acquire Area 1 Security: On February 23, 2022, Cloudflare Inc, a security, performance, and reliability company helping to build a better internet, agreed to acquire Area 1 Security Inc, a developer of threat intelligence products designed to focus on eliminating targeted, socially engineered cyberattacks. The transaction was valued at $162 million and is expected to close in the second quarter of 2022.

Beyond Identity Secures $100 million in Series C Funding: On February 22, 2022, Beyond Identity, a US-based passwordless authentication platform service provider, raised $100 million in a Series C funding round led by Evolution Equity Partners. The company intends to use the funds to accelerate its research and development and global expansion.

Related Data & Insights

Related Companies

United States of America

South Korea

China

United States of America

United States of America

United States of America

Germany

China

Don’t wait - discover a universe of connected data & insights with your next search. Browse over 28M data points across 22 industries.

Access more premium companies when you subscribe to Explorer

Get in touch about GlobalData Company reports

Contact the team or request a demo to find out how our data can drive your business forward