Artificial Intelligence (AI) in Automotive – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Explore trends and insights from the following data in our ‘Artificial Intelligence (AI) in Automotive’ thematic report. The report provides:

- The six main industry challenges that traditional automakers and suppliers face, along with a thorough discussion of how AI can be used to mitigate them.

- Primary research case studies on the use of AI in battery management and demand planning.

- Details of key automotive mergers and acquisitions (M&A) that have an AI thesis, including a year of the deal and deal value.

- Detailed profiles of leading AI adopters, leading vendors, and specialist vendors within the automotive sector.

- GlobalData’s parts and tires and vehicle manufacturing scorecards, rank the leadership of companies in the key themes disrupting their industry. This is informed by GlobalData’s comprehensive tracking of AI-related deals, job openings, patent ownership, company news, and financial and marketing statements.

How is the ‘Artificial Intelligence in Automotive’ thematic report different from other reports in the market?

- This report will help you to understand AI and its potential impact on the automotive sector.

- Benchmark your company against your competitors, by comparing how prepared 27 companies in the automotive sector are for AI disruption.

- Identify and differentiate between the leading AI vendors and formulate an adoption plan for your company.

- Position yourself for future success by investing in the right AI technologies. Cut through the noise with GlobalData’s priority ratings for each AI technology for each segment of the industry.

- Develop relevant and credible sales and marketing messages for automotive companies by understanding key industry challenges and where AI use cases are most useful.

- Identify attractive investment targets by understanding which companies are most advanced in the themes that will determine future success in the automotive industry.

We recommend this valuable source of information to anyone involved in:

- Automotive Companies and Start-ups

- Automotive OEMs/Battery Manufacturers

- Semiconductors Suppliers/Auto Component Providers

- Regulatory Bodies

- Technology Leaders and Startups

- Business Development and Market Intelligence

- Investment Analysts and Portfolio Managers

- Professional Services – Investment Banks, PE/VC firms

- M&A/Investment, Management Consultants, and Consulting Firms

To get a snapshot of the artificial intelligence in automotive thematic report, download a free report sample

AI in Automotive Market Analysis Report Overview

AI, particularly advanced ML models, has enabled significant advances in autonomous driving capabilities for vehicles. This has unlocked new opportunities to compete in markets with advanced driver assistance systems (ADAS), which can increase safety and allow for hands-free adaptive cruise control systems to help reduce driver fatigue. Countries are also introducing regulations allowing Level 3 and Level 4 AV autonomous shared mobility services, including robo-taxis, to operate within designated, mapped sections of selected cities.

Furthermore, the untapped potential of Generative AI is being explored across the automotive sector. Generative AI has the potential to reduce the time employees spend on repetitive tasks and increase their efficiency. The technology could transform automotive company operations; however, a corporate strategy is necessary to mitigate potential risks. Companies must regulate the use of open-source models and invest in training natural language processing (NLP) models with company data when necessary.

The AI in automotive thematic intelligence report provides an overview of this emerging technology and its wider impacts on commerce worldwide, while also providing insights on the immediate and future effects of AI in the automotive markets.

| Report Pages | 71 |

| Regions Covered | Global |

| Value Chain | · Hardware

· Data Management · Foundation AI · Advanced AI Capabilities · Delivery |

| Leading AI Adopters in Automotive | · BMW

· Mercedes-Benz · Geely |

| Leading AI vendors | · Alibaba

· Alphabet (parent company of Google, Waymo, and DeepMind) · Amazon |

| Leading Specialist AI vendors in automotive | · AEye

· AutoX · Cerence |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

AI in Automotive – Industry Analysis

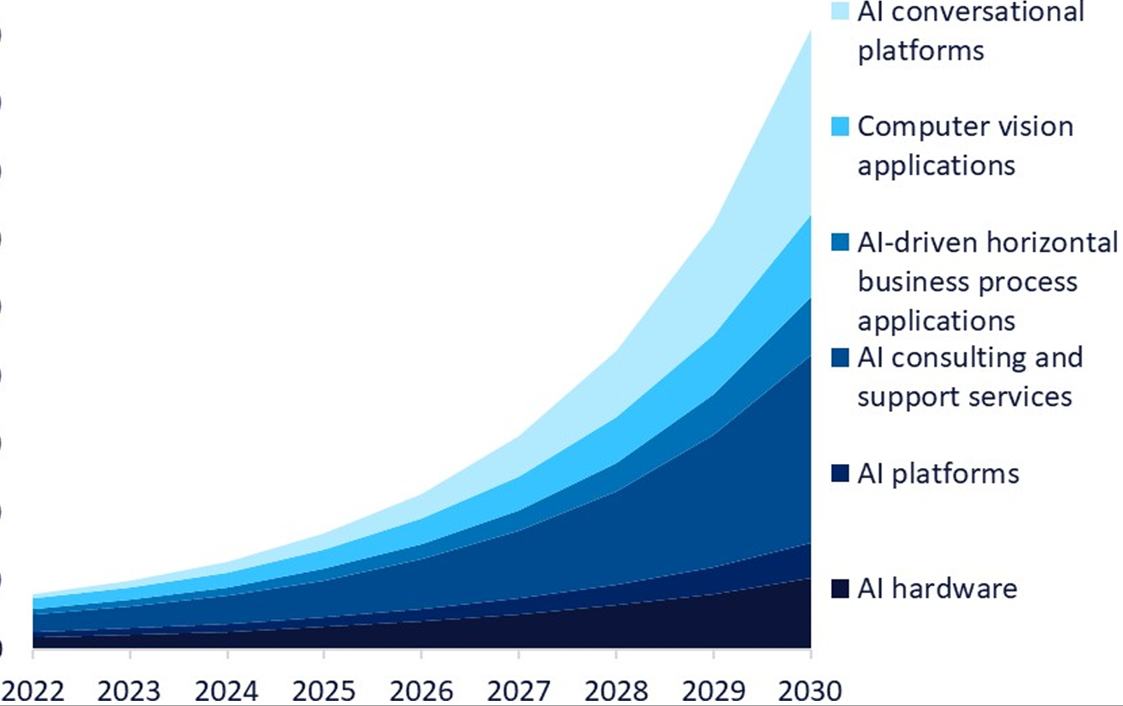

According to GlobalData forecasts, the total artificial intelligence (AI) market was worth $81.3 billion in 2022 and is expected to grow at a CAGR of more than 35% from 2022-2030. The AI consulting and support services category is currently the largest market segment. However, conversational platform is the fastest growing between 2022 and 2030. The emergence of generative AI applications has fueled this growth. It is important to note that a significant proportion of AI hardware revenues and sales of consulting and support services are driven by the sale of computer vision and conversational platforms. The growth in one sector is heavily intertwined with the growth in others.

AI Market Revenue, by Product, 2022-2030

To know more about the AI market forecast, download a free report sample

The AI in the automotive industry analysis also covers:

- Mergers and acquisitions

- Patent trends

- Company filing trends

- Hiring trends

AI - Value Chain Analysis

The AI value chain consists of hardware, data management, foundation AI, advanced AI capabilities, and delivery.

Data management: AI technology relies on large amounts of data, often called big data, and the various aspects of managing that data feature prominently in the AI value chain. However, data management is not exclusive to AI and can be seen as a generic foundational layer. Big data is produced by all forms of digital activity: phone calls, emails, sensors, payments, social media posts, and much more. It is also produced by machines, both hardware, and software, in the form of machine-to-machine data exchanges. It is typically managed in data centers, either in the public cloud, corporate data centers, or end devices. Broadly speaking, the objective of data management is to secure the data (through data governance and security technology) and manage the data (by applying storage, processing, aggregation, and integration techniques).

AI Value Chain Analysis

For more insights into the AI value chain, download a free report sample

Artificial Intelligence in Automotive - Competitive Landscape

Some of the leading adopters of AI:

- BMW

- Mercedes-Benz

- Geely

Some of the leading AI Vendors:

- Alibaba

- Alphabet (parent company of Google, Waymo, and DeepMind)

- Amazon

Some of the Specialist AI vendors in automotive:

- AEye

- AutoX

- Cerence

To know more about the leading vendors, adopters, and specialists in the AI in automotive sector, download a free report sample

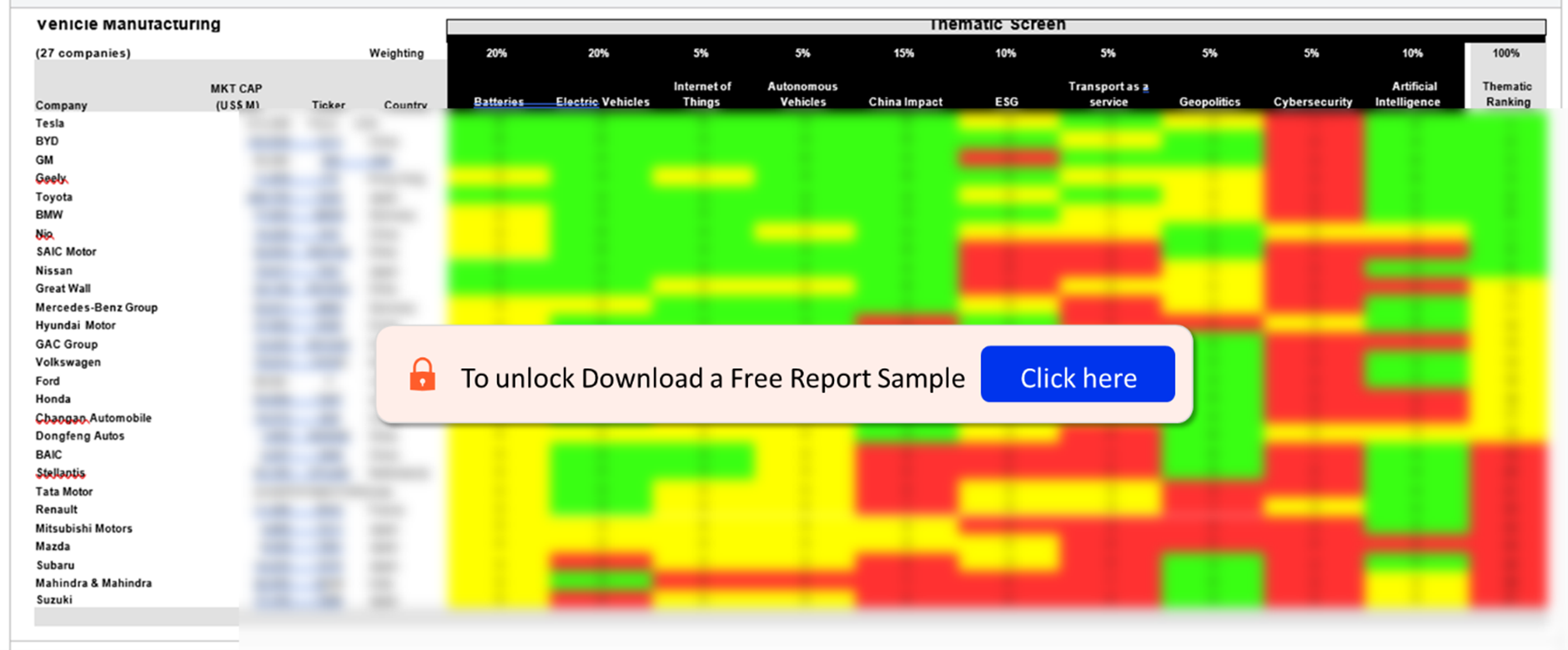

Automotive Sector Scorecard

The automotive sector scorecard approach predicts tomorrow’s leading companies within each sector. Our sector scorecards have three screens: a thematic screen, a valuation screen, and a risk screen.

Automotive Sector Scorecard Analysis

For more insights into the automotive sector scorecard, download a free report sample

Key Highlights

Global, Automotive, AI, AV, ADAS, Generative AI, Machine learning, Computer Aided Design

Argo AI

Aurora Innovation

BMW

Cerence

Cognata

Continental

Cruise

Daimler

Denso

Ford

GM

Honda

Horizon Robotics

Hyundai

Hyundai Mobis

Magna International

Porsche

Robert Bosch

Scale AI

Seeing Machines

Tesla

Toyota

UVeye

VW

Table of Contents

Frequently asked questions

-

What are the components of the AI value chain?

The AI value chain consists of hardware, data management, foundation AI, advanced AI capabilities, and delivery.

-

Who are the leading adopters of the AI theme?

Some of the leading adopters of AI are BMW, Mercedes-Benz, and Geely among others.

-

Who are the leading vendors in the AI theme?

Some of the leading vendors of AI are Alibaba, Alphabet (parent company of Google, Waymo, and DeepMind), and Amazon among others.

-

Who are the Specialist AI vendors in automotive?

Some of the Specialist AI vendors in automotive are AEye, AutoX, and Cerence among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.