Augmented Reality in Aerospace and Defense – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Augmented Reality in Aerospace and Defense Thematic Report Overview

Augmented reality (AR) is a technology that allows the user to see the real world overlaid with digital data. In defense, AR is currently used in manufacturing and engineering. Inherent advantages of remote assistance and instruction are also encouraging military medics to adopt AR. In addition, AR is becoming a crucial part of military training, as simulated assets can be overlaid into the real world.

AR has battlefield applications for pilots and soldiers, enhancing situational awareness (SA). A key driver in the widespread adoption of this technology is Microsoft’s AR headset, the HoloLens, which can be modified with specialized software to adapt to different scenarios. Major defense contractors are also active in developing AR. For instance, Elbit Systems has created several AR products for battlefield applications and training initiatives.

The ‘Augmented Reality In Aerospace and Defense’ thematic report provides insights into the AR theme and the impact it will have on the aerospace and defense sector. It provides a comprehensive analysis of the industry, including real-life case studies that showcase how the defense industry has responded to the impact of this theme on its operations. The report also gives an insight into the market players and the competitive landscape within the AR theme.

| Key Value Chain Components | • Semiconductors

• Components • Devices • Platforms • Applications & Content |

| Leading Augmented Reality Adopters in Defense | • Boeing

• General Dynamics • Hanwha Systems • Honeywell • Huntington Ingalls Industries |

| Leading Augmented Reality Vendors | • Alibaba

• Alphabet • Amazon • Apple • ByteDance |

| Specialist Augmented Reality Vendors in Defense | • Airbus

• Augmenti • BAE Systems • Dassault Aviation • Elbit Systems |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Augmented Reality Value Chain Analysis

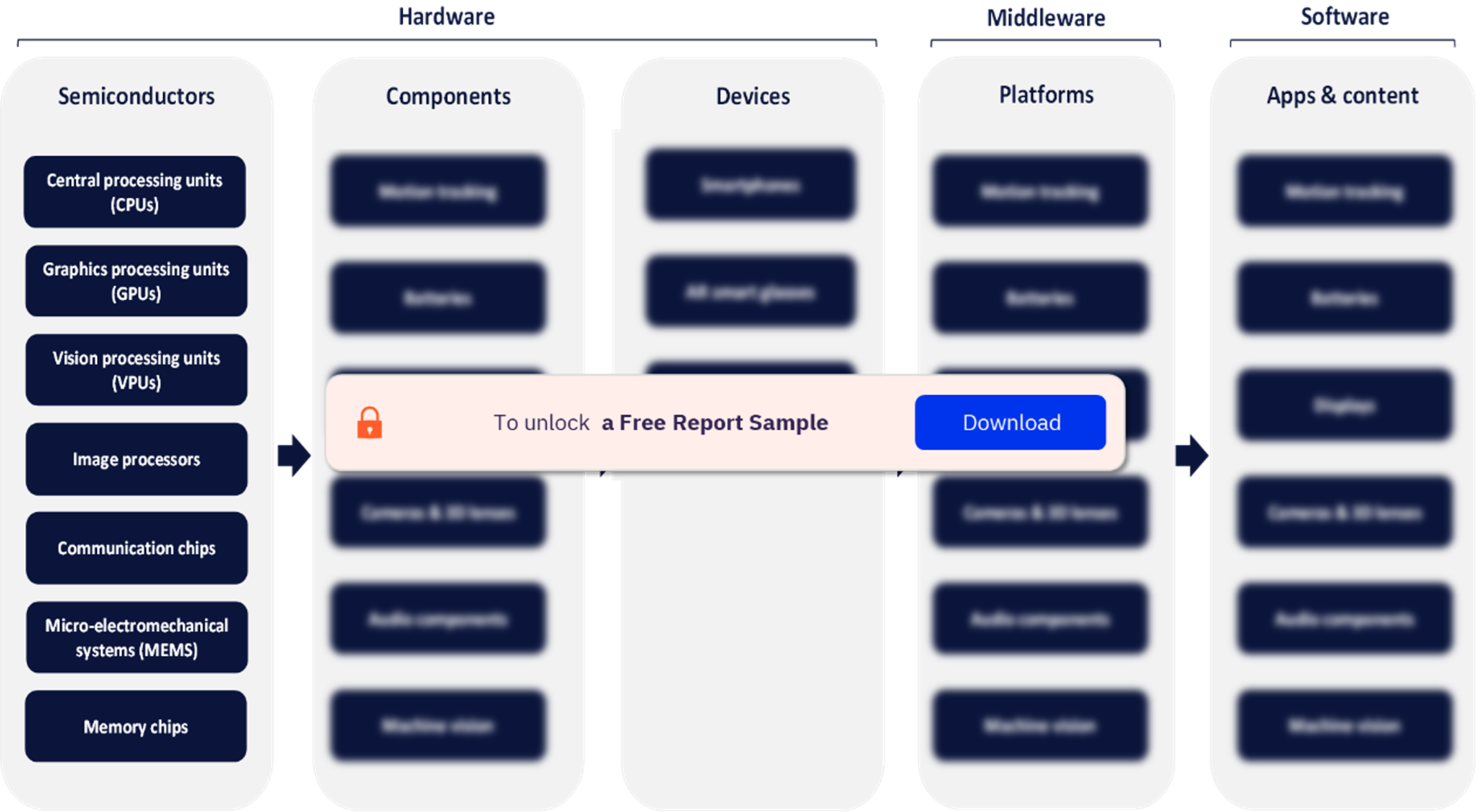

The augmented reality value chain is split into five segments including semiconductors, components, devices, platforms, and applications and content.

Semiconductors: Semiconductors are one of the key battlegrounds in AR today. Although no new AR-specific silicon has arrived on the market following the launch of the XR2 5G, chipmakers are striving to improve their existing capabilities to suit the evolving requirements of AR, mostly around screen resolution, frame rates, processing speed, and connectivity.

Augmented Reality Value Chain

Buy the Full Report for Augmented Reality Value Chain Insights, Download a Free Sample Report

Augmented Reality in Aerospace and Defense – Competitive Landscape

This thematic report highlights the companies making their mark within the augmented reality theme.

Leading augmented reality adopters in defense: Boeing, General Dynamics, Hanwha Systems, Honeywell, and Huntington Ingalls Industries among others are a few defense companies currently deploying AR.

Leading augmented reality vendors: Alibaba, Alphabet, Amazon, ByteDance, Magic Leap, Meta, and Microsoft among others are a few augmented reality vendors making their within the AR theme.

Specialist augmented reality vendors in defense: Airbus, Augmenti, BAE Systems, Dassault Aviation, and Elbit Systems are a few of the specialist AR vendors in the defense sector.

Buy the Full Report for More Insights on the Company-Wise Analysis of Augmented Reality in the Aerospace and Defense Sector, Download a Free Sample

Defense Sector Scorecard

The defense sector scorecard comprises of thematic screen, valuation screen, and risk screen. The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

Defense Sector Scorecard Analysis

Buy the Full Report for More Insights on the Scorecard Analysis of Augmented Reality in the Aerospace and Defense Sector, Download a Free Sample

Scope

• The key defense challenges that forces and defense sector suppliers face are covered.

• The investment opportunities for armed forces, suppliers, and institutional investors, across the whole augmented reality technology value chain are covered.

• Highlights from the range different augmented reality related research and development programs currently being undertaken by various military organizations and defense companies.

Key Highlights

• Studies of emerging technological trends and their broader impact on the defense market.

• Analysis of the various augmented reality programs and projects currently under development, as well as the diverse range of applications and use cases for this technology in both the civil and military domains.

Reasons to Buy

- Determine potential investment companies based on trend analysis and market projections.

- Gaining an understanding of the market challenges and opportunities surrounding the augmented reality in aerospace and defense theme.

- Understanding how spending on augmented reality and related segments will fit into the overall market and which spending areas are being prioritized.

General Dynamics

Hanwha Systems

Honeywell

Huntington Ingalls Industries

Lockheed Martin

L3Harris Technologies

Northrop Grumman

Rafael ADS

RTX Corp

Alibaba

Alphabet

Amazon

Apple

ByteDance

Magic Leap

Meta

Microsoft

Niantic

Qualcomm

Samsung Electronics

Snap

Tencent

Unity Technologies

Vuzix

Airbus

Augmenti

BAE Systems

Dassault Aviation

Elbit Systems

Leonardo

Red 6

Thales

Taqtile

Table of Contents

Frequently asked questions

-

What are the key value chain components in the augmented reality theme?

The augmented reality value chain is split into five segments which include semiconductors, components, devices, platforms, and applications and content.

-

Which are the leading augmented reality adopters in the defense sector?

Boeing, General Dynamics, Hanwha Systems, Honeywell, and Huntington Ingalls Industries among others are the leading defense companies currently deploying AR.

-

Which are the leading augmented reality vendors?

Alibaba, Alphabet, Amazon, ByteDance, Magic Leap, Meta, and Microsoft among others are the leading vendors making their mark within the AR theme.

-

Which are the specialist augmented reality vendors in the defense industry?

Airbus, Augmenti, BAE Systems, Dassault Aviation, and Elbit Systems are the specialist augmented reality vendors in the defense sector.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Aerospace and Defense reports