Australia Gold Mining Market by Reserves and Production, Assets and Projects, Fiscal Regime with Taxes, Royalties and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Australia Gold Mining Market Report Overview

The gold production in Australia was 10.3 million ounces (moz) in 2024, a 2.6% decrease from 2023. This is due to a planned reduction in the head grades at the country’s major mines such as Cadia, Boddington, Telfer, Fosterville, and Tanami mines. Moreover, several mines have been placed under care and maintenance due to increasing costs and declining margins.

However, Australia’s gold mine production will begin to recover in 2025 and will rise consistently until 2029 growing at a CAGR of more than 1% during 2024-2030. This nominal growth can be attributed to project expansions and the scheduled start-up of many projects, including Yandal (2025), Trident (2025), Hemi (2026), and Mcphillamys (2028).

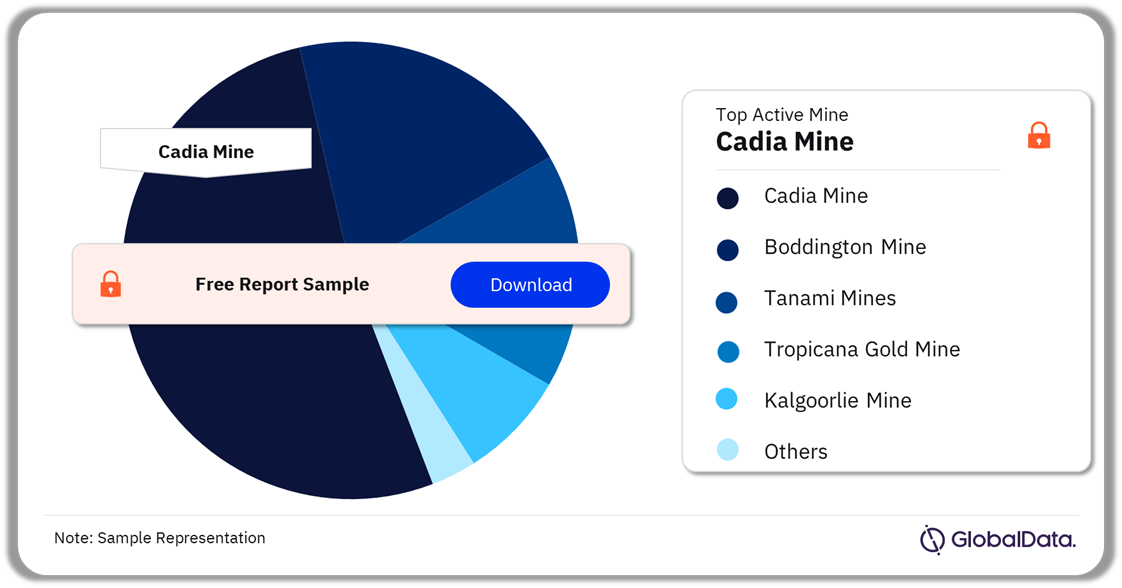

Australia Gold Mining Market Analysis by Active Mines, 2024 (%)

Buy the Full Report for More Active Mine Insights into the Australian Gold Mining Market

Download a Free Report Sample

The Australia gold mining market research report provides historical and forecast data on gold production, production by company, reserves by country, and world gold prices. The report also includes a demand drivers section providing information on factors that are affecting the global gold industry. Furthermore, it elucidates major operating mines, exploration, and operating as well as planned development projects. These critical topics will help identify gaps in operations and make high-impact business strategies.

| Total Production (2024) | 10.3 million ounces (moz) |

| CAGR (2024-2030) | >1% |

| Forecast Period | 2024-2030 |

| Historical Period | 2017-2023 |

| Active Mines | · Boddington Mine

· Cadia Mine · Tanami Mines · Tropicana Gold Mine · Kalgoorlie Mine |

| Development Projects | · Mount Todd Project

· Yandal Project · Leonora Gold Project · Cue Project · Mount Morgan Project |

| Exploration Projects | · Northern Molong Porphyry Project

· Winu Project · Temora Gold Copper Project · Khamsin Project · Parks Reef Project |

| Leading Companies | · Newmont

· Northern Star · Gold Fields · Evolution Mining |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Australia Gold Mining Market - Active Mines

Australia had the world’s largest gold reserves as of January 2024, accounting for over 20% of the global total. A few of the active gold mines in Australia are Boddington Mine, Cadia Mine, Tanami Mine, Tropicana Gold Mine, and Kalgoorlie Mine among others. As of 2024, Cadia Mine has the largest gold reserve in the country.

Australia Gold Mining Market Analysis by Active Mines, 2024 (%)

Buy the Full Report for More Active Mine Insights into the Australian Gold Mining Market

Download a Free Report Sample

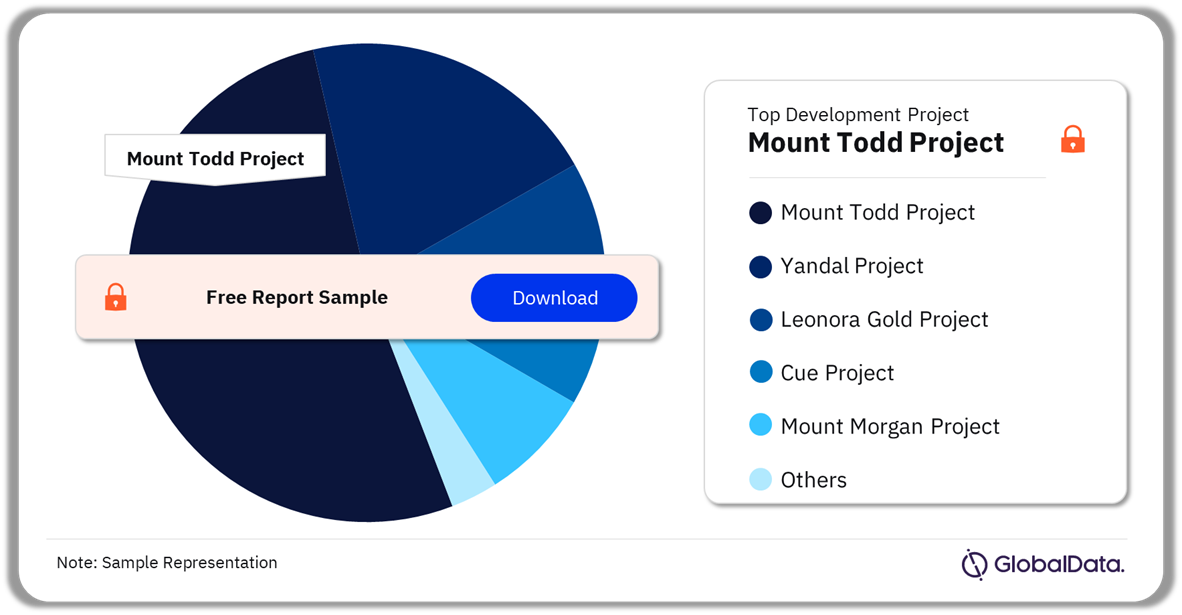

Australia Gold Mining Market - Development Projects

A few of the Australian gold mining development projects are the Mount Todd Project, Yandal Project, Leonora Gold Project, Cue Project, and Mount Morgan Project among others. Owned by Vista Gold Corp, the Mount Todd Project is likely to have the highest gold production capacity upon commissioning in 2028.

Australia Gold Mining Market Analysis by Development Projects, 2024 (%)

Buy the Full Report for More Insights on Development Projects in the Australia Gold Mining Market

Download a Free Report Sample

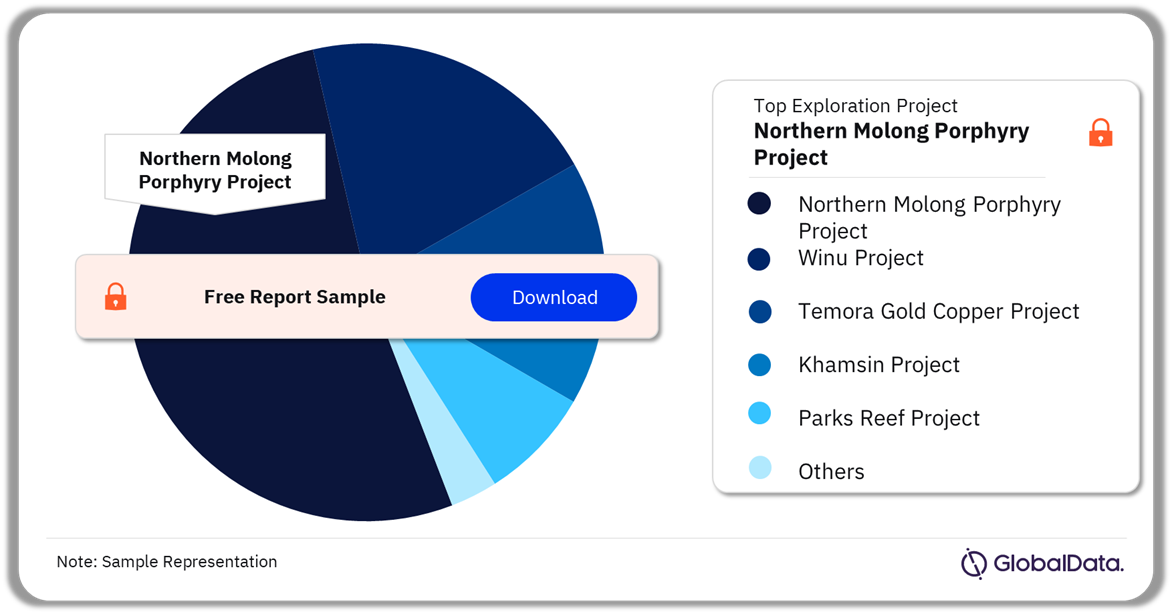

Australia Gold Mining Market - Exploration Projects

A few of the gold mining exploration projects in Australia are the Northern Molong Porphyry Project, Winu Project, Temora Gold Copper Project, Khamsin Project, and Parks Reef Project. The Northern Molong Porphyry Project has the highest capacity as of 2024.

Australia Gold Mining Market Analysis by Exploration Projects, 2024 (%)

Buy the Full Report for More Insights on Exploration Projects in The Australia Gold Mining Market

Download a Free Report Sample

Australia Gold Mining Market - Competitive Landscape

A few of the leading companies in Australia gold mining market are:

- Newmont

- Northern Star

- Gold Fields

- Evolution Mining

Newmont emerged as the largest gold mining company in 2023 after the acquisition of Newcrest. The acquisition of the Newcrest operations has enabled Newmont to combine long-term assets in the world-class gold and copper mining jurisdictions of Australia, Canada, and Papua New Guinea. Newmont operates gold mines in various countries across the globe, including the US, Canada, and Mexico among others.

Australia Gold Mining Market Analysis by Companies, 2023 (%)

Buy the Full Report for More Insights on Companies in The Australia Gold Mining Market

Download a Free Report Sample

Scope

- The report contains an overview of the Australian gold mining industry, including key demand-driving factors shaping the industry.

- The report provides detailed information on reserves, reserves by country, production, competitive landscape, major operating mines, and major exploration and development projects.

Reasons to Buy

- To gain an understanding of the Australia gold mining industry, relevant driving factors

- To understand historical and forecast trends in Australia gold production

- To identify key players in the Australia gold mining industry

- To identify major active, exploration and development projects by region

Northern Star

Gold Fields

Evolution Mining

Table of Contents

Table

Figures

Frequently asked questions

-

What is the total gold production in Australia in 2024?

The total gold production in Australia will be 10.3 million ounces (moz) in 2024.

-

What will the Australia gold production growth rate be during the forecast period?

The total gold production in Australia will grow at a CAGR of more than 1% during 2024-2030.

-

Which are the leading companies in the Australia gold mining market?

A few of the leading companies associated with the Australia gold mining market are Newmont, Northern Star, Gold Fields, and Evolution Mining.

-

Which are the active mines in Australia gold mining market?

A few of the active gold mines in Australia are Boddington Mine, Cadia Mine, Tanami Mine, Tropicana Gold Mine, and Kalgoorlie Mine among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.