Australia Gas and LNG Market Overview, Production Breakdown, Usage by Industry and Upcoming Projects, 2023

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Australia Gas and LNG Market Report Overview

Australia has a huge natural gas reserve, and the supply is forecast to remain stable over the next 5 years. The majority of natural gas production growth will originate from conventional gas sources.

For many years, natural gas has seen significant growth in Australia’s production and consumption, this is a result of the country’s shift from coal to natural gas as a primary source of cleaner energy. The rapid growth in renewable technologies, especially wind and solar has stunted the growth of natural gas in Australia. Coupled with Australia’s plan on achieving a net-zero emissions economy by 2050.

Australia gas and LNG market research report offers gas and LNG market analysis in the region. It also highlights recently announced projects by capacity. The report also offers insights into the demand for gas and LNG across different sectors.

| Key Play | · Northern Carnarvon Basin

· Browse Basin · Bass Basin · Copper Basin · Perth Basin |

| Key Projects | · Yarrow

· Enterprise · Glenaras · Mahalo · Range · Trefoil · Odin |

| Key Industries | · Commercial

· Industrial · Energy Industry · LNG Plant Use · Residential · Transportation |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

For more insights into the Australia gas and LNG market forecast, download a free sample report

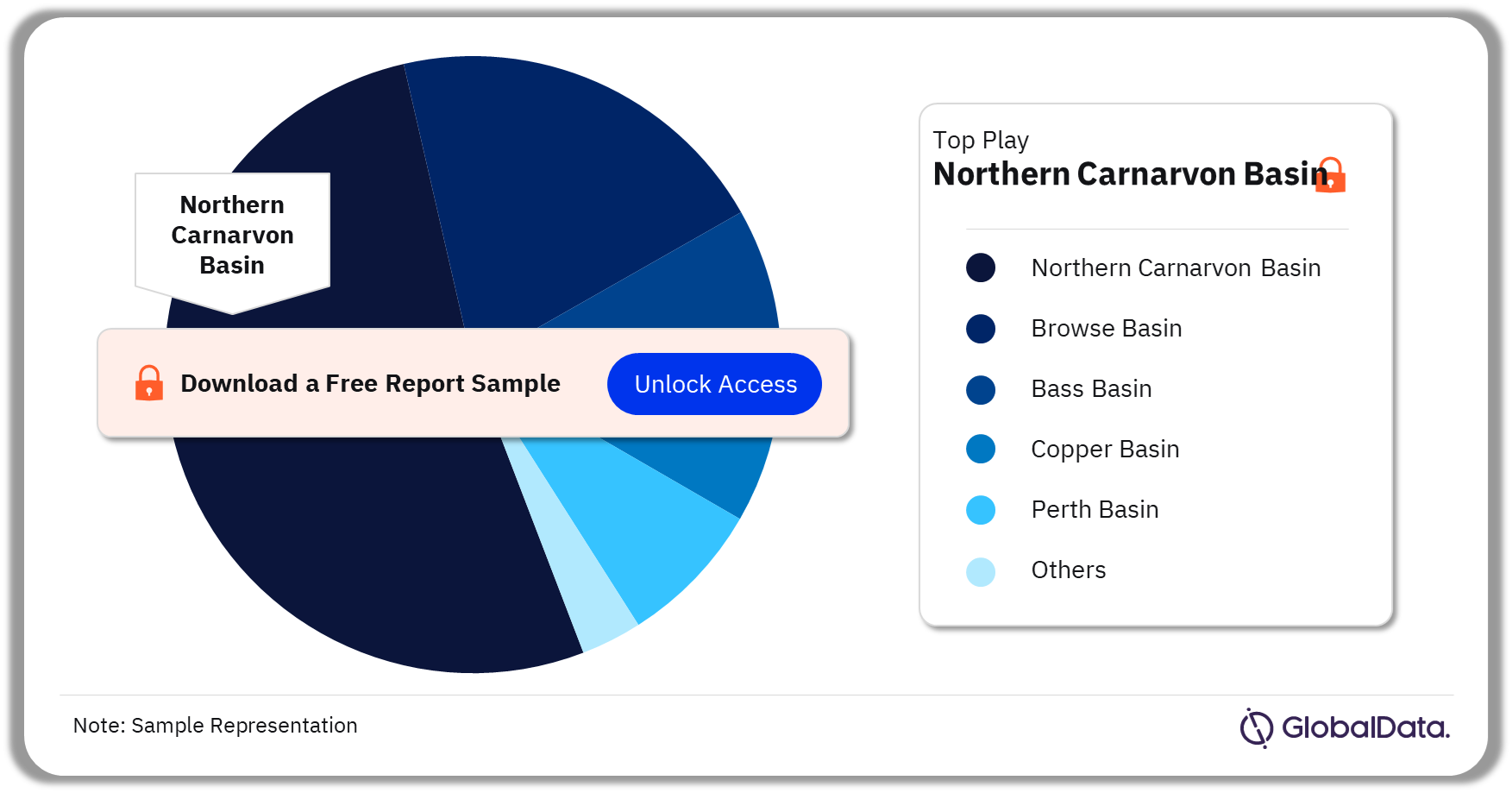

Australia Natural Gas Production Breakdown by Play

The key plays in the Australia natural gas market are Northern Carnarvon Basin, Browse Basin, Bass Basin, Copper Basin, and Perth Basin among others. Natural gas production and capacity is forecasted to remain generally stable but have a very slow decline, while renewable energy such as Solar PV and wind grow at a rapid rate. Northern Carnarvon Basin accounts for the most production in Australia.

Australia Natural Gas Production Analysis by Play, 2023 (%)

For more insights on natural gas production play in Australia gas and LNG market, download a free sample report

Australia’s Upcoming Gas and LNG Projects

Some of the largest upcoming natural gas and LNG projects in Australia are Yarrow, Enterprise, Glenaras, Mahalo, Range, Trefoil, and Odin among others. There are more than 25 upcoming gas projects, scheduled to come online in the next 5 years. 7 fields are planned to come online this year, examples include Glenaras and Odin. Most of the activity is occurring in the Northern Carnarvon Basin. Most production is expected to be a conventional gas resource type.

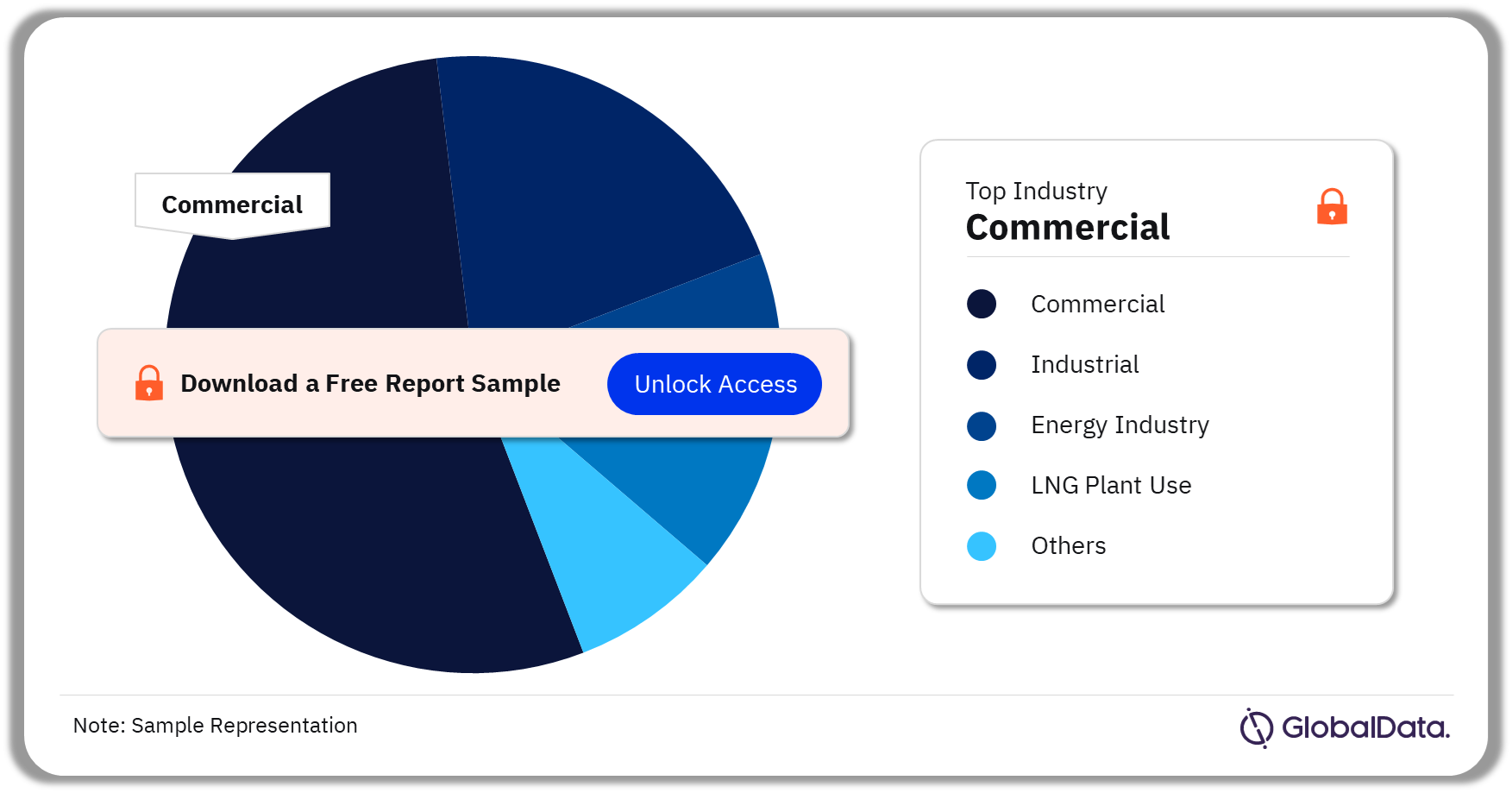

Australia Natural Gas Demand by Industry

The key industries demanding natural gas in Australia are commercial, industrial, energy industry, LNG plant use, residential, and transportation among others. The main industries that demand/consume energy in Australia include the commercial, industrial, and energy industries energy- specifically for LNG plant use and upstream other industries include power and transport and residential industries.

Australia Gas and LNG Market Analysis by Industry, 2030 (%)

For more industry insights into Australia gas and LNG market, download a free sample report

Scope

Natural gas and LNG outlook in Australia.

Key Highlights

Production, capacity, major importers

Reasons to Buy

Identify the expected future for the market.

Table of Contents

Table

Figures

Frequently asked questions

-

Which is the leading play in Australia natural gas market?

Northern Carnarvon Basin accounts for the most production in Australia.

-

What are the leading plays in Australia natural gas market?

The key plays in the Australia natural gas market are Northern Carnarvon Basin, Browse Basin, Bass Basin, Copper Basin, and Perth Basin among others.

-

What are the key upcoming natural gas and LNG projects in Australia?

Some of the largest upcoming natural gas and LNG projects in Australia are Yarrow, Enterprise, Glenaras, Mahalo, Range, Trefoil, and Odin among others.

-

Which are the main industries that demand/consume energy in Australia?

The main industries that demand/consume energy in Australia include the commercial, industrial, and energy industries.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.