Automated Home in Insurance – Thematic Research

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

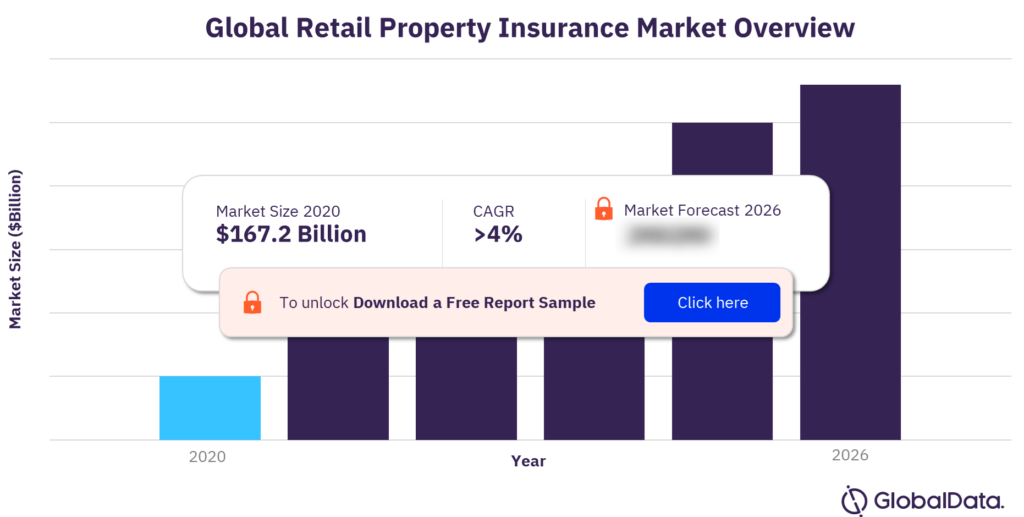

The global retail property insurance market size was $167.2 billion in 2020. The market is expected to grow at a CAGR of more than 4% during the forecast period. On a global level, increasing populations, soaring inflation, house rebuild costs, and growing frequencies of devastating natural disasters (driven by climate change) will drive growth and premium prices in the market.

In the past five years, smart home devices have become more pervasive in households across the world. Consumers have been able to derive numerous benefits from installing such devices into their homes, with leading advantages including energy efficiency, home security, and lifestyle comfort.

Global Retail Property Insurance Market Overview

To gain more information on the global retail property insurance market forecast, download a free report sample

What are the key trends that will shape the automated home in insurance theme in the coming months?

The key trends that will shape the automated home in insurance theme in the coming months can be divided into three categories: technology trends, macroeconomic trends, and regulatory trends.

Technology trends

The main technology trends that will shape the automated home in insurance theme are IoT, 5G, AI, interoperability, big data, and cybersecurity.

Macroeconomic trends

The main macroeconomic trends that will shape the automated home in insurance theme are demographics, generation rent, and COVID-19.

Regulatory trends

The main regulatory trends that will shape the automated home in insurance theme are cybersecurity and data protection regulations.

What are the key insurance industry value chains?

The key insurance industry value chains can be divided into five segments: product development, marketing and distribution, underwriting and risk profiling, claims management, and customer service.

Product development

The general framework of a smart home insurance product is not dissimilar to that of standard home insurance. However, the challenge facing providers in the product development stage is to successfully integrate basic smart devices into a workable and viable policy for both insurers and customers.

Marketing and distribution

Having determined that it is most effective for insurers to offer discounts on devices while simultaneously offering automated home insurance policies (that is, discounted premiums), the marketing of these policies must play on the benefits of such devices to the consumer. Consumers will be more inclined to commit to using such devices if appropriately rewarded, so a double-barreled, or double-discount, marketing approach could be taken.

Underwriting and risk profiling

While home insurers already benefit from a wealth of historical data, the extra data points collected through smart home devices should help to improve underwriting and risk profiling. This increase in data should also allow for greater personalization of policies for customers.

Claims management

The extra data and information provided through smart home devices should improve the claims management process. Some devices, such as water leak detection devices, will minimize or even remove the risk of escape-of-water claims. Other devices, such as smart locks or security cameras, will provide important evidence to support a claimant’s argument.

Customer service

Customer service is an important part of the insurance value chain, regardless of the product. Insurers’ handling of the claims process is largely the most important aspect of customer service within the insurance industry.

Which are the leading public companies associated with the automated home in insurance theme?

The leading public companies that are associated with the automated home in insurance theme are Alphabet, Alibaba, Amazon, Apple, Direct Line, Hippo, Hiscox, Lemonade, Samsung, and Zurich.

Which are the leading private companies associated with the automated home in insurance theme?

The leading private companies that are associated with the automated home in insurance theme are American Family, Honey, Locket, Nationwide Mutual Insurance, and State Farm.

Market report scope

| Market size (2020) | $167.2 billion |

| CAGR | >4% |

| Forecast period | 2020 to 2026 |

| Key trends | Technology Trends, Macroeconomic Trends, and Regulatory Trends |

| Value chains | Product Development, Marketing and Distribution, Underwriting and Risk Profiling, Claims Management, and Customer Service |

| Leading public companies | Alphabet, Alibaba, Amazon, Apple, Direct Line, Hippo, Hiscox, Lemonade, Samsung, and Zurich |

| Leading private companies | American Family, Honey, Locket, Nationwide Mutual Insurance, and State Farm |

Scope

- The key benefit of smart devices to insurers is the mitigation and reduction of several key claims areas, including escape of water, fire, and theft.

- The data created and processed by smart home devices could open the door for big tech companies and other affinity providers to become disruptors in the home insurance landscape, although for now, this is some way from coming to fruition.

- Leading smart home insurance providers offer discounts firstly on the devices themselves via partnerships with manufacturers, and secondly through discounted home insurance premiums to incentivize uptake and correct usage.

Reasons to Buy

- Determine the extent to which insurance providers can benefit from smart home technologies.

- Identify the key challenges and opportunities arising within the automated home space.

- Develop strategies to encourage uptake among policyholders to benefit both yourself and your customers.

- Benchmark yourself against the progress of leading insurers within this developing sector.

American Family

Direct Line

Allstate

Nationwide

State Farm

Travelers

Chubb

Hiscox

NFU Mutual

Locket

Lemonade

Honey

Hippo

Marsh

Aon

PolicyCastle

Centrica

John Lewis

Amazon

Samsung

Baidu

Apple

Alibaba

Sky

Xiaomi

Table of Contents

Frequently asked questions

-

What was the global retail property insurance market size in 2020?

The global retail property insurance market size was $167.2 billion in 2020.

-

What is the global retail property insurance market growth rate?

The global retail property insurance market is expected to grow at a CAGR of more than 4% during the forecast period.

-

What are the key trends that will shape the automated home in insurance theme in the coming months?

The key trends that will shape the automated home in insurance theme in the coming months can be divided into three categories: technology trends, macroeconomic trends, and regulatory trends.

-

What are the key insurance industry value chains?

The key insurance industry value chains can be divided into five segments: product development, marketing and distribution, underwriting and risk profiling, claims management, and customer service.

-

Which are the leading public companies associated with the automated home in insurance theme?

The leading public companies that are associated with the automated home in insurance theme are Alphabet, Alibaba, Amazon, Apple, Direct Line, Hippo, Hiscox, Lemonade, Samsung, and Zurich.

-

Which are the leading private companies associated with the automated home in insurance theme?

The leading private companies that are associated with the automated home in insurance theme are American Family, Honey, Locket, Nationwide Mutual Insurance, and State Farm.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports