Automotive Turbochargers Market Trends, Sector Overview and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Automotive Turbochargers Market Report Overview

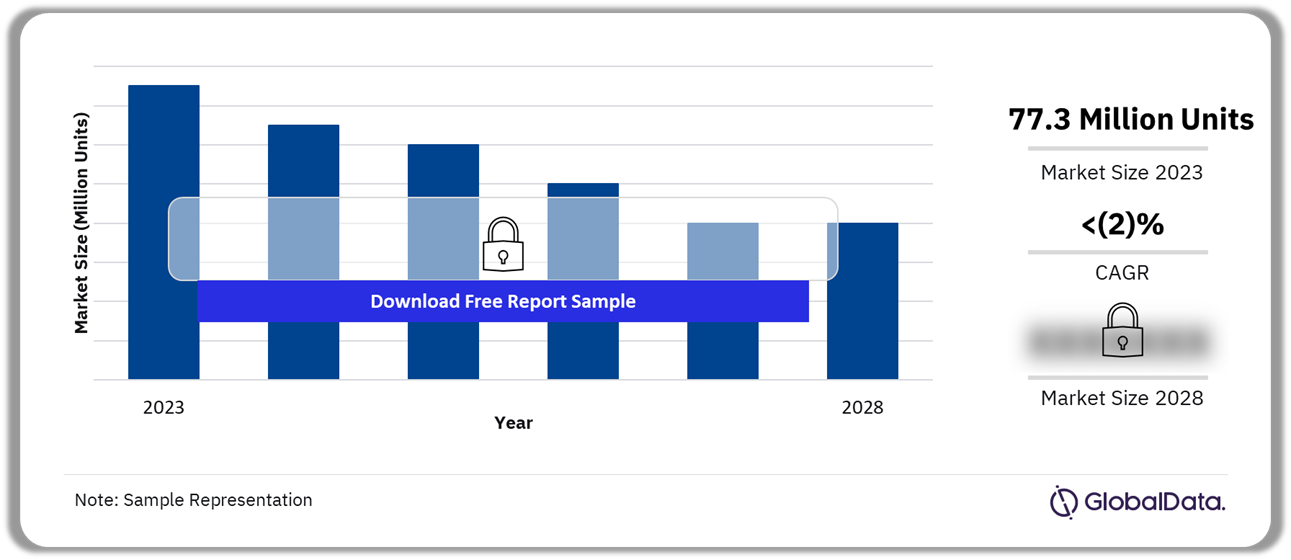

The automotive turbochargers market size was 77.3 million units in 2023. The market will register a negative CAGR of more than 2% during 2023-2028. The APAC region has a significant share of the automotive turbochargers market.

Automotive Turbochargers Market Outlook 2023-2028 (Million Units)

Buy The Full Report for Additional Automotive Turbochargers Market Forecast Insights or Download a Free Sample Report

The automotive turbochargers market report provides a comprehensive overview of the market trends and drivers. The report also provides a detailed overview of technological developments and innovations, PESTER analysis, and leading component suppliers at a global and regional level. Furthermore, it helps evaluate strategic initiatives by market players and their recent product innovations. The report also provides an overview of patent filings across; regions; countries; and top applicants.

| Market Size (2023) | 77.3 million units |

| CAGR (2023-2028) | <(2)% |

| Key Sectors | Turbochargers, Forced Induction Engines, Superchargers, Turbos and E-Chargers, and Turbos and Superchargers |

| Key Regions | Asia-Pacific, Europe, North America, South America, and The MEA |

| Key Companies | Garrett Motion Inc, BorgWarner Inc, IHI Corporation, Mitsubishi Heavy Industries Ltd, and BMTS Technology |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Automotive Turbochargers Market Trends

The major trend impacting the automotive turbochargers market is the increased adoption of turbochargers in hybrid vehicles and their extensive usage for engine downsizing.

The increasing global demand for hybrid vehicles is primarily driven by emission regulations. Turbochargers have become a common feature in hybrid vehicles, solidifying their role in this transition. Hybrid cars typically employ smaller engines compared to their pure petrol or diesel counterparts. The combination of an electric motor and a turbocharger works synergistically to compensate for the reduced power in these smaller engines.

Buy The Full Report For More Information on Trends in the Automotive Turbochargers Market Download a Free Sample Report

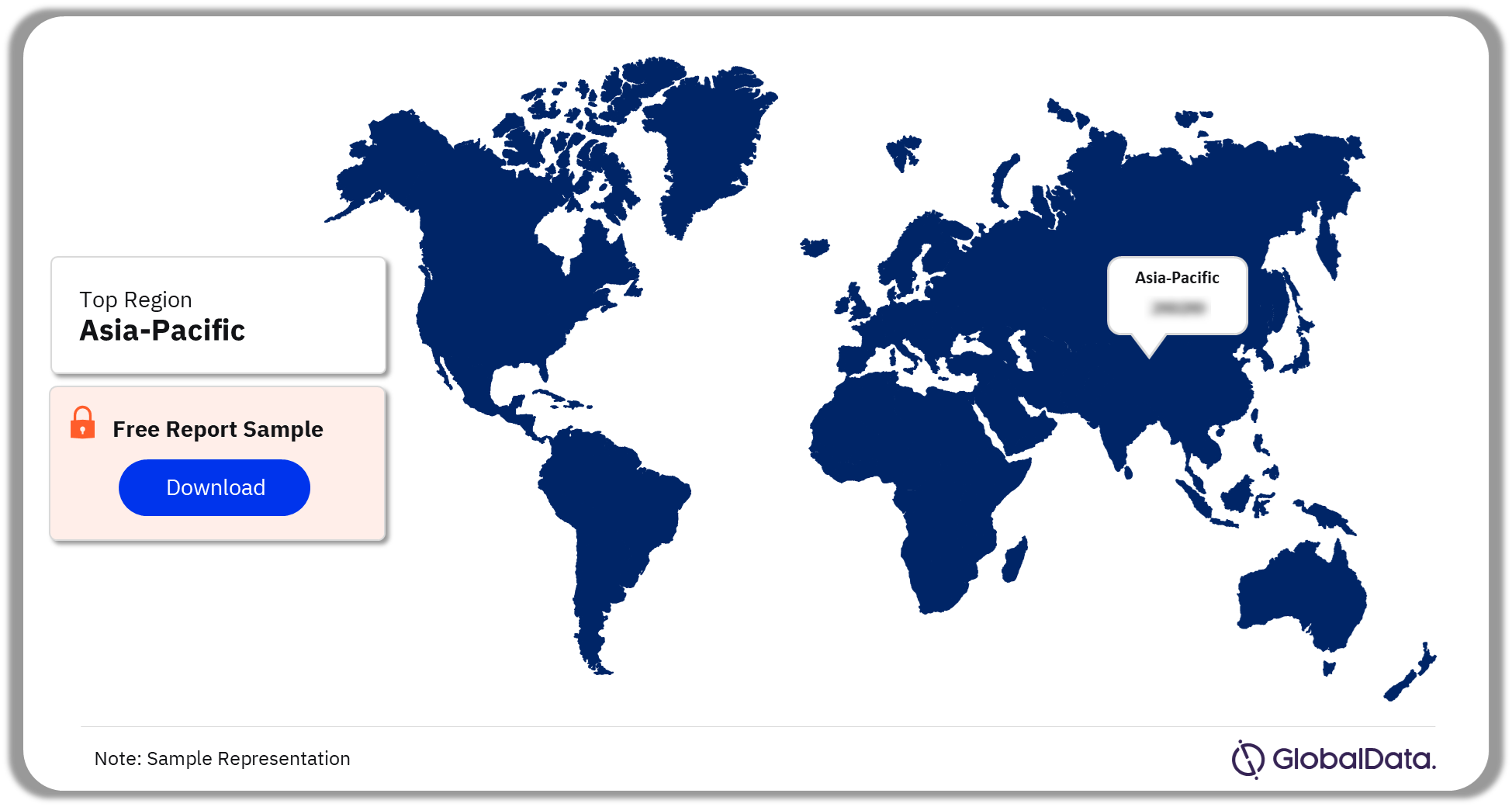

Automotive Turbochargers Market Segmentation by Region

In 2023, Asia-Pacific led the Automotive Turbochargers Market

The key regions in the automotive turbochargers market are Asia-Pacific, Europe, North America, South America, and MEA. Growth in the hybrid vehicle segment in the APAC region will act as a major drive for the turbocharger market in the coming years. Many Asia-Pacific countries are implementing stricter emission standards to combat air pollution and reduce greenhouse gas emissions. Moreover, electric and hybrid vehicles are gaining momentum quickly in the region. To improve efficiency, and enhance emissions standards of ICE engines, demand for turbochargers is rising.

Automotive Turbochargers Market Analysis by Region, 2023 (%)

Buy The Full Report For The Regional Automotive Turbochargers Market Outlook Download a Free Sample Report

Automotive Turbochargers Market – Competitive LandscapeGarrett led the Automotive

The top companies operating in the global turbochargers are:

- Garrett Motion Inc

- BorgWarner Inc

- IHI Corporation

- Mitsubishi Heavy Industries Ltd

- BMTS Technology

Garrett: The Garrett Boost | Club Line turbochargers offer high performance through a journal-bearing system within a cost-effective range. GBC integrates contemporary aerodynamics and a durable journal-bearing rotating group, resulting in a turbocharger that is both powerful and budget-friendly.

The company has also taken some strategic actions to uplift the growth of the automotive turbochargers market. For instance, In April 2023, Garrett Motion officially entered into definitive agreements with Centerbridge Partners, L.P., and funds managed by Oaktree Capital Management, L.P. The purpose of these agreements is to streamline the company’s capital structure by converting all existing Series A Preferred Stock into a unified class of Common Stock.

Automotive Turbochargers Market Analysis by Companies

Buy the Full Report to Know More about Major Innovations and Strategic Actions of Automotive Turbochargers Market Companies

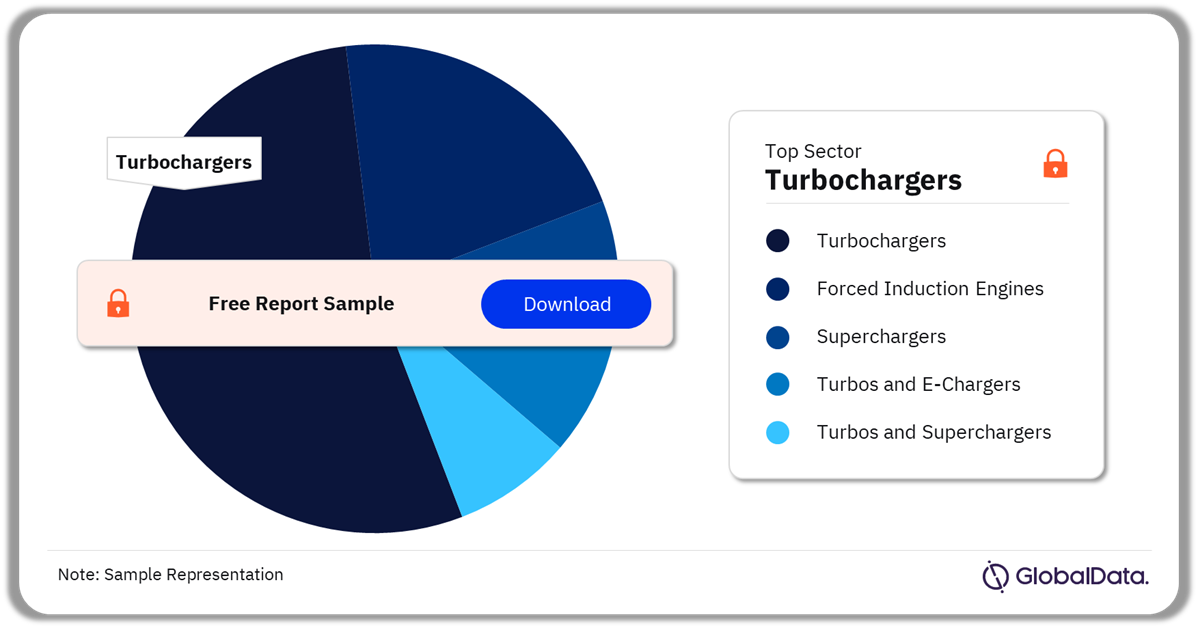

Automotive Turbochargers Market Segmentation by Sectors

In 2023, the turbochargers sector garnered a significant automotive turbochargers market share.

The key sectors in the automotive turbochargers market are forced induction engines, superchargers, turbochargers, turbos and e-chargers, and turbos and superchargers.

Automotive Turbochargers Market Analysis by Sectors, 2023 (%)

Buy The Full Report For insights on the Sectors in the Automotive Turbochargers Market Download a Free Sample Report

Automotive Turbochargers Market – Latest Developments

A few of the latest developments in the automotive turbochargers industry are:

- In 2023, Cloyes Gear & Products, Inc. is a company that creates and designs timing drive systems and components for the automotive aftermarket. Recently, Cloyes announced that it has acquired Rotomaster, a leading global specialist in turbochargers and components. However, the terms of the transaction were not disclosed.

- In 2023, The legal firm acted as the lead Chapter 11 counsel for Stanadyne and its subsidiary, Pure Power, in their Chapter 11 cases, and advised them on their section 363 asset sale to S-PPT Acquisition Company. Cerberus, the pre-petition agent, created S-PPT and secured the lender. The sale was conducted within the framework of the Chapter 11 cases.

Buy The Full Report For the Latest Development Insights in the Automotive Turbochargers Market Download a Free Sample Report

Key Segments Covered in this Report.

Automotive Turbochargers Sector Outlook (Volume, Million Units, 2018-2028)

- Forced Induction Engines

- Superchargers

- Turbochargers

- Turbos and E-Chargers

- Turbos and Superchargers

Automotive Turbochargers Regional Outlook (Volume, Million Units, 2018-2028)

- Asia-Pacific

- Europe

- North America

- South America

- MEA

Scope

This report brings together multiple data sources to provide a comprehensive overview of the global turbochargers sector. It includes an analysis of the following:

- Trends & Drivers: Provides an overview of the current sector scenario regarding the future outlook in terms of key trends and drivers of the sector.

- Technological Developments: Provides a detailed overview of technological developments and innovations in the sector.

- PESTER Analysis: Provides a detailed understanding of various factors such as political, economic, social, technological, environmental, and regulatory impacting the sector.

- Sector Forecast: Provides deep-dive analysis of the global market covering volume growth during 2017–2026, and spot estimates for 2030 and 2036. The analysis also covers a regional overview across four regions-Asia-Pacific, Europe, North America, South America, and highlighting sector size, and growth drivers for the region.

- Competitive Landscape: Provides an overview of leading component suppliers at a global and regional level, besides analyzing the recent product innovations and key strategic initiatives taken by the companies.

- Patent Analysis: Provides an overview of patent filings in the sector across regions, countries, and top applicants.

Reasons to Buy

- Auto OEMs and component suppliers seek the latest information on how the market is evolving to formulate their sales and marketing strategies. There is also a demand for authentic market data with a high level of detail.

- This report has been created to provide its readers with up-to-date information and analysis to uncover emerging opportunities for growth within the sector in the region.

- The report provides a detailed analysis of the regions and competitive landscape that can help companies gain insight into the region-specific nuances.

- The analysts have also placed a significant emphasis on the key trends that drive customer choice and the future opportunities that can be explored in the region, which can help companies in revenue expansion.

- To gain competitive intelligence about leading component suppliers in the sector in the region with information about their market share and growth rates.

,Forced Induction Engines

,Superchargers

,Turbochargers

,Turbos and superchargers

,Turbos and e-chargers

,Garrett

,BorgWarner

,IHI

,Mitsubishi Heavy Industries

BMTS Technology.

Table of Contents

Frequently asked questions

-

What was the automotive turbochargers market size in 2023?

The automotive turbochargers market size was estimated at 77.3 million units in 2023.

-

What will the CAGR in the automotive turbochargers market be during 2023-2028?

The automotive turbochargers market will decline at a negative CAGR of more than 2% during 2023-2028.

-

Which was the leading sector of the automotive turbochargers market in 2023?

In 2023, the turbochargers sector garnered a significant automotive turbochargers market share.

-

Which region was the leading automotive turbochargers market in 2023?

Asia-Pacific was the leading region in the automotive turbochargers market share in 2023.

-

Who are the leading automotive turbochargers market players?

The top companies operating in the global turbochargers are Garrett, BorgWarner, IHI, Mitsubishi Heavy Industries, and Bosch-Mahle Turbo Systems (BMTS) among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.