Belgium General Insurance Market Size and Trends by Line of Business, Distribution, Competitive Landscape and Forecast to 2028

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Belgium General Insurance Market Report Overview

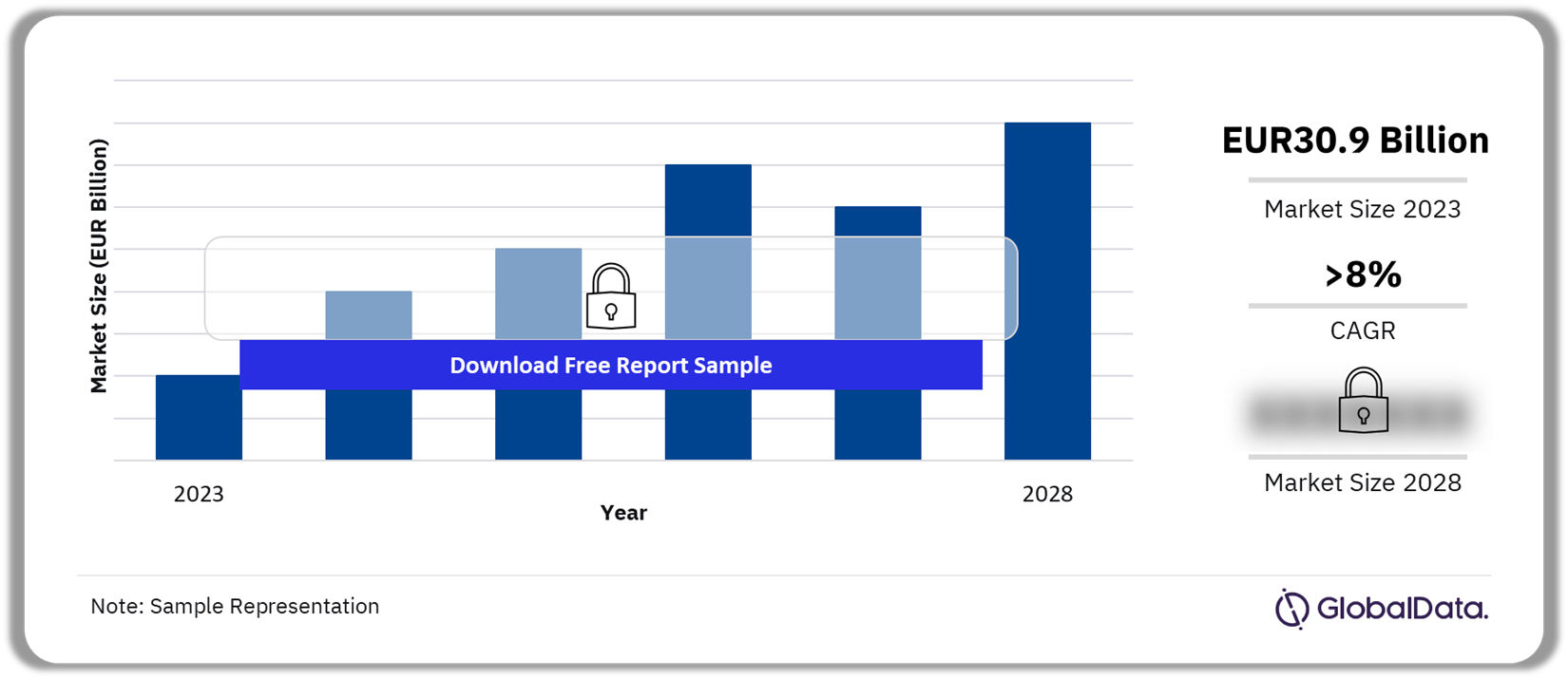

The gross written premium of the Belgium general insurance market was estimated to be EUR30.9 billion ($31.5 million) in 2023 and is expected to achieve a CAGR of more than 8% during 2024-2028. The Belgium general insurance market research report provides in-depth market analysis, including insights into the lines of business in the country’s general insurance industry. Furthermore, the report provides a detailed outlook by product category as well as values for key performance indicators, including gross written premium, penetration, and premium ceded and cession rates for the review and forecast periods.

Belgium General Insurance Market Outlook, 2023-2028 (EUR Billion)

Buy the Full Report to Gain More Information about the Belgium General Insurance Market Forecast

The Belgium general insurance market report also analyzes distribution channels operating in the segment and gives a comprehensive overview of the Danish economy and demographics. It further evaluates the competitive landscape in the country, which entails segment dynamics, competitive advantages, and profiles of insurers operating in the country. Moreover, it includes details of insurance regulations and recent changes in the regulatory structure.

| Market Size (2023) | EUR30.9 billion ($31.5 million) |

| CAGR (2024-2028) | >8% |

| Forecast Period | 2024-2028 |

| Historical Period | 2019-2023 |

| Key Lines of Business | · Property

· Motor · Liability · Financial Lines · Marine, Aviation, and Transit (MAT) · Non-life Personal Accident and Health PA&H · Miscellaneous |

| Key Distribution Channels | · Bancassurance

· Insurance Brokers · Direct Marketing · Agencies · Other Distribution Channels |

| Leading Companies | · AG Insurance

· AXA Belgium · Ethias · KBC Insurance · Baloise Belgium |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Belgium General Insurance Market Trends

Rising demand for electric vehicles (EVs), a growing focus on Environmental, Social, and Governance (ESG), the emergence of insurtech, and health insurers offering wellbeing as a service are a few of the key trends influencing the Belgium general insurance market.

- For instance, the Belgian insurance industry is experiencing a demand for fast, simple, and online services, paving the way for the emergence of insurtech startups and partnerships. In July 2023, Qover, a Belgian insurtech platform specializing in embedded insurance, raised $30 million in a Series C funding round. The insurtech platform enables insurance companies or intermediaries to digitally embed insurance as a component or add-on to their core products or services, thus creating tailor-made insurance solutions.

- Moreover, health insurers are actively investing in prevention and wellness programs for their customers and positioning themselves as health partners. Alan, a digital health insurer for businesses, not only provides traditional insurance services but also several other health benefits for the holistic well-being of the employees of their customers as a part of its insurance plans.

Buy the Full Report for More Insights on the Key Belgian General Insurance Industry Trends, Download a Free Sample Report

Belgium General Insurance Market Segmentation by Lines of Business

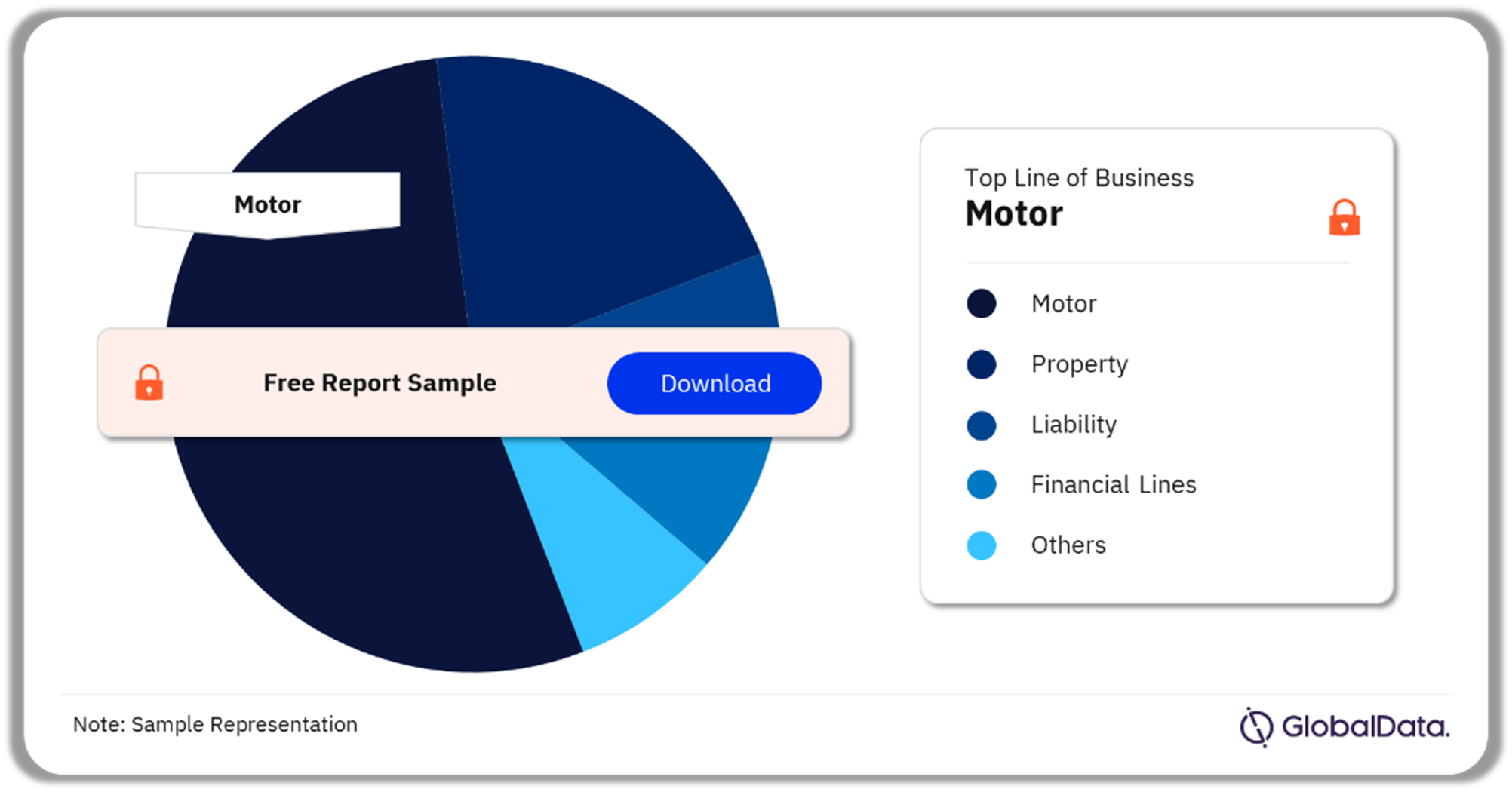

Motor insurance accounted for the highest share among the general insurance line of business in 2023

The key lines of business in the Belgium general insurance industry are property, motor, liability, financial lines, MAT, general insurance PA&H, and miscellaneous. In 2023, motor insurance led the total general insurance direct written premium (DWP), followed by property, and PA&H.

An increase in car sales during 2023 contributed majorly to the LoB’s growth. The motor insurance DWP will witness a decent CAGR growth during the projected period with the recovery in automobile sales and the increased adoption of EVs.

Belgium General Insurance Market Analysis by Lines of Business, 2023 (%)

Buy the Full Report for more Lines of Business Insights into the Belgium General Insurance Market

Belgium General Insurance Market Segmentation by Distribution Channels

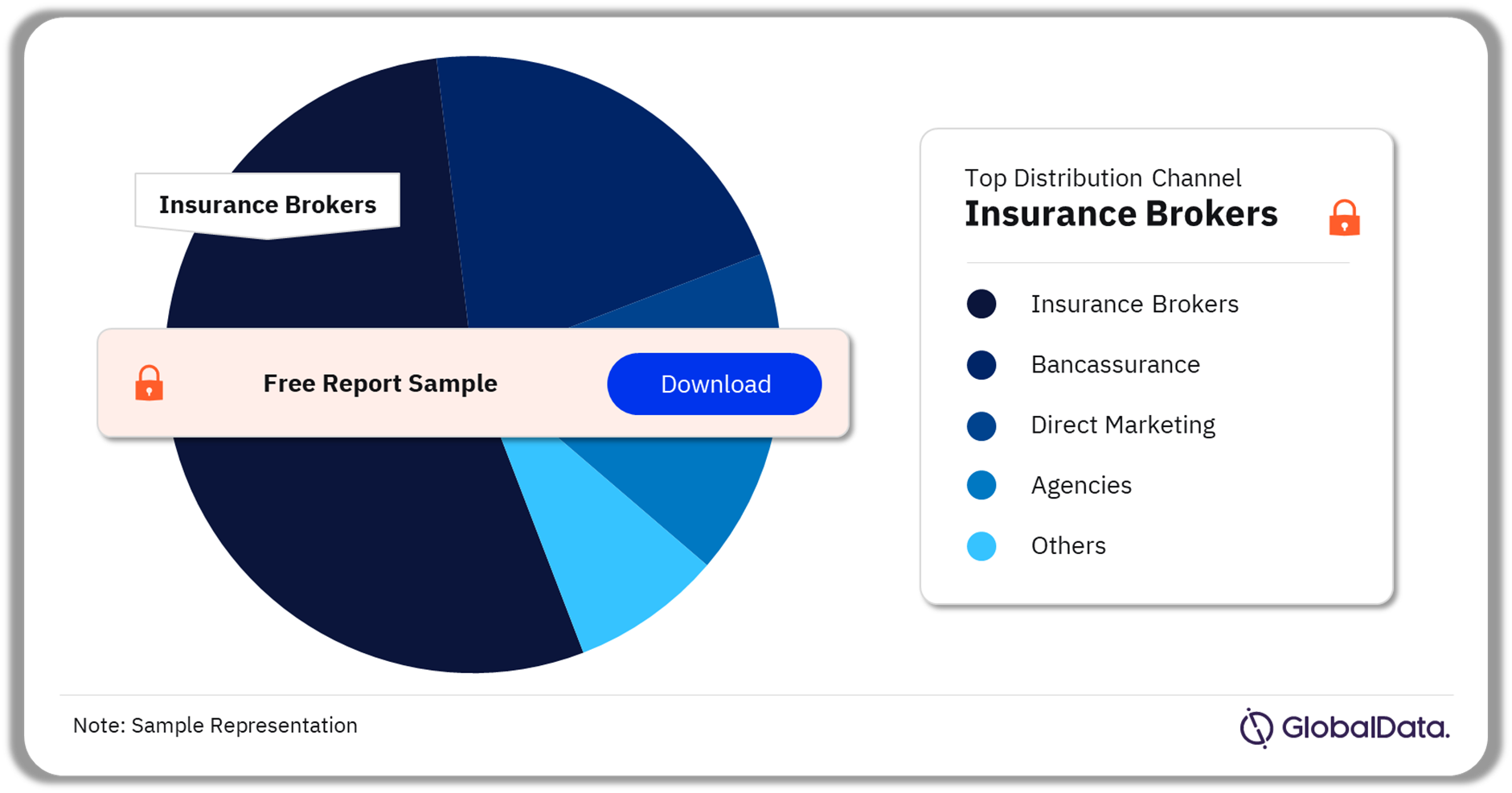

Insurance brokers accounted for the highest Belgian general insurance sales in 2023

A few of the key distribution channels in the Belgian general insurance industry are direct marketing, insurance brokers, bancassurance, and agencies, among others. In 2023, most sales were transacted through insurance brokers. The channel accounted for the largest DWP share in 2023 and is expected to remain the leading distribution channel up to 2028.

Belgium General Insurance Market Analysis by Distribution Channels, 2023 (%)

Buy the Full Report for more Distribution Channel Insights into the Belgium General Insurance Market

Belgium General Insurance Market - Competitive Landscape

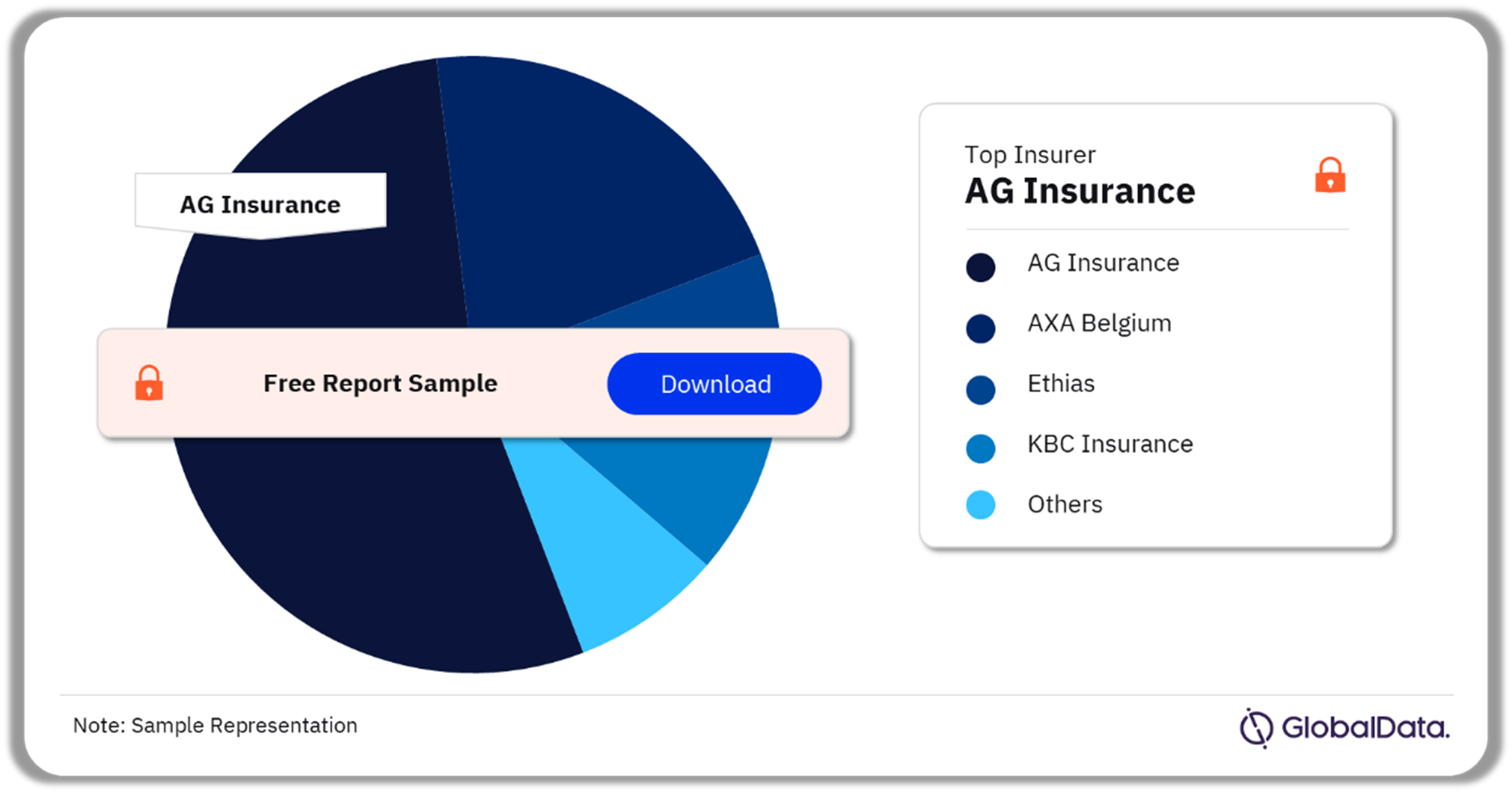

AG Insurance was the largest general insurer in 2022, followed by AXA Belgium and Ethias

A few of the leading general insurance companies in Belgium are:

- AG Insurance

- AXA Belgium

- Ethias

- KBC Insurance

- Baloise Belgium

Belgium General Insurance Market Analysis by Companies, 2022 (%)

Buy the Full Report to Know More about Companies in the Belgium General Insurance Market

Belgium General Insurance Market - Latest Developments

- In October 2023, the Belgian Parliament passed new rules to simplify the termination process of tacitly renewable non-life insurance contracts. Policyholders can terminate such an insurance contract via registered mail sent electronically and the period for opposing tacit renewal is at least two months before the term of the contract.

- In July 2023, Qover, a Belgian insurtech platform specializing in embedded insurance made a significant investment to enhance its business operations. The insurtech platform enables insurance companies or intermediaries to digitally embed insurance as a component or add-on to their core products or services, thus creating tailor-made insurance solutions.

Segments Covered in the Report

Belgium General Insurance Lines of Business Outlook (Value, EUR Billion, 2019-2028)

- Property

- Motor

- Liability

- Financial Lines

- MAT

- General Insurance PA&H

- Miscellaneous

Belgium General Insurance Distribution Channels Outlook (Value, EUR Billion, 2019-2028)

- Bancassurance

- Insurance Brokers

- Direct Marketing

- Agencies

- Other Distribution Channels

Scope

This report provides:

- A comprehensive analysis of the general insurance segment in Belgium.

- Historical values for the Belgium general insurance segment for the report’s review period and projected figures for the forecast period.

- Profiles of the top general insurance companies in Belgium and outlines the key regulations affecting them.

Key Highlights

- Key insights and dynamics of Belgium’s general insurance segment.

- A comprehensive overview of Belgium’s economy, government initiatives, and investment opportunities.

- Belgium’s insurance regulatory framework’s evolution, key facts, taxation regime, licensing, and capital requirements.

- Belgium’s general insurance industry’s market structure gives details of lines of business.

- Belgium’s general reinsurance business market structure gives details of premium ceded along with cession rates.

- Distribution channels deployed by Belgium’s general insurers.

- Details of the competitive landscape and competitors’ profiles.

Reasons to Buy

- Make strategic business decisions using in-depth historical and forecast market data related to Belgium’s general insurance segment.

- Understand the demand-side dynamics, key market trends, and growth opportunities in Belgium’s general insurance segment.

- Assess the competitive dynamics in the general insurance segment.

- Identify growth opportunities and market dynamics in key product categories.

AXA Belgium

Ethias

Baloise Belgium

Allianz Benelux

DKV Belgium

P&V Insurance

Allianz Benelux

Table of Contents

Frequently asked questions

-

What was the Belgium general insurance market gross written premium in 2023?

The gross written premium of the Belgium general insurance market was EUR30.9 billion ($31.5 million) in 2023.

-

What will the Belgium general insurance market growth rate be during the forecast period?

The general insurance market in Belgium is expected to achieve a CAGR of more than 8% during 2024-2028.

-

Which line of business held the highest share of the Belgium general insurance market in 2023?

Motor insurance held the highest share of the Belgian general insurance market in 2023.

-

Which distribution channel held the highest share in the Belgium insurance market in 2023?

Insurance brokers was the leading distribution channel for Belgium’s insurance market in 2023.

-

Which are the key companies operating in the Belgium general insurance market?

A few of the leading general insurance companies in Belgium are AG Insurance, AXA Belgium, Ethias, KBC Insurance, and Baloise Belgium among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Non-Life Insurance reports