BNP Paribas Wealth Management – Competitor Profile

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

BNP Paribas Competitor Profile Overview

Headquartered in Paris, France, BNP Paribas Group operates in Europe, Asia, and the Middle East. It has three divisions which are Corporate & Institutional Banking; Commercial, Personal Banking & Services; and Investment & Protection Services. BNP Paribas Wealth Management sits under Investment & Protection Services. BNP Paribas Wealth Management offers a wide range of wealth services to HNW and UHNW individuals, expats, families, and entrepreneurs.

The BNP Paribas competitor profile report comprehensively analyzes BNP Paribas’s private banking operations. It offers insights into the company’s strategy and financial performance, including key data on AUM. Customer targeting and service propositions are covered, as are product innovation and marketing activities.

| Key Strategy Parameters | · Structure

· Stakeholders · Global Presence · M&A Partnerships · Divestments · Active Jobs and Theme Activity · Company Filings · Digital Transformation |

| Key Financial Performance Parameters | · Cost/Revenue Analysis

· Contribution to Group Performance · Assets · Peer Comparison |

| Key Brand-Building Activities | · CSR

· Sponsorships · Social Media Presence |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for Additional Information about BNP Paribas

BNP Paribas – Strategy

The BNP Paribas competitor profile report covers key strategies in terms of company structure, stakeholders, global presence, M&A partnerships, divestments, active jobs, theme activity, company filings, and digital transformation, among others.

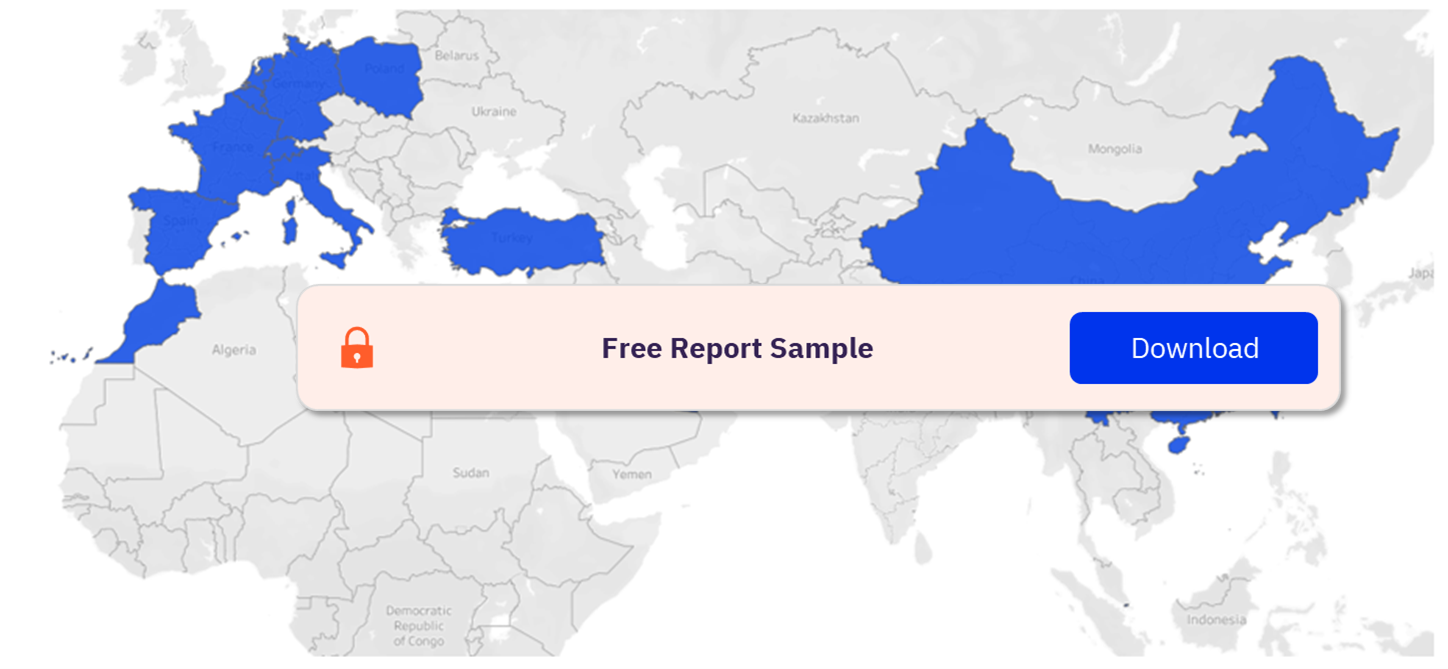

Company Structure: Each of the Commercial, Personal Banking & Services businesses in the BNP Paribas Group’s domestic markets of France, Belgium, Italy, and Luxembourg includes a private banking segment as well. Certain business volumes of these private banking segments are included in the reported Wealth and Asset Management figures. The BNP Paribas Wealth Management business within the Wealth and Asset Management unit encompasses the private banking activities of BNP Paribas, serving wealthy individuals, shareholder families, and entrepreneurs. It has a presence in 18 countries.

BNP Paribas Locations

Buy the Full Report for Strategy-Wise Insights of BNP Paribas

BNP Paribas – Financial Performance

Despite economic headwinds resulting from rising inflation and monetary policy tightening, BNP Paribas’ operating revenues rose in 2022. Revenue growth was supported by all its operational divisions, higher net interest income, and the integrated business model adopted by the company. Corporate & Institutional Banking revenues benefitted from strong client demand in the Global Markets division and increased transaction fees in the Securities Services division.

Buy the Full Report for Insights into BNP Paribas’s Financial Performance

BNP Paribas – Customers and Products

BNP Paribas Wealth Management offers specialist services by leveraging other divisions’ expertise. It offers a wide range of wealth services to HNW and UHNW individuals, expats, entrepreneurs, families, single-family offices, and external wealth managers. UHNW individuals are served by the Key Client Group, a dedicated team of relationship managers operating within BNP Paribas Wealth Management. BNP Paribas Wealth Management offers a range of products and services to clients, including portfolio management, financial advice, lending products, and philanthropy.

BNP Paribas Customers and Products

Buy the Full Report for Customer and Product Insights of BNP Paribas

BNP Paribas – Brand-Building Activities

BNP Paribas manages its philanthropic initiatives around three fields of action that are solidarity, environment, and culture. BNP Paribas Foundation leads and coordinates the development of the group’s philanthropy activities through the Rescue & Recover Fund (which collects donations from its employees, commercial banking customers in France, and pensioners to provide a rapid response to humanitarian and environmental disasters) as well as its foundations abroad.

Buy the Full Report for More Information on the Brand-Building Activities of BNP Paribas

Scope

• BNP Paribas Wealth and Asset Management’s revenues increased by 6.8% in 2022, driven by rising interest income. The unit’s pre-tax profit increased by 10%.

• BNP Paribas Wealth Management is focusing on growth in Asia-Pacific and Europe. BNP Paribas Wealth Management has a strong presence in Europe, particularly in its domestic markets Belgium, France, Italy, and Luxembourg. In April 2023, the bank launched a new wealth management unit in Thailand.

• BNP Paribas Wealth Management is investing in digital platforms for financial advisors and clients. In June 2022, it launched Private Assets Portal: a digital platform dedicated to investments in private assets.

Key Highlights

- BNP Paribas Wealth Management is focusing on growth in Asia-Pacific and Europe. It has a strong presence in Europe, particularly in its domestic markets Belgium, France, Italy, and Luxembourg. In April 2023, the bank launched a new wealth management unit in Thailand.

- BNP Paribas Wealth Management is investing in digital platforms for financial advisors and clients. In June 2022, it launched the Private Assets Portal which is a digital platform dedicated to investments in private assets.

Reasons to Buy

- Examine BNP Paribas’ financial performance, key ratios, and AUM growth.

- Benchmark the company against other global wealth managers.

- Understand its current strategic objectives and their impact on its financial performance.

- Discover BNP Paribas’ key products and client targeting strategies.

- Learn more about the company’s marketing strategy, social media presence, and digital innovations.

Bank of the West

International Woodland Company

Agricultural Bank of China

Banca March

ZEDRA

J.P. Morgan

Clearwater Analytics

Fireblocks

Metaco

Table of Contents

Frequently asked questions

-

What are the key strategy parameters of BNP Paribas?

The key strategy parameters of BNP Paribas are company structure, stakeholders, global presence, M&A partnerships, divestments, active jobs and theme activity, company filings, and digital transformation, among others.

-

What is the range of products and services offered by BNP Paribas?

BNP Paribas Wealth Management offers a range of products and services to clients, including portfolio management, financial advice, lending products, and philanthropy.

-

What are the CSR activities taken up by BNP Paribas?

BNP Paribas manages its philanthropic initiatives around three fields of action that are solidarity, environment, and culture.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports