Canada Gold Mining Market by Reserves and Production, Assets and Projects, Fiscal Regime with Taxes, Royalties and Forecast to 2030

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Empower your strategies with our Canada Gold Mining to 2026 report and make more profitable business decisions.

Canada Gold Mining Market Report Overview

After reporting a minor growth in 2022, gold production in Canada is expected to grow by more than 3% in 2023. Global demand for gold grew in 2022 due to the strong Q4 2022 performance, which can be attributed to increased demand from the jewelry and investment sectors. The Canada gold mining market research report comprehensively covers Canada’s reserves of gold, historic and forecast trends in the country’s gold production and the key active, exploration and development gold mines and projects. The report also analyses factors affecting the country’s demand for gold and profiles the major gold producers.

Canada Gold Mining Market- Key Assets

Active Mines: Some of the key gold active mines are Canadian Malartic Mine, Detour Lake Project, Meliadine Project, Meadowbank Complex, LaRonde Mine, Brucejack Project, Porcupine Mine, Eleonore Mine, Rainy River Gold Project, and Macassa Mine.

Development Projects: Some of the key gold development projects are KSM (Kerr-Sulphurets-Mitchell) Project, New Prosperity Mine, Casino Project, Red Chris Expansion Mine, Blackwater Gold Project, Cote Gold Project, Courageous Lake Project, Schaft Creek Project, Greenstone Project, and Galore Creek Project.

Exploration Projects: Some of the key gold exploration projects are Knife Lake Project, Treaty Creek Project, Malartic West Gold Property, Heva-Hosco Project, Monument Bay Project, Kena Property, Adventure Gold Dubuisson Property, Nelligan Project (Vanstar Mining Resources Inc), Nelligan Project, and Douay West Gold Project.

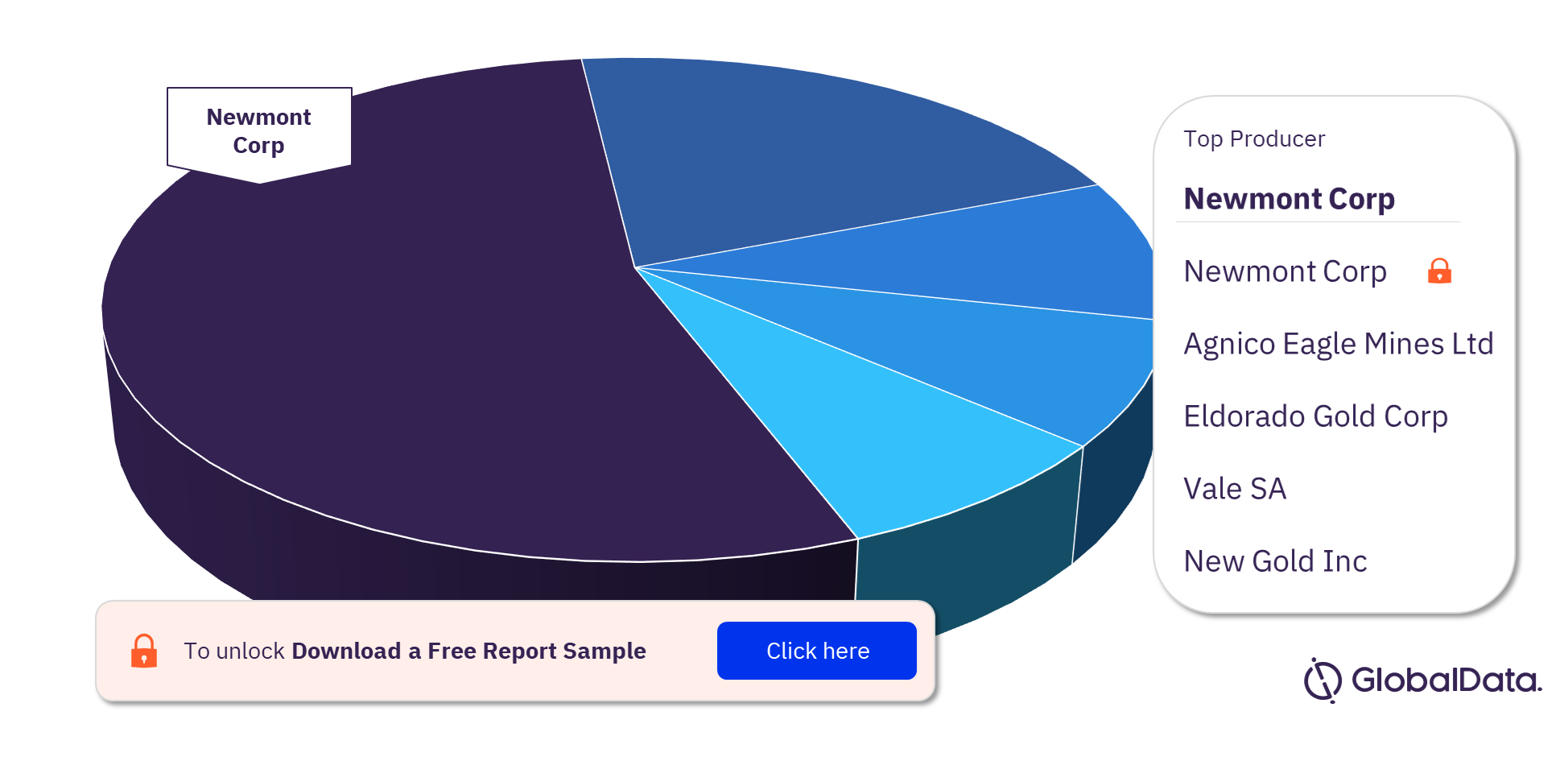

Canada Gold Mining Market - Competitive Landscape

Some of the leading gold producers in the Canada gold mining market are Newmont Corp, Agnico Eagle Mines Ltd, Eldorado Gold Corp, Vale SA, and New Gold Inc. In 2022, Newmont Corp dominated the market.

Newmont Corp: Headquartered in Denver, Colorado, the US, Newmont Corp is a gold mining and exploration company which also carries out the exploration, production, processing, and refining of silver, zinc, copper, lead, and molybdenum. The company operates open pit and underground mining assets in the US, Mexico, Canada, Ghana, Peru, Chile, Argentina, Dominican Republic, Suriname, and Australia. Its portfolio of mining assets includes Phoenix, Carlin, Twin Creeks and Long Canyon, Boddington, Tanami, Pueblo Viejo, Ahafo, and Yanacocha.

Agnico Eagle Mines Ltd: Agnico Eagle Mines Ltd is a diversified metal mining company which carries out the exploration, development and production of mineral properties. The company explores for gold, silver, zinc, copper and lead. Its key properties include LaRonde mine, LaRonde zone 5 mine, Goldex mine, Meadowbank complex, Meliadine mine, Hope Bay mine, Canadian Malartic joint operation, Kittila mine, Pinos Altos mine, Creston Mascota mine and La India mine.

Eldorado Gold Corp: Headquartered in Vancouver, British Columbia, Canada, Eldorado Gold Corp (Eldorado) is a gold mining company which carries out the exploration, development, production, and reclamation of gold mines. The company also explores metals such as silver, copper, zinc, and lead. Furthermore, the company’s operational mines include Kisladag and Efemcukuru in Turkey; Olympias and Stratoni mines in Greece, and the Certej project in Romania.

Canada Gold Mining Market Analysis, by Producers, 2022 (%)

For more insights into the Canada gold mining market, download a free report sample

For more insights into the Canada gold mining market, download a free report sample

Canada Gold Mining Market Report Overview

| Forecast Period | 2024-2030 |

| Historical Period | 2019-2022 |

| Active Mines | Canadian Malartic Mine, Detour Lake Project, Meliadine Project, Meadowbank Complex, LaRonde Mine, Brucejack Project, Porcupine Mine, Eleonore Mine, Rainy River Gold Project, and Macassa Mine |

| Development Projects | KSM (Kerr-Sulphurets-Mitchell) Project, New Prosperity Mine, Casino Project, Red Chris Expansion Mine, Blackwater Gold Project, Cote Gold Project, Courageous Lake Project, Schaft Creek Project, Greenstone Project, and Galore Creek Project |

| Exploration Projects | Knife Lake Project, Treaty Creek Project, Malartic West Gold Property, Heva-Hosco Project, Monument Bay Project, Kena Property, Adventure Gold Dubuisson Property, Nelligan Project (Vanstar Mining Resources Inc), Nelligan Project, and Douay West Gold Project |

| Leading Producers | Newmont Corp, Agnico Eagle Mines Ltd, Eldorado Gold Corp, Vale SA, and New Gold Inc |

Segments Covered in the Report

Canada Gold Mining Market Countries Outlook (Value, 2019-2030)

- Australia

- Russia

- South Africa

- The US

- Peru

Scope

- Overview of the Canada gold mining industry

- Key demand driving factors

- Historical and forecast data on gold production, production by company and reserves by country

- World gold prices

- Profiles of major gold producers

- Competitive landscape

- Major operating, explorational and developmental mines

Reasons to Buy

- In-depth Insights: Gain comprehensive industry insights into the Canada gold mining market and understand the key market drivers influencing production trends, reserves and market dynamics.

- Strategic market analysis: Access historical and forecast trends on Canada gold production to anticipate market shifts and make forward-looking decisions.

- Forge valuable partnerships: Identify the leading companies in the Canada gold mining market, including information on their sectors of operation, headquarters location, production capacity and owned gold mines.

- Uncover major projects: Dive into a detailed overview of major active, explorational, and developmental projects.

Table of Contents

Table

Figures

Frequently asked questions

-

What are the key active mines in the Canada gold mining market?

Some of the key active mines in the Canada gold mining market are Canadian Malartic Mine, Detour Lake Project, Meliadine Project, Meadowbank Complex, LaRonde Mine, Brucejack Project, Porcupine Mine, Eleonore Mine, Rainy River Gold Project, and Macassa Mine.

-

What are the key development projects in the Canada gold mining market?

Some of the key development projects in the Canada gold mining market are KSM (Kerr-Sulphurets-Mitchell) Project, New Prosperity Mine, Casino Project, Red Chris Expansion Mine, Blackwater Gold Project, Cote Gold Project, Courageous Lake Project, Schaft Creek Project, Greenstone Project, and Galore Creek Project.

-

What are the key exploration projects in the Canada gold mining market?

Some of the key gold exploration projects are Knife Lake Project, Treaty Creek Project, Malartic West Gold Property, Heva-Hosco Project, Monument Bay Project, Kena Property, Adventure Gold Dubuisson Property, Nelligan Project (Vanstar Mining Resources Inc), Nelligan Project, and Douay West Gold Project.

-

Who are the leading gold producers in the Canada gold mining market?

Some of the leading gold producers in the Canada gold mining market are Newmont Corp, Agnico Eagle Mines Ltd, Eldorado Gold Corp, Vale SA, and New Gold Inc.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.