Citi Private Bank – Competitor Profile

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Citi Private Bank Competitor Profile Overview

Citigroup has its headquarters in New York, the US. It is a global universal bank that provides a broad range of products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management. Citi Private Bank is part of Citigroup’s Global Wealth Management division, which serves ultra-high-net-worth (UHNW) clients.

The Citi Private Bank competitor profile report comprehensively analyzes Citigroup’s private banking operations. It offers insights into the company’s strategy and financial performance, including key data on AUM. Customer targeting and service propositions are covered, as are product innovation and marketing activities.

| Key Strategy Parameters | · Structure

· Stakeholders · Global Presence · Active Jobs and Theme Activity · Company Filings · Digital Transformation and ICT Spending |

| Key Financial Performance Parameters | · Revenues

· Contribution to Group Performance · Assets · Peer Comparison |

| Key Brand-Building Activities | · CSR

· Sponsorships · Social Media Presence |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for Additional Information about Citi Private Bank

Citi Private Bank – Strategy

The Citi Private Bank competitor profile report covers key strategies in terms of company structure, stakeholders, global presence, active jobs and theme activity, company filings, and digital transformation and ICT spending among others.

Company Structure: In January 2022, as a part of its updated strategy, Citigroup announced a major restructuring of its business segments to support the group in resources and capital allocation and to better assess business performance. According to the new business structure, the group operates through four divisions: Institutional Clients Group, Personal Banking and Wealth Management, Legacy Franchises, and Corporate/Other. Institutional Clients Group provides a full range of wholesale banking products and services to corporate, institutional, and public sector clients.

Citi Private Bank Locations

Buy the Full Report for Strategy-Wise Insights of Citi Private Bank

Citi Private Bank – Financial Performance

In 2022, Citi Private Bank’s revenues decreased. This can be primarily attributed to volatile market conditions that significantly affected investment fees, particularly in Asia. The lower wealth revenue in Asia is also likely due to the divestments made throughout the region. In addition, higher deposit rates made clients reluctant to invest. However, these factors were partially offset by the increase in net interest income driven by higher interest rates. In addition, in Q1 2023, Citigroup’s operating revenues were up by more than 19% in quarterly terms, primarily due to the sale of the India consumer business and higher revenues in Services and Fixed Income Markets, as well as strong average loan growth in US Personal Banking.

Buy the Full Report for Insights into Citi Private Bank’s Financial Performance

Citi Private Bank – Customers and Products

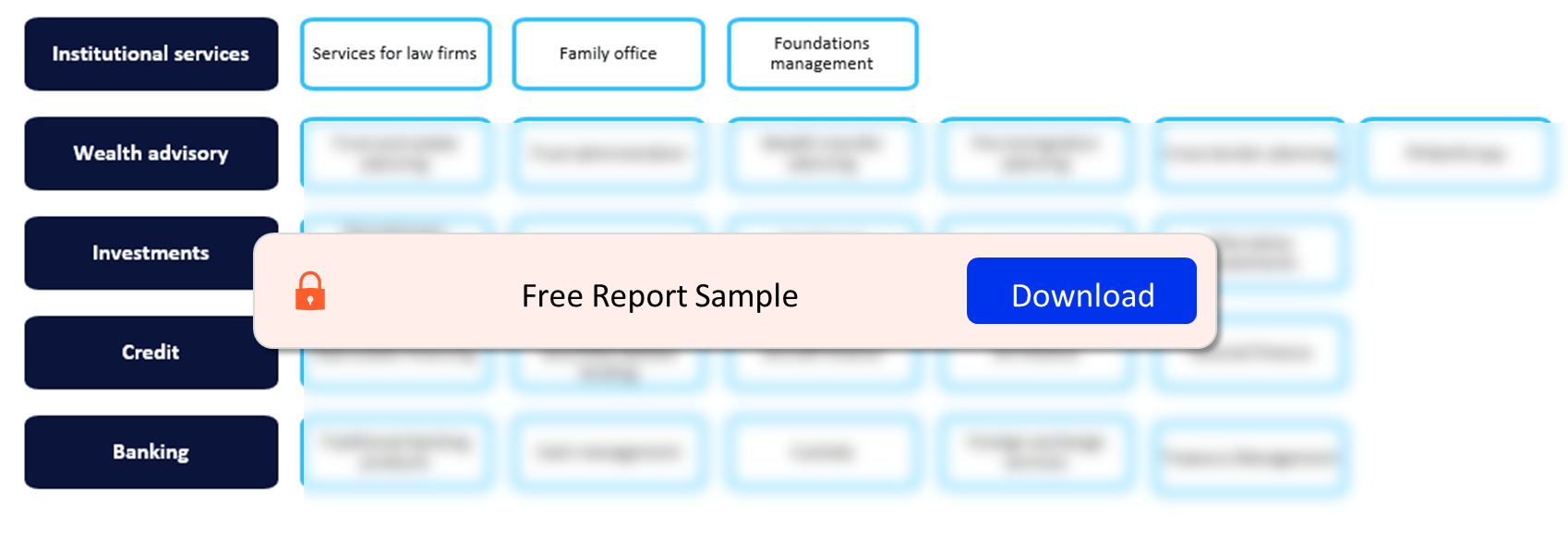

Citi Private Bank serves UHNW customers with assets of more than 24 million. It provides its clients with a comprehensive offering and highlights its institutional service capabilities, such as foundations management and its family office proposition. Its investment services offering can be used by individuals, as well as institutional investors.

In June 2020, Citi Private Bank formed the Citi Private Capital Group to provide institutional services to private investment companies, family offices, trusts, endowments, and foundations, helping clients manage their wealth effectively during the COVID-19 pandemic. Since the outbreak, the group has been helping clients with proactive investment advice, sophisticated hedging strategies, and other strategic capital markets solutions. The group is providing financial assistance in all strategic locations in North America, Latin America, Asia, and EMEA.

Citi Private Bank Customers and Products

Buy the Full Report for Customer and Product Insights of Citi Private Bank

Citi Private Bank – Brand-Building Activities

Citigroup and Citi Foundation have introduced initiatives that encourage employment, education, and entrepreneurship. Citigroup undertakes a wide range of socially responsible activities including corporate philanthropy, employee volunteering, and long-term strategic programs for financial education. Citigroup also works to promote economic progress and improve the lives of people in low-income communities through the Citi Foundation.

In May 2023, Citi Foundation invested in the second phase of the Ascend Program, a youth disability rights program of the European Disability Forum, which is a charitable organization that works for disabled persons. Ascend Program, launched as a part of Citi Foundation’s Pathways to Progress initiative in January 2022, is focused on young people with disability in the Central European countries of Bulgaria, the Czech Republic, Hungary, Romania, and Slovakia.

Buy the Full Report for More Information on the Brand-Building Activities of Citi Private Bank

Scope

GlobalData’s ‘Citi Private Bank – Competitor Profile’ provides a comprehensive analysis of Citigroup’s private banking and wealth management operations. It offers insights into the company’s strategy and financial performance, including key data on assets under management (AUM). Customer targeting and service propositions are covered, as are product innovation and marketing activities.

Key Highlights

- Citi Private Bank mainly focuses on UHNW customers with assets of at least $25 million. The bank also requires its clients to hold a minimum of $5 million-10 million (depending on the market) in assets in accounts and products managed by Citigroup.

- In 2022, Citigroup reorganized its business structure to create the Personal Banking and Wealth Management division, which includes the Citi Private Bank.

- In April 2021, Citigroup announced the sale of its consumer banking business in 13 markets globally, with most of these markets in the Asia-Pacific region. It also decided to exit the retail banking elements of its Citibanamex business in Mexico in January 2022. Following this move, Citigroup plans to ramp up its wealth management operations, especially in Asia-Pacific. In 2022, the group was aggressively hiring in Hong Kong (China SAR) and Europe. Furthermore, it aims to grow client assets in Asia-Pacific by over $150 billion by 2025, including a $120 billion increase in HNW assets under management (AUM).

- Citigroup’s growing focus on digitalization includes the launch of digital investment platform Citi Self Invest in July 2021. Citi Self-Invest is a self-directed investment platform available within the Citi Mobile app. It enables clients to make self-directed investments in equities and ETFs with no service charges and no minimum account balance.

- Environmental, social, and governance (ESG) remains a key focus of the group. Citi Private Bank runs the Investing with Purpose team, which offers portfolio management services that help clients make environmental and social impact investments without compromising on returns.

Reasons to Buy

- Examine the financial performance, key ratios, and AUM growth of Citigroup and its Private Bank division and benchmark this competitor against other global wealth managers.

- Understand Citi Private Bank’s current strategic objectives and their impact on its financial performance.

- Discover Citi Private Bank’s key products and client targeting strategies and examine whether these have been successful.

- Learn more about Citi Private Bank’s marketing strategy, social media presence, and digital innovations.

Citigold

National Australia Bank

Axis Bank

UnionBank of the Philippines

United Overseas Bank

Ahli United Bank

Citi Foundation

Table of Contents

Frequently asked questions

-

What are the key strategy parameters of Citi Private Bank?

The key strategy parameters of Citi Private Bank are company structure, stakeholders, global presence, active jobs and theme activity, company filings, and digital transformation and ICT spending among others.

-

What is the range of products and services offered by Citi Private Bank?

Citi Private Bank provides a broad range of products and services, including consumer banking and credit, corporate and investment banking, securities brokerage, transaction services, and wealth management.

-

What are the socially responsible activities taken up by Citi Group?

Citigroup undertakes a wide range of socially responsible activities including corporate philanthropy, employee volunteering, and long-term strategic programs for financial education.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports