Decarbonizing the Chemicals Industry – Trends, Assessing Technologies, Challenges and Case Studies

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Decarbonizing the Chemicals Industry Report Overview

The chemicals industry is responsible for 14% of global CO2 emissions. According to the International Energy Agency, the sector is also the largest industrial consumer of oil and gas products. The chemicals industry has been traditionally dependent on low-cost and readily available fossil fuels for feedstock and a source of process energy. Captured CO2, green hydrogen, and other alternative feedstocks such as biomass and waste can serve to replace oil and gas as the main sources of carbon and hydrogen, while electrification and the use of alternative fuels will aid in the replacement of fossil fuels for process energy. Meanwhile, increasing process efficiency through recycling of industrial heat or utilizing waste chemicals can help to reduce the overall energy demand of the sector, making the decarbonization challenge more manageable.

This report identifies the current and potential sector trends necessary to meet emissions targets and introduces the energy transition technologies most suited to decarbonizing the chemicals industry. The technologies discussed include hydrogen, alternative fuel sources, CCUS, as well as energy efficiency and optimization measures.

| Key Chemicals Causing Carbon Emissions | Ammonia, Methanol, Urea, Ethylene, Propylene, Xylenes, Benzene |

| Key Decarbonization Technologies | Carbon Capture, Utilization and Storage (CCUS), Hydrogen, Process Efficiency, and Biomass and Waste as Feedstock |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Download the Free Sample or Buy the Full Report for Additional Trends in the Decarbonizing the Chemicals Industry

Decarbonizing the Chemicals Industry – Chemicals Carbon Emissions

Almost two-thirds of emissions from the chemicals industry come from energy use. Energy is used to heat and cool reactions, grind, and mix compounds, and transport around the plants. Some of this can be electrified and switched to renewable sources, however, due to very high temperatures required in the heating of some reactions, this is not always possible and so alternative fuel sources are needed. In some reactions, CO2 is produced as a waste product of the reaction which in many cases is unavoidable, meaning carbon capture, storage, and utilization (CCUS) is needed.

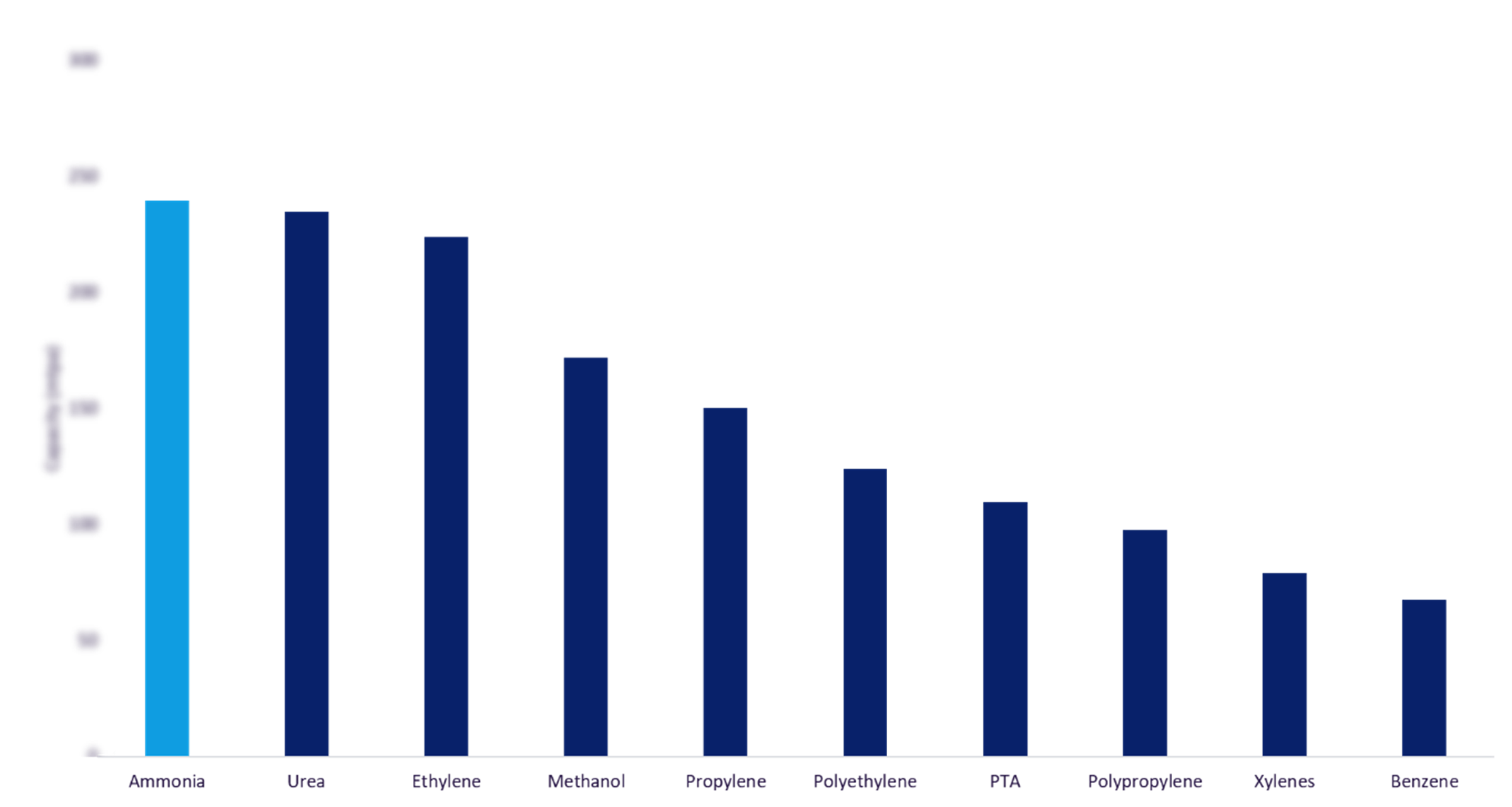

Ammonia, urea, ethylene, methanol propylene, and benzene are some of the commodities produced by the chemicals industry.

Ammonia production is responsible for over 44% of the chemicals industry’s emissions. To get on track with net zero emissions, ammonia needs to drastically reduce its petroleum dependency, going beyond the current policies set out. The upscaling of green hydrogen needs to be accelerated to decarbonize ammonia production.

Decarbonizing the Chemicals Industry by Carbon Emissions, 2022

Download the Free Sample Report or Buy the Full Report for More Insights on Chemicals Carbon Emissions

Decarbonizing the Chemicals Industry – Key Technologies

The key energy transition technologies that have the potential to decrease emissions emanating from the chemicals sector are process efficiency and optimization measures, Hydrogen and alternative fuels, Carbon Capture, Utilization and Storage (CCUS), and biomass and waste as feedstocks.

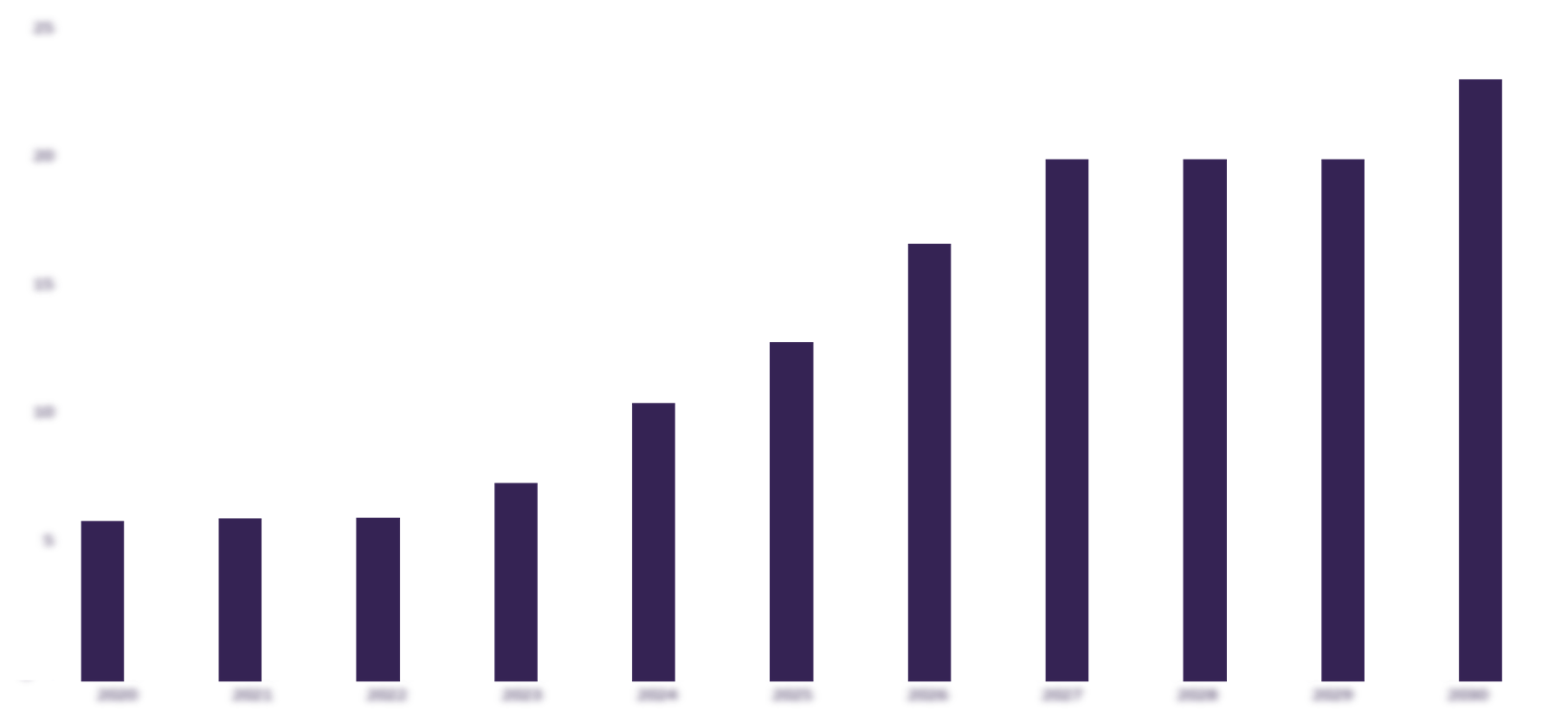

CCUS Capacity in Chemicals Industry: Gaseous carbon dioxide is captured, either from ambient air or from industry flues, and converted to a liquified or solid-state form to be permanently stored or used in some way. Global carbon capture capacity within the chemicals sector is forecast to see a CAGR of more than 14% from 2020-2030, with ground-breaking projects becoming operational in the next few years increasing capacity. There are several ways chemical processes can be amended to use CO2 captured from industry or directly from the air to produce high-value chemical products. Some of these technologies are still emerging and as such remain expensive but could be essential to reaching net zero goals.

Hydrogen in Chemicals: In the chemicals industry, green hydrogen has the most potential to decarbonize ammonia production, which currently is the highest-emitting primary chemical produced and is heavily reliant on fossil fuel feedstocks. Green hydrogen production incentivizes green ammonia production, with ammonia presenting a more energy-dense form making it more desirable for transportation.

Process Efficiency in Chemicals: Due to increasing demand for chemicals, process energy consumption must be reduced so that total levels can remain level. Chemical manufacturers can amend their processes in several ways to reduce overall energy use by reclaiming waste heat or reducing the amount of heat required in the first place by using novel catalysts.

Biomass and Waste as Feedstocks: Most developments in biomass and feedstock use have come in the production of renewable fuels. Although there is scope to use biomass as a feedstock to produce basic chemicals, biomass availability, and cost are large stumbling blocks for wider adoption by the chemicals industry.

Carbon Capture Capacity from Chemicals Manufacturing

Buy the Full Report or Download a Free Sample Report for CCUS Capacity in Chemicals Industry

Scope

- The chemical industry’s current contribution to carbon emissions

- Key chemicals for decarbonization

- Focus technologies for decarbonizing the chemical sector

- Carbon Capture, Utilization, and Storage (CCUS)

- Hydrogen

- Process efficiency

- Biomass and waste as feedstocks

Key Highlights

- Almost two thirds of emissions from the chemicals industry come from energy use. Energy is used to heat and cool reactions, grind, and mix compounds, and transport them around the plants.

- In order to get on track with net zero emissions, ammonia needs to drastically reduce its petroleum dependency, going beyond the current policies set out. The upscaling of green hydrogen needs to be accelerated to decarbonize ammonia production.

- Methanol made up around half the primary chemical production in 2018 and is expected to see a demand increase of 17.56% from 2023-2030 due to rising demand from automotive and construction industries in developing economies.

- Despite the ICCA claiming to support the Paris Climate Agreement, the IEA considers the chemicals industry to be ‘not on track’ for its 2030 checkpoint.

- Global carbon capture capacity within the chemicals sector is forecast to see a 14.2% CAGR from 2020-2030, with ground-breaking projects becoming operational in the next few years increasing capacity.

Reasons to Buy

- Obtain the most up to date information on recent developments and policies effecting the chemical industry’s energy transition.

- Identify key energy transition technologies for the decarbonization of the chemical industry

- Obtain market insight into current rates of technology adoption and the factors that will shape the sector’s decarbonization.

- Identify the companies most active companies across CCUS, hydrogen, process efficiency, and feedstocks derived from biomass and waste within the chemicals sector.

HIF Global

LanzaTech Inc

ArcelorMittal SA

Made of Air

H&M Group

Econic Technologies Ltd

Monument Chemicals Inc

ABB Group

Skovgaard Energy A/S

Topsoe A/S

Vestas Wind Systems AS

Fortescue Future Industries Pty Ltd

Plug Power Inc

Sasol Ltd

Svevind Energy Group

Korea Electric Power Corporation

CWP Global

HeatMatrix Group

BASF Corporation

OCI Global

SunGas Renewables Inc

Moller-Maersk AS

Enerkem Inc

Eastman Chemical Company

Table of Contents

Table

Figures

Frequently asked questions

-

What are the key chemicals causing carbon emissions?

Ammonia, methanol, urea, ethylene, propylene, xylenes, benzene are the key chemicals causing carbon emissions.

-

Which are the key technologies having the potential to decrease emissions emanating from the chemicals sector?

Process Efficiency and Optimization Measures, Hydrogen and Alternative Fuels, Carbon Capture, Utilization and Storage (CCUS), and Biomass and Waste As Feedstocks are the key technologies that have the potential to decrease emissions emanating from the chemicals sector.

-

What do carbon capture, utilization, and storage (CCUS) technology involve?

Gaseous carbon dioxide is captured, either from ambient air or from industry flues, and converted to a liquified or solid-state form to be permanently stored or used in some way. Global carbon capture capacity within the chemicals sector is forecast to see a CAGR of more than 14% from 2020-2030, with ground-breaking projects becoming operational in the next few years increasing capacity.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.