Demographics in Insurance – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Demographics in Insurance Theme Analysis Report Overview

Aging populations will present challenges to insurers as pensions will need to be larger to cover living expenses for a longer period. The growing pressure on public finances and state pensions will provide an opportunity for private pension providers to alleviate the financial challenges. These consumers will also present increased risk profiles within the health insurance space as they age, creating further challenges to the healthcare and insurance industry in tandem.

The Demographics in Insurance thematic intelligence report assesses how demographics can be used across the insurance value chain. The report includes relevant technology, macroeconomic, and regulatory trends and provides an overview of the current landscape, as well as key players, while also highlighting opportunities for the use of demographics in the future. The report provides an industry-specific analysis based on GlobalData databases and surveys.

| Report Pages | 58 |

| Regions Covered | Global |

| Key Trends | · Technology Trends

· Macroeconomic Trends · Regulatory Trends |

| Key Companies | · Alan

· Aviva · DeadHappy · Discovery |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase.a |

Buy the Full Report for More Insights into Demographics in the Insurance Industry

Demographics in Insurance – Key Trends

The main trends shaping the demographics theme in insurance over the next 12 to 24 months are technology trends, macroeconomic trends, and regulatory trends.

- Technology trends: Some of the key technology trends impacting the demographics theme in insurance are the growing AI market, hybrid working models, and IoT.

- Macroeconomic trends: The key macroeconomic trends explained in the report are the fraught geopolitical landscape, climate change concerns, and the growing number of refugees and migrants.

- Regulatory trends: Fertility policies, immigration policies in countries such as Singapore to attract talent, and changes to the state retirement age are a part of the regulatory trends impacting the demographics in insurance.

Demographics in Insurance – Industry AnalysisThe key demographic challenges facing the industry have been separated into three distinct categories: changing age demographics and evolving roles of the generations; changing wealth demographics, including widening income and wealth inequalities as well as the implications of the great wealth transfer; and urban migration and the changing urban environment. These changes can be seen as long-run, systemic shifts in the make-up and habits of populations.

Aging populations and changing roles of generations: An aging population will likely bring widespread change to life and health insurance offerings. Older populations are more likely to be affected by NCDs (conditions not caused by acute infection, such as cancer, diabetes, and cardiovascular disease) and more adversely affected by communicable diseases. Even with advances in medicine and healthcare over the coming decades, insurers will likely need to find new ways of supporting a larger proportion of the population through such illnesses.

The Demographics in the Insurance industry analysis also covers:

- Timeline

Buy the Full Report for More Insights into Demographics in the Insurance Industry

Demographics in Insurance – Insurance Companies

Some of the leading players associated with the demographics theme in insurance are:

- Alan

- Aviva

- DeadHappy

- Discovery

Buy the Full Report to Know More About the Companies in the Insurance Industry

Download a F ree Report Sample

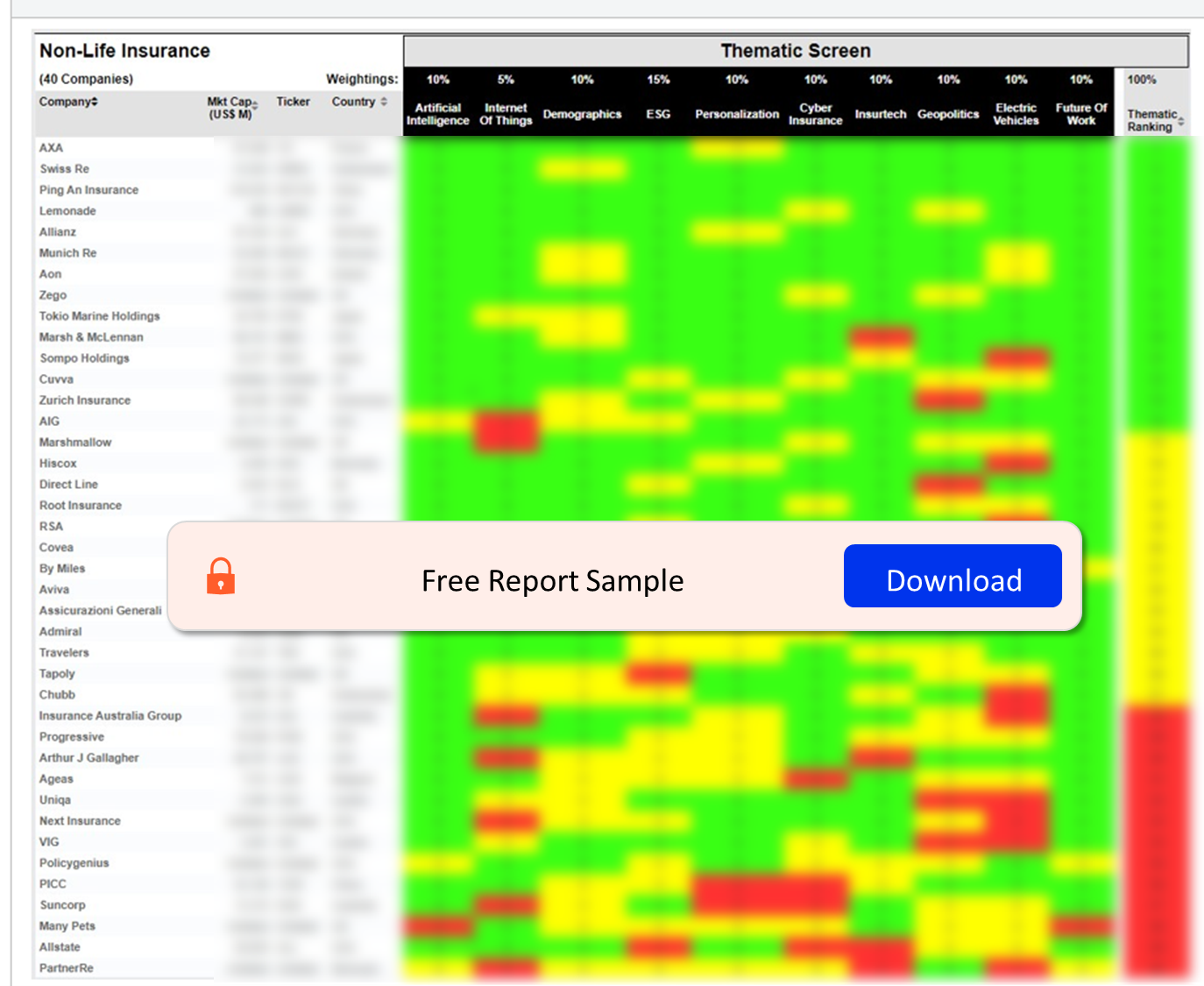

Non-life Insurance Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuation metrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Non-life Insurance Sector Scorecard – Thematic Screen

Buy the Full Report to Know More About the Sector Scorecards in the Demographics theme in the Insurance Industry

The other sector scorecard covered in the report is:

- Life insurance sector scorecard

Scope

• GlobalData’s 2023 UK Life and Pensions Survey suggests that over 50% of under-55s believe their retirement income will not be sufficient to cover their living expenses.

• Over three quarters of 18-24-year-olds consider sustainable investment principles important compared to just 32.9% of over-65s as per GlobalData’s 2023 UK Life and Pensions Survey.

• In England, the average student debt upon repayment was GBP2,690 in 1999–2000. By 2021–22 it had increased 1,578% to GBP45,150.

• According to GlobalData’s 2022 UK Insurance Consumer Survey, 20.2% of UK term assurance customers purchased the product because they had recently bought a new house. This was also true for 13.3% of income protection customers.

Reasons to Buy

- Determine how different ideologies of younger consumers will encourage a change in approach for the insurance industry in targeting this cohort.

- Identify features of insurance for which Generation Z and millennials have a greater preference due to differences in living styles.

- See how insurtechs and incumbents are adapting strategies to resonate with and market to this demographic.

- Understand how pension provision needs to change in the face of aging populations.

- Configure ESG strategies to fit in line with changing customer preferences before the great wealth transfer brings widespread change to investment markets.

Bupa

Aviva

Manulife

Sun Life

Legal & General

Saga

Dai-ichi Life

YuLife

Alan

Oscar

Clover

DeadHappy

Anorak

Dacadoo

BIMA

State Farm

Ping An

AXA

VIG

Allstate

Covea

Generali

Direct Line

Lemonade

Hedvig

Hippo

Zhong An

Arma Karma

Cuvva

Zego

Marshmallow

Revolut

Apple

Tesla

Ikea

Sky

Amazon

Samsung

Expedia

Table of Contents

Frequently asked questions

-

What are the main trends shaping the demographics theme in insurance?

The main trends shaping the demographics theme in insurance over the next 12 to 24 months are technology trends, macroeconomic trends, and regulatory trends.

-

What are the main technology trends shaping the demographics theme in insurance?

Some of the key technology trends impacting the demographics theme in insurance are the growing AI market, hybrid working models, and IoT.

-

What are the main regulatory trends shaping the demographics theme in insurance?

Fertility policies, immigration policies in countries such as Singapore to attract talent, and changes to the state retirement age are a part of the regulatory trends impacting the demographics in insurance.

-

Which are the leading insurance companies associated with the demographics theme in the insurance?

Some of the leading listed players associated with the demographics theme in the insurance are Alan, Aviva, DeadHappy, and Discovery among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports