Deutsche Bank Wealth Management – Competitor Profile

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Deutsche Bank Competitor Profile Overview

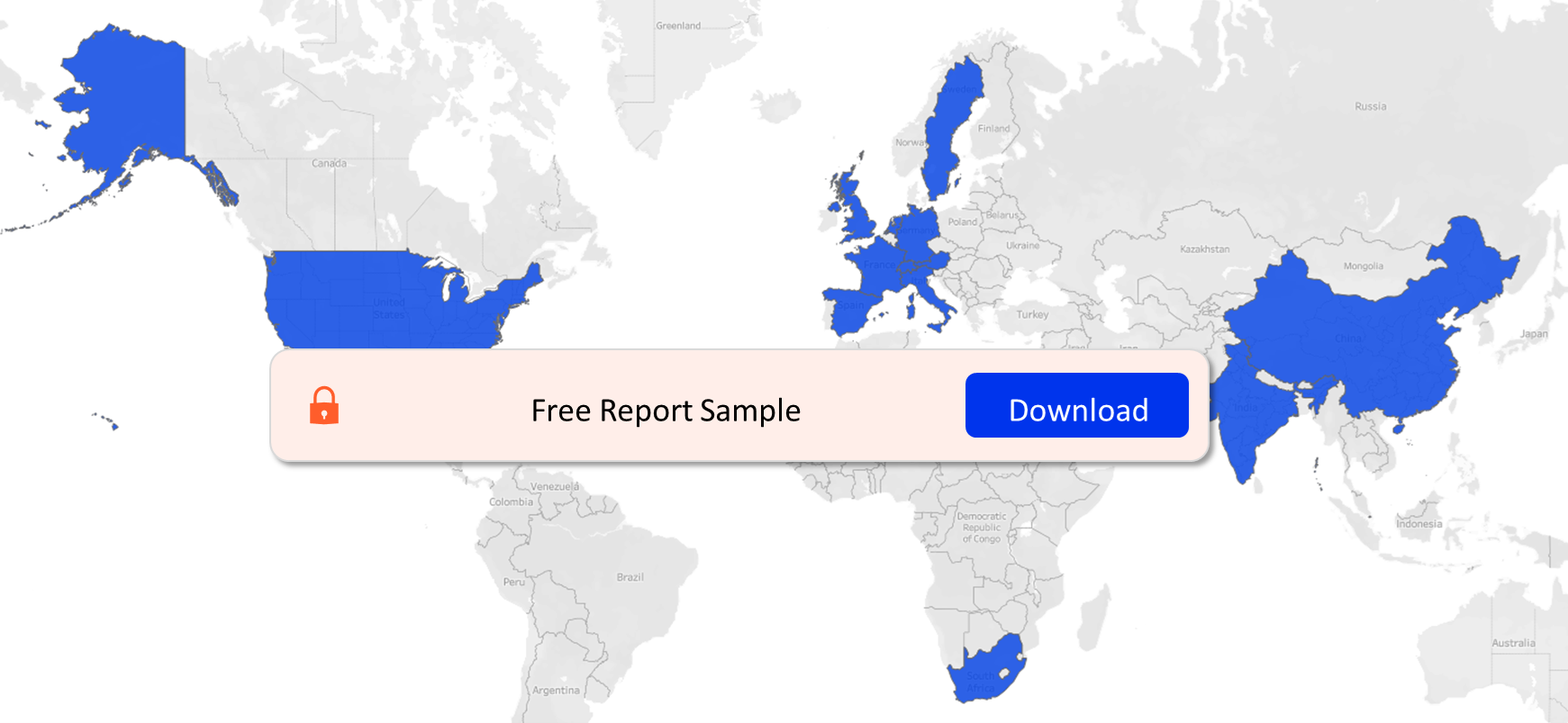

Deutsche Bank has its headquarters in Frankfurt, Germany with offices across the Asia-Pacific, the Americas, and the Europe, the Middle East, and Africa (EMEA) regions. The bank’s Wealth Management division sits within the overall Private Bank division which is one of five, main business segments. Deutsche Bank Wealth Management offers a wide range of traditional and alternative investment products and lending and deposit products to HNW and UHNW individuals, entrepreneurs, and family offices.

The Deutsche Bank competitor profile report comprehensively analyzes Deutsche Bank’s private banking operations. It offers insights into the company’s strategy and financial performance, including key data on AUM. Customer targeting and service propositions are covered, as are product innovation and marketing activities.

| Key Strategy Parameters | · Structure

· Stakeholders · Global Presence · Active Jobs and Theme Activity · Company Filings · Digital Transformation and ICT Spending |

| Key Financial Performance Parameters | · Revenues

· Contribution to Group Performance · Private Bank Performance · Assets · Peer Comparison |

| Key Brand-Building Activities | · CSR

· Sponsorships · Social Media Presence |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Buy the Full Report for Additional Information about Deutsche Bank

Deutsche Bank – Strategy

The Deutsche Bank competitor profile report covers key strategies in terms of company structure, stakeholders, global presence, active jobs and theme activity, company filings, and digital transformation and ICT spending among others. It has a presence in the Asia-Pacific, the Americas, and the Europe, the Middle East, and Africa (EMEA) regions.

Company Structure: Deutsche Bank operates through six business units: Corporate Bank, Investment Bank, Private Bank, Asset Management, Corporate & Other, and the newly-created Banking, Lending, and Investment Solutions division. In July 2023, Private Bank reorganized its business to create five, new units with wealth management offerings incorporated in different regions. The reorganized Private Bank division comprises Wealth Management and Private Banking (Germany), Personal Banking (Germany), Emerging Markets, Italy, Spain, and Belgium, and Central Europe and the US units.

Deutsche Bank’s Global Wealth Management Locations

Buy the Full Report for Strategy-Wise Insights of Deutsche Bank

Deutsche Bank – Financial Performance

Deutsche Bank’s operating revenues recorded more than 4% year-on-year growth in 2022. This is because revenue growth across core businesses outperformed forgone revenues from business exits. Corporate Bank recorded the highest growth in revenue since its incorporation. Private Bank and Corporate Bank divisions benefitted from increased interest rates, FX movements, and higher business volumes. Investment Bank revenue was up mainly due to increased income from Fixed Income and currencies and Financing businesses.

Buy the Full Report for more Insights into Deutsche Bank’s Financial Performance

Deutsche Bank – Customers and Products

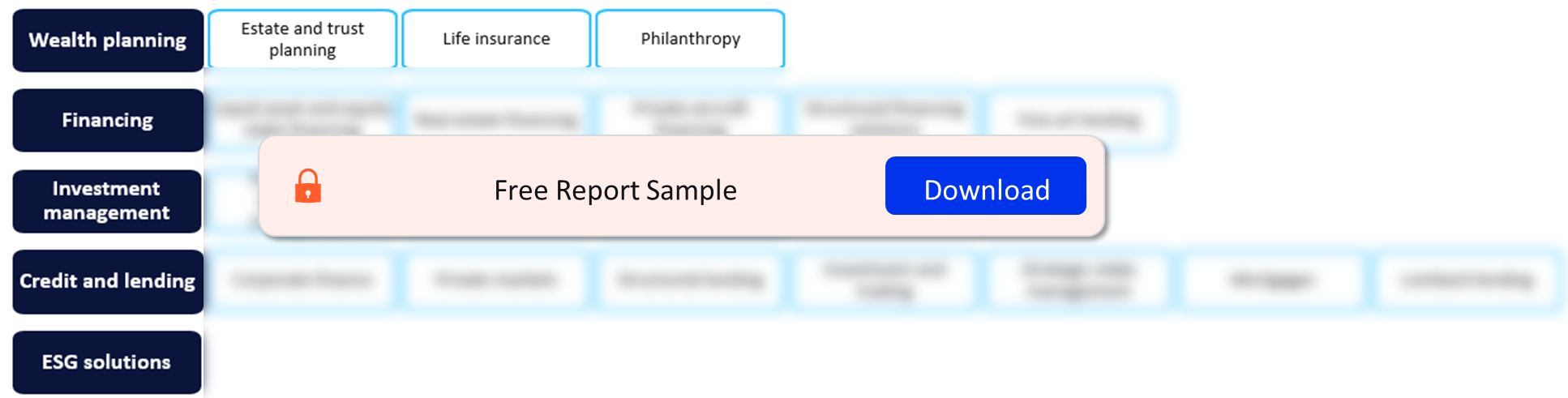

Deutsche Bank Wealth Management provides a holistic offering. Leveraging Deutsche Bank’s retail banking and asset management capabilities, Deutsche Bank Wealth Management offers a wide range of traditional and alternative investment products and lending and deposit products to HNW and UHNW individuals, entrepreneurs, and family offices. It also serves foundations, church institutions, and public sector institutions.

Deutsche Bank continues to drive digitalization in its product and service offerings. In February 2023, Deutsche Bank and Memento Blockchain, a provider of a software-based platform for digital asset management, completed a proof of concept—known as Project DAMA (Digital Assets Management Access)—to develop a digital fund investment servicing platform.

Deutsche Bank Customers and Products

Buy the Full Report for Customer and Product Insights of Deutsche Bank

Deutsche Bank – Brand-Building Activities

Deutsche Bank serves communities through regional units and endowed foundations to support projects focused on the environment, employability, education, and emergency relief, among other areas. Its social responsibility activities focus on youth, the environment, education, and other social causes. For instance, in September 2022, Deutsche Bank launched a new Corporate Social Responsibility environmental impact program known as “How We Live” that focuses on protecting, restoring, and providing education about the environment.

Deutsche Bank also provides sponsorships for sporting events, art, and culture. It has been the main sponsor of the equestrian sporting event CHIO Aachen since 1955, and also supports Berliner Philharmoniker, a German orchestra, for more than 30 years now. Furthermore, Deutsche Bank leverages prominent social media channels to communicate with its customers.

Buy the Full Report for More Brand-Building Activities Insights of Deutsche Bank

Scope

This report provides a comprehensive analysis of Deutsche Bank Wealth Management’s operations. It offers insights into the company’s strategy and financial performance, including key data on assets under management. Customer targeting and service propositions are covered, as are product innovation and marketing activities.

Reasons to Buy

- Examine the financial performance, key ratios, and AUM growth of Deutsche Bank and its Private Bank division and benchmark this competitor against other global wealth managers.

- Understand Deutsche Bank’s current strategic objectives and their impact on its financial performance.

- Discover Deutsche Bank’s key products and client targeting strategies and examine whether these have been successful.

- Learn more about Deutsche Bank’s marketing strategy, social media presence, and digital innovations.

Deutsche Bank Wealth Management

Abbove

Capco

NVIDIA

Traydstream

Memento Blockchain

Proximity

Commerzbank

Deutsche Börse

WWF

Table of Contents

Frequently asked questions

-

What are the key strategy parameters of Deutsche Bank?

The key strategy parameters of Deutsche Bank are company structure, stakeholders, global presence, active jobs and theme activity, company filings, and digital transformation and ICT spending among others.

-

How does Deutsche Bank serve communities?

Deutsche Bank serves communities through regional units and endowed foundations to support projects focused on the environment, employability, education, and emergency relief, among other areas.

-

What are the socially responsible activities taken up by Deutsche Bank?

The key brand-building activities adopted by Deutsche Bank are CSR, sponsorships, and social media presence.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Wealth Management reports