Eastern Europe Construction Market Size, Trend Analysis by Sector, Competitive Landscape and Forecast to 2027

Powered by ![]()

Access in-depth insight and stay ahead of the market

Explore actionable market insights from the following data in the ‘Eastern Europe Construction Market’ report:

- Eastern Europe construction market outlook: analysis as well as historical figures and forecasts of opportunities from the sector and regional segments.

- Key Insights on Leading Sectors: Commercial Construction, Energy and Utilities Construction, Industrial Construction, Infrastructure Construction, Institutional Construction, and Residential Construction.

- Overview of the Eastern Europe construction industry outlook to 2027.

- Analysis of the construction output values (Real) in major countries: Azerbaijan, Belarus, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Kazakhstan, Latvia, Lithuania, Poland, Romania, Russia, Slovakia, Slovenia, Turkey, Ukraine, Uzbekistan.

- Dedicated section covering key industry participants by country including top consultants and contractors.

How is the ‘Eastern Europe Construction Market’ report different from other reports in the market?

Businesses need to have a deeper understanding of the market dynamics to gain a competitive edge in the coming decade. Get the ‘ Eastern Europe Construction Market’ report today, which will help you to:

- Evaluate regional trends in construction development from insight into output values and project pipelines.

- Identify the fastest growers to enable assessment and targeting of commercial opportunities in the markets best suited to strategic focus.

- Identify the drivers in the Eastern Europe construction market and consider growth in developed economies.

- Formulate plans on where and how to engage with the market while minimizing any negative impact on revenues.

We recommend this valuable source of information to anyone involved in:

- Contractors Including Civil Works, Electrical, HVAC, and Others

- Consultants/Designers

- Building Material Merchants/Players

- Management Consultants and Investment Banks

- Portfolio Managers/Buy-Side Firms

- Strategy and Business Development

- Investment Banking

To Get a Snapshot of the Eastern Europe Construction Market Report, Download a Free Report Sample

Eastern Europe Construction Market Overview

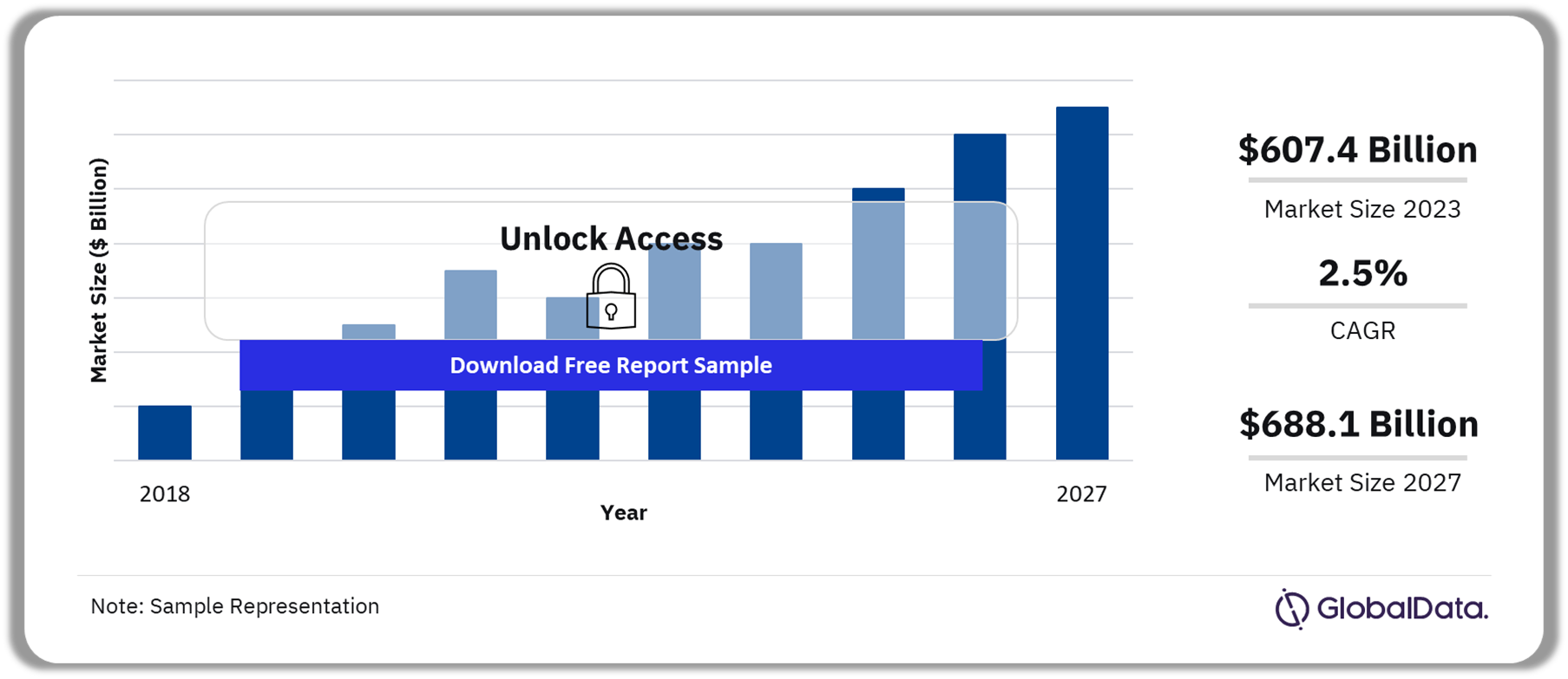

The Eastern Europe construction market size is expected to reach $607.4 billion in 2023 and is estimated to register a compound annual growth rate (CAGR) of 2.5% over the forecast period. The rising focus on infrastructural development is likely to remain a key driver for regional growth over the predicted timeline.

The regional infrastructure sectoral growth will be supported by investments in rail, road, and other public transport segment. For instance, the Eastern Europe Road construction pipeline consists of 503 projects, with a combined value of $330.6 billion. The highest-value project currently in execution in the Eastern Europe Road infrastructure category is the $8.9 billion Moscow to Kazan Toll Road development.

Eastern Europe Construction Market Outlook, 2018-2027 ($ Billion)

View Sample Report for Additional Insights on Eastern Europe Construction Market Forecast, Download a Free Report Sample

GlobalData expects the Eastern Europe construction industry to contract in 2023 by a marginal percentage of 0.2% in real terms, owing to the impact of high materials and energy prices, and supply chain disruptions on construction costs. Labor shortages are also a factor in driving up overall construction costs, with the labor market being among the tightest in the region. This downturn is likely to improve in 2024 and further ahead as the regional material prices stabilize in the region coupled with the easing of the labor market.

| Market Size (2023) | $607.4 billion |

| Market Size (2027) | $688.1 billion |

| CAGR (2022-2027) | 2.5% |

| Historic Period | 2018-2022 |

| Forecast Period | 2023-2027 |

| Report Scope & Coverage | Sector Overview, Construction Output Value ($ Million) by Country and Sector, Regional Outlook by Key Countries, Key Industry Participants |

| Key Sectors | Commercial Construction, Energy and Utilities Construction, Industrial Construction, Infrastructure Construction, Institutional Construction, and Residential Construction |

| Key Countries | Azerbaijan, Belarus, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Kazakhstan, Latvia, Lithuania, Poland, Romania, Russia, Slovakia, Slovenia, Turkey, Ukraine, Uzbekistan |

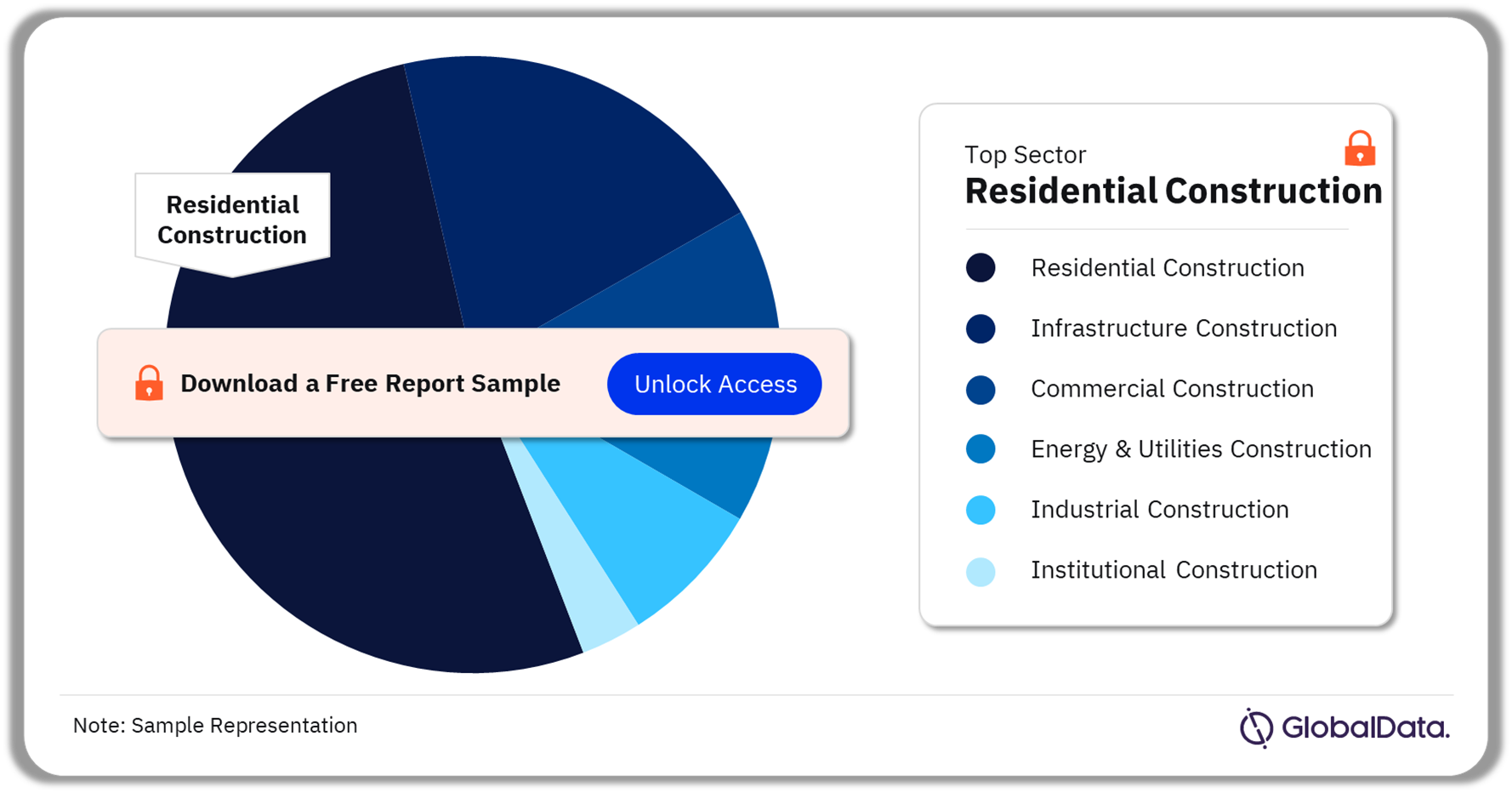

Eastern Europe Construction Market Segmentation by Sectors

The Eastern Europe construction industry covers commercial construction, energy and utilities construction, industrial construction, infrastructure construction, institutional construction, and residential construction. The residential construction category is predicted to account for the largest regional share in terms of construction output value (Real) in 2023.

Residential Construction: This segment is likely to capture the largest regional share in terms of construction output value (Real) in 2023 and is expected to continue its dominance over the forecast period. The redevelopment of housing space in Turkey that was damaged in the February 2023 earthquake coupled with the domestic government’s plan to build 500,000 social housing units is anticipated to aid the regional segmental growth over the near future.

Eastern Europe Construction Market Share by Sectors, 2023 (%)

Fetch Sample PDF for Segment-Specific Revenues and Shares, Download a Free Report Sample

Institutional Construction: This segment of the market is predicted to account for the smallest regional share in terms of construction output value (Real) in 2023. This category is expected to shrink in 2023 by 2.0% in real terms owing to weak economic and financial constraints. The number of permits issued also witnessed a slowdown within the first quarter of 2023.

Over the forecast period, the regional growth in this segment is likely to be catered by enhancing efforts to promote the development and expansion of healthcare buildings. The rising elderly population in the region is also expected to create opportunities for investment in the construction and modernization of healthcare buildings. There are more than 500+ healthcare building projects in the pipeline ranging from the announced stage to the design stage.

Infrastructure Construction: This segment is estimated to depict the fastest compound annual growth rate (CAGR) of 3.7% over the forecast period. The regional growth in this category is driven by the rising investment efforts in rail and road corridors. Russia records the longest road construction pipeline of 9,153 km. Turkey’s pipeline totals 4,668 km, of which 99% is in either pre-execution or is currently under construction.

The growth will be further supported by the increasing funding for the development of rail networks in different countries of the region. For instance, In November 2022, a Memorandum of Understanding was signed between the Czech Republic and the Europe Investment Bank to provide financial and technical support for railway projects between 2023 and 2027 with a funding of CZK170.3 billion ($7.1 billion).

Industrial Construction: The industrial construction segment is predicted to account for 7.5% of the regional share in real terms in 2023. The growth over the forecast period of this construction category will be supported by the rise in investments in manufacturing plants to meet the demand for new electric vehicles and parts.

For example, according to the Polish Association of the Automotive Industry, the total number of new alternative fuel vehicles, which run on electricity, hydrogen, natural gas, biodiesel and ethanol grew by 39% YoY in Q1 2023, following growth of 21% in the number of new passenger cars during the same period.

Energy and Utilities Construction: The regional dynamics of this segment are expected to remain stable over the forecast period. The regional targets to reduce greenhouse gas emissions by 2030 is likely to play a pivotal role in driving the segment growth over the near future.

To reach carbon neutrality, the Turkey government aims to increase installed wind capacity in the country from 10.7GW in 2022 to 17GW by 2027, and solar capacity from 7.8GW to 16GW, over the same period. In November 2022, the Turkish government introduced new rules for energy storage, which enable the developers of energy storage systems add a matching wind and solar power capacity to their projects.

Commercial Construction: The regional space of the commercial construction sector is predicted to contract by 3.4% in 2023 owing to weak macroeconomic activities. The retail and leisure sectors are likely to be impacted in the coming quarters, and although there has been an upturn in building permits for offices in recent quarters, construction work will remain sluggish for this year.

Another key factor contributing to the slowdown in 2023 is the falling number of tourist footprints in the region. For instance, according to Statistics Poland, the number of tourist arrivals in the country in Q1 2023 was still at 80.3% pre-pandemic pandemic level (Q1 2019). The low tourist footfall in the region is estimated to restrain the segmental growth over the short-term period.

Eastern Europe Construction Market Analysis by Region

The Eastern Europe construction sector is primarily dominated by six countries namely Russia, Turkey, Poland, Czech Republic, Romania, and Kazakhstan in terms of construction output value (Real). These six countries together are projected to account for more than 83.0% regional share in real terms in 2023.

Eastern Europe Construction Market Share by Country, 2023 (%)

View Sample Report for Additional Eastern Europe Construction Market Insights, Download a Free Report Sample

The Russian construction industry is predicted to account for more than 32.0% of the regional share in real terms in 2023. The country’s construction sector is expected to remain weak in the initial part of the forecast period. This weakness is attributed to a headwind caused by the Western sanctions, coupled with elevated inflation and interest rates, a growing budget deficit, subdued trade, falling government revenues, and an exodus of skilled workers.

Turkey’s construction sector is projected to expand in 2023 owing to the investments to rebuild buildings and infrastructure that were damaged in the February 2023 earthquake. In late June 2023, the World Bank approved a loan of TRY23.3 billion ($1 billion) to assist the Turkish government in the reconstruction of rural housing and essential public services in the earthquake-affected regions. However, the underlying dynamics of the domestic construction sector are likely to remain weak caused by elevated inflation and interest rates, rising construction costs, depreciation of the local currency, and a high current account deficit.

Poland’s construction industry is likely to capture the third spot in real terms in 2023. The industry is anticipated to contract in the current year owing to the subdued investment levels, amid high interest rates and construction costs. However, the domestic construction sector is expected to regain growth momentum from 2024, supported by investment in the construction of new housing, transport, and renewable energy infrastructure projects.

The construction sector of the Czech Republic is estimated to register the fourth position in the regional dynamics in 2023. The domestic construction sector is anticipated to grow at an annual average rate of 3.4% between 2024 and 2027, supported by developments in the area of transportation, housing, and energy sectors.

Eastern Europe Construction Market Segments and Scope

Eastern Europe Construction Market Sectors Outlook (Value, $ Million, 2018-2027)

- Commercial Construction

- Energy and Utilities Construction

- Industrial Construction

- Infrastructure Construction

- Institutional Construction

- Residential Construction

Eastern Europe Construction Market Countries Outlook (Value, $ Million, 2018-2027)

- Azerbaijan

- Belarus

- Bulgaria

- Croatia

- Czech Republic

- Estonia

- Hungary

- Kazakhstan

- Latvia

- Lithuania

- Poland

- Romania

- Russia

- Slovakia

- Slovenia

- Turkey

- Ukraine

- Uzbekistan

Key Highlights

The Eastern European construction market size will be evaluated at $607.4 billion in 2023. The construction market in the Eastern European region is expected to grow at a CAGR of 2.5% during 2022-2027.

Key Players

Table of Contents

Table

Figures

Frequently asked questions

-

What was the Eastern Europe construction market size in 2023?

The Eastern Europe construction market size will be evaluated at $607.4 billion in 2023.

-

What is the Eastern Europe construction market growth rate?

The construction market in the Eastern Europe region is expected to grow at a CAGR of 2.5% during 2023-2027.

-

Which is the leading sector in the Eastern Europe construction market?

The residential construction segment is likely to capture the largest Eastern Europe construction market share in terms of construction output value (Real) in 2023 and is expected to continue its dominance over the forecast period.

-

Which is the leading country in the Eastern Europe construction market?

Russia is predicted to account for the largest Eastern Europe construction market share in real terms in 2023.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.