Electric Vehicle (EV) Charging Infrastructure Market Size, Trends and Analysis by Region, Level, Power and Segment Forecast to 2030

Powered by ![]()

Access in-depth insight and stay ahead of the market

Accessing the in-depth insights from the ‘Electric Vehicle Charging Infrastructure’ report can help:

- In evaluating volume data and revenue generated by the public electric vehicle charging points installed across different regions and countries.

- Detailed mapping of the entire value chain ecosystem and its associated stages.

- In-depth viewing of key supporting regulatory policies influencing the deployment of EV charging infrastructure.

- Finding potential growth opportunities in terms of volume (unit) and revenue ($Million).

- Foreseeing the shifting landscape of the automotive sector towards electric vehicles and its supporting infrastructure.

- Gaining insights on technological trends and the recent developments.

- Analyzing key factors or variables aiding the adoption of EV charging infrastructure.

How is our ‘Electric Vehicle Charging Infrastructure’ report different from other reports in the market?

- The report explores the data on installed public electric vehicle charging station points in terms of volume and value across different regions and countries.

- The study entails a summarization of key factors or variables responsible for assisting market growth during the forecast period.

- Detailed segmentation by power– Less than 1.8 kW, 1.9 kW-7.8 kW, 7.9 kW-25 kW, 26 kW-100 kW, and More than 100 kW

- Detailed segmentation by level– Level 1, Level 2, and DC Chargers

- With more than 150+ charts, the report is designed with an easy digestible qualitative content.

- The study presents intelligence around recent mergers & acquisitions, filed patents, and social media analytics.

- Analysis of the battery raw material supply case and its evolving demand

- The key market participants operating within this market and their respective profiles are laid out with dedicated sections on company overview, financials, products & services, strategic initiatives, and key personnel.

We recommend this valuable source of information to professionals involved in:

- Automotive Manufacturing

- Electric Vehicle Manufacturing

- EV Charging Equipment Manufacturing

- EV Charging Component Manufacturing

- Regulations and Policy Making

- Independent Research

- BI analysts

- Venture Funding

Buy the Full Report to Get a Snapshot of the Electric Vehicle Charging Infrastructure Market, Download a Free Report Sample

Electric Vehicle (EV) Charging Infrastructure Market Report Overview

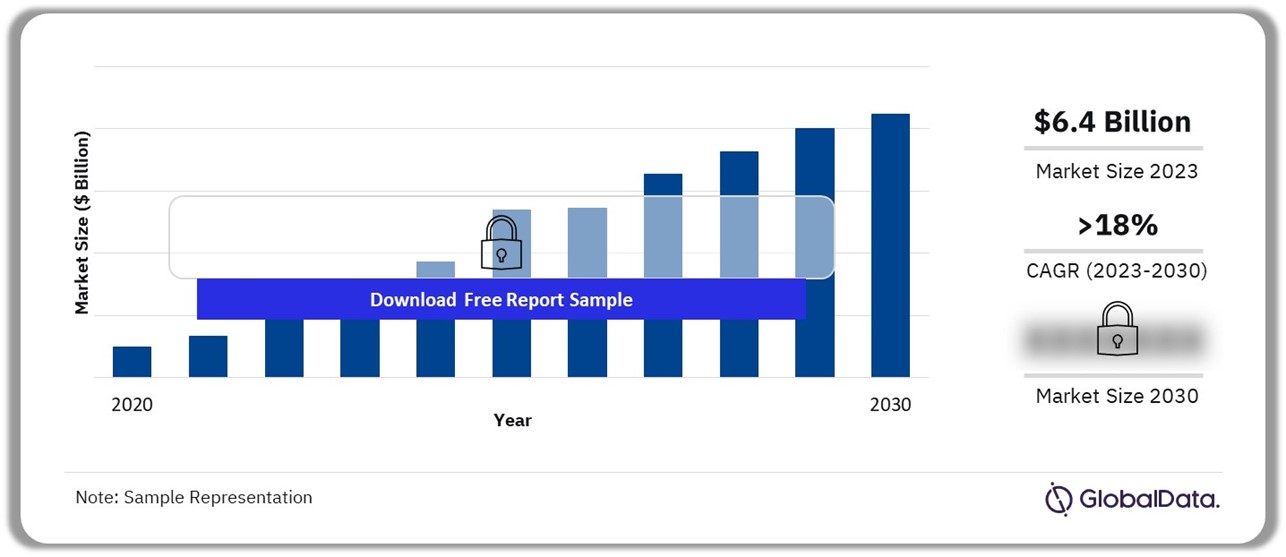

The electric vehicle charging infrastructure market size revenue was valued at $6.4 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of more than 18% over the forecast period. Surging collaboration between automakers, charging infrastructure providers, and increasing governments promotions toward the development of common standards for connectors, communication protocols, and payment systems is anticipated to drive the market growth significantly over the forecast period.

Interoperability is crucial for the uptake of EVs and in promoting compatibility among different electric automotive vehicles. This has prompted various stakeholders to collaborate and establish standards in the market. For instance, in February 2023, the US Federal Highway Administration announced new national standards for public electric vehicle chargers to ensure compatibility, accessibility, consistency, and reliability. As a result of the new standards, Tesla announced it will open a portion of its US Supercharger and Destination Charger network to non-Tesla EVs.

Electric Vehicle Charging Infrastructure Market Outlook, 2020-2030 ($ Billion)

Buy the Full Report for Additional Insights on the Electric Vehicle Charging Infrastructure Market Forecast

The charging station deployment in terms of volume observed a steady growth in the post-pandemic era fueled by a continuous rise in electric vehicle sales. For instance, as per the data released by the International Energy Agency (IEA) in July 2023, the share of electric cars sold has increased from 4% to 14% from 2020 to 2022. In the US alone, the sales volume jumped from 0.3 million units in 2020 to 1.6 million in 2023.

In January 2024, the US federal government announced a grant of $623 million to develop charging networks for electric vehicles across the country. This plan also aims to build 500,000 affordable and reliable public charging stations by 2030, thus ensuring a strong boost to the local EV industry and its associated sectors.

Similarly, in March 2023, the government of India announced a subsidy of $95 million to set up 7,432 charging points across the country. This subsidy is directed towards state-run oil marketing companies that already possess a strong existing network of fuel charging stations across the country. In addition, the offered subsidy is only for CCS chargers that offer a voltage of above 300 volts. Since EV adoption in India is still at a nascent stage, the government is refraining from mandating specific protocols around interoperability.

| Market Size (2023) | $6.4 billion |

| CAGR | 18.5% from 2023 to 2030 |

| Forecast Period | 2023-2030 |

| Historic Data | 2020-2022 |

| Report Scope & Coverage | Industry Overview, Volume and Revenue Forecast, Regional Analysis, Company Profiles, Growth Trends |

| Power Segment | Less than 1.8 kW, 1.9 kW-7.8 kW, 7.9 kW-25 kW, 26 kW-100 kW, and More than 100 kW |

| Level Segment | Level 1, Level 2, and DC Chargers |

| Geography | North America, Europe, Asia Pacific, South & Central America, and Middle East & Africa |

| Countries | US, Canada, Mexico, France, Germany, Italy, Netherlands, Norway, Sweden, UK, Turkey, China, India, Korea, Brazil, Chile, and South Africa |

| Key Companies | ABB Ltd., AeroVironment Inc., BYD Co Ltd., ChargePoint Holdings Inc., Eaton Corporation Plc., General Electric Co., Schneider Electric SE, Shell Plc., Siemens AG, Tesla Inc. |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Electric Vehicle Charging Infrastructure Market Segmentation by Power Type

The power type segment encompasses five different categories, among which in terms of value, the more than 100 kW group commanded a dominating share in 2023. This category of chargers is widely preferred for commercial usage owing to the higher power output as compared to its counterparts. In addition, this category is also witnessing rapid development in terms of technology upgradation and thus, is anticipated to remain a dominating group, providing hassle-free charging using wireless mechanism.

For instance, in March 2024, researchers at Oak Ridge National Laboratory (ORNL) in the US successfully demonstrated 100 kW wireless charging of an electric vehicle. The process was completed at a five-inch distance between the vehicle and the charger. The demonstration was carried out on the Hyundai Kona EV with an astonishing 96% efficiency rate. In addition, this technology provides power densities 8 to 10 times higher than the conventional coil technology as per the testing results carried out by ORNL scientists.

The next largest category is the 26 kW to 100 kW group which registered a revenue share of over 21% in 2023. This segment is poised to grow at a steady rate supported by developments in the field of DC-to-DC charging systems. For instance, in February 2023, the US-based company, Enteligent, unveiled the world’s first solar DC-to-DC charging hybrid bidirectional charging system.

Electric Vehicle Charging Infrastructure Market Analysis by Power, 2023 (%)

Buy the Full Report for More Segment-Wise Information on Electric Vehicle Charging Infrastructure Market, Download a Free Report Sample

The other remaining power segments together in terms of value registered a single-digit revenue share in 2023. Despite the low revenue share, the 7.9 kW to 25 kW category is expected to register the fastest compounded annual growth rate (CAGR) of 18.9% over the forecast period, aided by the peaking consumer interest for a fast charger at an economical price. However, in terms of volume 1.9 kW to 7.8 kW group accounted for the highest share in 2023 owing to its low pricing and moderate speed.

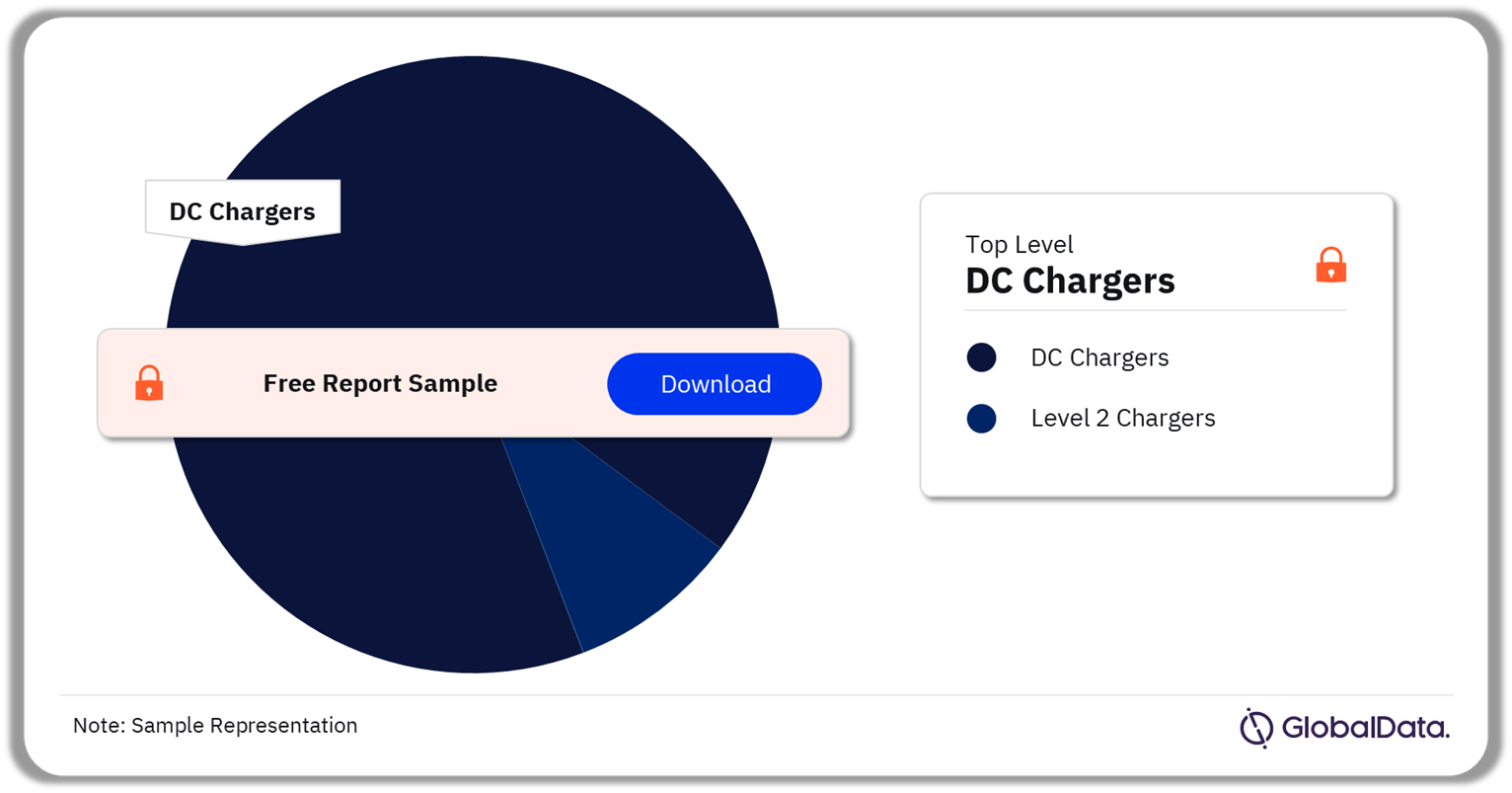

Electric Vehicle Charging Infrastructure Market Segmentation by Level

The Level 1 chargers accounted for the smallest revenue market share in 2023 owing to their economic value. In addition, these types of chargers are more suitable for smaller battery capacities and are primarily employed to charge electric vehicles at home. Despite its lower penetration, the growth in this charger segment remained steady in the previous year aided by the installations at transportation terminals. For instance, in Q3 of 2023, the Level 1 chargers demonstrated the highest growth of 15.5% in the US as per the data released by the National Renewable Energy Laboratory (NREL). This included the installation of 132 Level 1 charging points at Washington and California airports.

The next category of Level 2 chargers observed a year-on-year (YoY) growth rate of over 31% in terms of value in 2023. This growth was primarily driven by the launch of residential purpose level 2 chargers. For example, in August 2023, Tesla launched its universal level 2 charger for residential usage with NACS and J1772 plugs. Similarly, in November 2023, DeWalt unveiled its residential level 2 charger to meet the growing demand in the domestic market.

Electric Vehicle Charging Infrastructure Market Share by Level, 2023 (%)

Buy the Full Report for More Information on Electric Vehicle Charging Infrastructure Market Level

Download a Free Report Sample

The third category of DC chargers, being the fastest compared as compared to its counterparts, dominated the overall market in terms of value in 2023. This category of chargers is mostly employed at commercial sites offering swift charging ability in the range of 20 minutes to one hour. This segment is also poised to demonstrate the fastest-compounded annual growth rate (CAGR) of more than 19% in terms of value over the forecast period. In January 2024, EVIQ unveiled the fast-charging site in Riyadh powered by two DC chargers allowing it to serve four electric vehicles simultaneously. The rising number of such projects will ensure segmental growth during the forecast period.

Electric Vehicle Charging Infrastructure Market Analysis by Region

Europe captured the largest regional share in terms of value in 2023, aided by the expansion in electric vehicle sales. As per the statistics released by the European Automobile Manufacturers’ Association, the sales volume of the battery-EVs surged by 37% in 2023 as compared to the previous year. This rise in sales of EVs directly assisted the development of charging station points in the region during 2023. As per the data from the European Alternative Fuel Observatory (EAFO), the public charging points in the European Union alone reached 630,000 by the end of 2023. For future growth, Germany has already marked $983 million in subsidies to expand the number of charging stations in the country. Thus, government-based incentives coupled with the rising sales volume of electric vehicles are set to aid regional growth over the projected timeframe.

Asia Pacific emerged as the second-largest region in terms of value in 2023. The regional growth is primarily driven by China which is among the largest markets for EVs in the world. The China EV industry flourished in recent years with an integrated approach from raw material processing to battery manufacturing. The country observed the highest number of electric vehicle sales in 2022 and 2023. As per the China Passenger Car Association, the shipment of EVs and hybrid vehicles to local dealers is set to reach 11 million units, representing a year-on-year increase of 25% in 2024, a trend that will boost the market growth in the forecast period.

Electric Vehicle Charging Infrastructure Market Share by Region, 2023 (%)

Buy the Full Report for Regional Insights into the Electric Vehicle Charging Infrastructure Market

Download a Free Report Sample

The charging infrastructure of EVs in North America accounted for a global revenue share of over 23% in 2023. The regional dynamics are primarily influenced by the development of the US electric vehicle sector. The US accounted for over 91% of the regional share in 2023, supported by government incentives and subsidies. Notably, the Bipartisan Infrastructure Law aims to invest $7.5 billion to develop high-speed charging stations every 50 miles across the country’s major interstates and freeways. This government-based interest in uplifting the domestic infrastructure for electric vehicles is set to aid the market growth over the forecast period.

The regions of South & Central America and Middle East & Africa in terms of value accounted for a minuscule share as compared to their counterparts in 2023. However, both regions are set to register a high compounded annual growth rate as compared to the other regions over the projected timeframe, aided by efforts to boost electric vehicle adoption and related infrastructure. For instance, Brazil is anticipated to have 10 thousand public and semi-public electric charging points by 2025 as per the estimation made in the 3rd Electric Mobility Yearbook from Plataforma Nacional de Mobilidade Elétrica (PNME).

Electric Vehicle Charging Infrastructure Market – Competitive Landscape

The competitive landscape of the electric vehicle charging infrastructure industry is gradually shifting towards consolidation, especially in the maturing markets of Europe. For instance, in February 2023, Shell announced the acquisition of evpass, which has the largest network of charging stations in Switzerland. This acquisition aligns with Shell’s objective to operate 2.5 million charging stations worldwide by 2030.

On the other hand, the capital raising activities through equity financing and loan deals are accelerating in 2024. For example, in January 2024, the European Investment Bank (EIB) permitted a $43 million loan to Eldrive to expand the charging station network across Bulgaria, Romania, and Lithuania.

Similarly, in January 2024, Powerdot secured $107 million in capital to expand its coverage across the European region. The company already has a strong presence across four European countries including France, Poland, Spain, and Portugal.

Leading Companies in the Electric Vehicle Charging Infrastructure Market

- ABB Ltd.

- AeroVironment Inc.

- BYD Co Ltd.

- ChargePoint Holdings Inc.

- Eaton Corporation Plc

- General Electric Co.

- Schneider Electric SE

- Shell Plc

- Siemens AG

- Tesla Inc.

Other Electric Vehicle Charging Infrastructure Market Vendors Mentioned

RWE, EVBox, EnBW, Vattenfall, Bosch, Innogy, Enel, BP, EVgo, Teld New Energy, Electricity Highway, Pod Point, Park & Charge, Blink, Star Charge, Ecotricity, EV Connect, Ionity, and Engie, among others.

Leading Electric Vehicle Charging Infrastructure Market Players

Buy the Full Report to Know More About Leading Electric Vehicle Charging Infrastructure Companies

Download a Free Report Sample

Electric Vehicle Charging Infrastructure Market Segments

GlobalData Plc has segmented the electric vehicle charging infrastructure market report by power, level, and region:

Electric Vehicle Charging Infrastructure Market Power Outlook (Revenue, $Million; Volume, Units 2020-2030)

- Less than 1.8 kW

- 9 kW to 7.8 kW

- 9 kW to 25 kW

- 26 kW to 100 kW

- More than 100 kW

Electric Vehicle Charging Infrastructure Market Level Outlook (Revenue, $Million; Volume, Units 2020-2030)

- Level 1 Chargers

- Level 2 Chargers

- DC Chargers

Electric Vehicle Charging Infrastructure Market Regional Outlook (Revenue, $Million; Volume, Units 2020-2030)

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- The Netherlands

- Norway

- Sweden

- The UK

- Turkey

- Rest of Europe

- Asia Pacific

- China

- India

- South Korea

- Rest of Asia Pacific

- South & Central America

- Brazil

- Chile

- Middle East & Africa

- South Africa

Key Highlights

The EV charging infrastructure market will be valued at $ 6.4 billion in 2023 and is expected to grow at a CAGR of 18.5% over the forecast period (2023-2030). The EV charging infrastructure market report provides an executive-level overview of the electric vehicle charging infrastructure industry worldwide today, with detailed forecasts of key indicators up to 2030.

Key Players

ABB LtdAeroVironment Inc

BYD Co Ltd

ChargePoint Holdings Inc

Eaton Corporation Plc

General Electric Co

Schneider Electric SE

Shell plc

Siemens AG

Tesla Inc

Table of Contents

Figures

Frequently asked questions

-

What was the electric vehicle charging infrastructure market size in 2023?

The electric vehicle charging infrastructure market size was valued at $6.4 billion in 2023.

-

What is the electric vehicle charging infrastructure market growth rate?

The electric vehicle charging infrastructure market is expected to grow at a CAGR of 18.5% during the forecast period.

-

What is the key electric vehicle charging infrastructure market driver?

The electric vehicle charging infrastructure market growth is primarily driven by technological advancements and declining EV battery costs.

-

Which was the leading power segment in the electric vehicle charging infrastructure market in 2023?

The more than 100 kW category accounted for the largest electric vehicle charging infrastructure market share in 2023.

-

Which are the leading electric vehicle charging infrastructure companies globally?

The leading electric vehicle charging infrastructure companies are ABB Ltd., AeroVironment Inc., BYD Co Ltd., ChargePoint Holdings Inc., Eaton Corporation Plc, General Electric Co., Schneider Electric SE, Shell Plc, Siemens AG, Tesla Inc.

-

Is there a third level of segmentation in the report?

GlobalData’s focus is on providing reliable and accurate data that is supported by robust research methodology. Our reports undergo rigorous quality checks and are based on primary and secondary research sources, ensuring that the numbers and insights provided are trustworthy. However, despite the best efforts to gather comprehensive data, there could be instances where the available data is limited, making it challenging to provide third-level segmentation. In such cases, GlobalData may choose to provide high-level insights and general trends rather than forcing segmentation that may not be backed by sufficient data. This approach ensures that the report’s overall quality and credibility are maintained.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.