Branches to Bots – How Startups Reimagine FinTech

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

FinTech Startups Report Overview

The journey of FinTech, progressing from its foundation era of 1.0 to the dynamic landscape of 4.0, marks a transformation from basic digitization efforts to the seamless integration of AI technologies. Amidst this evolutionary trajectory, startups have emerged as a key force, igniting substantial shifts within the banking and payments sector. In the current phase, Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) revolutionize the FinTech landscape. Blockchain-led decentralized financial systems have emerged as well. The banking and payments sector is also witnessing the rise of open banking, green banking, and embedded finance solutions.

Cost reduction, customer engagement, and increased revenue are a few of the key benefits resulting from FinTech innovations in banking and payments.

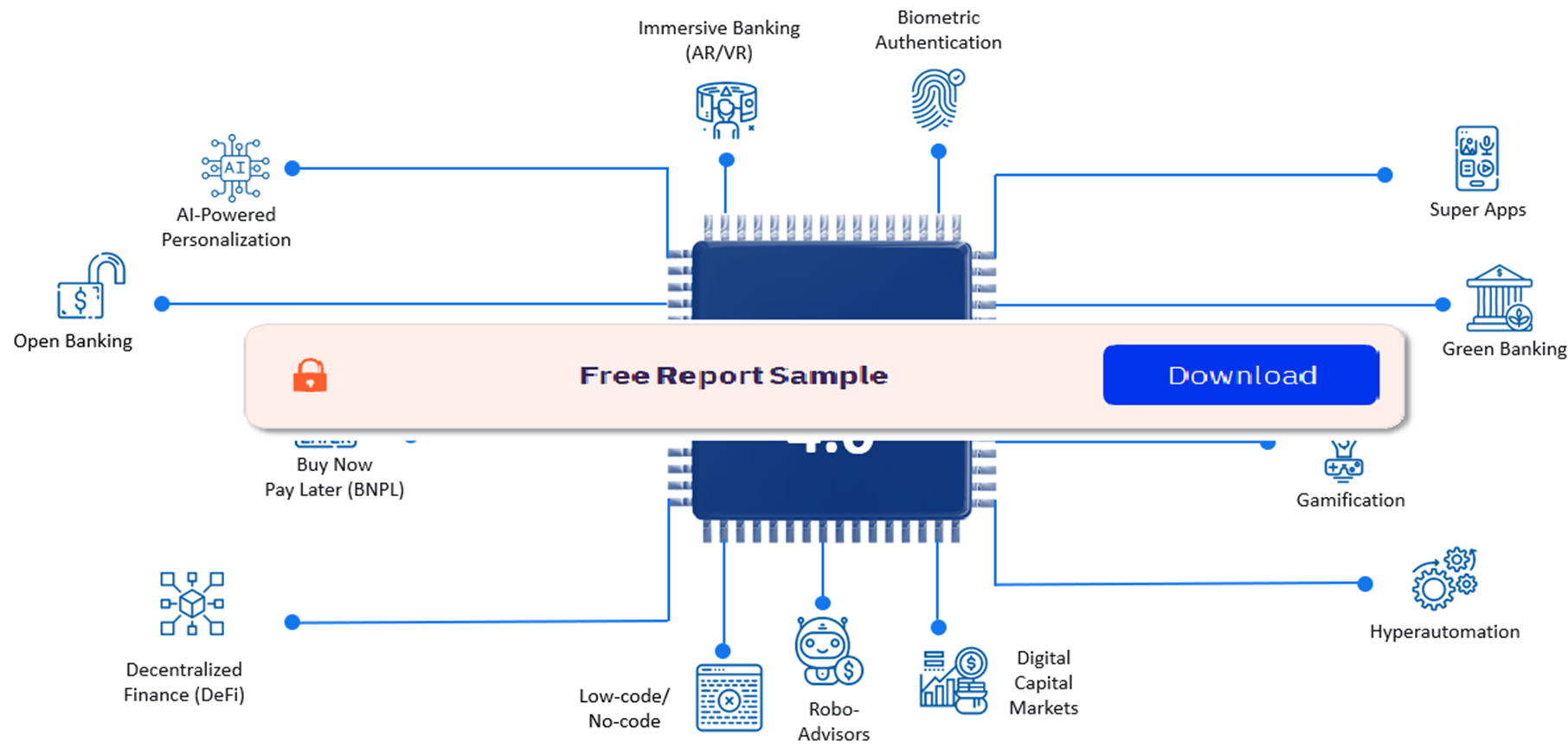

The Branches to Bots – How Startups Reimagine FinTech report presents a comprehensive overview of how FinTech startups are spearheading innovation across the 15 latest trends in banking & payments. The report goes beyond the surface to uncover the sectors, products, and venture capital activity within the FinTech startup ecosystem. From decentralized finance to super apps, gamification, and hyper-automation, the report serves up a concise overview of the disruptive innovations these FinTech startups are bringing to life.

| Emerging Trends | · Open Banking

· AI-Driven Personalization · Embedded Finance · Buy Now Pay Later (BNPL) · Decentralized Finance (Defi) · Low Code/ No Code · Hyper Automation · Immersive Banking (AR/VR) · Biometric Authentication · Super Apps · Green Banking · Zero Trust · Gamification · Digital Capital Markets · Robo-Advisors |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

FinTech Innovations in Banking and Payments – Key Benefits

As new technologies progress, FinTech offers benefits such as cost savings, personalized customer interactions, increased revenue potential, operational efficiency, and improved risk management. Implementing FinTech in the banking and payments sector eliminates traditional banking overheads, enables automation, and simplifies infrastructure. Using automation reduces manual processes, and a simple infrastructure reduces IT expenses. Moreover, FinTech streamlines processes through advanced algorithms, reduces transaction times with tech-led applications, and enhances interoperability and scalability.

Buy the Full Report to Know More about the Benefits of the FinTech Market

FinTech Innovations in Banking and Payments – Emerging Trends

The banking and payments sector is undergoing a significant transformation due to disruptive FinTech trends in the banking and payments sector including open banking, AI-powered personalization, embedded finance, buy now pay later (BNPL), Decentralized Finance (DeFi), low code/ no code, and hyper-automation, immersive banking (AR/VR), biometric authentication, super apps, green banking, zero trust, gamification, digital capital markets, and robo-advisors.

AI-Powered Personalization: As a result of implementing ML, generative AI, data analytics, and natural language processing (NLP) technologies in banking and payments, customer experiences are more personalized, credit decisions are sharper, and tax tasks are easier. The key sub-trends in the AI-powered personalization trend are customer assistance, credit risk evaluation, personalized marketing, personalized tax planning and filing, and user behavior analysis. Some of the start-ups following this FinTech trend are Forethought, Quantexa, and Credolab, among others.

Biometric Authentication: Biometric authentication enhances security by combining multi-modal techniques such as facial, voice, and iris scanning with behavioral analytics to ensure robust and user-friendly identity verification. The sub-trends within this trend are behavioral analytics, facial recognition, iris/retina scanning, multi-modal biometrics, and voice recognition. Some of the start-ups following this FinTech trend are TypingDNA, ID-Pal, and PayEye.

Buy Now Pay Later (BNPL): BNPL utilizes technologies such as AI, ML, application programming interfaces (APIs), payment gateways, big data analytics, and risk assessment algorithms to transform finance with micro-loans, B2B solutions, cross-border services, and in-app integrations. This enhances the flexibility and convenience for businesses and consumers alike. The sub-trends within this trend are BNPL for B2B, Cross-border BNPL, and In-app BNPL, among others. Some of the start-ups following the BNPL trend are Mondu, Addi, and Fintoria (40Seas).

FinTech Innovations in Banking and Payments by Trends

Buy Full Report for More Trend Insights into FinTech

Scope

This report emphasizes the emerging trends in the FinTech world and their significance in the business landscape. The report delves into the FinTech landscape by startups, highlighting their solutions and disruptive potential across 15 different trends. By providing valuable insights into this field, GlobalData’s report aids industry stakeholders in identifying promising FinTech startups and understanding the implications of their technologies.

Key Highlights

GlobalData’s Startup Series – “Startup Series – Branches to bots: how startups reimagine FinTech” emphasizes the emerging FinTech trends and their significance in the evolving financial world. The report delves into the dynamic FinTech solutions by startups, highlighting their key offerings and disruptive potential. By providing valuable insights into this domain, GlobalData’s report serves as a valuable resource for industry stakeholders, enabling them to identify promising FinTech startups and comprehend the far-reaching implications of their technologies.

Reasons to Buy

- Stay updated: The field of FinTech is rapidly evolving with game-changing innovations, notably from startups.

- Discover new startups: The report covers promising startups that are working on groundbreaking technologies and solutions.

- Identify emerging trends: The report helps in decoding emerging FinTech trends and disruptive startups focused on those trends.

- Learn about products: Deep dive into FinTech startups leveraging cutting-edge technologies to offer distinct products.

- Assess investment potential: Access valuable information for assessing the investment potential of different startups in FinTech.

Ada

Addi

Airbyte

AlgoBulls

April

AQRU

Archax

Archblock

Aryel

Auditoria.AI

Bankbuddy.ai

Banyan Security

Bibit

Breeze

Brex

Bud

ConductorOne

Credolab

Cyolo

DoinGud

dydx

Endowus

faire.ai

Fam

Fintoria

Flowcarbon

Flyy

Forethought

Friday Finance

Fyp

HeyTrade

Hokodo

Humantic AI

ID-Pal

Jaris

Keyo

Lifetree Asset Management

Lumeus

Merge

Mondu

Monite

MultiversX

Neufin

Neural Payments

Ondo

PayEye

Perimeter 81

Persefoni

Quantexa

Rain

Raise Green

Rakkar Digital

Retool

Savvy Wealth

Shardeum

Signzy

Softr

STRIVR

Syfe

Synctera

Taktile

Tomorrow

Toters

TransactionLink

TypingDNA

Uniswap

Unqork

V2verify

Virtualitics

Volt

VUZ

WealthKernel

Zilch

Zywa

Table of Contents

Frequently asked questions

-

Which start-ups are following the AI-powered personalization trend in FinTech?

Some of the start-ups following the AI-powered personalization trend in FinTech are Forethought, Quantexa, and Credolab, among others.

-

Which start-ups are following the biometric authentication trend in FinTech?

Some of the start-ups following the biometric authentication trend in FinTech are TypingDNA, ID-Pal, and PayEye.

-

Which start-ups are following the BNPL trend in FinTech?

Some of the start-ups following the BNPL trend are Mondu, Addi, and Fintoria (40Seas).

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Fintech reports