G8 Countries Car Manufacturing Market Summary, Competitive Analysis and Forecast to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

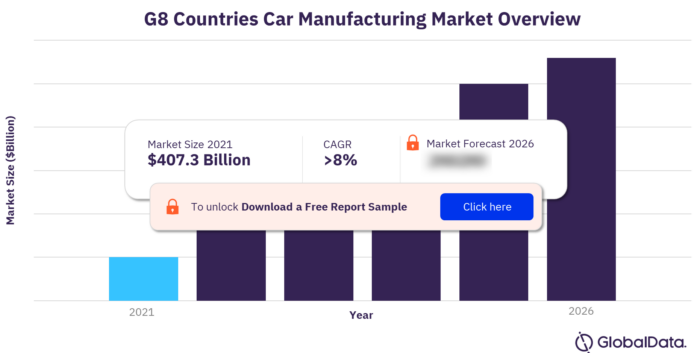

The G8 countries contributed $407.3 billion in 2021 to the global car manufacturing industry, and it is expected to grow at a CAGR of more than 8% between 2021 and 2026. The G8 countries car manufacturing market research report provides qualitative and quantitative information including market size and forecast of the car manufacturing industry among the G8 nations. The profile also contains descriptions of the leading players including key financial metrics and an analysis of competitive pressures within the market.

For more insights on key countries, download a free report sample

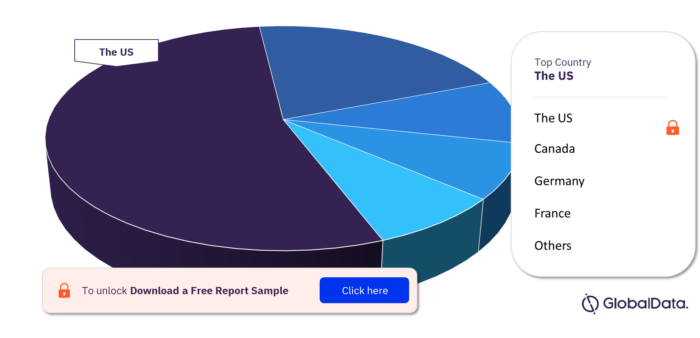

Key Nations in the G8 Countries Car Manufacturing Market

The Group of Eight (G8) comprises eight of the fastest growing industrial nations in the world: the US, Canada, Germany, France, the UK, Italy, Russia, and Japan. Among the G8 countries, the US is the leading country in the car manufacturing industry, followed by Japan and Germany.

The US: Temporary shutdowns in the US car manufacturing plants amid labor shortages and severe disruption in the supply chain, including a shortage of semiconductors which persisted throughout the COVID-19 pandemic, led to a steep decline in production.

Canada: Canada is a net exporter of cars, with Stellantis, Honda, and Ford among the largest manufactures operating locally. In terms of value, the majority of cars manufactured in Canada are exported to the US.

Germany: Despite the declines seen in the German car manufacturing industry, which is the largest in Europe industry in recent years, the hybrid and electric cars segment has been a bright spot.

The G8 Countries Car Manufacturing Market, by key countries

For more insights on key countries, download a free report sample

Key Companies in the G8 Countries Car Manufacturing Market

The key companies in the G8 countries car manufacturing market are Honda Motor Co., Ltd., Toyota Motor Corporation, Daimler AG, Volkswagen AG, Bayerische Motoren Werke AG, Stellantis NV, Ferrari SpA, Suzuki Motor Corporation and Mazda Motor Corporation among others.

Honda Motor Co., Ltd.: Honda is primarily involved in the development, production, and sales of a variety of automobiles, motorcycles, and power products. The company also provides a range of financial services to its customers and dealers. Honda operates through a global network subsidiaries and affiliates operating over the world. It primarily operates in North and South America, Asia, the Middle East and Europe.

Toyota Motor Corporation: Toyota designs, manufactures and sale of sedans, minivans, compact cars, sports utility vehicles, trucks and related parts and accessories throughout the world. It also provides financing, vehicle and equipment leasing, and certain other financial services primarily to its dealers and their customers to support the sales of vehicles and other products manufactured by Toyota.

Daimler AG: Daimler manufacturers, distributes and sells a range of cars, trucks, vans and buses. The company also offers a choice of tailored automotive services and automotive financial services, including financing, leasing, insurance, and fleet management.

Market Report Overview

| Market Size (2021) | $407.3 billion |

| CAGR (2021-2026) | >8% |

| Key Countries | The US, Canada, Germany, France, the UK, Italy, Russia and Japan |

| Key Companies | Honda Motor Co., Ltd., Toyota Motor Corporation, Daimler AG, Volkswagen AG, Bayerische Motoren Werke AG, Stellantis NV, Ferrari SpA, Suzuki Motor Corporation and Mazda Motor Corporation |

Scope

- Save time carrying out entry-level research by identifying the size, growth, and leading players in the G8 car manufacturing Industry

- Use the Five Forces analysis to determine the competitive intensity and therefore attractiveness of the G8 car manufacturing Industry

- Leading company profiles reveal details of key car manufacturing Industry players’ G8 operations and financial performance

- Add weight to presentations and pitches by understanding the future growth prospects of the G8 car manufacturing Industry with five year forecasts by both value and volume

- Compares data from the US, Canada, Germany, France, UK, Italy, Russia and Japan, alongside individual chapters on each country

Reasons to Buy

- What was the size of the G8 car manufacturing Industry by value in 2021?

- What will be the size of the G8 car manufacturing Industry in 2026?

- What factors are affecting the strength of competition in the G8 car manufacturing Industry?

- How has the industry performed over the last five years?

- Who are the top competitors in the G8 car manufacturing Industry?

Ford Motor Company Limited

Toyota Motor Corporation

Daimler AG

Volkswagen AG

Bayerische Motoren Werke AG

Stellantis NV

Ferrari SpA

Suzuki Motor Corporation

Mazda Motor Corporation

Renault SA

Hyundai Motor Company

Tata Motors Limited

Nissan Motor Co., Ltd.

Tesla, Inc.

Table of Contents

Table

Figures

Frequently asked questions

-

What was the market size of the G8 countries car manufacturing industry in 2021?

The G8 countries car manufacturing market was valued at $407.3 billion in 2021.

-

What is the growth rate of the G8 countries car manufacturing market?

The G8 countries car manufacturing market is expected to grow at a CAGR of more than 8% during the forecast period.

-

Which are the countries listed in the G8 countries car manufacturing industry?

The G8 countries include the US, Canada, Germany, France, the UK, Italy, Russia, and Japan.

-

What are the key companies in the G8 countries car manufacturing market?

The key companies in the G8 countries car manufacturing market are Honda Motor Co., Ltd., Toyota Motor Corporation, Daimler AG, Volkswagen AG, Bayerische Motoren Werke AG, Stellantis NV, Ferrari SpA, Suzuki Motor Corporation and Mazda Motor Corporation.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.