Gas Processing Plants Capacity and Capital Expenditure Forecast by Region, Key Countries and Companies and Projects, 2023-2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Gas Processing Plants Capacity and Capital Expenditure Market

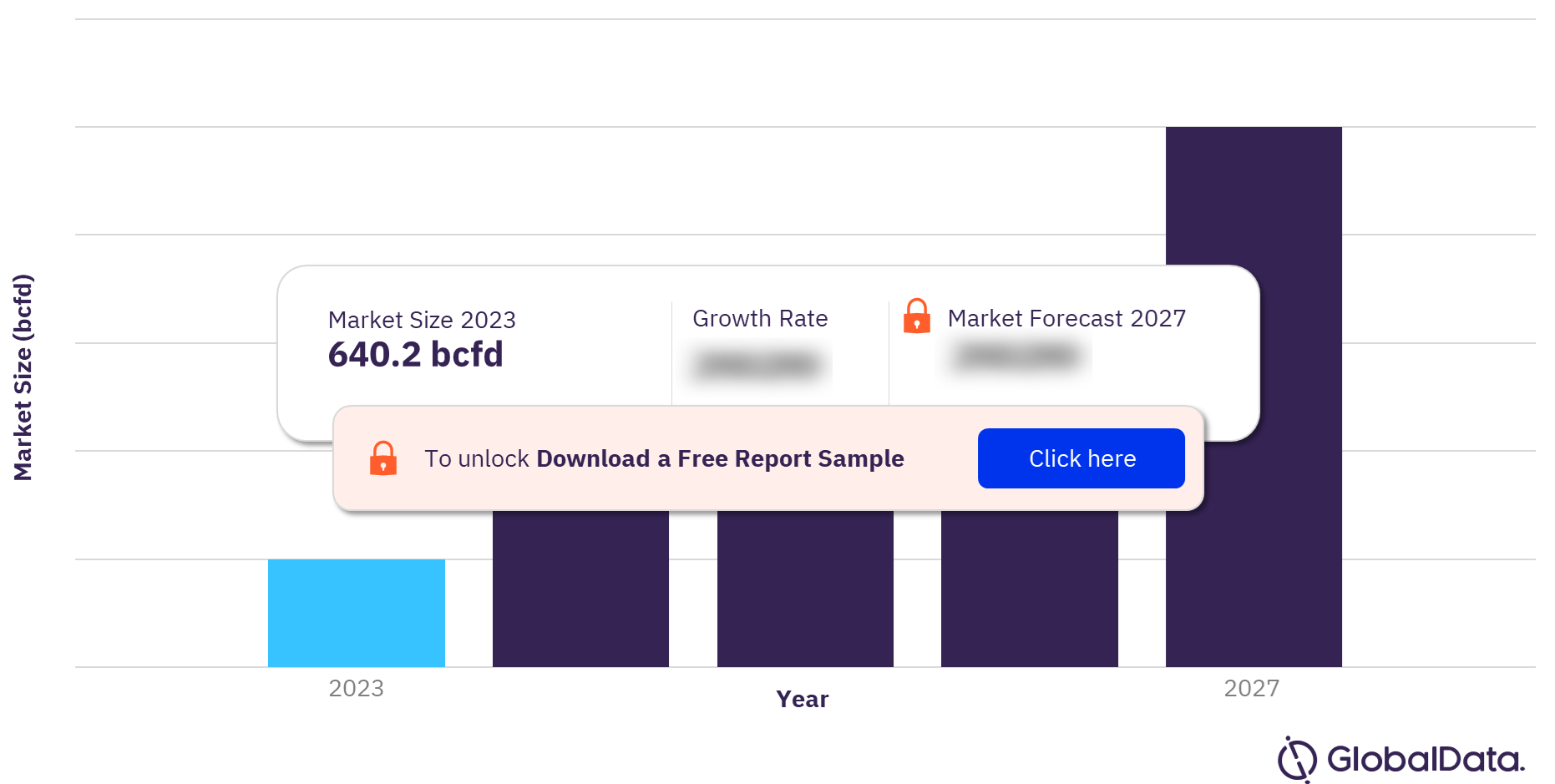

The gas processing capacity is 640.2 billion cubic feet per day (bcfd) in 2023. North America leads globally with over 40 new build plants, followed by Africa and the Middle East. Among all the new build projects expected to start operations from 2023 to 2027. The Ras Laffan-NFE plant in Qatar is expected to witness the highest gas processing capacity, followed by Ust-Luga in Russia, and Jafurah in Saudi Arabia.

The gas processing market research report provides a detailed analysis of planned and announced gas processing capacity by regions, key countries, and key companies.

Gas Processing Market Outlook, 2023-2027 (bcfd)

For more insights into the gas processing market forecast, download a free report sample

Gas Processing Plants – Major Announced Projects

Some of the major gas processing plants that have been announced are Kolmani, Uch Expansion, Dakhni Expansion, SOGIP Sipitang, Preakness ll, and Guyana.

Kolmani: Kolmani is a dehydration-type gas processing plant to be set up in Nigeria and is expected to start operations in 2025. NNPC is the operator as well as the 100% equity owner of this project.

Uch Expansion: Uch Expansion is a sweetening-type gas processing facility proposed in Pakistan and is expected to start operations in 2024. Oil & Gas Development Co Ltd is the 100% equity owner as well as the operator of this facility.

Dakhni Expansion: Dakhni Expansion is a fractionation-type gas processing plant proposed in Punjab, Pakistan, and is expected to start operations in 2024. Oil & Gas Development Co Ltd is the operator as well as 100% equity owner of this project.

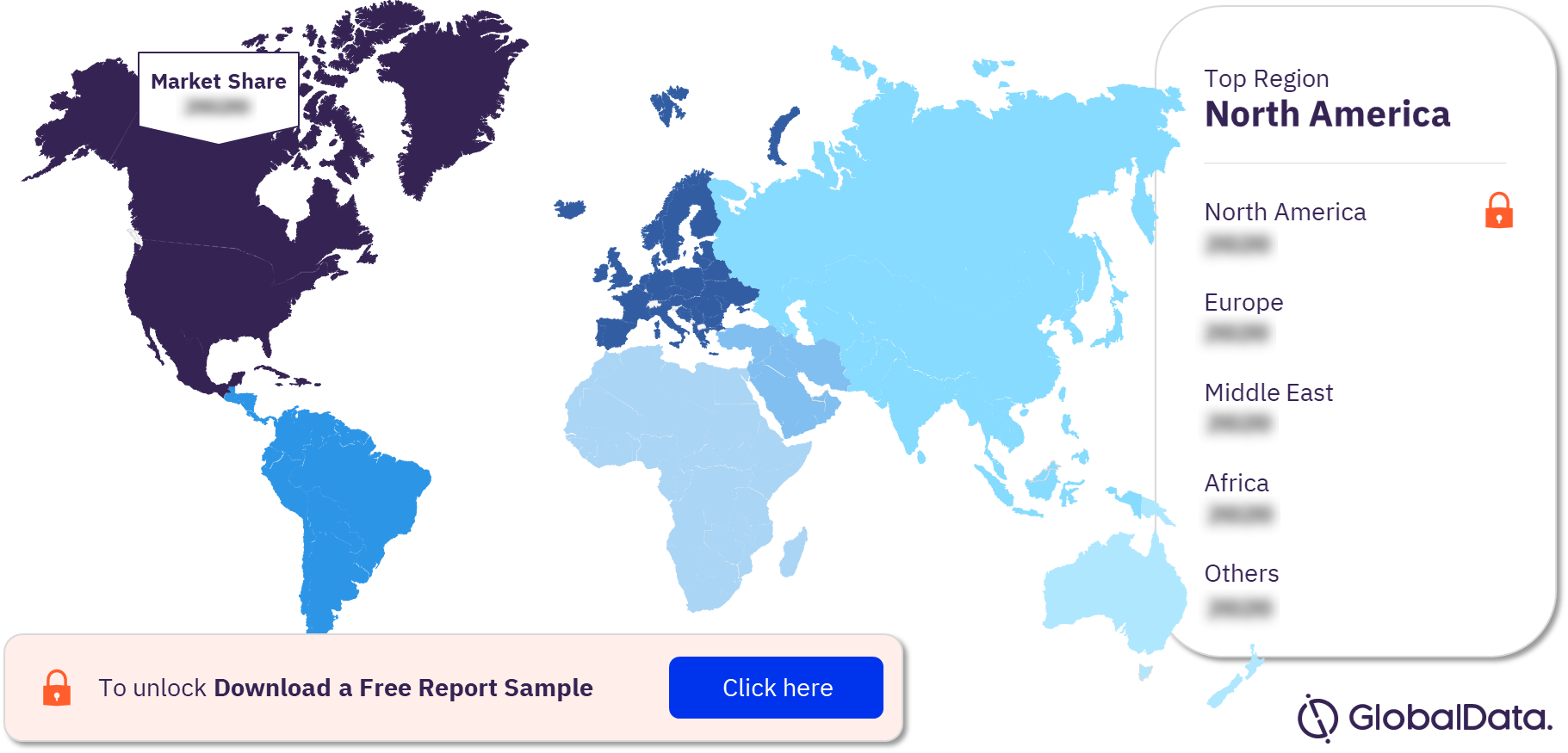

Gas Processing Capacity by Regions

The key regions analyzed in the gas processing industry are North America, the Middle East, the Former Soviet Union, Europe, Africa, Asia, South America, Oceania, and Caribbean. North America dominated the industry in 2022.

North America: In North America, the US is expected to lead in terms of new build capex on planned and announced gas processing plants during the outlook period 2023–2027. Additionally, Alaska Gasline Development Corp leads with the highest new build capex on announced gas processing plants in the region.

Middle East: In the Middle East region, the UAE is expected to lead in terms of new build capex on planned and announced gas processing plants during the outlook period 2023–2027. Moreover, Abu Dhabi National Oil Co. leads with the highest new build capex on planned and announced gas processing plants in the region.

The Former Soviet Union: In the FSU, Russia is expected to spend the majority of the FSU’s new build capex. Furthermore, Gazprom leads with the highest new build capex on planned and announced gas processing plants in the region.

Gas Processing Capacity Analysis by Regions, 2023-2027 (%)

For more regional insights into the gas processing market, download a free report sample

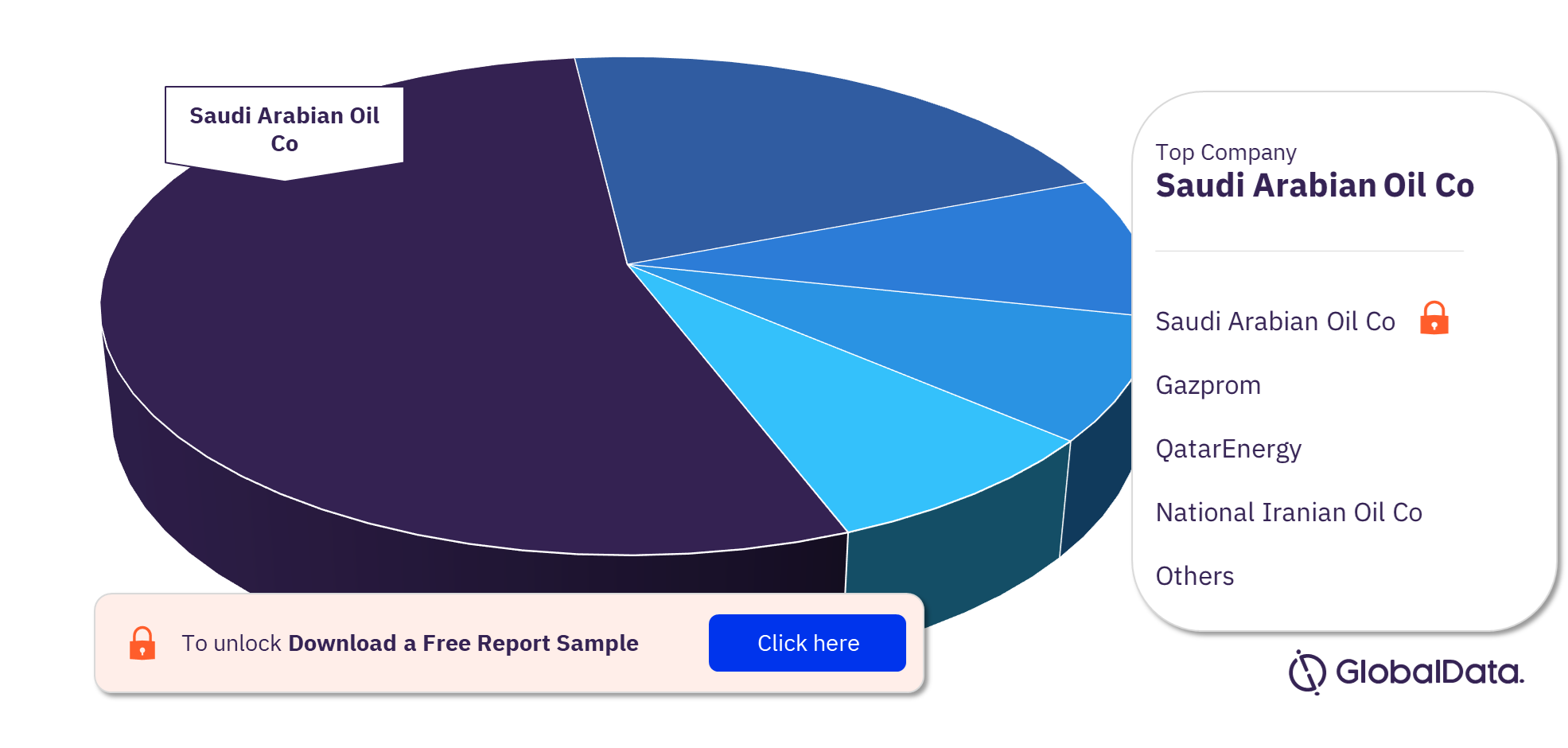

Gas Processing Capacity - Competitive Landscape

Some of the leading companies in the gas processing industry are Saudi Arabian Oil Co, Gazprom, QatarEnergy, RusGazDobycha, National Iranian Oil Co, TotalEnergies SE, Enterprise Products Partners LP, Sonatrach SpA, Marathon Petroleum Corp, and Targa Resources Corp. Among companies, Saudi Arabian Oil Co leads globally with the highest planned and announced gas processing capacity during 2023–2027, followed by Gazprom and Qatar Energy.

Gas Processing Capacity Analysis by Companies, 2023-2027 (%)

To know more about the leading companies in the gas processing market, download a free report sample

Gas Processing Market Report Overview

| Market Size (2023) | 640.2 bcfd |

| Forecast Period | 2023-2027 |

| Major Gas Processing Plants | Kolmani, Uch Expansion, Dakhni Expansion, SOGIP Sipitang, Preakness ll, and Guyana |

| Key Regions | North America, Middle East, Former Soviet Union, Europe, Africa, Asia, South America, Oceania, and Caribbean |

| Leading Companies | Saudi Arabian Oil Co, Gazprom, QatarEnergy, RusGazDobycha, National Iranian Oil Co, TotalEnergies SE, Enterprise Products Partners LP, Sonatrach SpA, Marathon Petroleum Corp, and Targa Resources Corp |

Segments Covered in the Report

Gas Processing Capacity Regional Outlook (Volume, bcfd, 2023-2027)

- North America

- Middle East

- Former Soviet Union

- Europe

- Africa

- Asia

- South America

- Oceania

- Caribbean

Scope

This report provides:

- Planned and announced capital expenditure outlook by region, key countries, and companies globally from 2023 to 2027

- Details of the major planned and announced gas processing plant capacities globally up to 2027

Reasons to Buy

- Obtain the most up-to-date information available on gas processing plants globally

- Identify growth segments and opportunities in the global gas processing industry

- Facilitate decision-making on the basis of the outlook of gas processing capacity data

- Develop business strategies with the help of specific insights about gas processing plants globally

- Keep abreast of key planned and announced gas processing plants globally

- Assess your competitors planned and announced gas processing plants and capacities

- Keep abreast of production trends for key countries and companies globally

- Facilitate decision-making based on development and production capex

- Develop business strategies with the help of specific insights into the global upstream sector

- Assess your competitor’s oil and gas production across the world

Table of Contents

Table

Figures

Frequently asked questions

-

What is the gas processing capacity in 2023?

The gas processing capacity is 640.2 billion cubic feet per day (bcfd) in 2023.

-

What are some of the major gas processing plants?

Some of the major gas processing plants that have been announced are Kolmani, Uch Expansion, Dakhni Expansion, SOGIP Sipitang, Preakness ll, and Guyana.

-

Which key regions have been analyzed in the gas processing industry?

The key regions analyzed in the gas processing industry are North America, the Middle East, the Former Soviet Union, Europe, Africa, Asia, South America, Oceania, and Caribbean.

-

Which are the leading companies in the gas processing industry?

Some of the leading companies in the gas processing industry are Saudi Arabian Oil Co, Gazprom, QatarEnergy, RusGazDobycha, National Iranian Oil Co, TotalEnergies SE, Enterprise Products Partners LP, Sonatrach SpA, Marathon Petroleum Corp, and Targa Resources Corp.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.