Honduras Insurance Industry – Key Trends and Opportunities to 2026

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

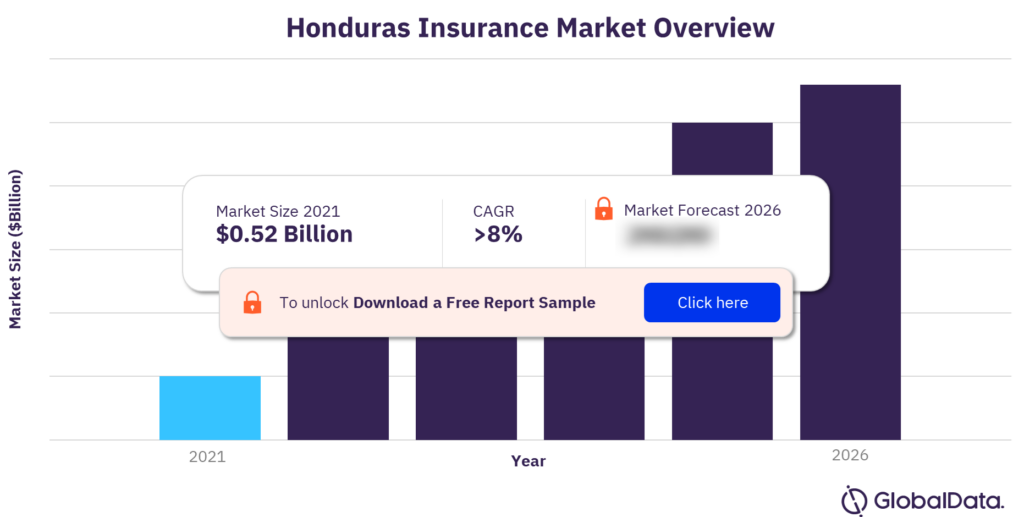

The Honduras insurance market size was $0.52 billion in 2021. The market is expected to grow at a CAGR of more than 8% from 2021 to 2026.

The Honduras insurance market research report provides a detailed outlook by product category for the Honduras insurance industry. It provides values for key performance indicators such as gross written premium, penetration, premium accepted and ceded, profitability ratios, and premium by line of business, during the review period and forecast period. The report also analyzes distribution channels operating in the segment and gives a comprehensive overview of the Honduras economy and demographics. Moreover, it provides detailed information on the competitive landscape in the country and includes details of insurance regulations and recent changes in the regulatory structure.

Honduras Insurance Market Outlook

To gain more information on the Honduras insurance market forecast, download a free report sample

What are the key Honduras insurance market trends?

The National Commission of Banks and Insurance (CNBS) issued the Regulation on Reinsurance Operations, Fronting, and the Registry of Foreign Reinsurance Companies and Reinsurance Brokers. The purpose of this new Regulation is to establish the provisions and guidelines that must be observed by insurance and reinsurance institutions in their reinsurance and fronting operations.

The National Banking and Insurance Commission (CNBS) also issued a directive stating that through the Electronic Management System, insurers can use the electronic signature of the CNBS for the exchange of information.

Bancassurance partnerships are the distribution channels that help insurance companies reach a wider customer base and increase penetration. MAPFRE Seguros Honduras, one of the largest insurance companies in Honduras, has partnerships with many Honduran companies, which multiplies its points of sale for insurance. A significant part of many of these banks’ profits is derived from their sale of insurance products.

What are the key segments in the Honduras insurance market?

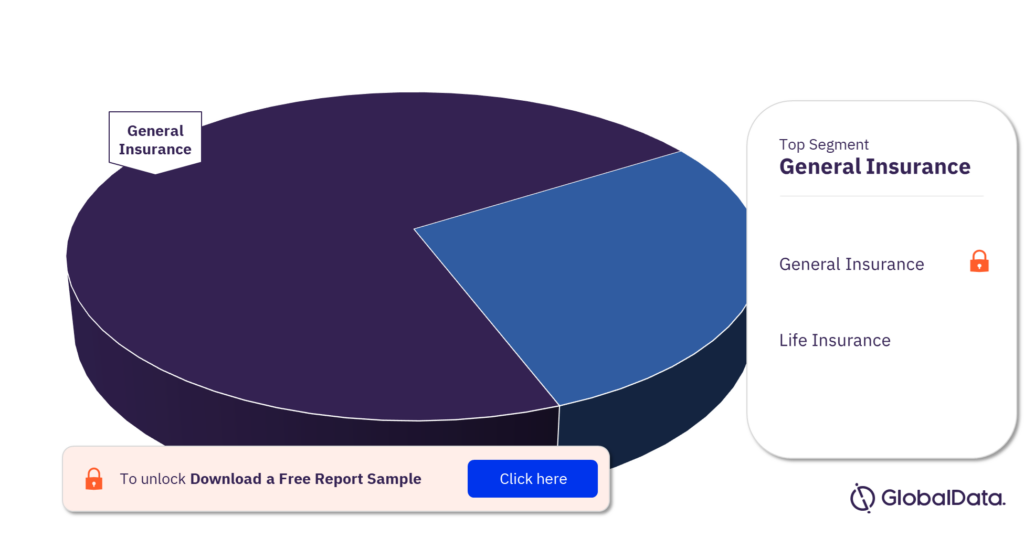

The key segments in the Honduras insurance market are life insurance and general insurance.

Life insurance market in Honduras

Honduran life insurance market penetration remained low in comparison to developed markets and emerging markets. It is expected to grow marginally over the forecast period. Due to low life insurance penetration, claims related to Coronavirus (COVID-19) had a low impact on life insurers’ profitability.

General insurance market in Honduras

The Honduras insurance industry was dominated by the general insurance segment in 2021. In 2021, property insurance was the highest contributing line within general insurance, followed by personal accident and health (PA&H) and motor insurance.

Honduras Insurance Market Analysis by Segments

For more segment insights, download a free report sample

Which are the leading companies in the Honduras insurance market?

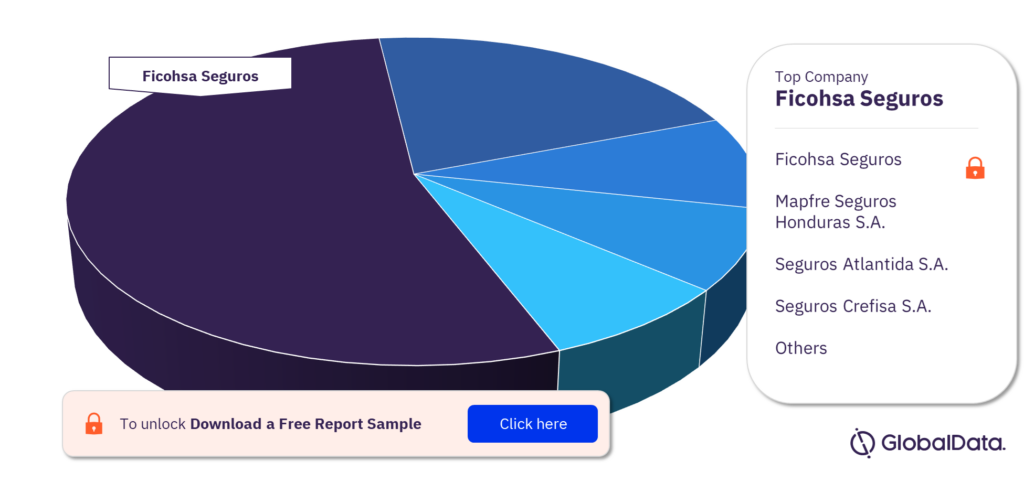

Some of the leading insurance companies in Honduras are Mapfre Seguros Honduras S.A., Ficohsa Seguros, Pan American Life Insurance Company (Honduras), Seguros Atlantida S.A., Seguros Equidad S.A., Seguros del Pais S.A., Seguros Lafise (Honduras) S.A., Seguros Crefisa S.A., and Seguros Banrural Honduras, S.A. Ficohsa Seguros was the largest insurer in 2021 followed by Mapfre Seguros Honduras SA and Seguros Atlantida SA.

Honduras Insurance Market Analysis by Companies

To know more about the leading companies, download a free report sample

Market Report Overview

| Market size (2021) | $0.52 billion |

| CAGR (2021 to 2026) | >8% |

| Key segments | Life Insurance and General Insurance |

| Leading companies | Mapfre Seguros Honduras S.A., Ficohsa Seguros, Pan American Life Insurance Company (Honduras), Seguros Atlantida S.A., Seguros Equidad S.A., Seguros del Pais S.A., Seguros Lafise (Honduras) S.A., Seguros Crefisa S.A., and Seguros Banrural Honduras, S.A. |

Scope

This report provides a comprehensive analysis of the Honduras insurance industry –

- It provides historical values for the Honduras insurance industry for the report’s review period, and projected figures for the forecast period.

- It offers a detailed analysis of the key categories in the Honduras insurance industry, and market forecasts till 2026.

- It profiles the top life insurance companies in Honduras and outlines the key regulations affecting them.

Reasons to Buy

- Make strategic business decisions using in-depth historic and forecast market data related to Honduras’s insurance segment, and each category within it.

- Understand the demand-side dynamics, key market trends and growth opportunities in Honduras’s insurance segment.

- Assess the competitive dynamics in the insurance segment.

- Identify growth opportunities and market dynamics in the insurance segment.

Mapfre Seguros Honduras, S.A.

Seguros Atlantida, S.A.

Davivienda Seguros

Pan American Life Insurance Company (Honduras)

Seguros del Pais, S.A.

Seguros Crefisa, S.A.

Seguros Equidad, S.A.

Table of Contents

Frequently asked questions

-

What was the Honduras insurance market size in 2021?

The insurance market size in Honduras was $0.52 billion in 2021.

-

What is the Honduras insurance market growth rate?

The insurance market in Honduras is expected to grow at a CAGR of more than 8% from 2021 to 2026.

-

What are the key segments in the Honduras insurance market?

The key segments in the Honduras insurance market are life insurance and general insurance.

-

Which are the leading companies in the Honduras insurance industry?

Some of the leading companies in the Honduras insurance industry are Mapfre Seguros Honduras S.A., Ficohsa Seguros, Pan American Life Insurance Company (Honduras), Seguros Atlantida S.A., Seguros Equidad S.A., Seguros del Pais S.A., Seguros Lafise (Honduras) S.A., Seguros Crefisa S.A., and Seguros Banrural Honduras, S.A.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Insurance reports