Hungary Cards and Payments – Opportunities and Risks to 2027

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Hungary Cards and Payments Market Report Overview

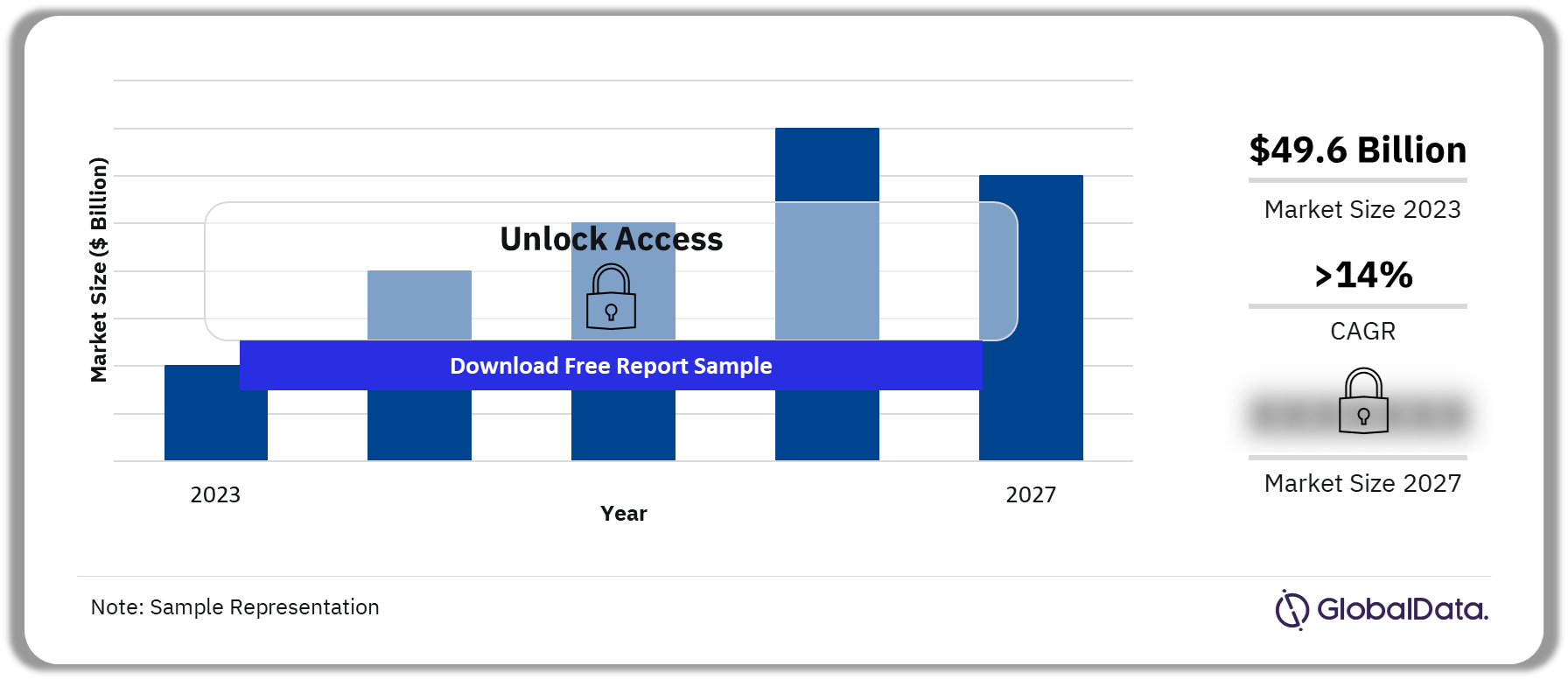

The Hungary cards and payments market is valued at $49.6 billion in 2023. The market is expected to achieve a CAGR of more than 14% during 2023-2027. The Hungarian government and the central bank are promoting electronic payments, leading to a gradual rise in payment card acceptance. Hence, Hungarians are gradually shifting towards electronic payments and substituting cash for debit cards. This highlights consumers’ desire to avoid debt. As a result, the credit and charge card market is still at the developmental phase. The emergence of digital-only banks, the gradual adoption of contactless payments, the emergence of alternative payment solutions, and growth in the e-commerce space will boost the Hungarian payment card market going forward.

Hungary Cards and Payments Market Outlook, 2023-2027 ($ Billion)

To gain more information on the Hungary cards and payments market forecast, download a free report sample

The Hungary Cards and Payments market research report provides a detailed analysis of market trends in the Hungarian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry including cash, cards, credit transfers, mobile wallets, and direct debits during the review period. The report also analyzes various payment card markets operating in the industry and provides detailed information on the number of cards in circulation, transaction values, and volumes during the review period and over the forecast period. It also offers information on the country’s competitive landscape, including market shares of issuers and schemes. The report provides information on the payment instruments that are in use in the Hungarian market, the key segments within the market, as well as the companies associated with the Hungary cards and payments market.

| Market Size (2023) | $49.6 billion |

| CAGR (2023-2027) | >14% |

| Forecast Period | 2023-2027 |

| Historical Period | 2019-2022 |

| Key Payment Instruments | · Cash

· Cards · Mobile Wallets · Credit Transfers · Direct Debits |

| Key Segments | · Card-Based Payments

· E-commerce Payments · Alternative Payments |

| Leading Players | · Magyar Nemzeti Bank

· OTP Bank · Erste Bank · KBC Bank · Budapest Bank · BNP Paribas Bank · Visa · Mastercard · PayPal · Apple Pay |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Hungary Cards and Payments Market Dynamics

Since increasing banking penetration and the combined efforts of banks and government bodies to promote electronic payments and financial inclusion have driven the uptake of debit cards, they are the preferred payment card in Hungary. The rise is also in line with the EU’s regulations relating to citizens’ right to a basic bank account, which requires banks to offer features including debit cards, cash withdrawals, and fund transfers. Moreover, the e-commerce market in Hungary is showing growth mainly due to rising internet and smartphone penetration, coupled with increasing consumer confidence in online shopping.

For additional Hungary cards and payments market dynamics, download a free report sample

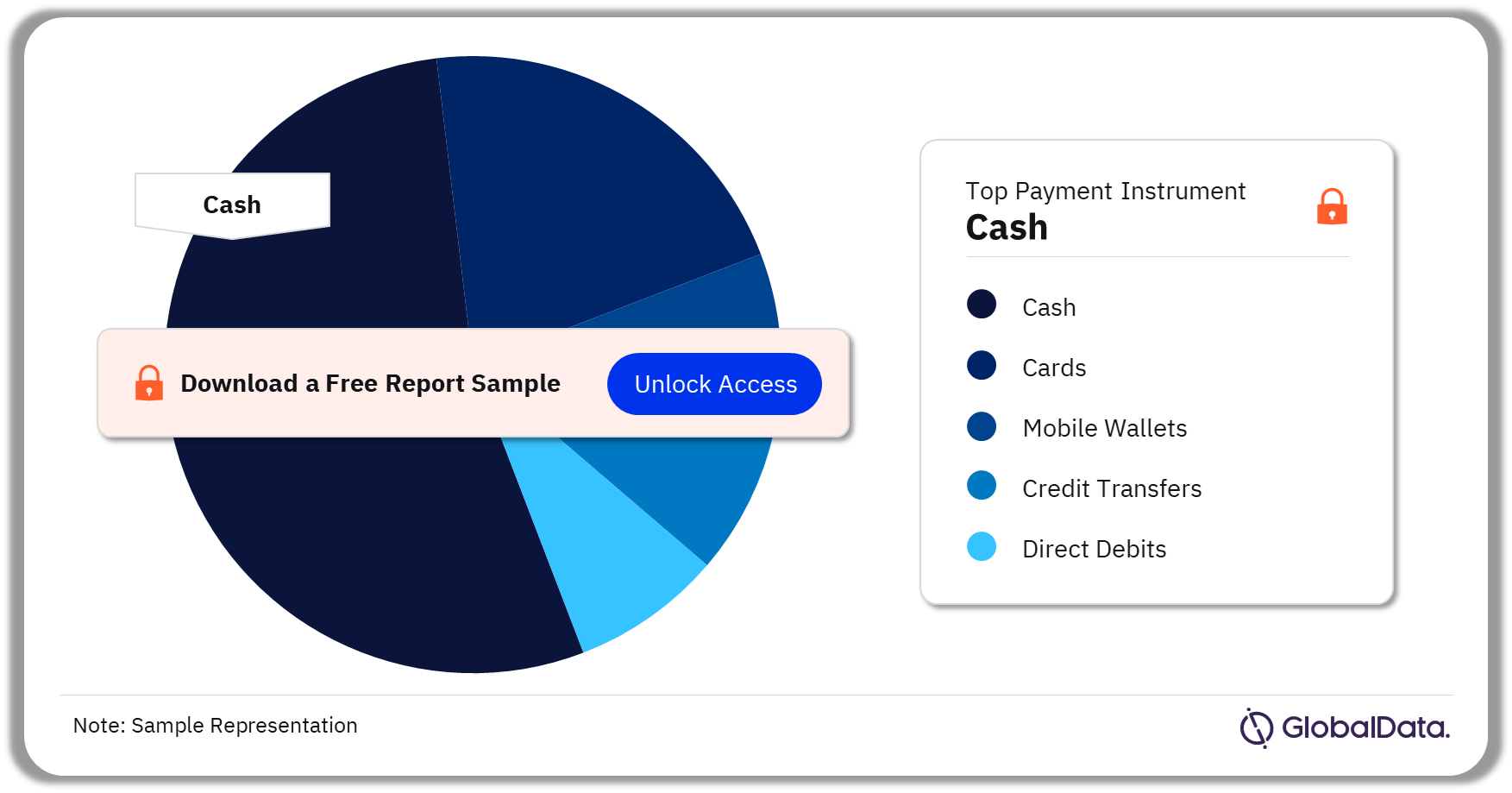

Hungary Cards and Payments Market Segmentation by Payment Instruments

In 2023, cash is still the preferred method for transactions.

The key payment instruments in the Hungary cards and payments market are cash, cards, mobile wallets, credit transfers, and direct debits. Cash is steadily losing ground to card payments as the preferred payment method. The rising banked population, installations of POS terminals, growing adoption of contactless cards, and government efforts to boost financial inclusion have contributed to growth in the payment card market.

Hungary Cards and Payments Market Analysis by Payment Instruments, 2023 (%)

For more payment instrument insights into the Hungary cards and payments market, download a free report sample

Hungary Cards and Payments Market Segments

The credit card market in Hungary is yet to gain traction as Hungarian consumers are primarily debt-averse in nature.

The key segments in the Hungary cards and payments market are card-based payments, e-commerce payments, and alternative payments.

Card-based Payments: The frequency of usage in payment cards increased due to growth in banking penetration, increasing financial awareness among consumers, and efforts by banks to promote electronic payments. This trend is set to continue over 2023-2027. The emergence of digital-only banks and the availability of contactless cards will further support the payment card market going forward.

Payment Cards Market Analysis by Segments, 2023 (%)

For more segment insights into the Hungary payments cards market, download a free report sample

Hungary Cards and Payments Market - Competitive Landscape

Some of the leading players in the Hungary cards and payments market are:

- Magyar Nemzeti Bank

- OTP Bank

- Erste Bank

- KBC Bank

- Budapest Bank

- BNP Paribas Bank

- Visa

- Mastercard

- PayPal

- Apple Pay

Hungary Cards and Payments Market Analysis by Players, 2023

For more player insights into the Hungary cards and payments market, download a free report sample

Hungary Cards and Payments Market – Latest Developments

- To combat inflation, the central bank has increased its base interest rate. With elevated inflation and interest rates squeezing consumer purchasing power, the credit and charge card market will be negatively affected.

- The Budapest Bank, MKB Bank, and Takarekbank merged in April 2023, with the new entity operating as MBH Bank thereafter. MHB Bank offers a wide range of debit cards for both retail and corporate customers.

Segments Covered in the Report

Hungary Cards and Payments Instruments Outlook (Value, $ Billion, 2019-2027)

- Cash

- Cards

- Mobile Wallet

- Credit Transfers

- Direct Debits

Hungary Cards and Payments Market Segments Outlook (Value, $ Billion, 2019-2027)

- Card-Based Payments

- E-commerce Payments

- Alternative Payments

Scope

This report provides:

- Top-level market analysis, information, and insights into Hungary’s cards and payments industry

- Current and forecast values for each market in the Hungarian cards and payments industry, including debit, credit, and charge cards.

- Detailed insights into payment instruments including cash, cards, credit transfers, mobile wallets, and direct debits. It also includes an overview of the country’s key alternative payment instruments.

- E-commerce market analysis.

- Analysis of various market drivers and regulations governing the Hungarian cards and payments industry.

- Detailed analysis of strategies adopted by banks and other institutions to market debit, credit, and charge cards.

Reasons to Buy

- Make strategic business decisions, using top-level historic and forecast market data, related to the Hungarian cards and payments industry and each market within it.

- Understand the key market trends and growth opportunities in the Hungarian cards and payments industry.

- Assess the competitive dynamics in the Hungarian cards and payments industry.

- Gain insights into marketing strategies used for various card types in Hungary.

- Gain insights into key regulations governing the Hungarian cards and payments industry.

OTP Bank

Erste Bank

KBC Bank

Budapest Bank

BNP Paribas Bank

Visa

Mastercard

PayPal

Apple Pay

Masterpass

Google Pay

paysafecard

Table of Contents

Frequently asked questions

-

What is the Hungary cards and payments market size in 2023?

The cards and payments market size in Hungary is valued at $49.6 billion in 2023.

-

What is the Hungary cards and payments market growth rate?

The cards and payments market in Hungary is expected to achieve a CAGR of more than 14% during 2023-2027.

-

Which is the leading payment instrument in the Hungary cards and payments market in 2023?

Cash is the preferred method for transactions in the Hungary cards and payments market in 2023.

-

Who are the leading players in the Hungary cards and payments market?

Some of the leading players in the Hungary cards and payments market are Magyar Nemzeti Bank, OTP Bank, Erste Bank, KBC Bank, Budapest Bank, BNP Paribas Bank, Visa, Mastercard, PayPal, and Apple Pay.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.

Related reports

View more Payments reports