Hydrogen in Power – Thematic Intelligence

Powered by ![]()

All the vital news, analysis, and commentary curated by our industry experts.

Hydrogen in Power Thematic Report Overview

Green hydrogen via electrolysis is one of the most promising and sustainable technologies within the power sector. Industries, where greenhouse gas emissions are harder to suppress, are investing heavily in it owing to its versatility. In addition, the production of Hydrogen from renewable electricity will play a vital role in the realization of long-term decarbonization goals and improvement in energy security. Greater demand for renewable hydrogen will determine the pace of dedicated renewable capacity expansion in the coming years.

The Hydrogen in Power thematic intelligence report gives you an in-depth insight into the hydrogen market and the impact it will have on the power industry. It further entails a deep-dive analysis of the industry, including real-life case studies that showcase how power companies have responded to the impact of this theme on their operations. The report identifies the key market trends that will shape the Hydrogen market over the coming years and gives an insight into the market players and the competitive landscape within the Hydrogen theme.

| Report Pages | 75 |

| Regions Covered | Global |

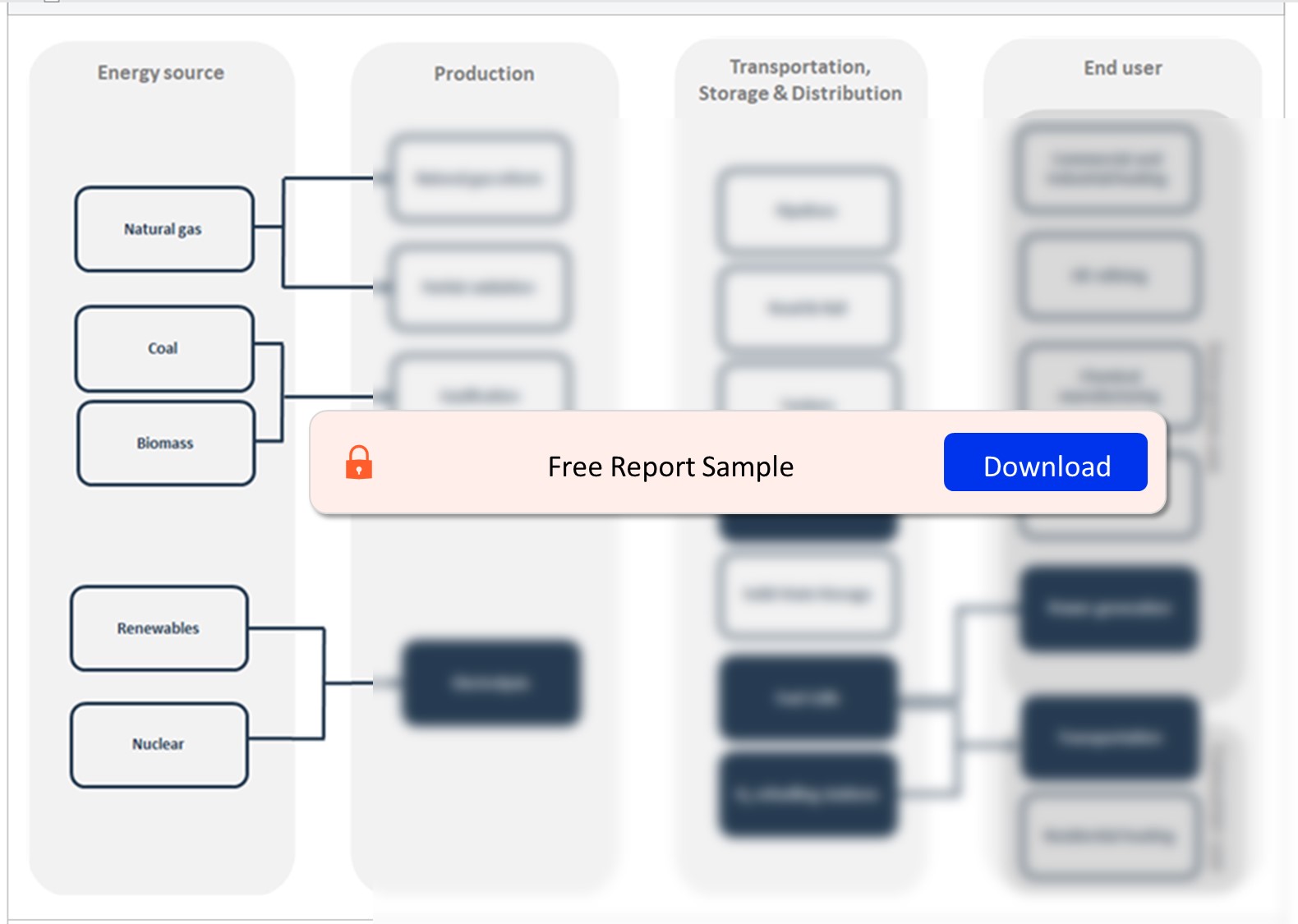

| Key Value Chain Components | · Energy Source

· Production · Transportation, Storage, and Distribution · End-User |

| Key Trends | · Technology Trends

· Macroeconomic Trends · Regulatory Trends |

| Leading Companies | · AES Corporation

· CenterPoint Energy · EDF · E.ON · Enel |

| Enquire & Decide | Discover the perfect solution for your business needs. Enquire now and let us help you make an informed decision before making a purchase. |

Hydrogen in Power – Key Trends

The primary trends that will shape the Hydrogen theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, and regulatory trends.

- Technology trends: The key technology trends impacting the Hydrogen theme are the production of hydrogen from biomass regasification technology, the emergence of hydrogen fuel cell technology, and hydrogen production with carbon capture among others.

- Macroeconomic trends: The growing usage of hydrogen as a sustainable alternative for heavy-duty vehicles, the focus on R&D to make green hydrogen cost-competitive, development of hydrogen infrastructure to connect the production and demand centers of hydrogen are the key macroeconomic trends expected to drive the hydrogen market.

- Regulatory trends: The rise in incentives and tax schemes toward hydrogen is a key regulatory trend impacting the hydrogen market. For instance, in August 2023, Brazil announced tax incentives for green hydrogen projects. It will be a key step for the energy sector to ignite renewable fuel projects and keep pace with international competitors. The tax credits will support more than $29 billion in clean hydrogen projects.

Hydrogen in Power – Industry Analysis

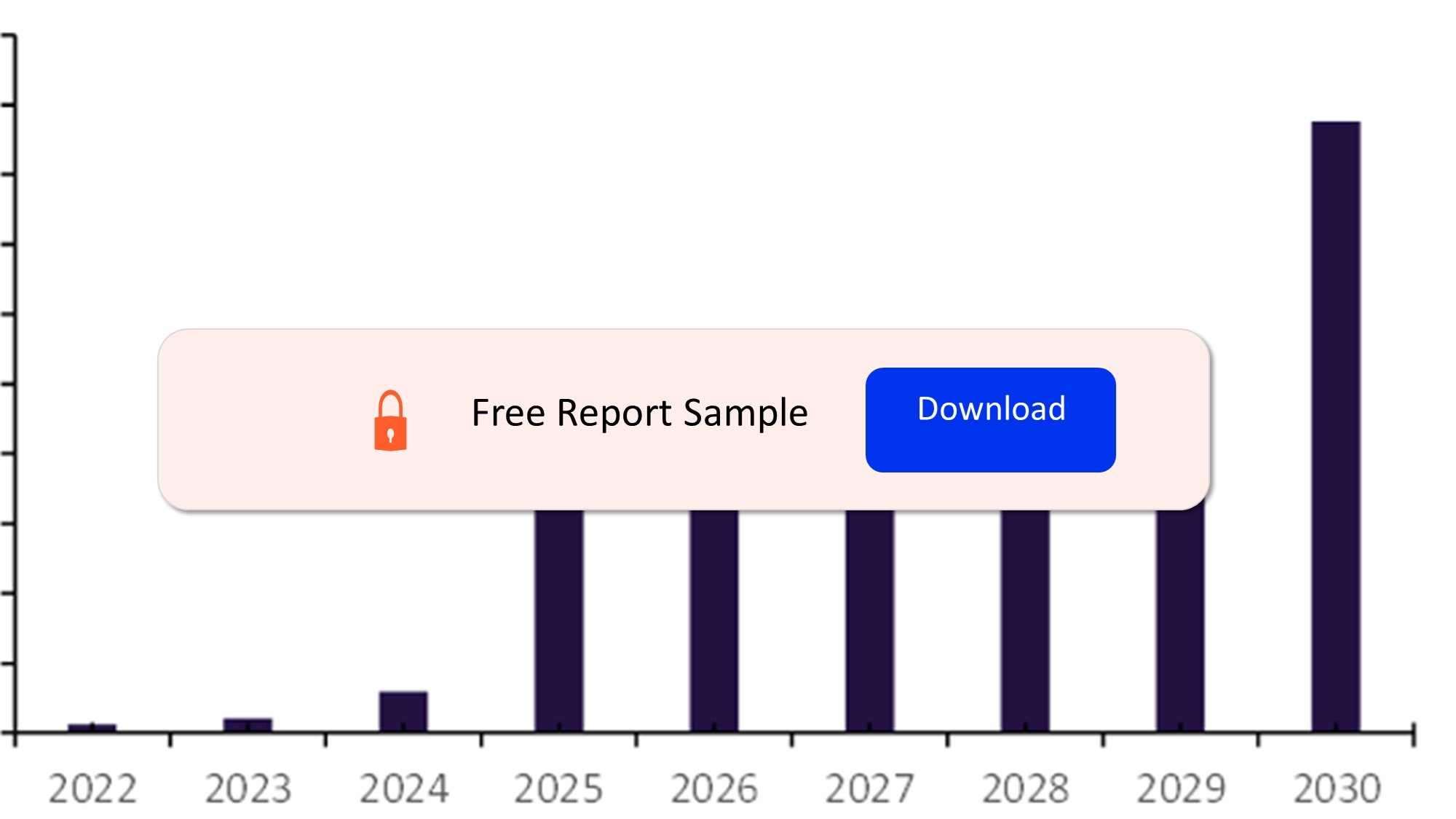

In 2023, the low-carbon hydrogen production capacity was more than 4,100 ktpa, with a major contribution from green hydrogen through renewables. The US had the largest production capacity in low-carbon hydrogen, followed by Canada and China in 2023. Furthermore, hydrogen production will grow in the coming years owing to the rising demand for green hydrogen, which will eventually accelerate the renewable capacity expansion.

The Hydrogen in Power industry analysis also covers:

- Hydrogen overview

- Challenges in the green hydrogen economy

- Electrolyzers in hydrogen production

- Use cases

- Timeline

- Signals

- Mergers and acquisitions trends

- Venture financing trends

- Patent trends

Low-Carbon Hydrogen Capacity Forecast, 2022-2030

Buy the Full Report for More Insights into the Hydrogen Theme in the Power Market

Download a Free Report Sample

Hydrogen in Power - Value Chain Analysis

The hydrogen energy value chain can be split into the energy source; production; transportation, storage, and distribution; and end-use.

Energy source: Hydrogen is produced from natural gas, coal, and water. It can also be produced from energy sources such as nuclear and renewable sources such as wind, solar, and biomass. The major process used to produce hydrogen from natural gas is called steam methane reforming. Similarly, the process of converting coal into hydrogen is called coal gasification. The third major method for hydrogen production involves the electrolysis of water molecules.

Power Industry Value Chain Analysis

Buy the Full Report for More Insights into the Power Industry Value Chain

Download a Free Report Sample

Hydrogen in Power – Competitive Landscape

A few leading power companies making their mark within the hydrogen theme are:

- AES Corporation

- CenterPoint Energy

- EDF

- ON

- Enel

AES Corporation: AES is an American utility and power generation company. It owns and operates power plants and generates and sells electricity to end users. The company is leveraging its existing capabilities and insight-based innovation to increase efficiency and drive substantial cost reduction of green hydrogen.

Buy the Full Report to Know More About the Leading Companies in The Hydrogen Theme in the Power Market

Download a Free Report Sample

Power Sector Scorecard

At GlobalData, we use a scorecard approach to predict tomorrow’s leading companies within each sector. Our power sector scorecard has three screens: a thematic screen, a valuation screen, and a risk screen.

- The thematic screen ranks companies based on overall leadership in the 10 themes that matter most to their industry, generating a leading indicator of future performance.

- The valuation screen ranks our universe of companies within a sector based on selected valuationmetrics.

- The risk screen ranks companies within a particular sector based on overall investment risk.

Power Sector Scorecard – Thematic Screen

Buy the Full Report to Know More About the Sector Scorecards

Download a Free Report Sample

Scope

- The report focuses on hydrogen in power as a theme.

- It provides an industry analysis on how big the hydrogen theme is and how fast it will grow in the coming years.

- The report provides the hydrogen market size and growth forecast.

- It provides a snapshot of green hydrogen and low-carbon hydrogen market production capacity by region for 2030.

- It covers patent trends and venture financing trends in power.

- The report provides an overview of hydrogen adoption in key industries.

- It provides an overview of upcoming green hydrogen projects.

- The report discusses the challenges in the green hydrogen economy.

- The report discusses the use cases of hydrogen by power utilities.

- It contains details of M&A deals driven by the hydrogen theme, and a timeline highlighting milestones for hydrogen.

- The report focuses on the trends related to hydrogen as a theme in technology, macroeconomic, and regulatory trends.

- The report also includes an overview of competitive positions held by power utility companies adopting hydrogen.

Reasons to Buy

The report provides –

- A detailed analysis of the growing hydrogen market.

- The report gives an insight into the leading players in hydrogen and where they fit in the value chain.

- The report gives an overview of the leaders, challengers, and key users in the hydrogen chain.

- Technology briefing on the production of hydrogen, steam methane reforming, coal gasification, electrolysis, and other production methods.

- A briefing on detailed analysis of the hydrogen value chain, an overview of key participants, and their role in the hydrogen value chain.

- A briefing on how green hydrogen will accelerate renewable production capacity.

- An insight on electrolyzers in hydrogen production and policies to scale up hydrogen production.

- Company profiles of leading adopters of hydrogen in the power sector.

- A snapshot of the power sector scorecard predicting the position of leading power companies in hydrogen theme.

ENGIE

Gazprom

Iberdrola

Ørsted

RWE

Rosatom

Vattenfall

Linde

Air Liquide

Energias de Portugal

Duke Energy

Korea Electric Power

Xcel energy

Uniper

Cummins

Siemens Energy

Bloom Energy

Plug Power

Powercell Sweden

FuelCell Energy

EnBW

Naturgy Energy

HES Energy Systems

AFC Energy

Air Products & Chemicals

Proton Power System

Toshiba ESS

HyGear

Table of Contents

Frequently asked questions

-

What are the key trends impacting the Hydrogen theme in power?

The primary trends that will shape the Hydrogen theme over the next 12 to 24 months are classified into technology trends, macroeconomic trends, and regulatory trends.

-

Which country accounted for the highest share of low-carbon hydrogen production capacity in 2023?

The US had the largest production capacity in low-carbon hydrogen, followed by Canada and China in 2023.

-

What are the key components of the Hydrogen value chain?

The hydrogen energy value chain can be split into the energy source; production; transportation, storage, and distribution; and end-use.

-

Which are the leading companies making their mark within the hydrogen theme?

A few of the leading companies making their mark within the power theme are AES Corporation, CenterPoint Energy, EDF, E.ON, and Enel among others.

Get in touch to find out about multi-purchase discounts

reportstore@globaldata.com

Tel +44 20 7947 2745

Every customer’s requirement is unique. With over 220,000 construction projects tracked, we can create a tailored dataset for you based on the types of projects you are looking for. Please get in touch with your specific requirements and we can send you a quote.